15 Wealthtech Software That Help RIAs Scale and Grow Faster

August 1, 2025

The financial services industry is changing. Fast.

Every day, it seems like there's a new wealthtech solution promising to make your job easier, streamline your workflows, and help you better serve your clients.

Between artificial intelligence, machine learning, and next-generation platforms, it's hard to know which wealthtech companies actually deliver value and which ones are just riding the latest trend.

This guide cuts through the noise to highlight 15 wealthtech software solutions that help financial advisors scale their practices and deliver better client experiences.

No hype, just practical tools that work.

Why financial advisors need to know about wealthtech

Technology isn't just changing how we work; it's changing what clients expect from their advisors.

Financial advisors who embrace wealthtech solutions can keep up with changing client expectations while leapfrogging competitors who are still printing reports and manually updating spreadsheets.

Reduces manual work and costs

Modern wealthtech platforms automate the repetitive tasks that used to eat up hours of your day.

From data aggregation to portfolio management, automation handles the administrative tasks so you can focus on providing financial advice. (Because nobody got into this business to spend their days on data entry.)

Wealthtech’s automation doesn’t just make your life easier. Being more efficient translates directly into cost savings and higher profit margins for your firm.

Provides personalized investment plans

Today's wealthtech solutions use algorithms and big data to create highly personalized investment strategies.

Instead of cookie-cutter approaches, you can deliver customized investment portfolios based on each client's specific goals, risk tolerance, and financial situations.

Replaces subjectivity with data-driven insights

The best wealthtech companies provide real-time analytics that take the guesswork out of financial planning and help you make better recommendations across all areas of your practice.

These data-driven insights let you make better recommendations and track performance more accurately.

Streamlines firm management

Run your practice, don't let it run you. Comprehensive wealthtech platforms integrate everything from client onboarding to compliance monitoring.

This holistic approach to wealth management technology simplifies your day-to-day operations while ensuring nothing falls through the cracks.

Supports advisor marketing

Many wealthtech solutions include marketing tools that help you attract new clients and grow your practice.

Lead capture forms, automated email campaigns, and social media management features help you reach prospects more effectively and automate your marketing workflows.

15 wealthtech apps for financial advisors and firms

Wealthtech tools come in all shapes and sizes, from comprehensive financial planning software to specialized investment platforms that help with specific aspects of your business.

Here are 15 solutions that live up to the hype and actually make your job easier.

All-in-one financial planning tools

These comprehensive platforms serve as the foundation of modern wealth management practices, combining financial planning, client management, and business intelligence all in one integrated ecosystem.

