How to Reflect SECURE 2.0 Act Opportunities to Clients

January 19, 2023

RightCapital likes to be first to the metaphorical party. (And if you have a real party, you can bet we’ll be first to the buffalo chicken dip.) We’d been anticipating the passing of the SECURE 2.0 Act as it had bipartisan support at all levels. Because of this, just days after the act was passed and signed into law, our team was able to incorporate changes into the platform so advisors would be ready for client and prospect conversations right away.

Learn about the need for SECURE 2.0 Act

The goal of SECURE 2.0 Act is to help increase American families’ retirement savings. The original SECURE Act (passed in December 2019) made it easier for small business owners to access “safe harbor” retirement plans and pushed Required Minimum Distributions (RMDs) to age 72. It also gave 401(k) providers the ability to offer annuities. It was a good first step, but not enough to bridge the retirement income gap in the United States, expected to be $137 trillion by 2050.

A 2018 study conducted at Boston College revealed that 51% of US households are at risk of not being able to maintain their pre-retirement income after they retire. 45% of households ages 55-64 have no retirement savings at all. The original SECURE Act attempted to address these issues. SECURE 2.0 Act was written to build on that foundation.

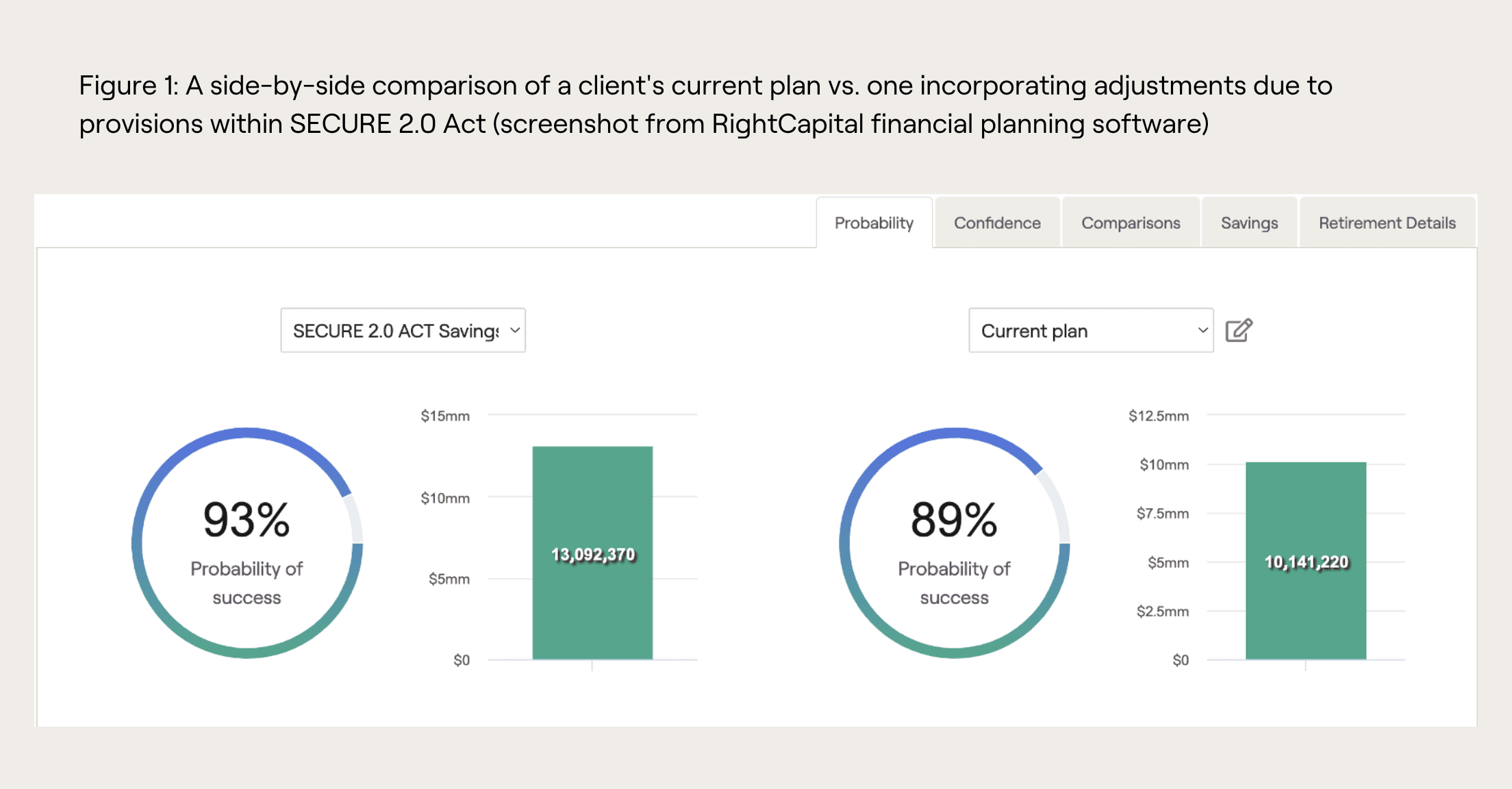

Illustrate benefits of SECURE 2.0 Act provisions

It is easy to demonstrate the value of SECURE 2.0 Act with side-by-side comparisons within RightCapital. Adjust variables to reflect new accounts for SIMPLE and SEP Roth IRAs, penalty-free distributions from qualified accounts, and map out new catch-up contribution opportunities for 401(k), SIMPLE IRA, and Roth plans for certain individuals.

