Wealth Management Software Solutions for Financial Advisors

September 5, 2025

Finding wealth management software that works for your practice isn't as easy as it sounds.

With client expectations rising and regulatory requirements becoming more complex, you need technology that simplifies your workflows instead of creating more hassle for your team.

The problem is that most financial advisor tools and wealthtech are built for general use, not the specific demands of wealth management firms. Whether you're handling complex portfolios for high-net-worth clients or need to streamline operations for the mass-affluent market, generic tools often miss the mark.

This guide breaks down wealth management software solutions that actually work for financial advisors who want to streamline operations, boost client engagement, and grow their practices without sacrificing quality.

You'll find platforms that integrate financial planning, portfolio management, reporting, and client engagement into one system, eliminating the frustration of managing multiple tools that don't always know how to get along.

What is wealth management software?

Wealth management software gives firms the exact tools they need to manage client assets and provide more holistic financial advice.

Unlike general financial advisor tools or basic wealthtech apps, these solutions are designed to support the complex needs of wealth management practices. Some of their functions include:

Portfolio management and analytics: Track client portfolios, monitor performance, and generate detailed investment reporting across multiple asset classes and custodians.

Financial planning and analysis: Develop comprehensive financial plans, run scenario modeling, and provide interactive client presentations that bring complex strategies to life.

Client engagement and communication: Create secure client portals, automate communications, and provide real-time access to account information and planning documents.

Data aggregation and integration: Connect with custodians, CRM systems, and third-party data providers to create unified workflows to save you from typing the same client details over and over.

Compliance and risk management: Monitor regulatory requirements, maintain audit trails, and ensure fiduciary responsibilities are met across all client relationships.

Business intelligence and reporting: Generate insights on practice performance, client demographics, and operational efficiency so you can make smarter decisions about your business.

14 wealth management software solutions for financial advisors

There are tons of wealth management software options out there, each designed for different parts of your business. Here are several solutions that you can use to manage client assets, simplify financial planning, and scale your practices efficiently.

