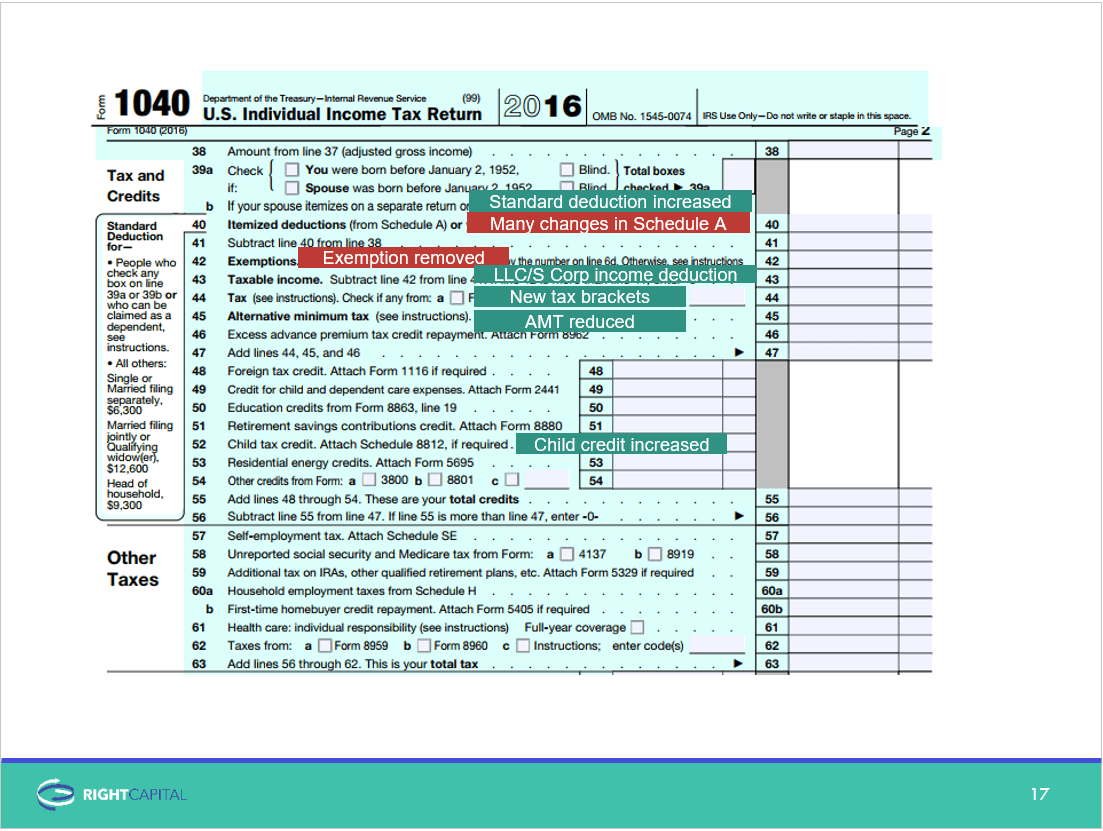

It’s hard to read any financial publication these days without seeing some mention of the Tax Cut and Jobs Act (TCJA). Your clients are most likely aware of the tax changes as well and have started peppering you with questions regarding their financial plan.

Will I be paying more or less for taxes?

How do the tax changes impact my long-term planning goals?

What happens if the tax cut and jobs act expires in 2025?

Understandably, clients grow nervous during times of change. As a financial advisor, it’s important to show clients that you are a trusted resource. You must be able to explain how these changes affect them while providing an appropriate solution. Here are a few examples of scenarios you may find yourself in with clients.

