Portfolio Management Software for RIAs Compared

June 13, 2025

Trying to find the right portfolio management software for your RIA can make your head spin.

There are dozens of software solutions out there claiming to be the best platform for your firm. But which tools will actually help you improve your ROI, better serve (and retain) your clients, and keep your business secure and compliant?

This guide will help you explore the functionality of several popular portfolio management tools, identify how those tools can make your job easier, and empower you to find the best, most user-friendly platform for your firm.

What is portfolio management software?

To help clients make the best decisions, it's important to understand all the ins and outs of their portfolios.

Portfolio management software helps you do just that, giving you the real-time investment analysis tools, performance insights, and forecasting capabilities you need to provide each client with the best guidance for their unique situation.

Why advisors use portfolio management tools:

Manage clients' investments from one user-friendly dashboard

Generate real-time reports and forecasting models to help guide clients’ decision-making

Streamline your internal workflows

Improve client communications and engagement

Deliver better, more personalized investment strategy advice

5 portfolio management software tools for financial advisors

To help you find the best portfolio management software for your firm, let’s explore five solutions advisors use to manage their client investments.

Black Diamond

Black Diamond describes itself as a portfolio and wealth management platform that provides accounting, performance reporting, trading, and rebalancing capabilities to firms of all sizes. Black Diamond integrates with RightCapital.

Key Features

Portfolio accounting and performance reporting

Trading and rebalancing automation

Client relationship management (CRM) tools

Data aggregation and reconciliation

Orion

Orion, which also integrates with RightCapital, has established itself as an all-in-one financial advisor software platform that provides portfolio management and business intelligence tools to firms and individuals.

Key Features

Portfolio accounting and performance reporting

Trading and rebalancing tools

CRM

Business intelligence and analytics

Addepar

Addepar describes itself as a technology platform that specializes in data aggregation, analytics, and portfolio reporting for complex investments. Addepar also integrates with RightCapital.

Key Features

Data aggregation across all asset classes

Portfolio analytics and performance reporting

Portfolio construction and rebalancing tools

Client portal with mobile access

Advyzon

Advyzon offers users such as advisors, aggregators, broker-dealers, wirehouses, and bank trusts a comprehensive technology platform that combines portfolio management, performance reporting, client portals, and business intelligence. Advyzon integrates with RightCapital.

Key Features

Portfolio management and reporting

Trading and rebalancing automation

Client relationship management (CRM)

Business intelligence and analytics

Envestnet | Tamarac

Envestnet | Tamarac provides web-based portfolio rebalancing, performance reporting, and customer relationship management software to clients such as independent advisors, exchange partners, and asset managers. RightCapital integrates with Envestnet | Tamarac.

Key Features

Portfolio rebalancing and trading automation

Performance reporting and analytics

CRM

Data aggregation and reconciliation

More financial advisor software that supports portfolio management

In addition to the list above, there are other software solutions that offer portfolio management capabilities as part of their broader wealth management solutions.