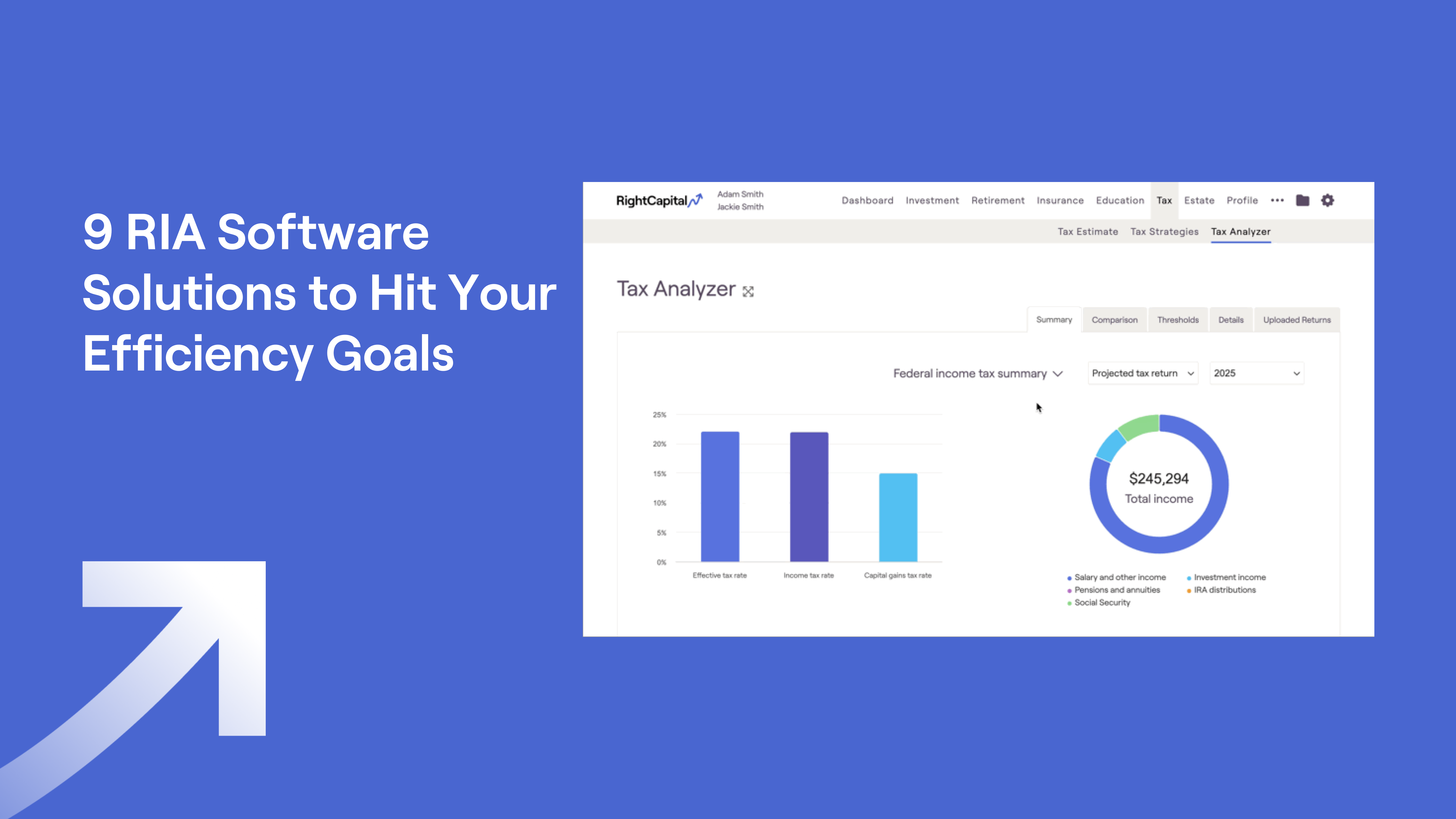

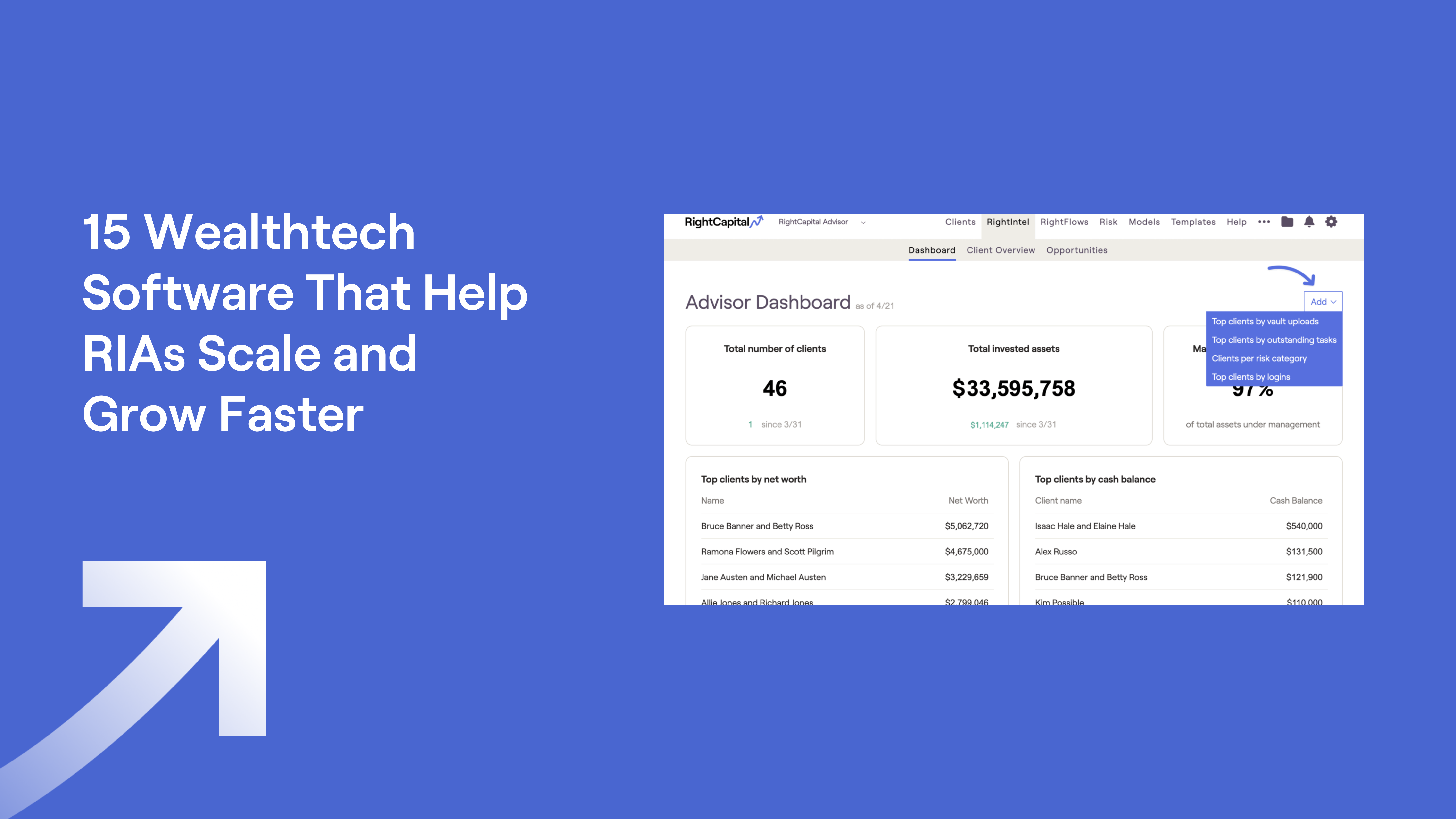

RightCapital

RightCapital provides intuitive, advisor-focused financial planning tools designed with wealth management firms in mind. The platform offers advisors tax planning functionality, cash flow analysis, retirement projections, and interactive reports that help you deliver more engaging client experiences.

RightCapital integrates with all the major custodians, CRM platforms, and portfolio management tools, so your client data flows seamlessly between systems without any copying and pasting on your part.

Key features:

Comprehensive tax strategies, cash flow modeling, and retirement planning tools

Interactive client reports and presentation tools

Snapshot™ plan summaries and Blueprint™ visuals for financial life

RightRisk™ risk assessment and portfolio analytics

Client portal with mobile accessibility and real-time updates

Seamless connections with custodians, CRMs, and portfolio management systems

Orion Advisor Solutions

Orion Advisor Solutions describes itself as a comprehensive wealth management platform that provides portfolio management, financial planning, and business intelligence tools for advisory firms.

The platform offers integrated solutions for performance reporting, client relationship management, and portfolio accounting. Orion integrates with RightCapital so your portfolio information feeds directly into your financial planning projections.

Key features:

Trading and rebalancing automation

Client relationship management tools

Business intelligence dashboards and analytics

Financial planning integration capabilities

Compliance monitoring and regulatory reporting

Portfolio accounting and performance reporting

SEI Wealth Platform

SEI operates as a turnkey asset management platform that provides portfolio construction, investment management, and operational support for wealth management firms.

The platform offers model portfolios, unified managed accounts, and comprehensive back-office services. SEI integrates with RightCapital to make your financial planning workflows more robust and powerful.

Key features:

Model portfolio construction and management

Unified managed account capabilities

Investment research and due diligence services

Operational support and back-office automation

Performance reporting and client communications

Global investment platform and multi-currency support

Black Diamond Wealth Platform

Black Diamond is a comprehensive wealth management platform that provides portfolio accounting, performance reporting, and client management tools for advisory firms.

