Most people hear the term “new normal” and attribute it to the social, economic, and financial impact of the 2020 pandemic. The truth is that Americans have been living in a new normal since 9/11. That was the first of three “black swan” events in this century that caused extreme market volatility. S&P 500 returns have been just 6.34% since then, significantly lower than 20th century averages.

Investment returns aren't the only concern for clients. In 2010, the Social Security Administration (SSA) released a report titled “The Future Financial Status of the Social Security Program.” The report states that “benefits are now expected to be payable in full on a timely basis until 2037, when the trust fund reserves are projected to become exhausted.” That’s only fifteen years from now.

Americans over fifty tend to worry about this more than younger people. As Millennials approach retirement age, they mourn the potential loss of what their parents and grandparents regarded as a "guaranteed" safety net. Generation Z, or "Zoomers" as they've come to be known, never expected social security to be there. Neither position is entirely accurate. We'll clarify that in the sections below.

Financial Planning for Reduced Social Security Benefits

Workers won’t be completely left out in the cold by the SSA. At the point where the reserves are used up, continuing taxes are expected to be enough to pay 76% of scheduled benefits. That’s the number that financial planners have to work with. It’s not guaranteed to get to that point, but without further action we need to consider it as a strong possibility.

Preparing clients for the possibility of reduced social security benefits has become an integral part of the financial planning process in 2022. Advisors need to be able to answer questions about it and recommend social security filing strategies that take it into account. Filing at age 62 may seem more appealing to clients with insolvency looming.

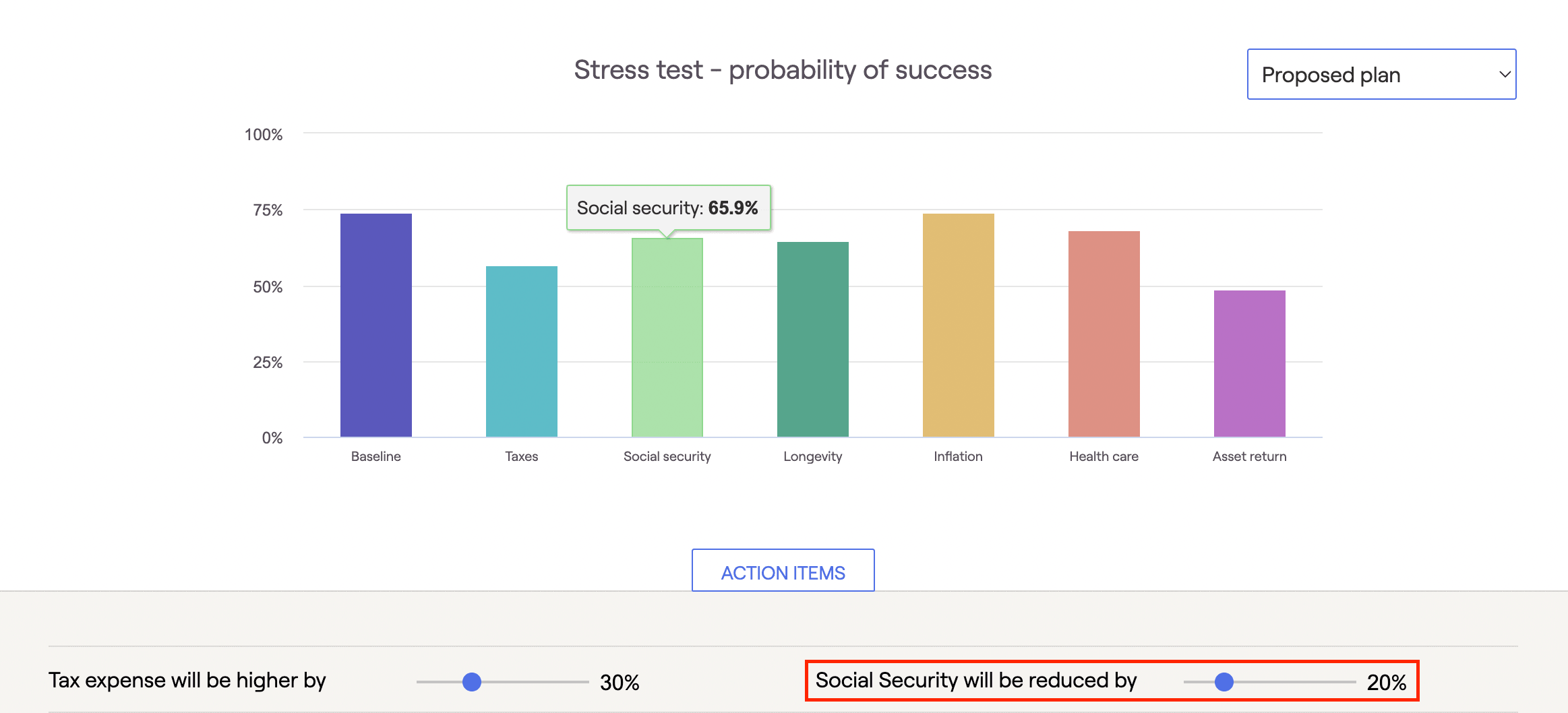

RightCapital can show your clients what filing at age 62 looks like and how much they gain if they wait until age 67 or age 70. We even offer a "stress test" feature that can give them a visual of what their fixed social security income will look like if benefit payouts are reduced. The graphic below shows how you can also use this feature to adjust for higher taxes, inflation, and rising health care costs.