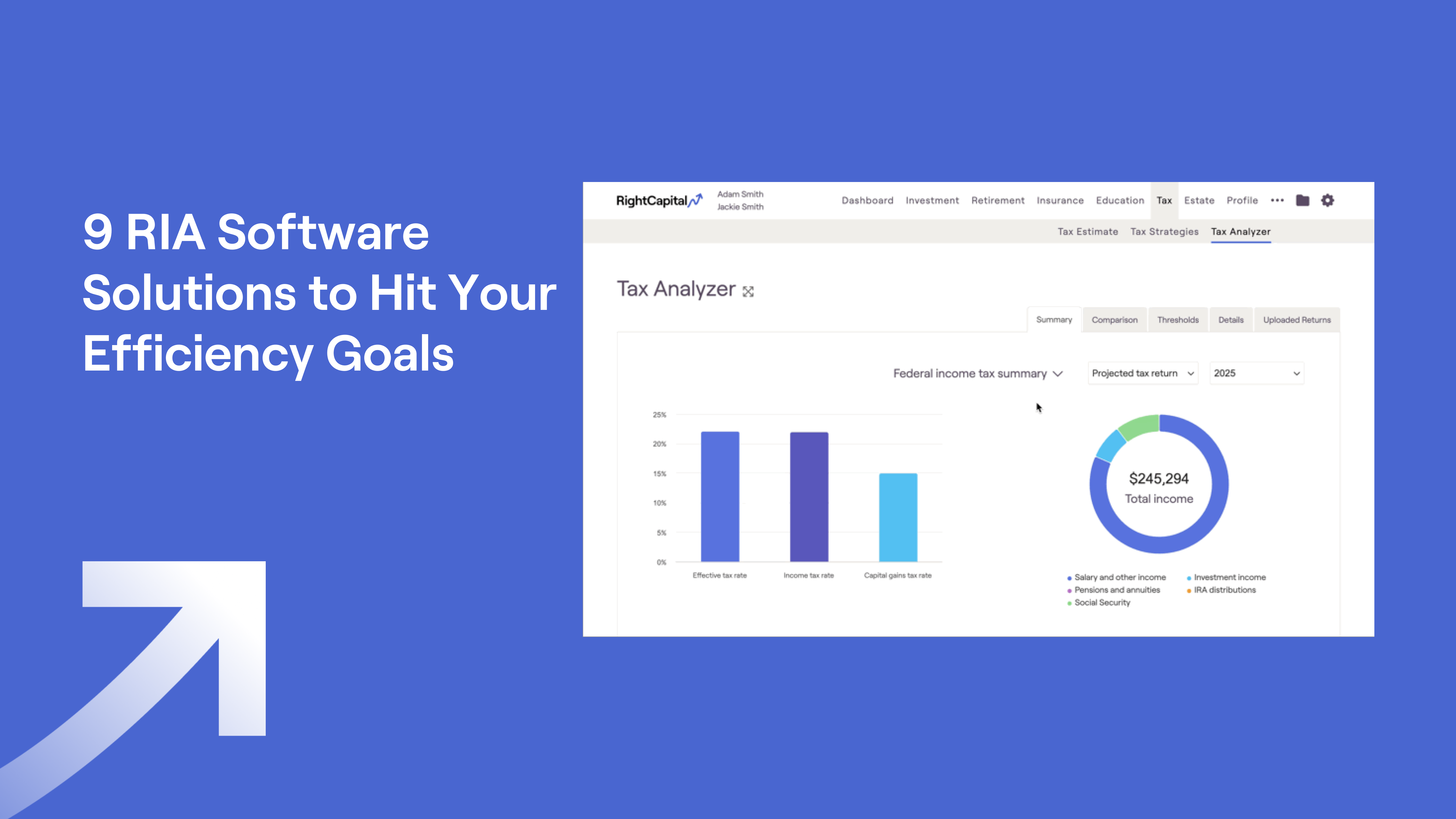

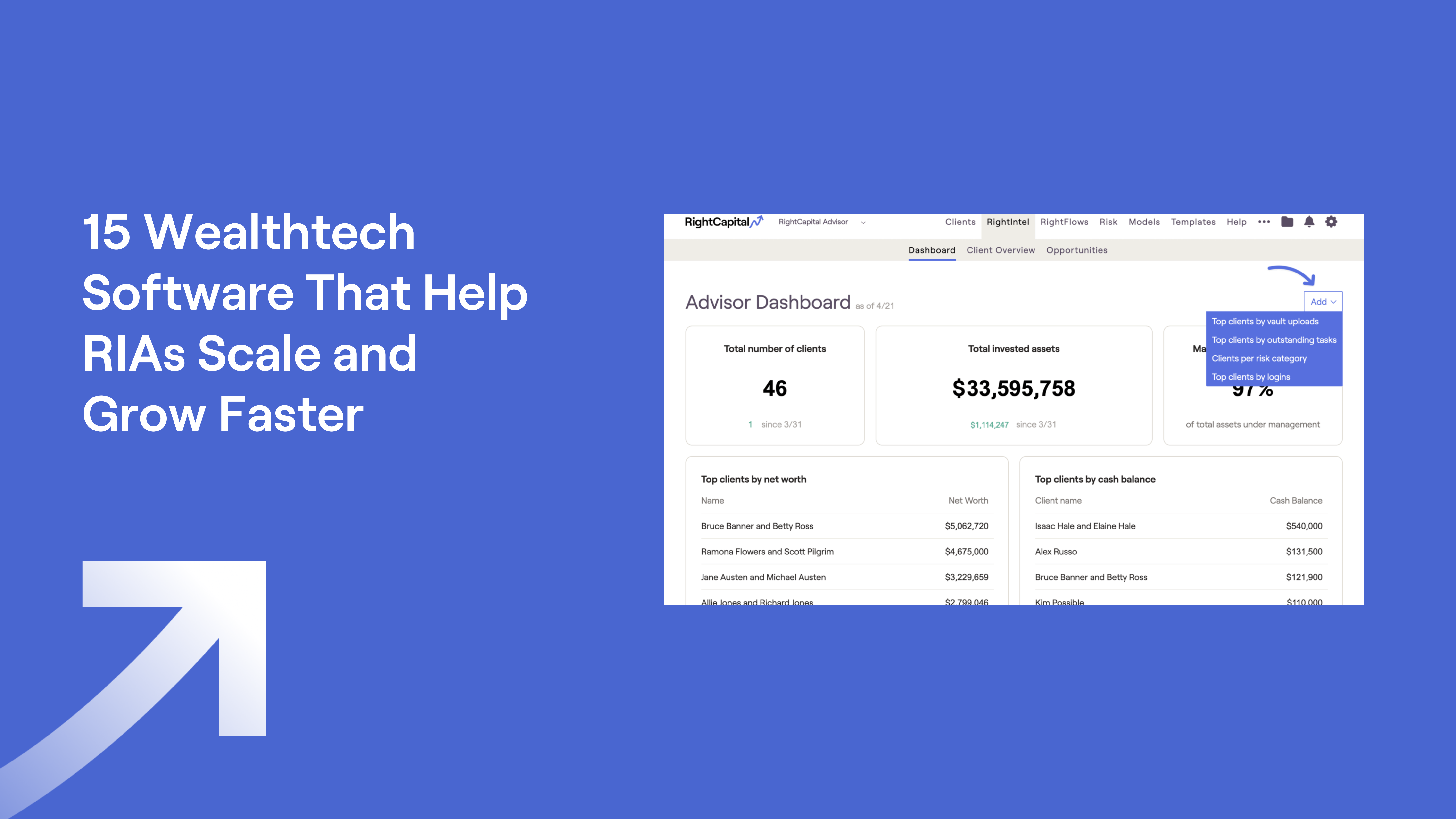

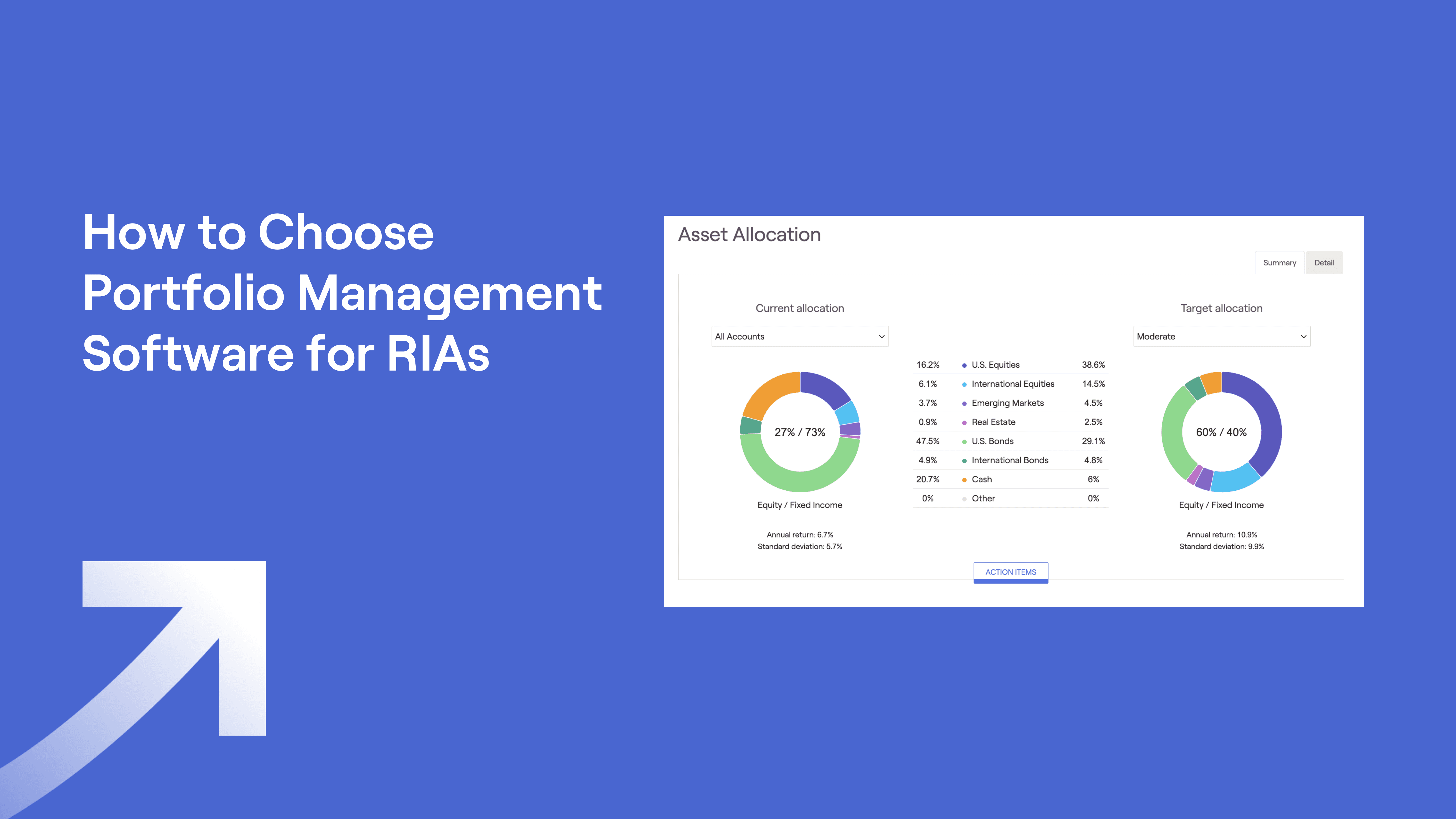

RightCapital provides modern advisors with holistic financial planning software and portfolio-related features and integrations. Show clients how their investments fit into the bigger financial picture with tools and functionality that make planning conversations more engaging and visual.

AssetMark, which integrates with RightCapital, describes itself as a leading provider of wealth management and technology solutions that help financial advisors and teams meet the needs of their clients and businesses. AssetMark operates as a TAMP (turnkey asset management platform) that provides portfolio construction, investment management, and due diligence services.

SEI, which also operates as a TAMP, offers a range of programs that make investment processing, operations, and asset management more efficient for clients such as corporations, financial institutions and professionals, and ultra-high-net-worth families. SEI provides model portfolios, unified managed accounts, separately managed accounts, and mutual fund and ETF strategies. It also integrates with RightCapital.

Charles Schwab, Fidelity, and Interactive Brokers serve as custodians that offer portfolio management tools for advisors, typically integrated with their custody and clearing services. All integrate with RightCapital.

What are the main features of investment management software?

Choosing the right portfolio management software comes down to finding the features that will best help you serve your clients.

Here are some features that may be important to your firm:

Data integration and aggregation: Ensure the platform can seamlessly connect with your custodians, third-party data providers and analysis tools, and existing technology stack. This helps you create and maintain a unified dashboard view of each client’s portfolio and asset allocation.

