20 Financial Analysis Software Tools for Advisors

July 18, 2025

Running an RIA firm is a juggling act. There are so many balls you have to keep in the air: managing client relationships, creating comprehensive financial plans, tracking performance, and staying compliant, just to name a few.

When you’re also trying to scale, it can be even more overwhelming. It’s not always easy to deliver the personalized advice your clients deserve, while also growing your business and keeping your operations running smoothly.

Fortunately, the right financial analysis software can make your entire team more efficient and impactful, while also improving your client service.

These tools don't just crunch numbers; they help you automate routine tasks, create interactive dashboards that make client interactions more engaging, and provide the data analysis you need to make smart business decisions on how to grow your practice and increase your profitability.

This guide explores 20 popular financial analysis software solutions for RIAs that can help transform how your team works in 2025 and beyond.

5 benefits of using financial analysis software at your firm

Here are five ways financial analysis software makes it easy to work smarter (not harder), communicate more effectively with clients and team members, and scale your practice easily and efficiently, while increasing your profitability.

Automate time-consuming tasks

Financial analysis software uses automation to reduce the time your team spends on manual data entry and report generation, freeing them up for higher-value advisory work.

Enhance your financial planning capabilities

Advanced analytical capabilities can streamline cash flow modeling, forecasting, budgeting, and scenario analysis. These tools help you create more accurate forecasting reports and develop comprehensive strategies tailored to each client's specific needs.

Create more engaging dashboards and client presentations

Data visualization tools can transform complex financial data into clear, engaging presentations that help clients easily understand their current portfolio and make informed decisions.

Optimize your operations

Business intelligence features help you analyze your firm's financial performance, plan for growth, track profitability, and make strategic planning and forecasting decisions. Real-time data gives you the insights you need to boost your profitability without stressing out your team.

Scale efficiently as you grow

Cloud-based financial analysis tools grow with your practice, supporting increasing client counts, evolving KPIs, and more complex analytical needs without requiring you to switch systems later. (Because you already have enough on your plate.)

Features to look for when choosing financial analysis software

When evaluating financial analysis software for your RIA, prioritize tools that are easy to use (for you and your clients), make your team more efficient, and simplify the hard stuff, such as compliance and cybersecurity.

User-friendly interface

Your team is busy. The last thing you need from any new financial analytics software is a lengthy onboarding and training process. The best financial analysis tools balance sophisticated analytical capabilities with ease of use for both advisors and clients.

You want to get the most value out of every feature without having a billion questions for your IT team every time you log in.

Robust automation capabilities

This is the secret to scaling your firm. Choose platforms that automate data integration and other time-consuming processes that hold you back from meeting your KPIs.

Automation reduces manual errors and makes your finance team more efficient. It also frees up your time for more strategic work, which helps maximize your ROI.

Compliance and security features

You shouldn't have to choose between powerful functionality and peace of mind. The best cloud-based financial analysis software handles the complex compliance and cybersecurity requirements so you don't have to.

Customizable dashboards and reporting

Look for software that offers dashboards tailored to each advisor, team, and client.

Customizable financial reporting lets you present financial data in a way that resonates with different stakeholders, supports their decision-making processes, and responds in real time to new inputs and considerations.

Advanced forecasting and budgeting tools

Essential features such as cash flow modeling, scenario planning, and predictive analytics help you create more accurate projections and test different assumptions for clients in real time.

You can also use these forecasting insights to improve your own business performance.

Strong data integration capabilities

Ensure the software connects with your CRM, accounting software, and other tools in your tech stack. Look for platforms that can consolidate information from various data sources as they’re updated so you’re always working with the most up-to-date information.

Comprehensive analytics tools

Look for platforms that offer in-depth financial analysis, metrics analysis, and business intelligence features. These tools should support both client-focused analysis and firm-level performance monitoring. They should also make tracking KPIs easy.

Responsive support and scalability

No matter how intuitive a tool is, you're bound to have questions. Look for platforms that offer human customer support, not just AI chatbots, when you need help with automations, data integrations, financial modeling, and other features or technical issues.

20 financial analysis software solutions for RIAs in 2025

Ready to take advantage of all these features and more? Here are some of the top financial analysis software platforms that you can use to enhance your practice and streamline your workflows.

