What to Include in a Financial Advisor Business Plan

September 12, 2025

Starting your own financial advisory firm is exciting. And can be intimidating.

You know you want to help clients reach their financial goals, but between defining your target market and figuring out your pricing structure, it's easy to get overwhelmed by all the moving parts.

Whether you're launching a new RIA or breaking away from a wirehouse to an independent practice, a solid financial advisor business plan serves as your roadmap for turning your vision into a profitable reality.

This guide breaks down exactly what goes into building a comprehensive business plan. You'll learn which key elements matter most, get actionable tips for writing each section, and find out how to avoid the common mistakes that can trip up new advisory firms.

Do financial planners really need a business plan?

Starting a financial advisory business without a business plan is like giving investment advice without doing your research first. You might get lucky, but you're much more likely to run into problems down the line.

Here's how a well-crafted financial advisor business plan sets you up for success:

Clarifies your vision and goals: A business plan helps you define exactly what kind of advisory firm you want to build and what success looks like for your practice.

Attracts investors and partners: Whether you need start-up capital or want to bring on team members, potential stakeholders want to see that you've thought through the details.

Guides decision-making: When you're faced with tough choices about pricing, staffing, or technology investments, your business plan provides a framework for making smart decisions.

Tracks progress: Regular plan reviews help you stay on course and adjust your strategy as market conditions and business goals evolve.

Demonstrates professionalism: A solid business plan shows prospects, regulators, and business partners that you take your financial advisory business seriously.

So just how important is a business plan? Consider these stats: Entrepreneurs who write formal plans are 152% more likely to launch than those who don’t, and companies that set clear objectives with a business plan grow 30% faster than those that don't.

What's included in a financial advisor business plan?

A comprehensive financial advisor business plan paints the complete picture of your future firm. Each section serves a specific purpose, but together they tell the story of how you'll operate, attract clients, and grow your advisory business.

Here are the key sections to include:

Executive summary

The executive summary provides a high-level overview of your entire financial advisory business. This section should cover your firm's mission, target market, competitive advantages, financial projections, and funding requirements, all of which we’ll dive into below. Save this section for last so you can summarize the whole story after you've figured out all the details.

Company overview

The company overview explains what your financial advisory firm does and why it exists. It outlines your mission statement, core values, and the specific financial services you'll provide. It also describes your firm's legal structure, location, and any specialized offerings, such as retirement planning or specific demographics served.

Industry analysis

Your industry analysis is where you prove you actually understand the wealth management world. This means digging into current market trends, figuring out how the industry is growing, and understanding what's happening with regulatory changes. It’s also helpful to explore how shifting demographics and new technology are creating fresh opportunities for advisory firms like yours to succeed.

Customer analysis

Define your target market by age, income level, net worth, profession, and location. For example, a tech executive in their forties requires different services than a pre-retiree running a small business. Understanding who your ideal clients are and what they value most in an advisor relationship helps you attract the right people.

Competitor analysis

Research other advisory firms in your area, including fee structures, minimum account sizes, and specializations. Look for gaps in the market where your firm can provide better service. You may also want to target client segments that other advisors have overlooked.

Marketing plan

Your marketing plan is all about how you'll find new clients and get your name out there. Think through your client acquisition strategies, whether that's getting referrals, networking at local events, or using social media and content marketing. Set a realistic marketing budget and figure out which approaches will actually help you connect with your ideal client.

