It’s no surprise that divorce can be emotional and messy. Your clients may require extra support during this transitional—and often transformational—time in their lives. Earlier this year, we held a webinar “Divorce and Its Impact on Clients” with Carol Lee Roberts, CFP®, CDFA®, President, Institute for Divorce Financial Analysts (IDFA). Watch the full recording on our YouTube channel.

Carol discussed how divorce is becoming more commonplace, with particular booms in recent years of divorces seen in couples married for less than 5 months as well as those 50 and older—a trend called “Gray Divorce”. With divorces rising, there is a larger need for financial advisors who have earned their CDFA® (Certified Divorce Financial Analyst) designations.

Here’s how you can use RightCapital to model some of the scenarios that Carol discusses in her webinar:

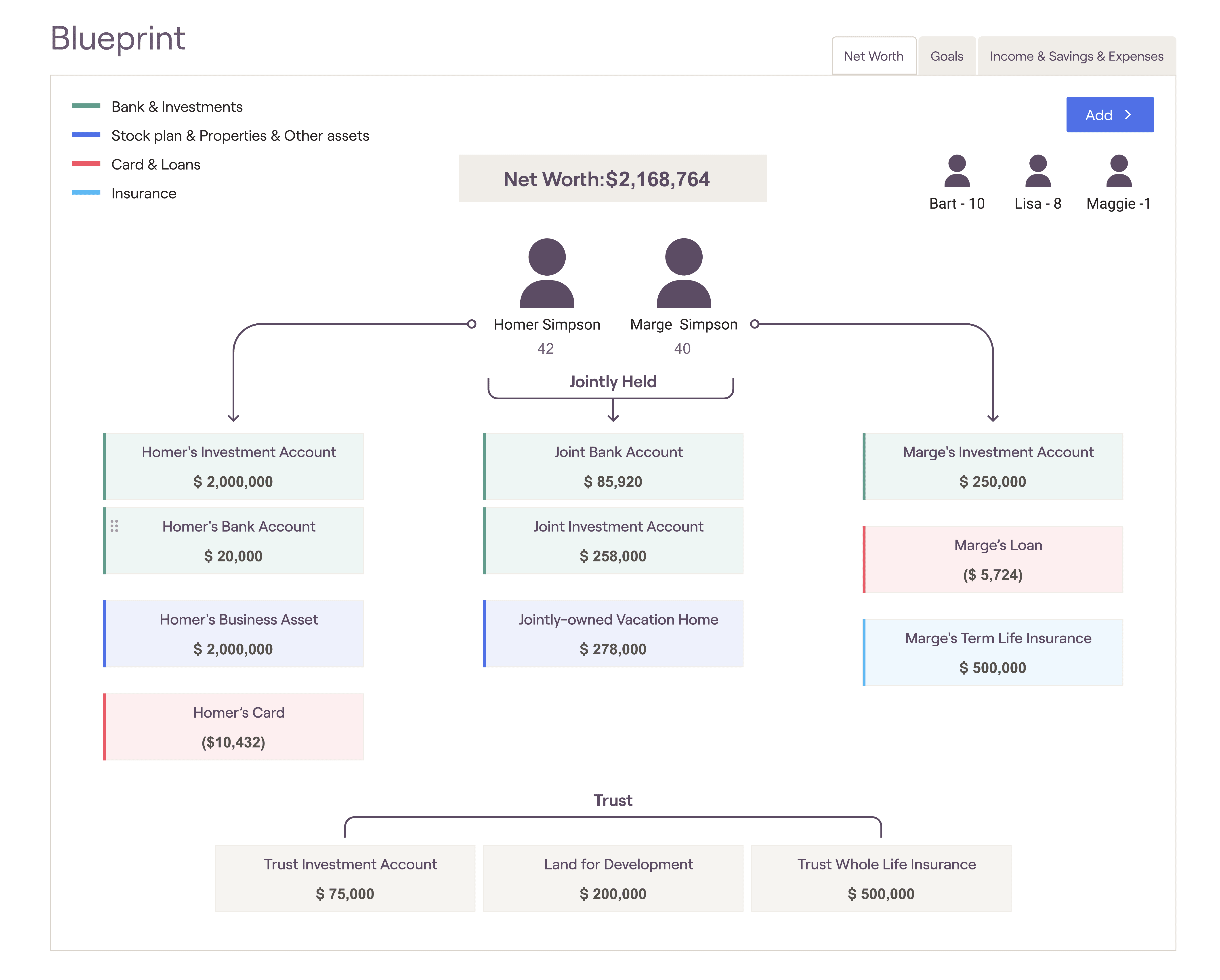

Review ownership of assets

Prior to a divorce, the Blueprint feature within RightCapital makes it easy to review which accounts, loans, and other assets and liabilities belong to each plan member individually (separate property) and which are owned jointly (marital property). If adjustments need to be made while reviewing the Blueprint, they can be completed directly within the module by clicking into each item.

There are some nuances when it comes to separate property. Property inherited by one partner is still considered separate unless it has been commingled. Gifts are typically considered separate property with some exceptions, such as anything viewed as an investment for the couple (ex. an expensive piece of artwork).

Consider impact of different scenarios