Using Social Security Optimization as a Prospecting Tool

Americans are concerned about social security. Candidates from both parties politicized insolvency during the midterm elections. Volatility in the stock market, shrinking retirement savings, and rising consumer prices are exacerbating the problem. Simply offering to discuss it from an informed position is a great prospecting tool. RightCapital provides the visuals you need to do that.

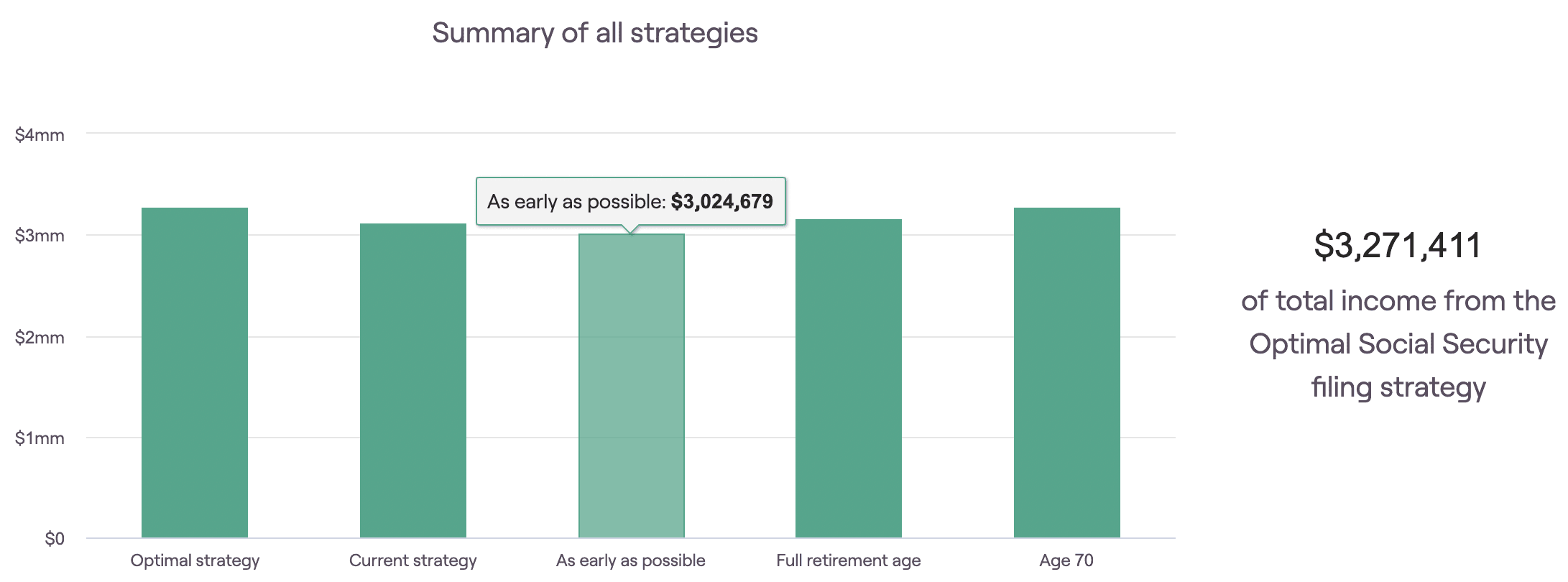

Reduced benefits due to social security insolvency will change the numbers, but it won’t change the percentage gains of waiting longer to file. That’s an important point to emphasize to clients. When they file at age 62, they’re stuck with that amount for the duration of their life. That’s a big hit to take, even at a reduced rate, but it might be the right choice for some clients.

Retirees can currently collect a full social security benefit payment at age 67 and a reduced benefit at age 62 if they choose to retire early. Extending their social security filing to age 70 triggers a “delay credit” that could increase total lifetime benefits by several hundred thousand dollars. These three scenarios are illustrated in the graphic below.

Existing Proposals to Prevent Social Security Insolvency

There is a proposal in Congress now to raise the age of full retirement from 67 to 70. That would cut down on the amount of money being drawn from the social security trust funds and increase tax revenue by incentivizing people to work longer. In the business world, that’s called cost cutting. Some are in favor of it. Others are not.

The Social Security Administration stated in their 2010 report that an increase in the combined payroll tax from 12.4% to 14.4% would add seventy-five years to the solvency of the social security trust funds. That proposal has not been presented as a standalone bill, but the concept has been discussed recently as part of larger legislation by both parties.

RightCapital takes no political position on either of these proposals. What we will do is modify our software when necessary to reflect the changes if they’re made. Many of these features are already built in and under your control as the advisor. Contact one of our team members today to learn more about those and the visuals you can use to present social security optimization to your clients.