Operations plan

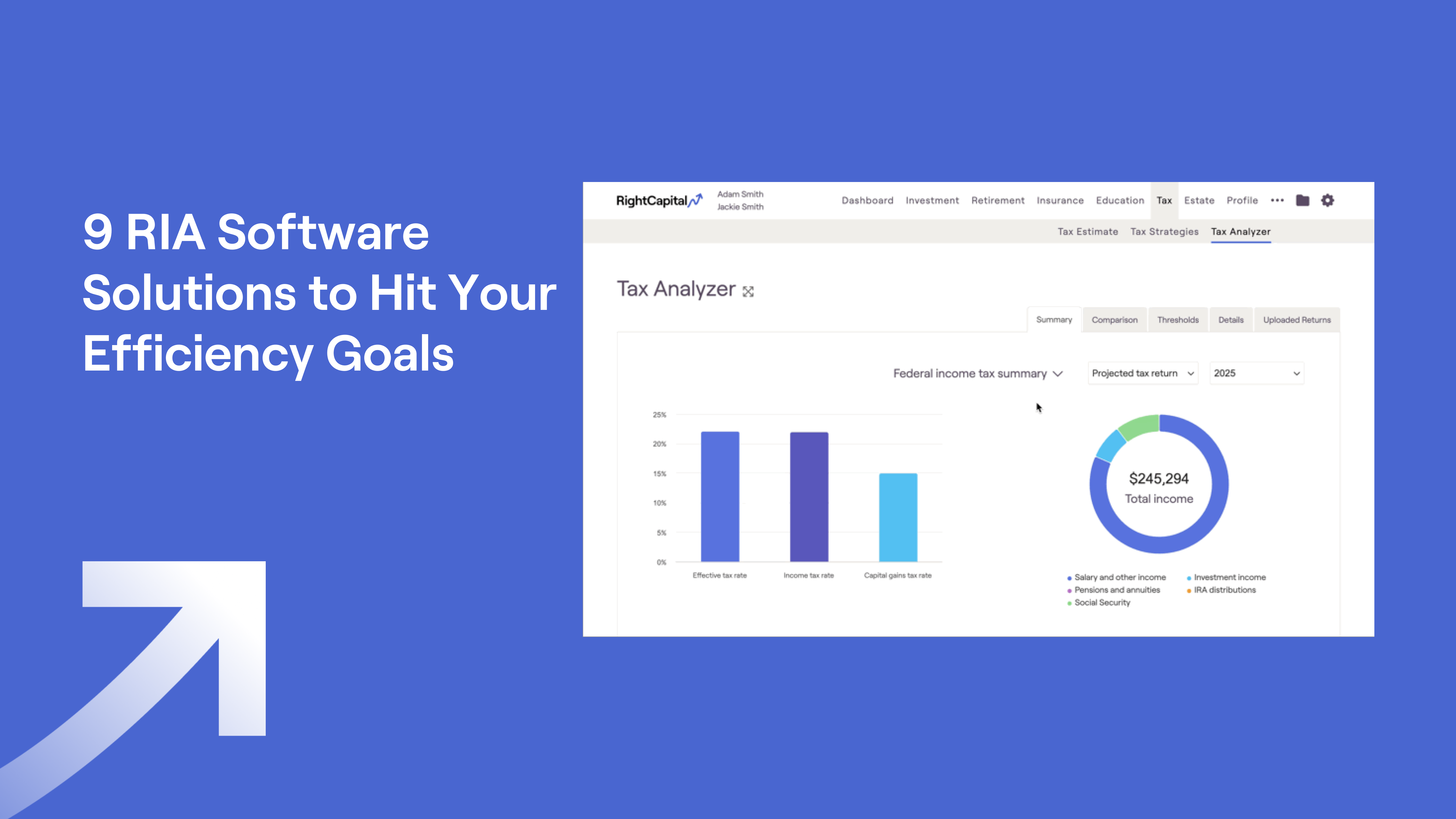

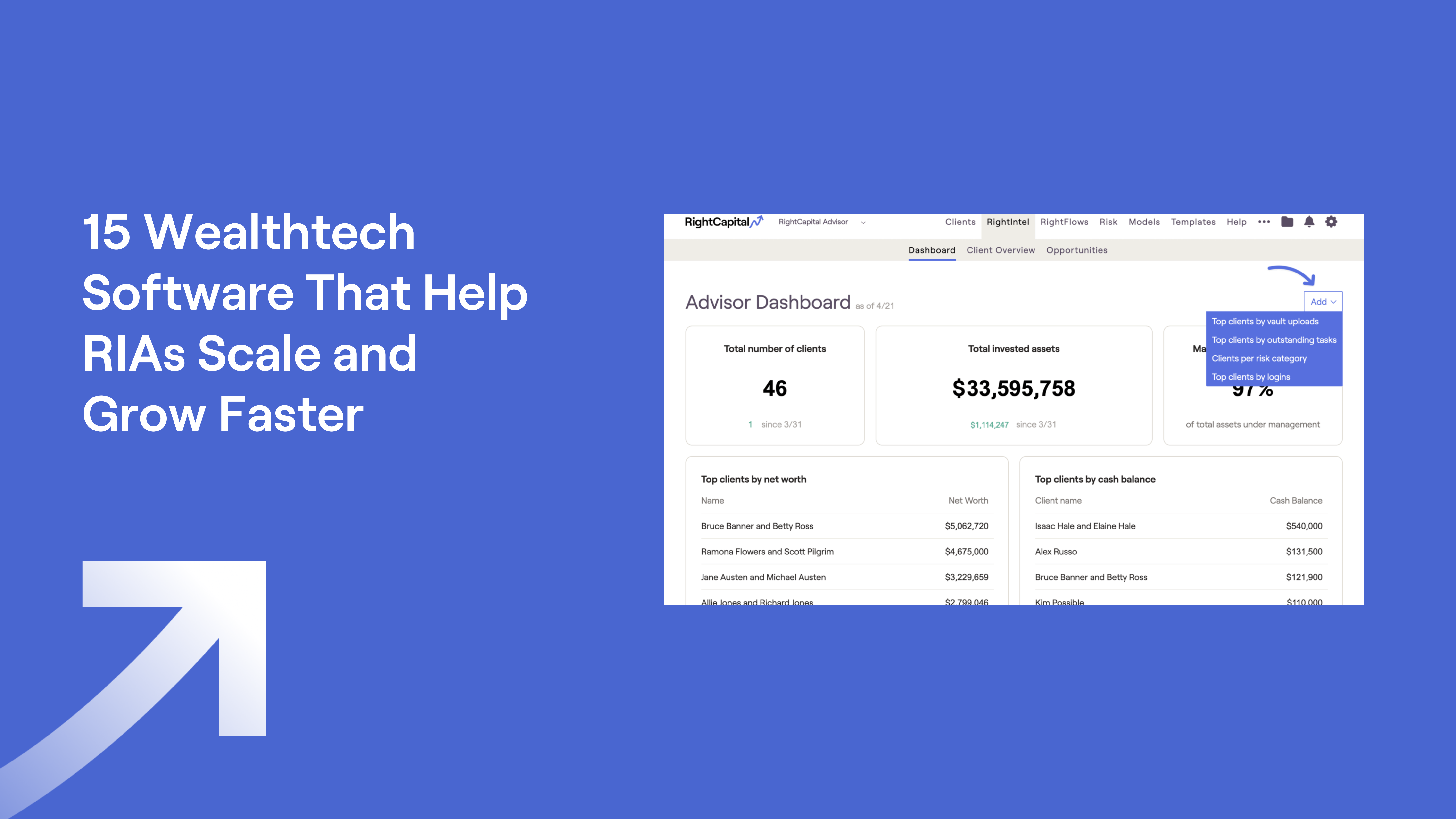

The operations plan explains how your business will function on a day-to-day basis. List out the tools and systems you'll need, your client onboarding process, and compliance procedures. Include information about your technology requirements and the high-level workflow for common business processes.

Management team

Highlight your background, including your education, certifications such as CFP, CFA, or ChFC, and any relevant experience. If applicable, introduce other team members or future hires and explain how their expertise will support your firm’s success.

Financial plan

Your financial plan provides concrete projections for your firm's growth and profitability. Include startup costs, operating expenses, revenue forecasts, and cash flow projections for at least three years. Be realistic about how long it takes to build a sustainable client base.

Best practices for writing your business plan

Creating an effective financial advisor business plan requires more than just filling in templates. These strategies help you develop a plan that guides your business decisions and attracts the support you need.

Keep it short and sweet

Your financial advisor business plan should be comprehensive but not overwhelming. Aim for 10 to 15 pages that cover all essential elements without getting too much in the weeds. Use clear language and focus on the most important information in each section.

Define your unique value proposition

Your value proposition explains why potential clients should choose your advisory firm over the competition. Consider what makes your approach different and address real client pain points that other advisors might miss.

Include visual aids

Charts, graphs, and infographics make complex information easier to understand. Use visuals to illustrate your financial projections, market analysis, and organizational structure to help readers quickly grasp how your business will work.

Back up claims with data

Support your assertions with credible research and specific numbers. Instead of vague statements, cite research showing concrete market opportunities and industry trends that support your business model.

Address potential challenges

Your contingency plans build credibility with readers. Acknowledge potential obstacles and explain how you'll handle them. Common challenges include client acquisition costs, regulatory compliance expenses, and competition from established firms.

Get feedback from industry professionals

Ask experienced financial advisors or business mentors to review your draft and provide feedback. Outside perspectives help you refine your plan and increase your chances of building a successful practice.

Review and update your plan regularly

Your business plan is a living document. Schedule quarterly reviews to assess your progress and adjust your strategy based on market and industry changes. Update financial projections as needed as you gather more data about costs related to client acquisition and other operating expenses.