With RightCapital, you can set up the different scenarios of splitting assets for your clients, including the associated tax impacts. For example, you may wish to demonstrate the differences between selling the marital home and splitting the equity, continuing to own the property together with one person residing there, or having one partner buy out the other. That buyout may be financed by a reverse mortgage, more common in a gray divorce.

Determine retirement plan division

Visualizing cash flows for retirement plans is one of the ways to use RightCapital’s new Cash Flow Maps, showing a yearly waterfall flow of income and expenses as well as a breakdown per scenario. Identify any gaps between expected expenses and distributions and determine the minimum needed, whether the result becomes requesting more from a spouse’s plan, starting distributions at a different age, or lowering expenses during retirement.

A defined contribution plan (such as a 401k) is relatively easy to value, but make sure to learn the status of any outstanding loans against the plan and the vesting schedule. Only employer contributions that are fully vested are subject to division during a divorce. For a defined benefit plan (such as a pension), the present value must be considered. It’s important to note how much of the pension plan is marital in nature—if the person gained the funds during the marriage or if a portion should be backed out prior to the division.

Other things to keep in mind are the potential tax benefit to taking out some extra funds at the same time of the division of plans—for example, for attorney fees or setting up a new home—or an offset for a partner who previously elected for a lower monthly pension amount to provide for a surviving spouse.

