Looking for the most recent updates?

The RightCapital team has been hard at work this year with innovative updates designed to elevate your financial planning processes. From RightFlows™, an industry-first workflow tool, to feature enhancements such as state estate tax calculations and budget category templates, let’s dive into the substantial upgrades that marked an exciting start to the year:

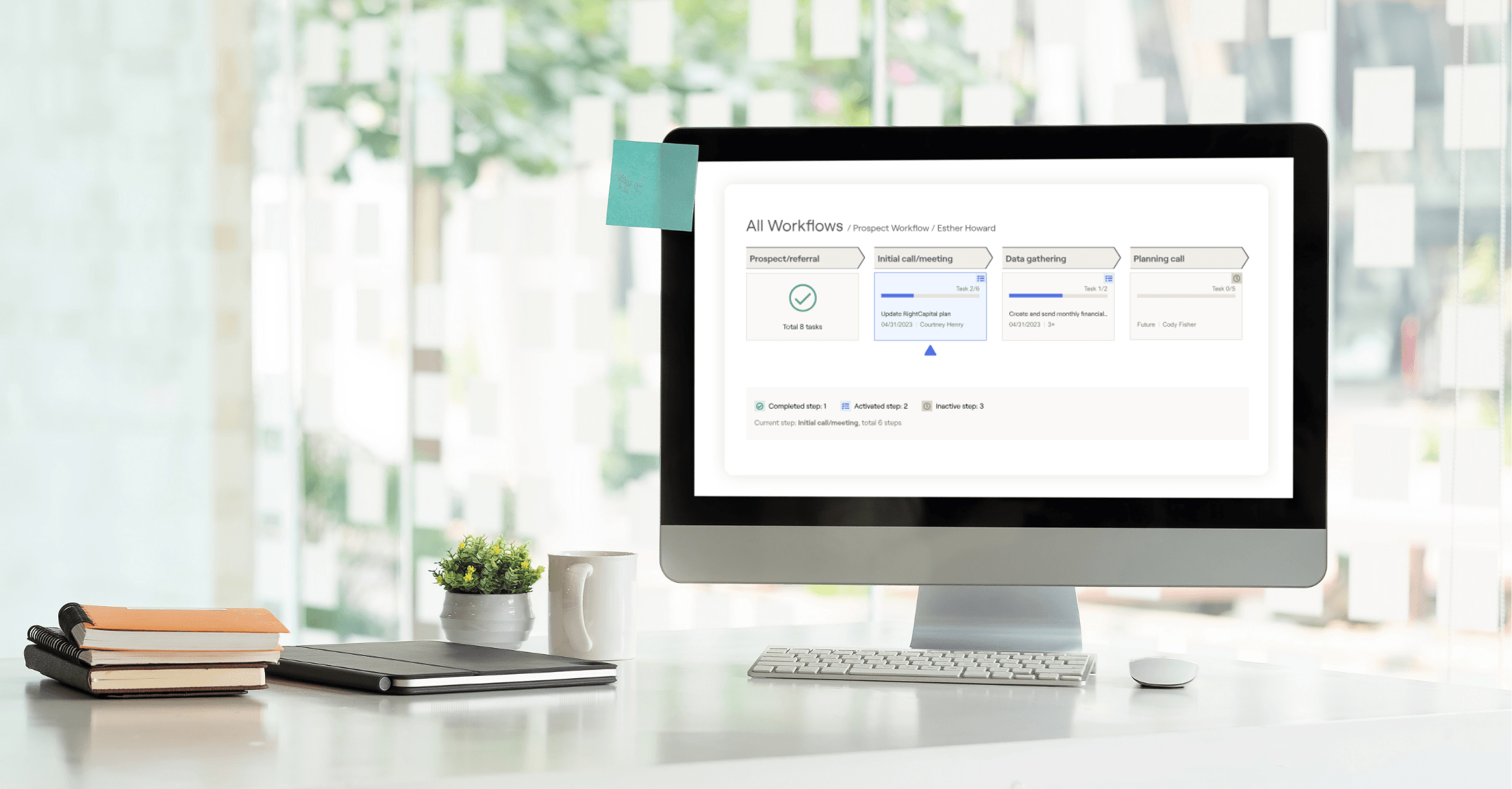

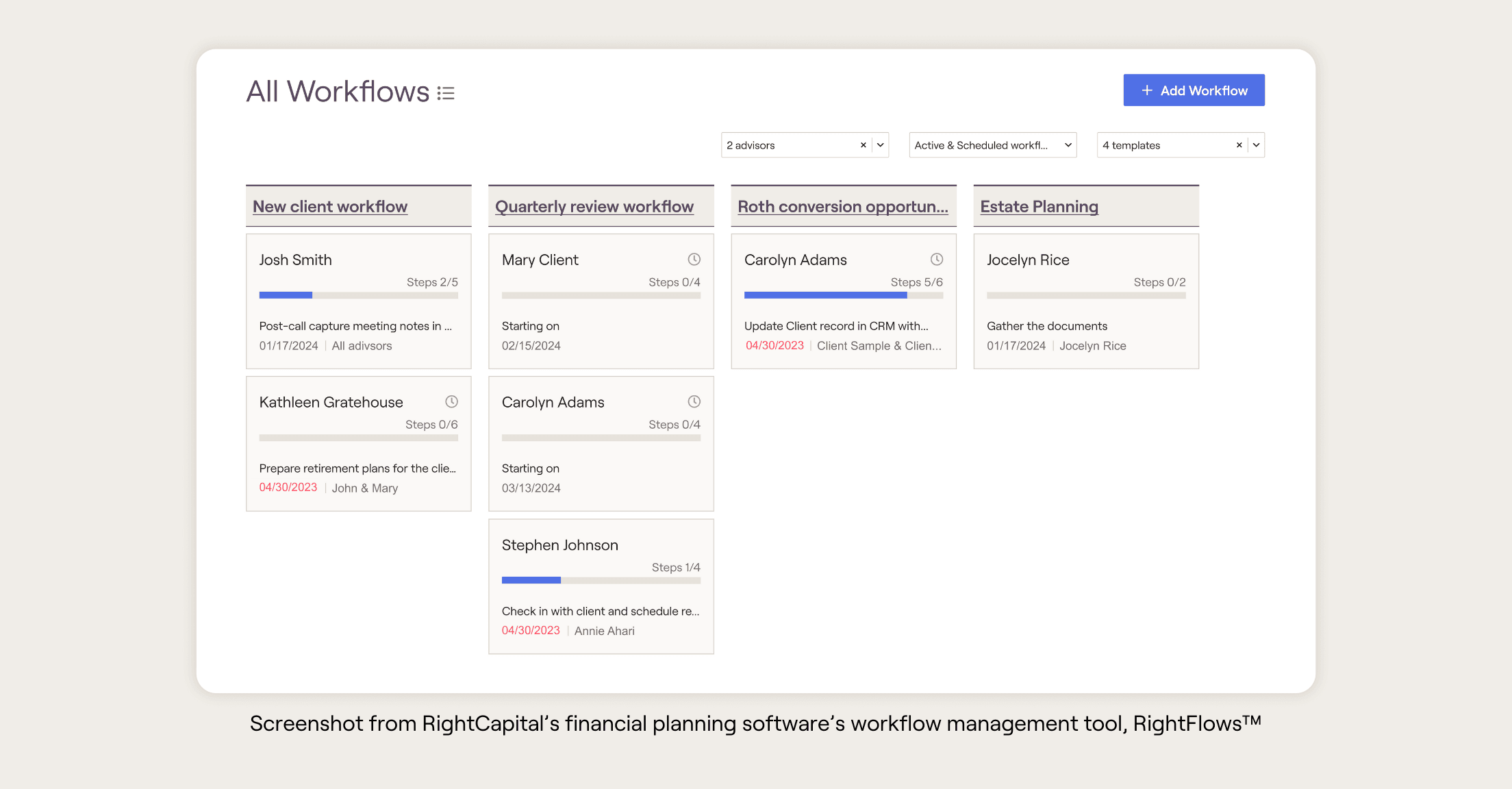

RightFlows™, the first financial planning workflow tool to incorporate direct client collaboration

In January, we were excited to launch RightFlows, a tool to help firms manage financial planning processes and tasks across advisors, assistants and—most importantly—clients! RightFlows makes it easy to create workflow templates that break down complex planning processes into repeatable steps and tasks, monitor progress, and automate task assignments.