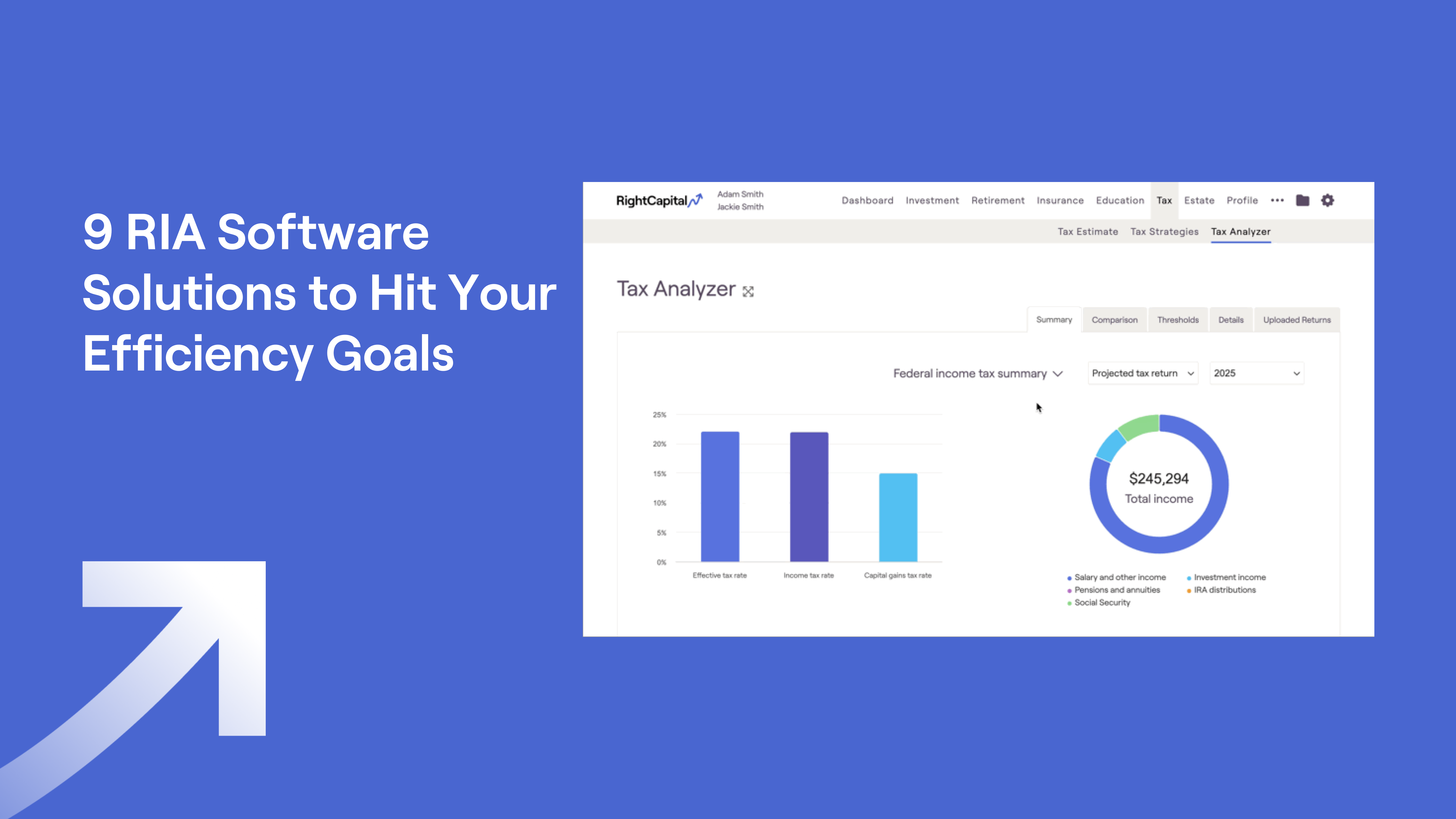

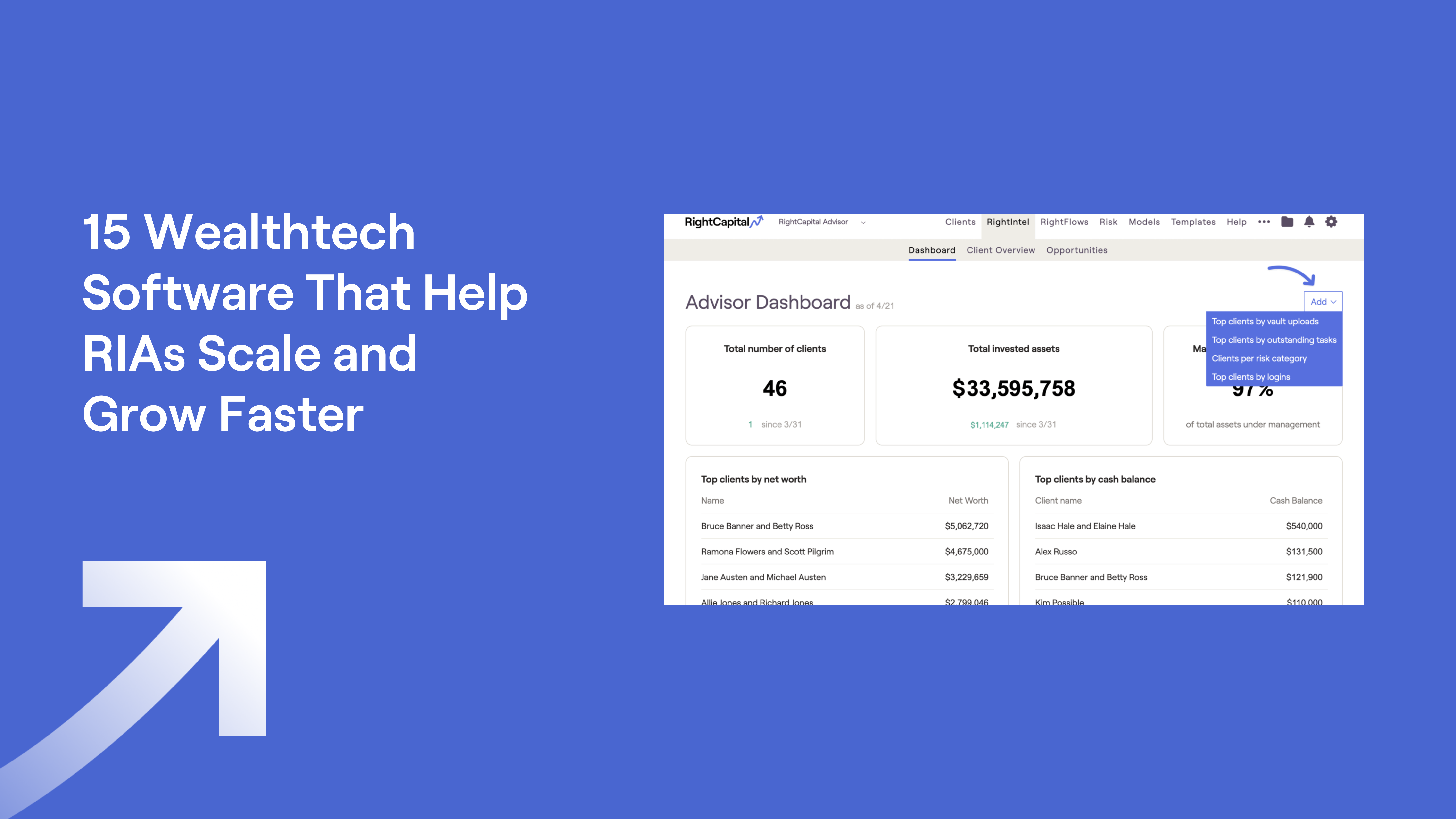

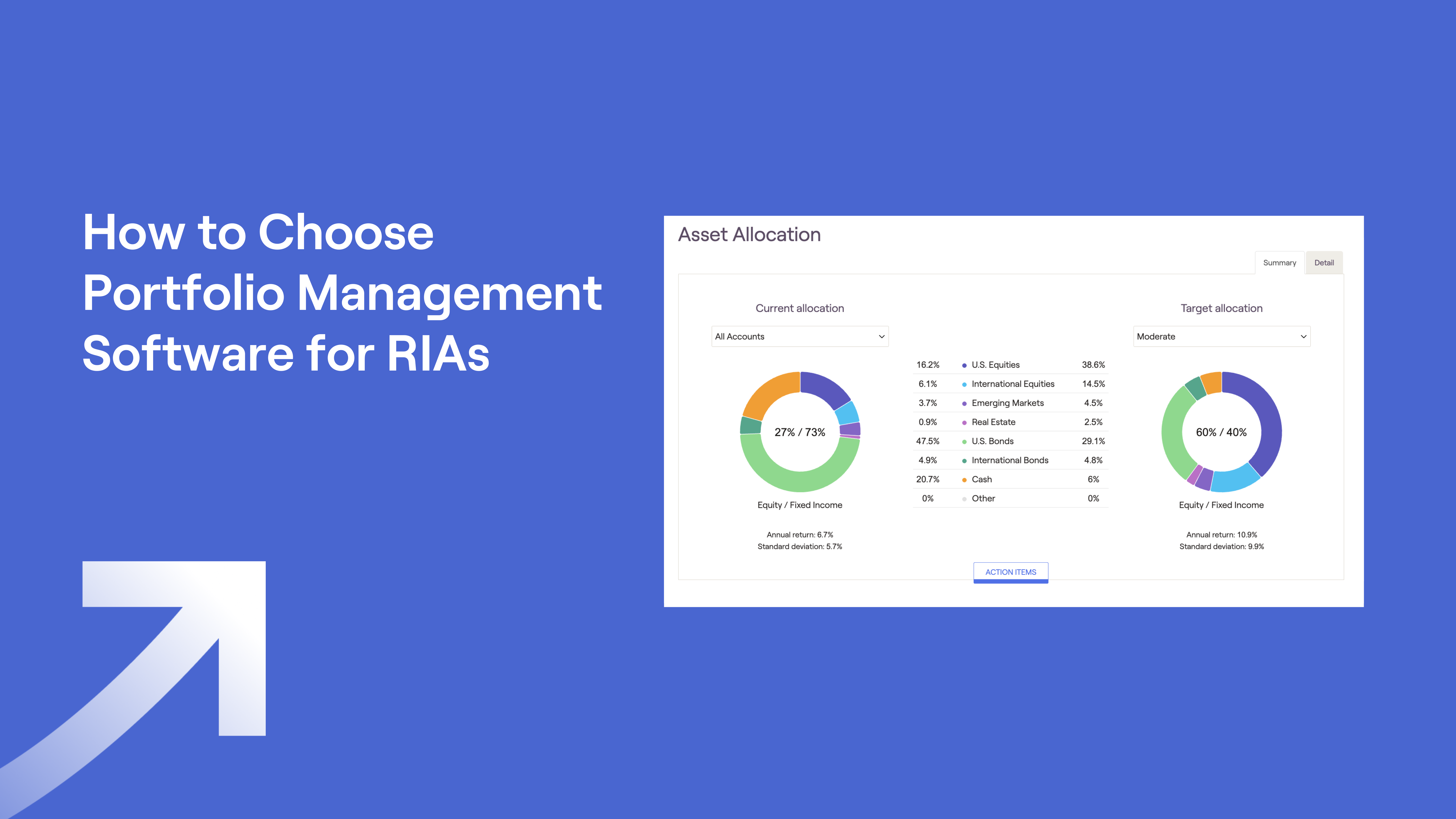

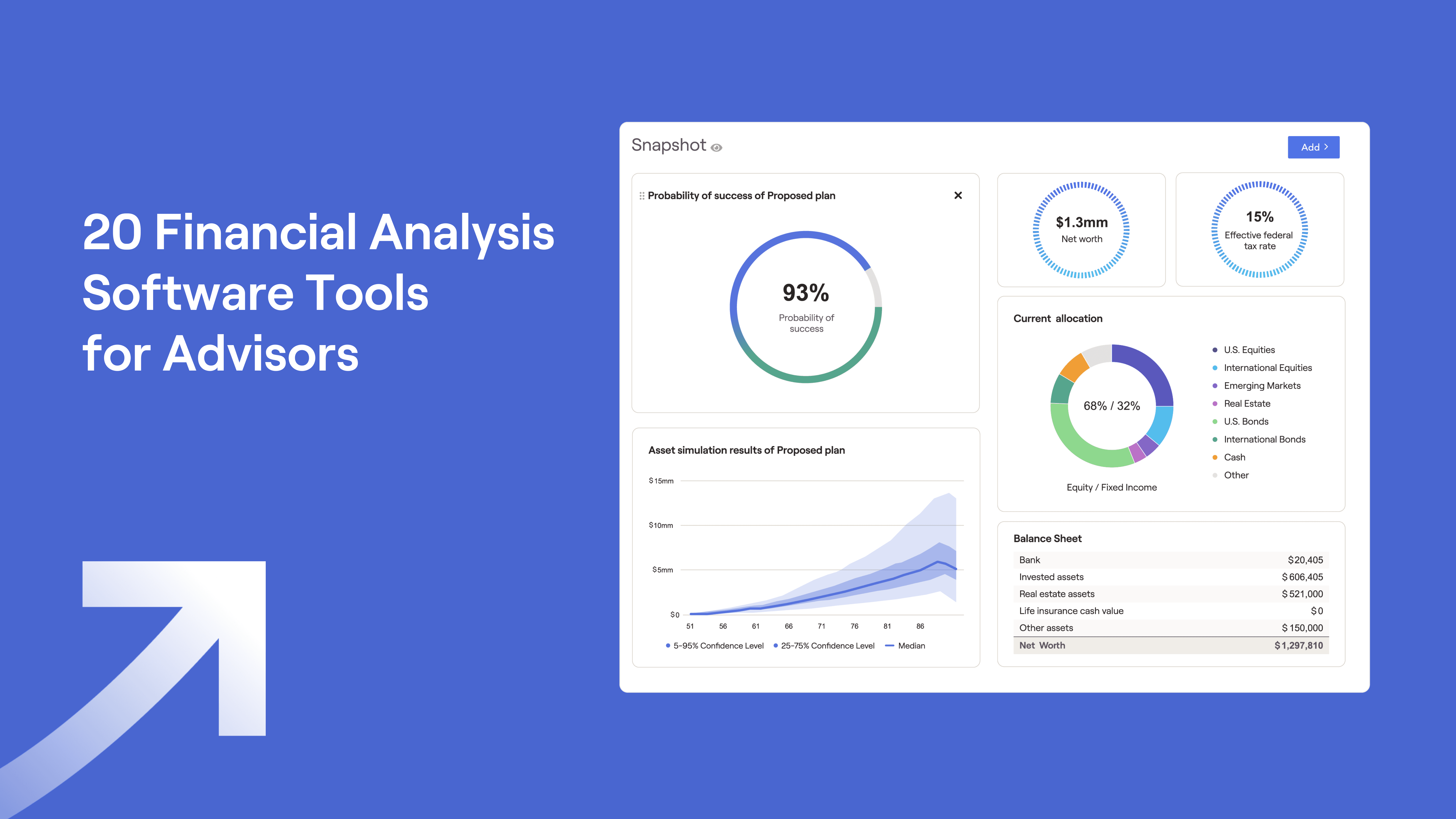

RightCapital

RightCapital’s easy-to-use software offers powerful tools to simplify planning, enhance client engagement, and help your firm scale more efficiently. The platform combines comprehensive financial planning and analysis capabilities with modern data visualization and intuitive dashboards.

RightCapital also provides cash flow analysis, scenario modeling, and interactive client tools such as Snapshot™ plan summaries and Blueprint™ visuals to help you and your clients easily see the big picture of their financial data.

The platform integrates with leading custodians and portfolio management systems, enabling real-time data flow and automated updates.

Key features:

Interactive investment and financial planning, as well as cash flow analysis