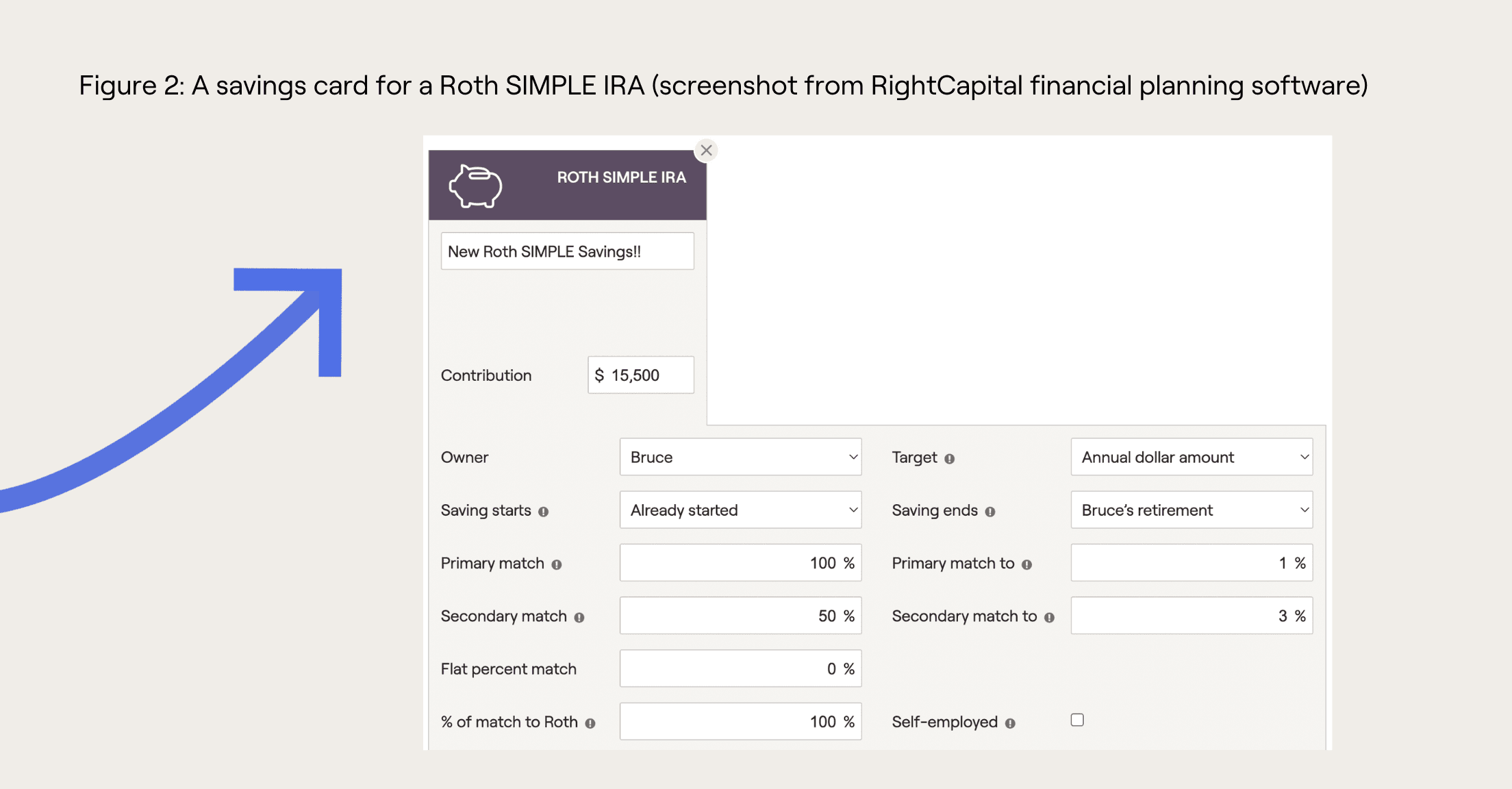

Track new workplace retirement plan contributions

Within the data entry process during client onboarding, the options now exist to create cards for Roth SEP IRAs and Roth SIMPLE IRAs. In Net Worth, view new Roth SEP IRA and Roth SIMPLE IRA account types. Designate employer contributions to Roth accounts using the new “% of Match to Roth” field within RightCapital.

