Earning New Business with Tax-Efficient Distributions

June 30, 2022

Derek Mazzarella, an advisor with Gateway Financial Partners, spoke with us about his experience with RightCapital. In his practice, he typically works with young professionals and pre-retirees. Derek was searching for a software that was easy to understand from the client perspective but which also offered enough tools from an advisor’s perspective—something he hadn’t yet found on the market.

Challenge

Derek had previously worked with a number of financial planning software programs, but found each to be lacking in some way. For example, one software had account aggregation and nice client reports, but was limited in terms of projections, Monte Carlo simulations, and other tools he considered vital for today’s advisors. He found another software with tools that were great for advisors, but outputs that were difficult for clients to understand.

Solution

When Derek discovered RightCapital, he found that it was the “Goldilocks” of solutions, being ideal from both standpoints of the client and the advisor. He was happy to see that RightCapital had clear-to-understand client-facing reports and enough robust advisor tools to run simulations. “It’s very easy to do things live in front of a client and show the impact of different decisions.”

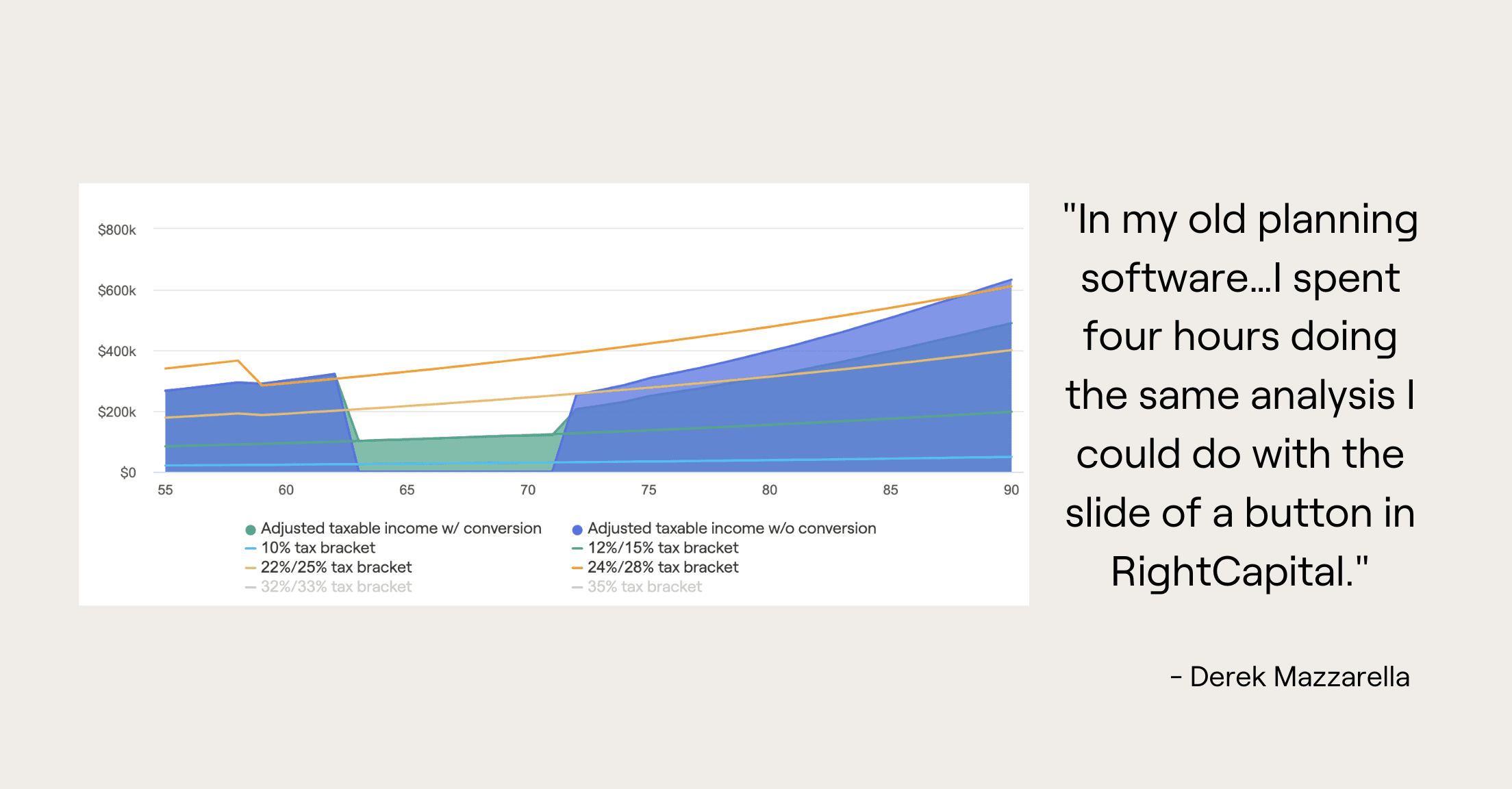

What most stood out to Derek was the tax tool in RightCapital’s retirement module. “In my old planning software…I spent four hours doing the same analysis I could do with the slide of a button in RightCapital.”

Results

One exciting success story Derek has had with RightCapital’s tax-distribution tool was being able to demonstrate to a prospective client that he could save $116,000 in taxes over the course of his retirement by using a tax-efficient distribution strategy. This fact and the visuals surrounding it helped win the business.

Another way RightCapital has helped Derek with opportunities is that since the clients’ accounts are all linked through the account aggregation tool, he has been able to uncover new assets—from old 401k accounts or cash on hand, for example—and integrate them into his practice.

Derek also spoke about the time savings he has experienced with RightCapital. He appreciates being able to send clients one sign-up link instead of having them fill out a detailed “40-page” questionnaire that then needs to be entered and RightCapital’s tools have saved time on plan creation as well. “I’ve calculated it’s probably saved me about 2-3 hours a week on planning time, just because you’re able to slide things much easier and it’s quicker to use as a planning tool.”

While Derek was the first in his office to use RightCapital, when he showed it to other advisors, “they were quite frankly pretty blown away and a number of them have actually switched from other tools to RightCapital”. He’s also been impressed with the continuous updates to the platform. “Every week I get an email from RightCapital stating all the things that they’ve changed…no other planning software updates that often.”

For more advisor success stories, visit this page. Want more from Derek? He also participated in this tax-planning panel with Warren Duthie.