There’s no question about it, student loan debt is a hot topic, with 46 million Americans holding student loan debt totaling $1.75 trillion, according to Student Loan Hero. Across the generations, members of Gen X (typically defined as those born between 1965 and 1980) hold about 38% of that total and Millennials (born between 1981 and 1996) hold almost 32%, so it’s pretty likely you have clients dealing with this burden. But where to start in helping them? We have three steps to get you on your way:

Step 1: Understand what type of loan(s) your clients have

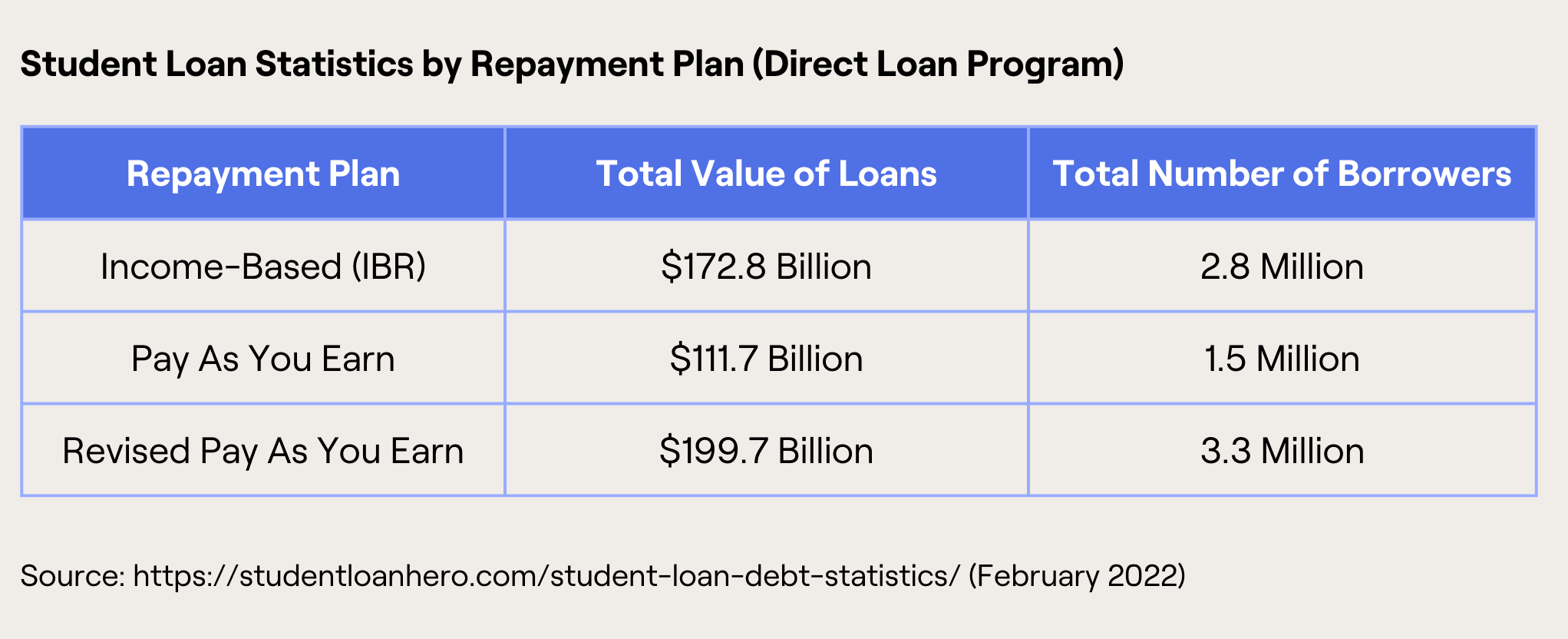

The type of loan your client has dictates their repayment options. Generally speaking, federal loans have far more options for repayment than private. If your client or prospect has a federal loan such as a Direct Loan (the vast majority of borrowers at 37 million as of 2022) or a Federal Family Education Loan aka FFEL (10.2 million borrowers) which can be consolidated into a Direct Loan, they may be eligible for an Income Driven Repayment Plan or Public Service Loan Forgiveness.