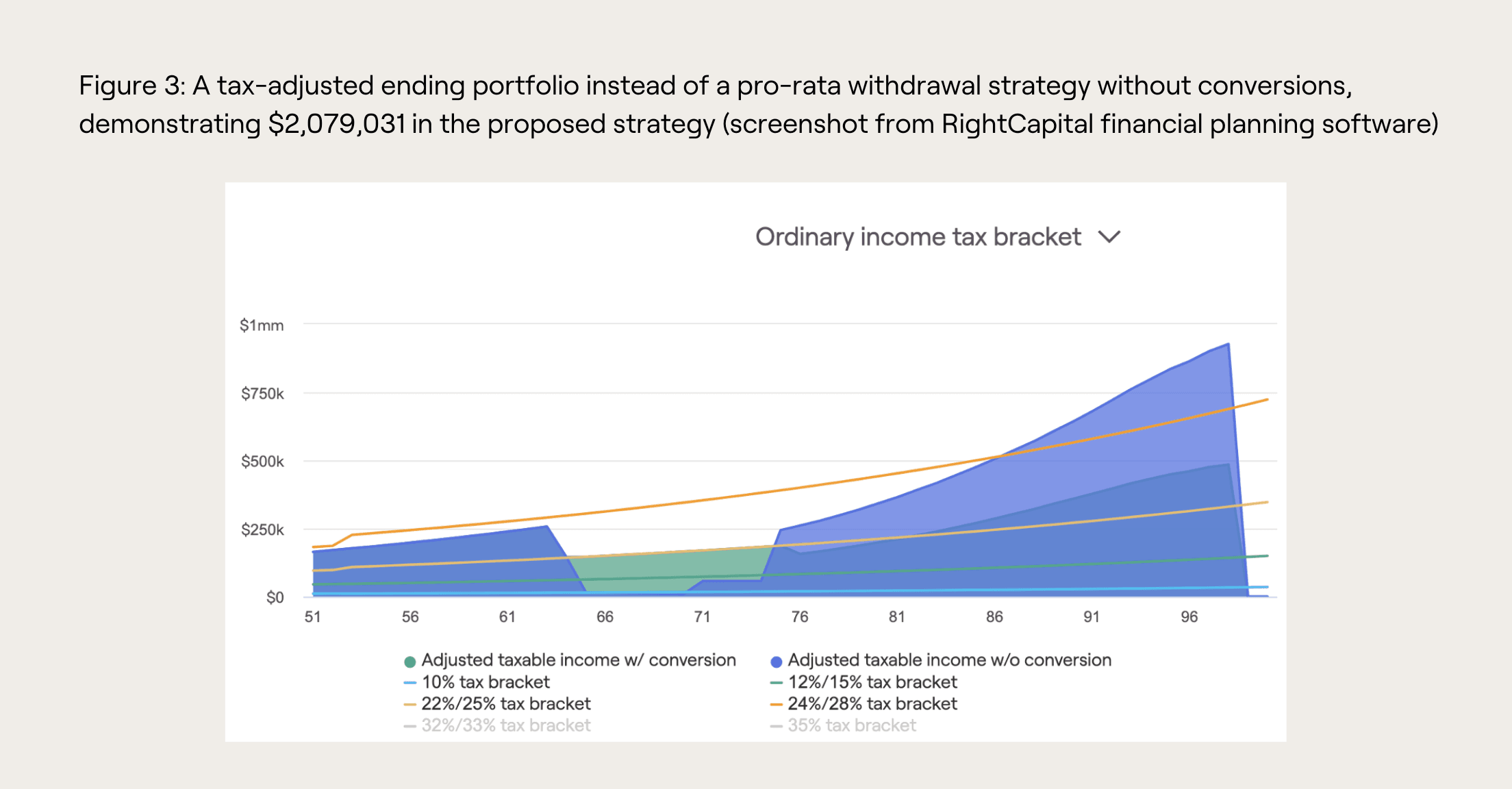

Demonstrate new tax-efficient distribution opportunities

Show the impact of new RMD age requirements, built into our system automatically. Go a step further and use RightCapital’s distribution and conversion tool to demonstrate the benefits of saving to a 401(k) account now and converting to Roth accounts in the future. Maximize value by filling up tax brackets and illustrate it in a way that makes sense to clients.

Stay tuned for more updates!

We are awaiting clarification on some of the items within the signed act and will be continuing to make changes to our platform as you need them. If you’re a current subscriber, you’ll be notified of these updates in the RightCapital Weekly Roundup.

Watch our recorded webinar, “Exciting Planning Opportunities with SECURE 2.0 Act” discussing “The Retirement Problem”, laying out the act’s provisions, and walking through a case study. To learn even more about how to demonstrate this within RightCapital, sign up for a 1:1 demo and ask all the questions you need to.