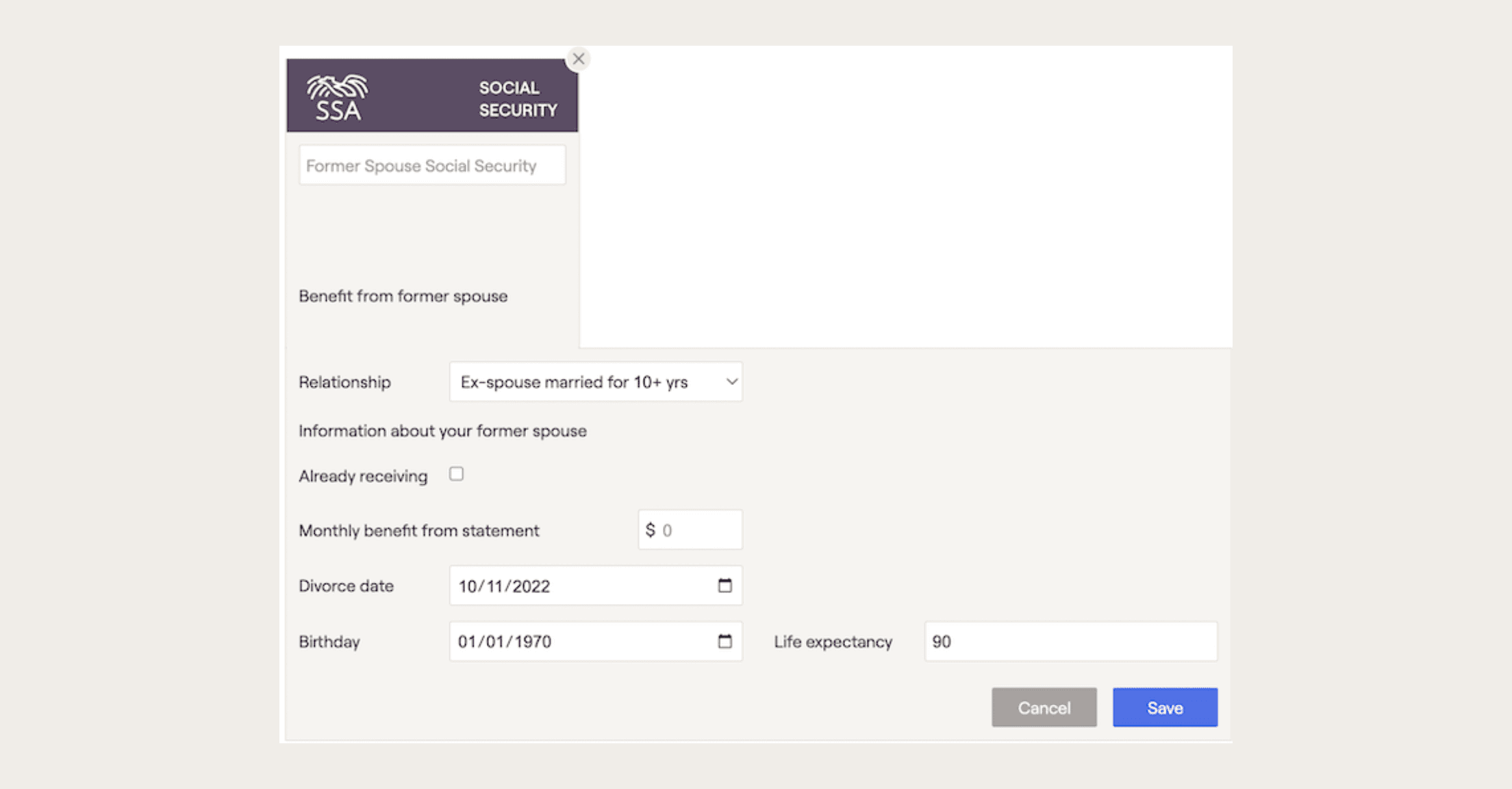

Model Social Security spousal benefits

Clients may elect to receive half of a former spouse’s Social Security benefits if they are higher than their own, if their marriage lasted at least 10 years, and if they have not remarried. Within the income section of RightCapital, there is a separate Social Security card to account for anything received as part of a former spouse’s benefits. Details can be noted inside this card such as relationship (for a divorced couple, “Ex-spouse married for 10+ years” may be the right selection), whether the spouse is already collecting, what the monthly full retirement benefit amount (PIA) is, and more.

Evaluate insurance needs

RightCapital’s insurance module can help demonstrate the protection of spousal and child support with life and/or disability insurance in case of an emergency. When it comes to long-term life insurance, Carol noted it may be beneficial financially to apply prior to divorcing, if possible, as rates may be lower.