Automated portfolio rebalancing: Look for sophisticated rebalancing engines that can accommodate complex client restrictions, tax sensitivity settings, and multiple asset classes while keeping portfolios aligned with your target allocations and investment strategy.

Real-time performance reporting capabilities: Choose a software that offers flexible, customizable reporting with in-depth performance metrics, benchmarking options, and client-friendly visualizations.

Trade order management: Platforms that provide efficient trade workflow capabilities—including order routing, execution tracking, and settlement reconciliation across multiple custodians—help you save time and reduce errors when executing trades.

Tax optimization features: Features such as tax-loss harvesting, asset location optimization, and wash sale monitoring enable you to help clients reduce their tax burdens.

Compliance monitoring: Software that includes robust compliance workflows, audit trails, and regulatory reporting capabilities helps you meet requirements and avoid costly violations.

Client communication tools: Look for integrated client portals, document-sharing capabilities, and communication features to keep clients informed and engaged with their portfolios.

Scalability: Choose an agile platform that can grow with your firm, with functionality that supports increasing client counts, assets under management, asset allocation strategies, and operational complexity without requiring you to switch systems later.

How do I choose the right portfolio management software for my needs?

As you can see, when it comes to portfolio management software, there are a lot of options out there.

The key is finding the platform that fits your firm’s needs and will help you grow. Here's a recommendation on how to approach your search:

Step 1: Assess your needs. Start by figuring out what you actually need. Think about the size of your firm's client base, forecasting needs, the types of assets you manage, which custodians you use, and what other software you already have in play.

Step 2: Evaluate top solutions for necessary features. Make a list of the features you absolutely need versus the nice-to-haves. Focus on finding platforms that can support your current investment strategy and management process. Also, ask about the frequency of software updates. Will the platform evolve to meet your changing needs?

Step 3: Consider scalability and integrations. Make sure each platform can play nice with your current tech stack. Look at which custodians they connect to and what other integrations they offer.

Step 4: Assess pricing and support. Compare what each platform costs, including setup fees and ongoing costs. Think about whether the efficiency gains and improved decision-making will be worth the investment.

Step 5: Test drive options. Request demos and trials so you can see how each platform works. Have your team try each tool, too, since they’re the ones who will work with the software and dashboards each day.

Best practices for getting the most out of your portfolio management software

Connect your systems

Link your portfolio management software with your CRM, custodians, and other tools you already use. When everything talks to each other, it empowers you to spend less time on data entry and obtain better metrics on each client relationship.

Use automation wherever you can

Consider leveraging automated rebalancing, allocation monitoring, reporting, and billing to create more agile workflows that streamline manual work. This frees up time to work with clients (instead of wrestling with spreadsheets).

Create real-time reports that clients can understand

Create reporting templates that clearly show portfolio performance and your value as their advisor. Use visuals that make complex information easy to digest.

Keep your data clean

Your business depends on accurate data. Check data accuracy regularly and reconcile trades to make sure your reports are reliable.

Stay compliant without the headaches

Use your platform's compliance tools to stay on top of regulatory requirements. Set up workflows that make audit prep much easier.

Train your team

Make sure everyone knows how to use the platform well. When new functionalities come out, take time to learn them so you get the most value from your software.

Conclusion

The best portfolio management software makes your workflows smoother and more agile, and helps you deliver better client service.

You want software that connects with the tools you use every day, automates anything tedious, and gives you the reporting flexibility you need to help clients see the value you provide.

Pro tip: Whichever portfolio management platform you choose, make sure it integrates with RightCapital.

RightCapital provides advisors with interactive visualizations, tax-planning features, and streamlined workflows to help make your team’s job easier.

RightCapital integrates with all the major portfolio management platforms and gives you planning tools that complement your investment management work, without duplicating it.

Because when your planning software works seamlessly with your portfolio management platform, you spend less time on data entry and more time helping clients reach their goals.

Curious how RightCapital works with your portfolio management software? Schedule a demo to see it in action.