Here are some benefits advisors are seeing with RightFlows:

Task assignment to clients, advisors, or assistants within the same workflow: Once tasks are completed, RightFlows automatically triggers the next step within the workflow so you don't have to!

Time savings and lessening of the mental load: Advisors can see where each client’s financial plan stands and each plan’s next steps from the centralized RightFlows dashboard in the Advisor Portal.

Efficiencies across the organization: Ensure planning processes are followed, while providing flexibility for advisors to adjust specific steps or tasks when needed.

For more on RightFlows, watch the below video:

RightFlows is available within the Platinum subscription. To upgrade your subscription, contact our sales team at sales@rightcapital.com or (888) 982-9596; Option: 1.

State estate taxes

Estate tax calculations for the 13 states imposing an additional estate tax are now included in RightCapital. The calculation is performed based on the client's state of residence at the time of their death, and takes into account each state's specific tax rates, exemptions, and adjustments.

Budget category templates

Budgets are now easier than ever to set up and follow! Advisors can set up expense, income, and other budget categories and apply the template to client plans. These categories can be used in the Budget module for advisors with account aggregation, as well as in Pre-retirement and Retirement Living Expense cards when entering data in the Detailed Worksheet.

Easier data entry with copying of detailed expenses

Advisors now have the ability to duplicate monthly expense figures between the Budget, Pre-retirement Living, and Retirement Expense cards during data entry in the Detailed Worksheet. For clients who have linked one or more accounts with budget transactions, the "Copy from Budget" option is readily available.

"Quick Fill" population of glide and scenario models

When setting up new glide and scenarios models, advisors can quickly populate the annual percentages for Equity, Fixed Income, and Cash using the "Interpolate" option or "Clear all" in the "Quick Fill" dropdown. Based on the entered starting and ending percentages, annual allocations are calculated for Glide models, which you can edit individually if desired.

Advisor Portal enhancements

We’ve made the Advisor Portal more efficient to use as you can now search the client list by using either the client or co-client name. A new family information tooltip quickly displays the names and ages of the client, co-client, and any children entered in the plan when hovering over the household name in the navigation menu.

For better organization, we’ve moved client-related settings to Advisor Portal > Gear Icon > Client Settings. You’ll find the “Client Presets” and “Client Groups” tabs that you are used to as well as two new tabs:

"Notifications," where advisors can set up default email notifications for all new clients.

"Permissions," where advisors can choose to allow clients to add/edit tasks and budget categories.

RightIntel™ updates

Advisors using RightIntel for business intelligence can view demographic information on clients with two new visuals on age and employment (pre-retirement and retired). Client activity in the Client Overview tab of RightIntel has been extended to the past four weeks, as compared to the previous two-week display.

RightIntel, our business intelligence dashboard, is included in Premium and Platinum subscriptions.

Additional flexibility

Advisors can opt to have Medicare Part D costs either "Estimated based on AGI" or specify that the client is "Not enrolled", all within the "Detailed estimate" option. Additionally, advisors can now select which plans' cash flows they'd like to include in the PDF report, with the option to feature multiple plans.

New year refreshes

Each year, for your convenience, RightCapital updates tax brackets, contribution/income limits, IRMAA surcharges, return and volatility assumptions, state-specific tax parameters, national average health care and long-term care costs, and more.

To learn more about these changes as well as smaller updates such as the ability to include additional individuals in the plan for education planning purposes and notifications when clients upload documents to the vault, schedule a demo today!