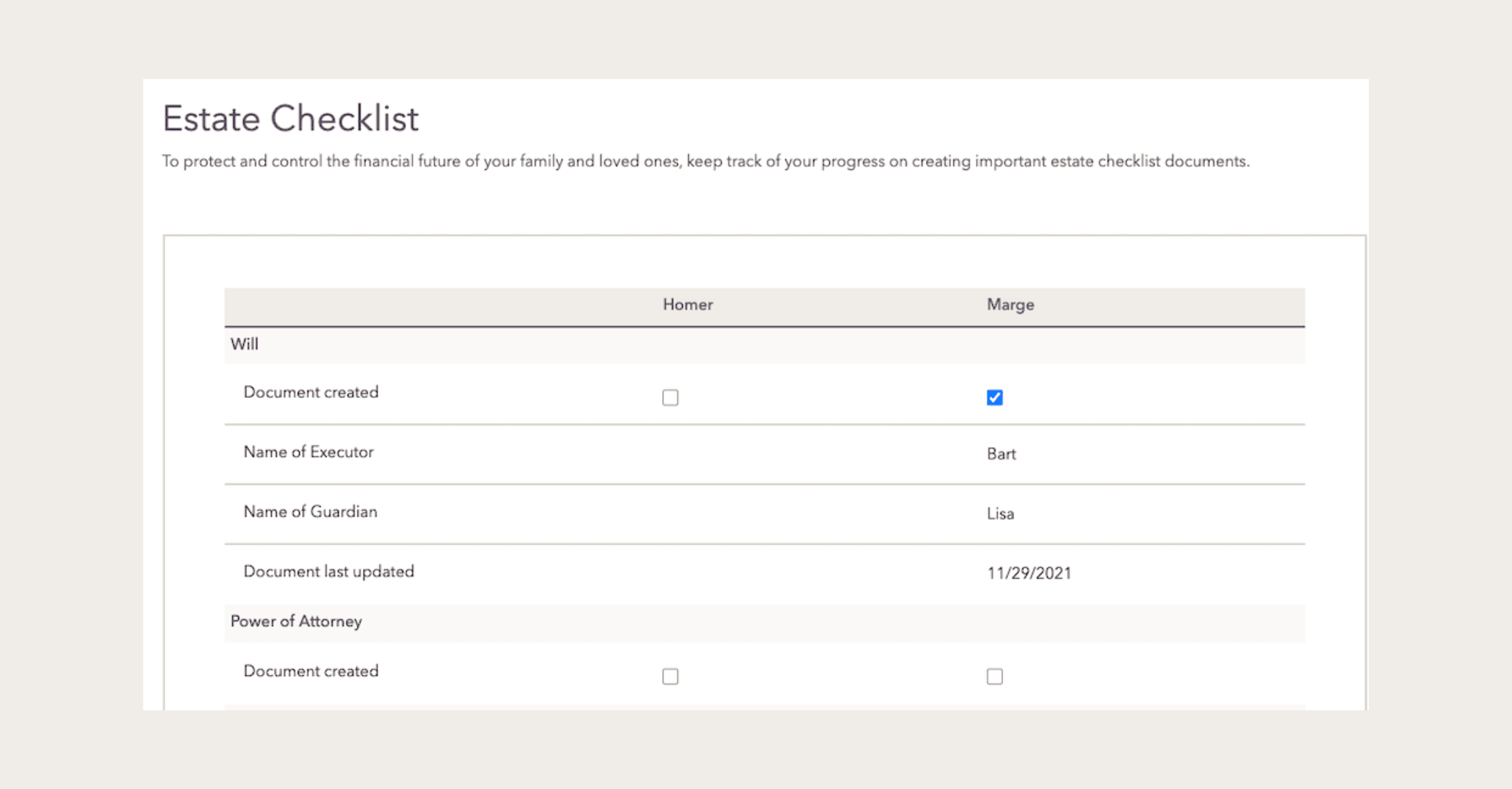

Adjust estate plans

After significant life changes, clients should review estate plans as well as beneficiaries. RightCapital’s Estate module can help organize the flow of assets as well as who is to receive access to a client’s accounts after their passing. It is also important at this time to review who is named in important documents, such as executor of the will, power of attorney, and health care proxy, within our Beneficiaries section.

For divorced clients who have remarried, RightCapital can demonstrate the impact of assets being passed to a former spouse vs. the co-client listed in the financial plan within the Account Assumptions settings.

Account for alimony payments and child support

Within the data-entry process, there is a specific “Alimony” card in both the income and expense sections to account for alimony payments made or received post-divorce. Whether the date is before or after January 1, 2019 will impact if the income is taxable and if expenses are deductible. There is also a separate “Child Support” card in the income section for the receiving client, as it would not be taxed.

Learn more about supporting clients going through a divorce by visiting IDFA’s website and more about how RightCapital can help you support your clients with a 1:1 demo with one of our product specialists.