Retirement and retirement planning should be fun

Retirement should be fun—a phase during which a hard-worked life can be celebrated by traveling abroad, spending time with family, or focusing on a cherished hobby. But this time can also be shadowed with concerns such as “Will I have enough money to last the rest of my life?” or “Should I be spending more now so that my hard-earned money doesn’t go to waste?”

Financial advisors can help alleviate these worries by incorporating dynamic retirement spending strategies into clients’ financial plans. In a time where nothing is certain, flexible strategies that adapt to market, behavioral, and life changes help reinforce your clients' confidence in their retirements. Below you’ll find video clips of Alexus, our Customer Relationship Lead, walking through how you can demonstrate different retirement strategies within RightCapital’s financial planning software. If you’d like to watch the full webinar these clips are from, visit the RightCapital YouTube channel.

Static strategy shortfalls

While static retirement strategies often adjust for an estimated inflation rate, they fall short in addressing uncertainties such as unpredictable market returns, the sequence of these returns, unknown future inflation rates, and longevity—the number of people in the US living to 100 is expected to quadruple by 2050. Static strategies do not consider potential changes in spending behavior over the length of retirement.

Advanced retirement spending strategies breakdown

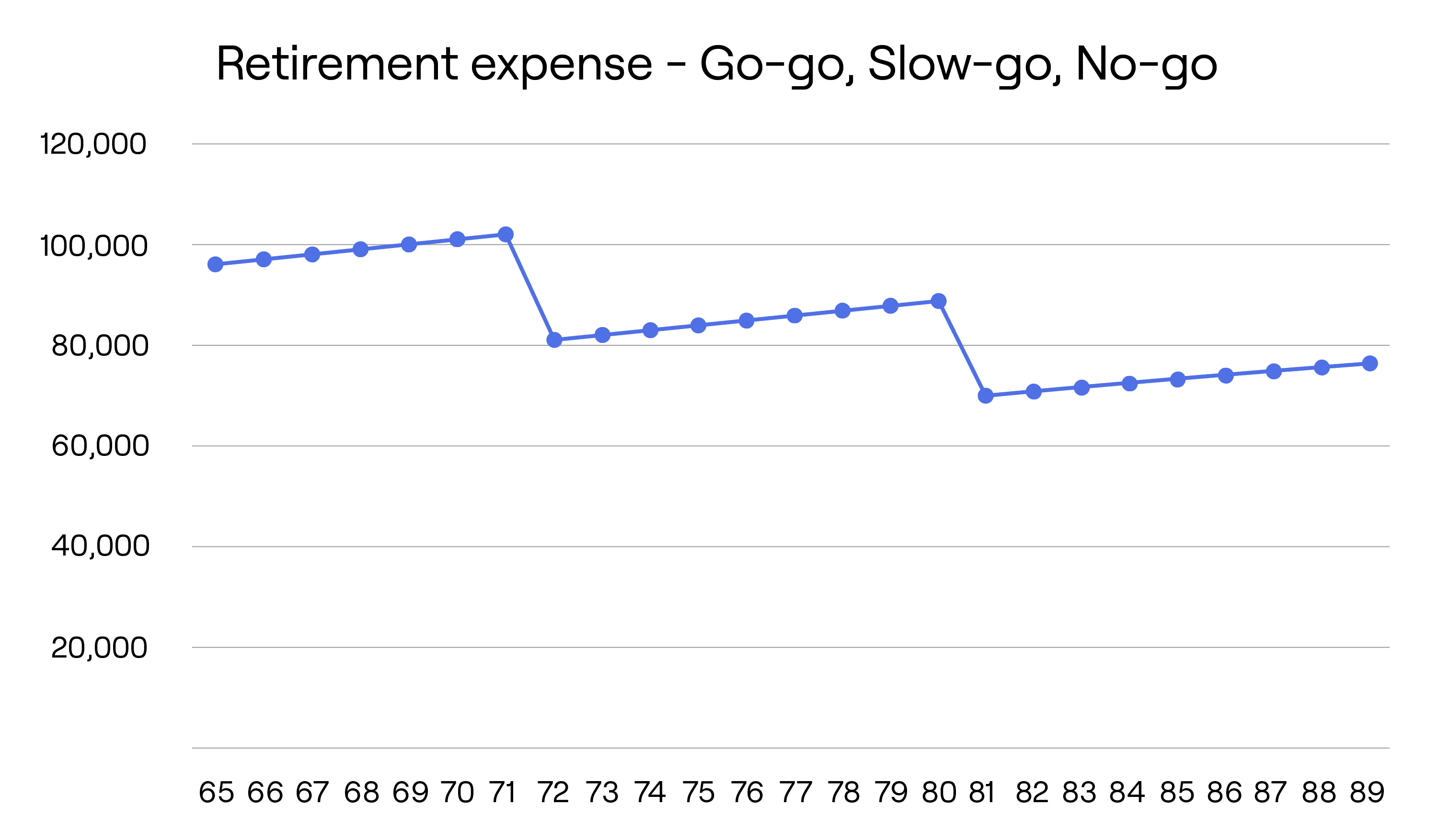

Staged spending: go-go, slow-go, no-go

A staged spending strategy (introduced by Michael Stein in “The Prosperous Retirement”) allows advisors to manage spending levels by age, often referred to as go-go, slow-go, and no-go. Typically, a client has greater expenses in the first few years of retirement when they are most active (go-go) and spending slows down as the retiree transitions throughout retirement (slow-go and no-go). It is a simple approach that accounts for the behavioral aspects of aging and impact on expenses.