The platform now includes Morningstar Office to simplify investment research and analysis. Black Diamond also integrates with RightCapital, enabling advisors to easily use portfolio data for financial planning.

Key features:

Portfolio accounting and performance reporting

Trading and rebalancing automation

Investment research and analysis through Morningstar Office

Client relationship management tools

Document management and client communications

Business analytics and operational reporting

Altruist

Altruist describes itself as a modern investment platform designed to help financial advisors manage client portfolios more efficiently while reducing costs.

The platform provides automated portfolio management and streamlined client onboarding processes. Altruist integrates with RightCapital so you can use your client's portfolio information in their financial plans.

Key features:

Automated portfolio rebalancing and management

Streamlined client onboarding and account management tools

Performance reporting and analytics capabilities

Cost-effective platform operations

Transparent fee structure for advisor planning

AssetMark

AssetMark operates as a turnkey asset management platform that provides portfolio construction, investment management, and advisor support services, including due diligence.

AssetMark integrates with RightCapital, making it easy to use your client's investment data in their financial plans.

Key features:

Portfolio management and asset allocation services

Investment research and due diligence capabilities

Practice management and business consulting support

Performance reporting and client communication tools

Technology integrations and platform connectivity

Advisor education and training resources

Addepar

Addepar describes itself as a wealth management technology platform specializing in data aggregation, analytics, and portfolio reporting for complex investments.

The platform serves high-net-worth clients and institutional investors who need detailed reporting and advanced analytics. Addepar integrates with RightCapital so you can easily turn complex investment data into clear financial plans.

Key features:

Data aggregation across all asset classes and custodians

Portfolio analytics and performance reporting

Risk management and scenario analysis tools

Client portal with real-time access and mobile capabilities

Alternative investment tracking and reporting

Compliance and regulatory reporting features

Advyzon

Advyzon offers independent advisors and wealth management firms a comprehensive, integrated technology solution with portfolio management, performance reporting, client portals, and business intelligence tools.

The platform integrates with RightCapital for seamless financial planning workflows.

Key features:

Investment tracking and performance analytics

Automated trading and portfolio rebalancing tools

CRM functionality and client communication features

Analytics dashboards and business intelligence reporting

Mobile client access and secure document storage

Regulatory compliance and monitoring capabilities

Envestnet | Tamarac

Envestnet | Tamarac provides web-based portfolio rebalancing, performance reporting, and customer relationship management software to independent advisors and wealth management firms.

Envestnet | Tamarac integrates with RightCapital, enabling you to incorporate portfolio rebalancing data into client planning scenarios.

Key features:

Portfolio rebalancing and trading automation

Performance reporting and analytics capabilities

Client relationship management tools

Data aggregation and reconciliation features

Compliance monitoring and audit trail capabilities

Integration with third-party systems and custodians

More financial advisor software that supports wealth management

Redtail CRM describes itself as a comprehensive customer relationship management platform, helping advisors organize client communications, track interactions, and automate follow-ups.

Wealthbox provides a modern, cloud-based CRM solution, focusing on streamlining client relationship management and daily workflow automation.

Charles Schwab operates as a major brokerage and custodial platform that provides trading tools and account custody services, simplifying the operational side of investment management and client account administration.

Fidelity is a comprehensive financial services provider offering custodial services, trading platforms, and data aggregation tools that make managing accounts and making investments easier.

Raymond James functions as both a custodian for client assets and a service provider that offers trading and operational support. RightCapital integrates with Raymond James, letting you easily use custody information to build more accurate financial projections.