Step 2: Identify your clients’ available options

Income-Driven Repayment Plans

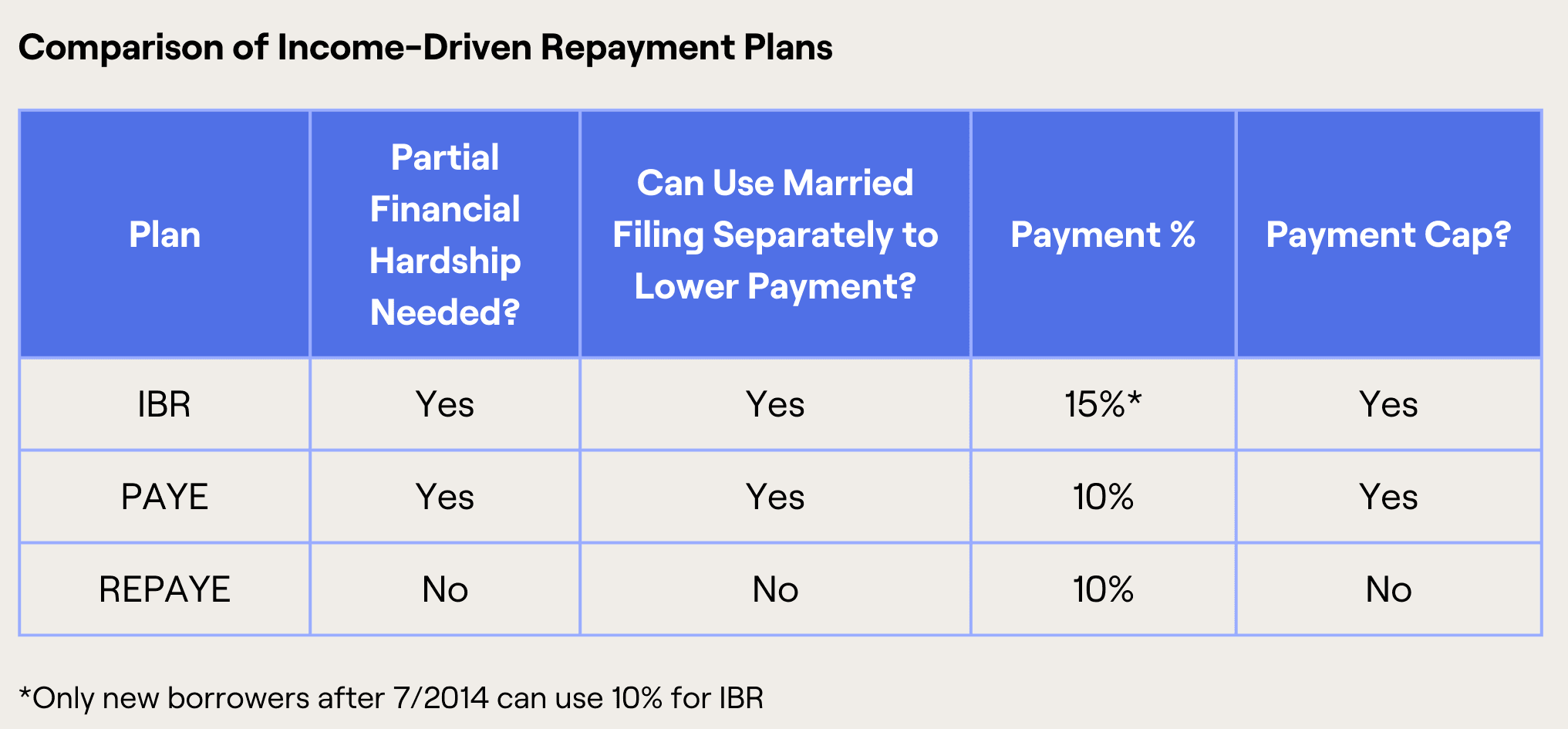

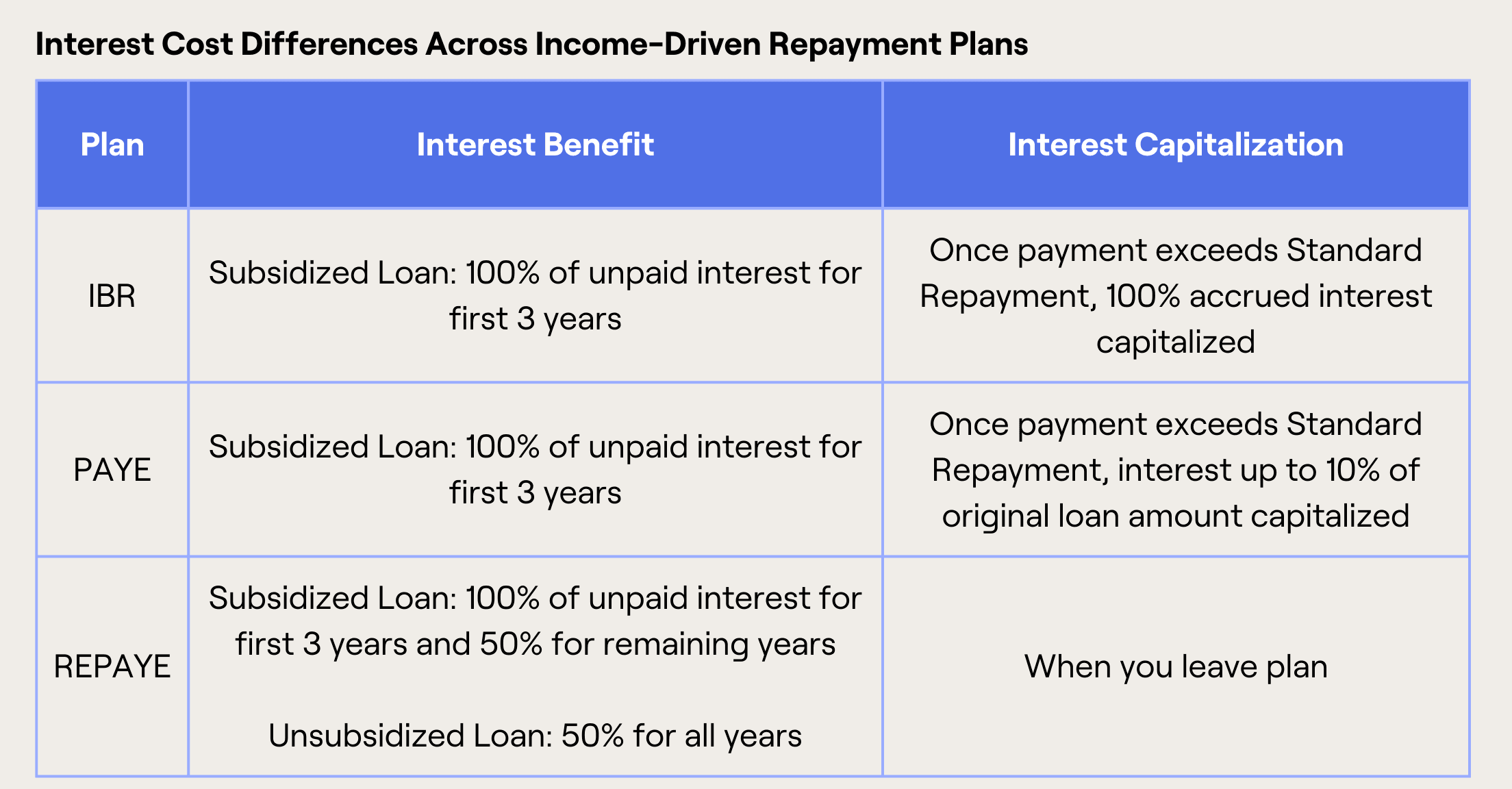

There are different types of Income-Driven Repayment Plans with varying eligibility requirements. These plans set the monthly student loan payment at an amount intended to be affordable based on your client’s income and family size. The remaining balance is forgiven at the end of the term, but it should be noted that this is considered taxable income. Your client will need to fill out an application for each of these plans and be officially accepted. Let’s get into the details of three such plans:

Income-Based Repayment Plan (IBR)

Pay As You Earn Repayment Plan (PAYE)

Revised Pay As You Earn Repayment Plan (REPAYE)

Public Service Loan Forgiveness

In order to be eligible for Public Service Loan Forgiveness, your client must work full-time (30+ hours a week) for a public service organization (for example: US federal, state, local, or tribal government or a not-for-profit organization). They must have a Direct Loan or another federal loan consolidated into a Direct Loan, utilize an Income-Driven Repayment Plan (requirement is sometimes waived) or a 10-year standard repayment plan, and have paid the last 120 monthly payments on-time and in-full.

The balance forgiven with Public Service Loan Forgiveness is not taxable. As of September 2021, the average balance forgiven for those borrowers accepted was $94,907.

Step 3: Create a plan based on need and lifestyle

Debt repayment is not one-size-fits-all so find out as much as you can about your clients current lifestyle, work situation, and overall financial goals to lead you toward a plan that works for them. For example, your client may be interested in working in public service so they can work toward Public Service Loan Forgiveness, or they may be more excited about working in the private sector, perhaps with a higher salary, so they can make higher debt payments and pay off their loans faster.

RightCapital is the only major financial planning software in the industry with a comprehensive student loan module that can account for the type of loan, determine eligibility toward various payment plans, calculate tax on any forgiven loan balances, and more.