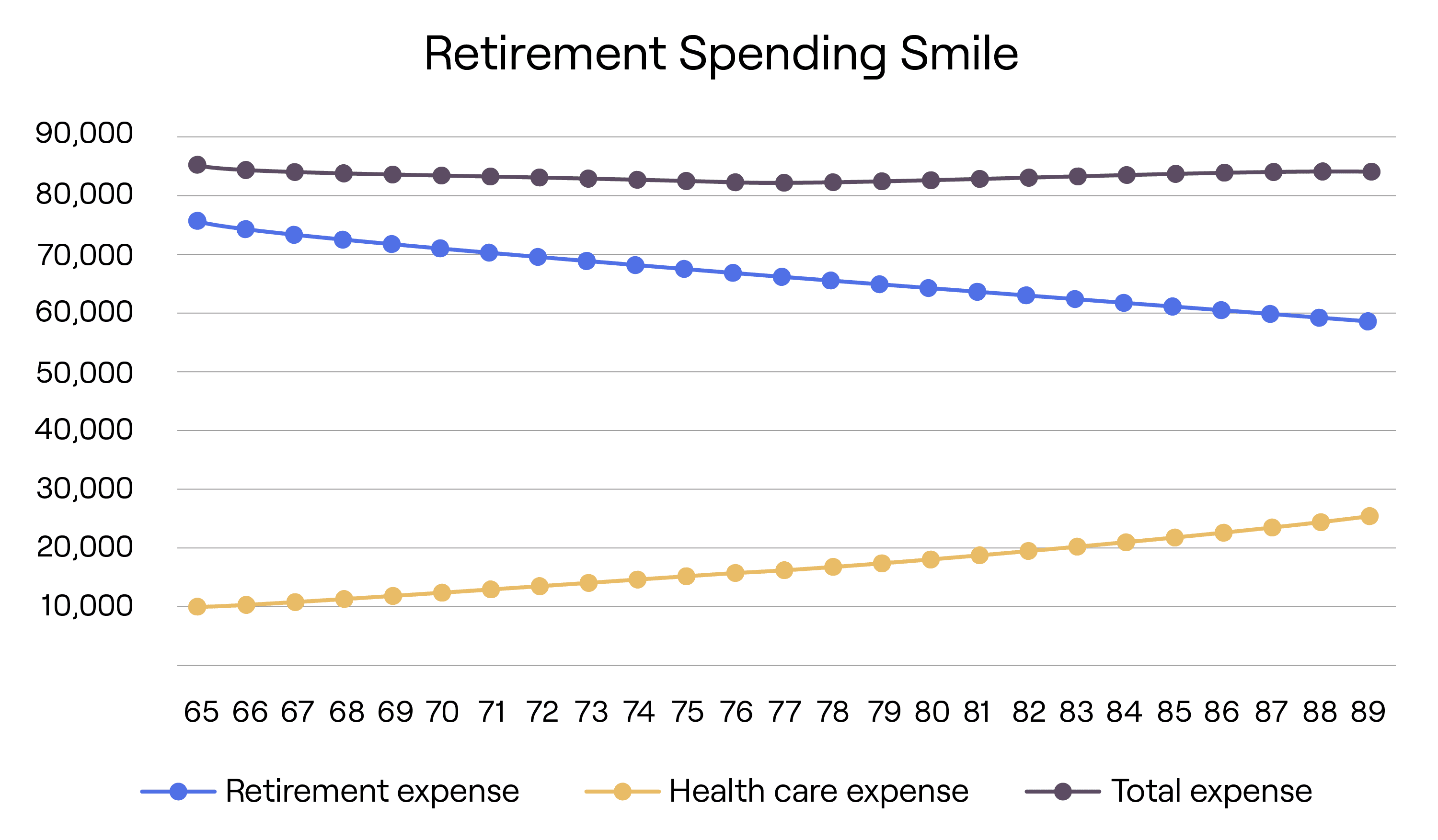

Retirement spending smile

Another advanced option is retirement spending smile, a concept brought to life by David Blanchett. Research suggests that retiree household expenditures decline slowly but steadily throughout retirement while healthcare costs increase over time. The accompanying chart represents the distinctive “smile” pattern resulting from the combination of these two expenses.

Dynamic retirement spending strategies

Dynamic retirement spending strategies are designed to help advisors and clients adjust retirement spending based on market performance and be more in line with real spending behavior. They allow for mid-course adjustments to minimize overspending or underspending, and provide the flexibility needed in retirement financial planning. If your clients have ever had questions such as “How will I know when to reduce my spending?”, keep reading.

Guardrail strategy

If a client’s withdrawing from their portfolio too rapidly in retirement, their retirement spending can be set to decrease automatically to keep the client’s plan on track. This methodology, founded by Guyton and Klinger, empowers the client to spend sensibly when appropriate, and adapt to a more modest spending level when necessary. This can allow for the plan to incorporate both client behavior and your recommendation to client spending in retirement.