RightRisk™ risk assessment with customizable questionnaires

Snapshot™ plan summaries and Blueprint™ client visuals

RightIntel® business intelligence for firm analytics

Secure client portal and mobile app

Integration with 40+ custodians and financial platforms

Friendly, human-powered customer support

Addepar

Addepar is a technology platform that specializes in data aggregation, analytics, and portfolio reporting for complex investments. Addepar integrates with RightCapital to provide consolidated balance sheet views and detailed investment performance analysis.

Key features:

Data aggregation across all asset classes

Portfolio analytics and financial reporting

Custom client dashboards and financial data visualization

Real-time data feeds and operational automation

Advanced reporting templates for complex portfolios

Pershing X (formerly Albridge)

Pershing X is a technology provider and business unit of BNY Mellon | Pershing with the mission to incubate, engineer, and deliver breakthrough solutions to transform the advisory market.

Key features:

Centralized client data management

Integrated business intelligence and financial reporting

Portfolio analytics and performance tracking

Client communication tools and dashboards

Workflow automation and operational efficiency features

Black Diamond

Black Diamond provides portfolio management and wealth management capabilities including accounting, performance reporting, trading, and rebalancing.

Black Diamond integrates with RightCapital and now includes Morningstar Office, which enhances investment analytics and provides deeper research capabilities for financial analysis.

Key features:

Portfolio accounting and performance reporting

Trading and rebalancing automation

Client relationship management tools

Data aggregation and reconciliation

Morningstar Office research integration

CircleBlack

CircleBlack aggregates account data across custodians and delivers portfolio analytics with CRM integration capabilities. CircleBlack integrates with RightCapital to simplify portfolio visibility and enhance client engagement.

Key features:

Multi-custodian account aggregation

Portfolio analytics and performance reporting

Billing support and fee management

CRM integrations and client communication tools

Customizable dashboards and financial reporting templates

Envestnet | Tamarac

Envestnet | Tamarac has established itself as a comprehensive suite that provides portfolio management, reporting, trading, and rebalancing tools for advisors. Tamarac integrates with RightCapital to create a centralized hub for analytics and operational efficiency.