Common business plan mistakes to avoid

Good intentions don't always lead to good business plans. Financial advisors often make the same avoidable mistakes that can sink an otherwise solid strategy.

Here's how to dodge the most common pitfalls:

Insufficient market and competitor research

Many advisors assume they understand their market without actually digging into the details. Take time to research what other advisory firms are doing and have real conversations with potential clients about their biggest frustrations. This kind of market research reveals opportunities you might otherwise miss.

Lack of clear objectives

"I want to help people with their money" is a lovely thought but it isn't a business goal. Set concrete targets such as "acquire 50 clients with an average account size of $500K within 24 months." Specific business goals give you something to track and make it easier to explain your vision to potential partners or investors.

Undefined target audience or niche

When you try to be everything to everyone, you end up being nothing to anyone. Pick a target market based on what you know and what opportunities exist. Having a clear niche makes your marketing efforts way more effective and helps you build the kind of expertise that justifies higher fees.

Unrealistic financial forecasts

Getting too excited about potential revenue while underestimating actual expenses is a recipe for cash flow disaster. Do your homework on industry benchmarks and err on the conservative side. Most successful advisors need 18 to 24 months to build a client base that actually pays the bills.

Omitting day-to-day operations

It's natural to get excited about your big-picture vision and gloss over the practical details, but those everyday operations are what keep your business running smoothly. Take time to think through your client service workflows and administrative processes. Strong operational planning helps you deliver consistent service as your client base grows.

Conclusion

A well-crafted financial advisor business plan is your roadmap to building a thriving advisory practice. Each section covered here, from defining your target market to creating realistic financial projections, helps you think through what it actually takes to run a successful independent firm.

The best advisory firms don't just have solid business strategies; they pair them with the right technology to deliver real value to clients. RightCapital helps advisors deliver on the planning services and client engagement strategies you'll outline in your business plan, giving you the tools you need to actually execute your strategy.

Your business plan sets the foundation for growth. Now, get the tools that help you build on it.

See how RightCapital grows with your firm and supports long-term client relationships in a free 1:1 demo.