As an example, if the portfolio return were negative, you can choose not to apply an inflation adjustment for retirement expense—this is referred to as the "Withdrawal Rule". If the current withdrawal rate were 20% greater than the initial withdrawal rate, you would reduce retirement spending by 10% if before age 80—this is known as the "Capital Preservation Rule". If the current withdrawal rate were 20% lower than the initial withdrawal rate, you would increase retirement spending by 10% if before age 80—this is noted as the "Prosperity Rule". Alexus explains it clearly here:

Floor and ceiling

Using the floor and ceiling strategy, if the client’s portfolio is performing well, the client can consider the possibility of spending more without jeopardizing the retirement plan. This allows for retirement spending to fluctuate with market performance as a consistent retirement expense rate is reflected within a specified corridor. The spending will be reduced in years with down markets, but no lower than the specified floor (for example, 15% below the initial retirement expense adjusted with inflation). Conversely, the spending will be increased in years of strong markets, but no higher than the specified ceiling (for example, 20% above the initial retirement expense adjusted with inflation).

Create custom retirement strategies with RightCapital

With RightCapital, you have the maximum flexibility to customize any of the above existing strategy types with different names and parameters. You can then use these strategies in a single plan or across multiple plans. Here’s Alexus one more time, discussing how you can customize strategies within RightCapital:

Are you ready to start planning with Dynamic Retirement Spending Strategies? Schedule a demo of RightCapital today.