Key features:

Portfolio management and rebalancing automation

Financial reporting and performance analytics

Trading tools and execution management

Business intelligence and firm-level metrics

Client portal and communication features

eMoney

eMoney describes itself as a comprehensive financial planning solution that provides interactive planning, cash flow modeling, and business intelligence tools. eMoney offers dynamic dashboards to help advisors engage clients and identify growth opportunities.

Key features:

Client portal with secure document sharing

Business analytics and performance tracking

Account aggregation and data integration

Customizable performance reporting and presentation tools

MoneyGuidePro

MoneyGuidePro focuses on goal-based financial planning with intuitive budgeting and forecasting tools. The platform's scenario modeling capabilities help advisors tailor recommendations and enhance client communication.

Key features:

Goal-based planning and budgeting tools

Scenario analysis and forecasting capabilities

Risk tolerance assessment and portfolio analysis

Client engagement tools and interactive presentations

Integration with various financial platforms

Other financial analysis tools to consider

In addition to more comprehensive platforms, your finance team may also consider specialized software tools that focus on specific functionality and workflows such as billing, financial data analysis, or portfolio accounting.

These solutions often complement your existing tech stack while streamlining particular tasks.

Advyzon: Combines CRM, billing, financial performance reporting, and client portals in one comprehensive technology platform

AssetBook: Offers performance analytics and portfolio reporting specifically designed for RIAs

Blueleaf: Provides account data aggregation and client-facing reporting tools for financial advisors

Bridge FT: Delivers wealth management infrastructure with portfolio analytics and API support capabilities

Capitect: Features custom dashboards, performance tracking, and rebalancing tools for advisors

DST Vision: Operates as a centralized financial performance reporting platform designed for advisors and broker-dealers

FinFolio: Specializes in portfolio accounting, billing, and analytics with customization options for advisory firms

Investigo: Part of Broadridge Wealth Aggregation & Insights, Investigo provides data aggregation and business intelligence for financial professionals

Morningstar Advisor Workstation: Delivers investment research and financial modeling tools

Orion: Offers portfolio management and business intelligence capabilities for financial advisors

Panoramix: Focuses on billing and performance reporting designed specifically for advisory firms

Wealth Access: Aggregates account data and supports business analytics. Wealth Access integrates with RightCapital

Conclusion

The right financial analysis software makes life easier for you, your team, and your clients by automating routine tasks, improving client communication, and simplifying the decision-making process.

The tools highlighted in this guide help with various aspects of financial analysis, from full-blown comprehensive planning solutions to specialized tools built for specific needs and functionality. It’s helpful to consider your firm's growth goals, existing tech stack, and client obligations when making your selection.

But don’t stop there. Look for software that's easy to use and won’t bog your team down with complicated implementation processes or data analysis workflows. Because you can’t streamline your workflows if you’re struggling with your software.

RightCapital’s intuitive interface helps make your team more efficient, so you get the most ROI out of your software and increase your profitability. And if you do have questions, the friendly, 100% human support team is ready to help, allowing you to focus on serving your clients, not fighting your technology.

Ready to see how RightCapital's financial analysis capabilities can work with your existing tools? Try a RightCapital demo and experience interactive visuals, cash flow analysis, and scenario modeling for better client and business decisions.

Financial analysis software FAQ

What is financial analysis software?

Financial analysis software helps advisors evaluate client financial data, create forecasting models, and generate comprehensive reports.

These tools support budgeting, scenario planning, and business intelligence by analyzing financial statements, cash flow patterns, and performance metrics to inform strategic business decisions without drowning in spreadsheets.

Is Excel used for financial analysis?

Microsoft Excel and Google Sheets remain popular for custom financial modeling and quick calculations, but dedicated financial analysis software offers significant advantages over old-school spreadsheets.

Modern platforms provide automation, real-time financial data integration, interactive dashboards, client-facing features, and other functionality that Microsoft Excel spreadsheets simply can’t match.

What are financial modeling tools?

Financial modeling tools allow advisors to simulate scenarios based on client goals, cash flow assumptions, financial statements, and market conditions.

These tools support retirement planning, tax analysis, budgeting, and scenario analysis by creating predictive models that help clients understand potential outcomes and guide their decision-making.

Book a demo and explore interactive visuals, cash flow analysis, scenario modeling, and more to better support and engage your clients.