Essential features to look for when choosing a wealth management platform

Not all wealth management software is created equal. These features tend to make the biggest impact on your day-to-day operations and client service:

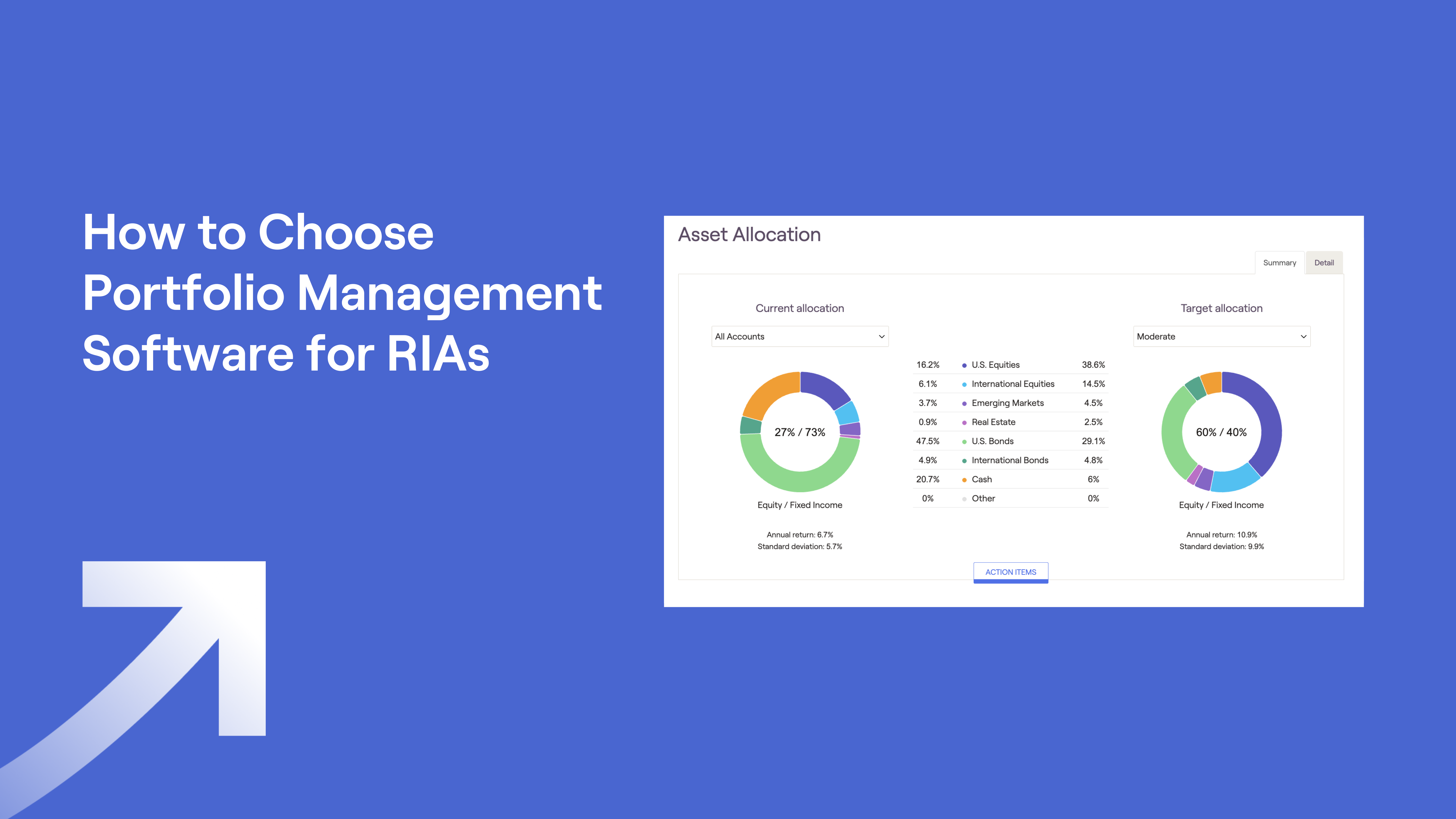

Comprehensive portfolio management capabilities

Look for platforms that provide real-time portfolio analytics, automated rebalancing, and performance reporting across multiple asset classes. The best solutions integrate with your custodians and provide unified views of client portfolios regardless of where assets are held.