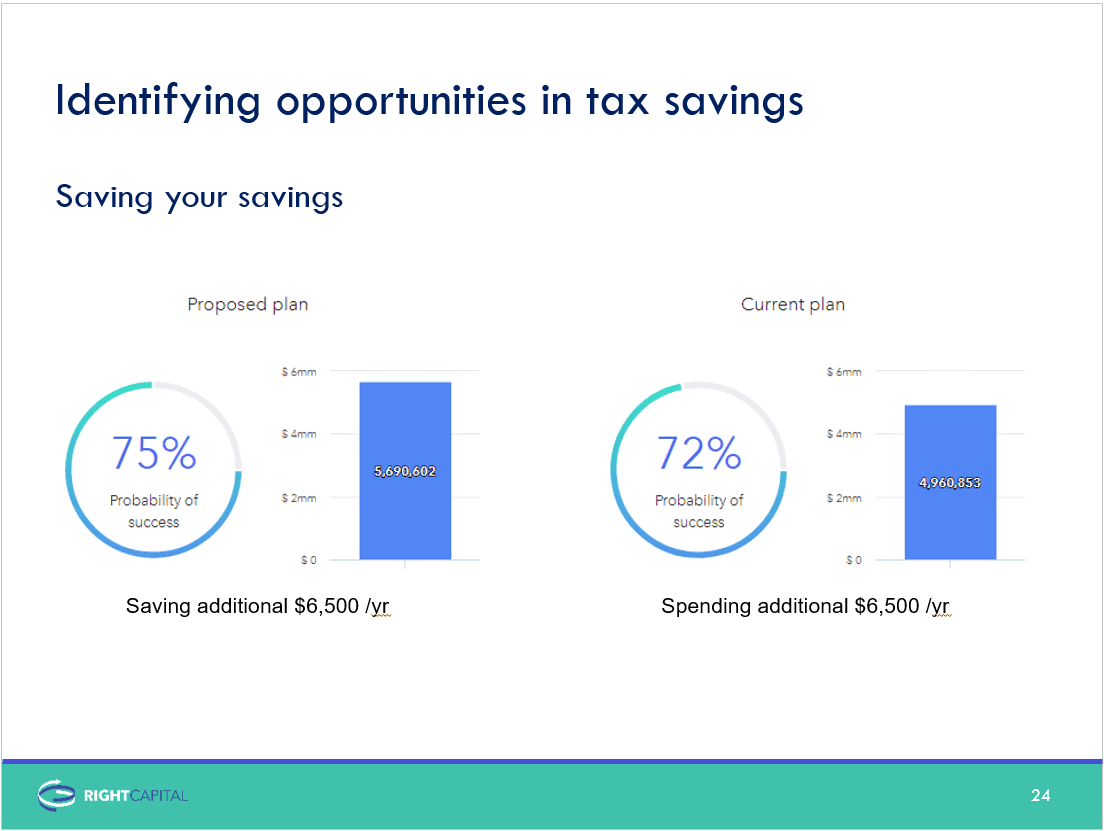

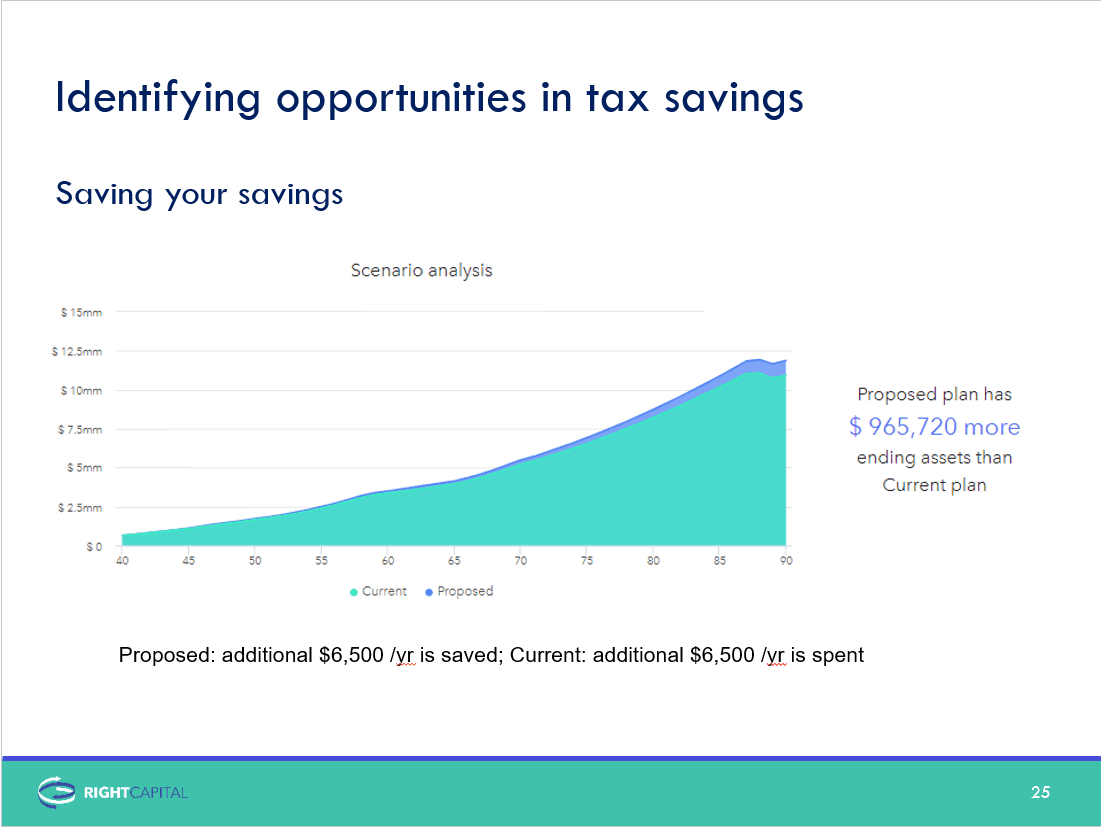

Scenario 1) To save or spend? Translate tax saving into $1mm more in your retirement portfolio!

Your clients (John and Sarah) are a young married couple in their 40s looking to retire in their 60s. They want to know if they are going to receive any tax savings due to TCJA. After looking at their total tax liability, you see they will have a sizable savings. But now what?

As their financial advisor, your role is critical to helping John and Sarah determine what to do with their extra income. You can show them how saving vs. spending the additional money will increase their probability of success for retirement and how much money that savings ultimately becomes in the long run. Sarah and John leave your office with piece of mind and a plan for moving forward that includes an extra million dollars in retirement savings!

Scenario 2) Employee vs. Self-Contractor: Evaluating business opportunities

You provide financial planning for another couple (Mike and Amanda) who are in their late 50s respectively. They are both looking to retire in their mid-60s, but Mike has always wanted to open his own consulting business. He was hoping the new qualified business passthrough outlined in the tax changes would help him out. After reviewing and discussing the differences of being a salaried employee vs. an independent contractor, you determine that Mike will end up paying considerably more in taxes if he moves to self-employment. Although Mike is disappointed the timing still isn’t right to open his own business, he was thrilled that he consulted with you first and prevented a large tax increase. You’ve now strengthening your bond as trusted resource and advisor and kept Mike and Amanda on a successful path to retirement.

As a financial advisor, you are uniquely positioned to guide and enhance your clients’ quality of life. Providing them with tangible examples of how their financial decisions not only affect their immediate future but their retirement as well, shows that you have their best interests in mind and are keeping abreast of important industry changes.

RightCapital Financial Planning Software can help you have the types of discussions outlined above with your clients. Having fully incorporated the Tax Cut and Jobs Act changes into our software by January 15th, we are prepared to assist you with your tax planning needs. Want to learn more about our #1 user rated software? Schedule a demo today and get your free trial.