Pointing advisors & their clients in the right direction: forward

Breathe easy knowing RightCapital will provide the clarity, flexibility, and support you need to confidently build financial plans.

Clearly illustrate multiple scenarios, stress tests, and more. Your clients will thank you for helping them make their golf-in-the-morning, beach-all-day dreams a reality.

Easily show your clients how they'll save money with an optimal tax-efficient distribution strategy—explaining withdrawal schedules and Roth conversions in a way they'll truly understand.

Show your clients how to maximize their Social Security income. You’ll help them confidently make big decisions, like when to start receiving benefits.

Try these features and more for free!

20-minute 1:1 virtual demo

14-day free trial

Ask any questions

Help clients easily visualize where their cash is coming and going for each year.

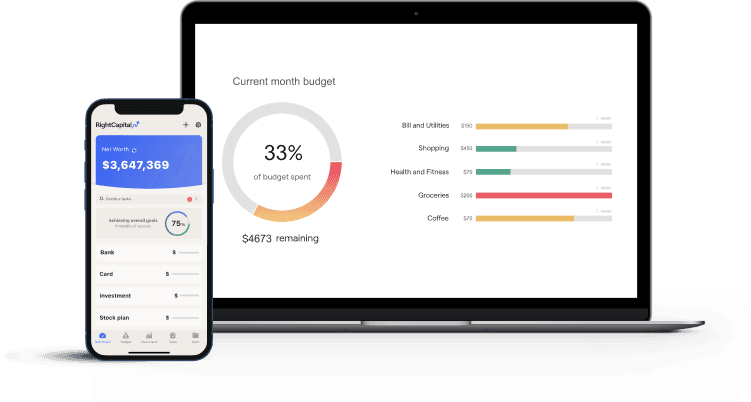

Provide your clients with one place to manage all their credit card and bank accounts, track spending in various categories, and see how they are doing against monthly budget goals.

Use our unique student loan module to illustrate different scenarios so your clients can reduce payments. Help ease the burden of student debt for your clients or their children.

Help protect your clients in the event of situations such as disability or death. Evaluate their needs in different situations and identify ways to ensure their success.

Help clients learn the flow of assets at the end of life, including any possible estate tax ramifications. Replace their anxiety with the peace of mind, knowing their assets are in order.

Incorporate risk assessment as part of your holistic financial planning process. Show how each client household's risk score relates to their investment strategies and probability of success.

Learn MoreBring together your client's bank accounts, credit cards, and externally-held investment accounts all in one place. It’s finally easy to see the full financial picture.

Digitally onboard your clients in six simple steps with our streamlined client portal. It’s easy for you and your clients to get up and running to plan for their futures!

RightPay integrated payment solution for fee-for-service financial planning

Collect financial planning fees from your client's credit card

Flexible payment options: one-time or ongoing

Seamless client experience: all-in-one portal