Robust financial planning and analysis tools

Consider platforms that offer comprehensive financial planning capabilities, including cash flow analysis, retirement projections, tax planning, and scenario modeling.

Seamless integrations and data flow

It helps when your tools can talk to each other. Seamless integrations (between your CRM and financial planning software, for example) eliminate duplicate data entry and create more efficient workflows.

Client engagement and communication features

Look for platforms that make it easy to stay connected with clients. Features like secure client portals, client messaging capabilities, and document sharing tools help you keep people engaged between meetings.

Scalability and operational efficiency

Prioritize solutions that can handle the needs of a growing firm, including the ability to manage increased assets under management and more complex client needs, without requiring you to switch platforms later.

Compliance and risk management tools

Look for platforms with built-in compliance monitoring, audit trail capabilities, and regulatory reporting features to help you meet your fiduciary responsibilities and maintain your operational risk.

6 benefits of using wealth management solutions

Good wealth management software makes your life easier and helps you take better care of your clients. So you can focus on what matters: building relationships and helping people reach their goals.

Spend less time on busywork, more time with clients

Wealth management platforms help automate tasks such as portfolio rebalancing, performance reporting, and client communications. This means less manual work, fewer mistakes, and more time for activities that actually grow your business, such as marketing, finding new prospects, and developing new revenue streams.

Give clients a better experience

Modern wealth management software gives you interactive planning tools, client portals, and real-time reporting to help clients feel more engaged. Now, you can deliver presentations that actually resonate, maintain stronger relationships, and provide the ongoing value that clients appreciate.

Get better data to make smarter decisions

When you have comprehensive analytics at your fingertips, you can help clients make better investment and planning decisions. Real-time data aggregation and portfolio analytics make it easier to spot opportunities and get ahead of potential problems.

Enjoy a smoother experience

The best wealth management platforms connect seamlessly with your CRM, custodians, and other essential tools. This creates smoother workflows and eliminates the frustration of managing systems that don't communicate with each other.

Grow without growing pains

Good wealth management software expands alongside your practice. Instead of hitting capacity limits and having to start over with new software, there are plenty of flexible solutions out there to accommodate more clients, larger asset bases, and expanded service offerings.

Stay compliant without the stress

These platforms include monitoring tools, documentation features, and reporting capabilities that make meeting regulatory requirements less painful. And who doesn’t want that?

Conclusion

The right wealth management software makes everything easier. Instead of juggling separate systems for planning, portfolio management, and client communications, run your firm from a platform that works the way you do.

The tools we've covered here help financial advisors work more efficiently, keep clients happier, and grow their practices. Whether you need detailed portfolio analytics or engaging planning presentations, these tools have you covered.

RightCapital provides intuitive financial planning tools that integrate seamlessly with the portfolio management and custodial platforms you already use. The user-friendly interface and comprehensive planning capabilities help you deliver more engaging client experiences while simplifying your workflows.

Book a demo to discover how RightCapital enhances portfolio planning and decision-making for advisors.

Wealth management software FAQ

How does wealth management software improve financial planning?

Wealth management software makes financial planning easier by connecting your portfolio data with sophisticated planning tools in real time. You can build more accurate projections, quickly test different scenarios, and create interactive client visuals that are easier to understand.

When your investment tracking and planning work together instead of separately, you can give clients more complete advice and better results.

How much does wealth management software cost?

Pricing varies depending on what you need, the size of your firm, and your AUM. Most charge monthly per-advisor fees or a percentage of AUM. Some also offer subscription plans that scale with your business. You may also encounter some setup costs. The real question isn't just price. It's whether the software saves you time, improves your client experience, and helps you grow.