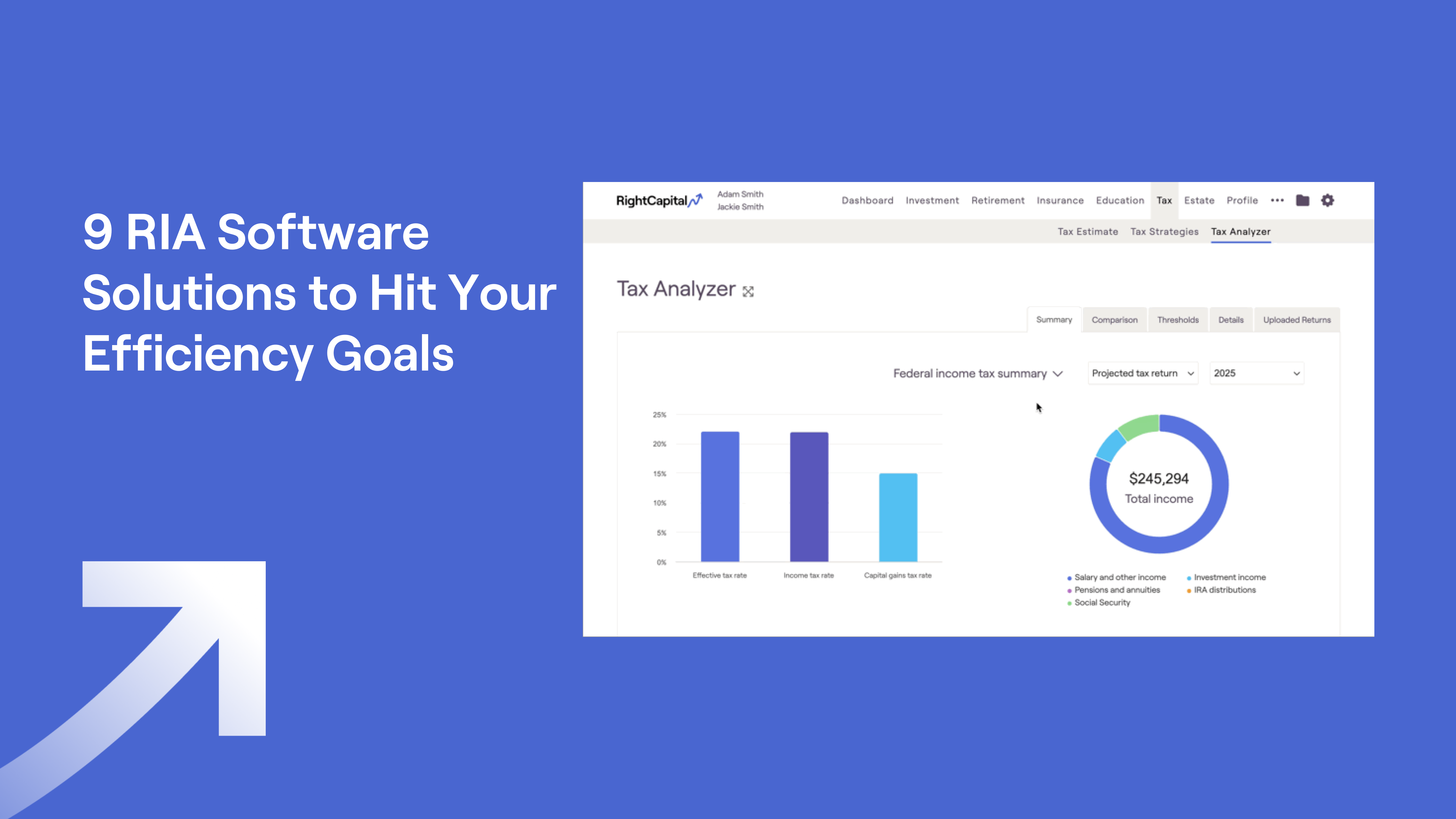

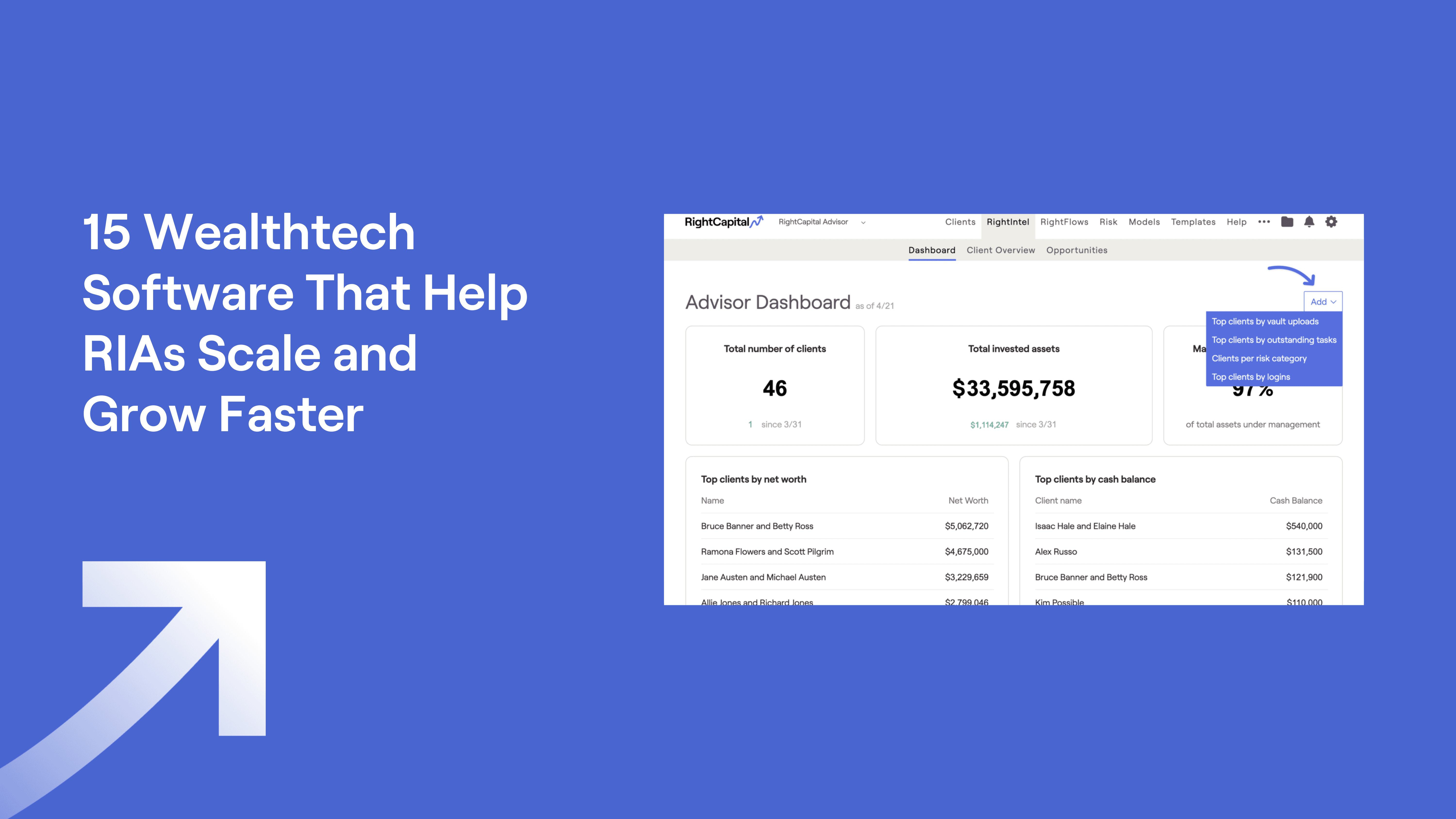

RightCapital

RightCapital offers a financial planning solution that simplifies the complexity. The easy-to-use and powerful financial planning software is built to simplify planning, enhance client engagement, and help advisors scale efficiently.

The platform combines comprehensive financial planning and analysis capabilities with modern data visualization and intuitive dashboards.

Key features:

Snapshot™ plan summaries and Blueprint™ visuals

Tax planning and Social Security optimization

Estate planning and insurance analysis

RightRisk™ risk assessment tools

Client portal and mobile accessibility

Integrations with major custodians and CRMs

Advisor360°

Advisor360° is a comprehensive wealth management platform that provides financial advisors with integrated technology solutions for client management, financial planning, and business development.

Advisor360° integrates with RightCapital to give you even more powerful planning tools.

Key features:

Client relationship management tools

Financial planning and analysis

Portfolio management capabilities

Business intelligence and reporting

Marketing and lead generation tools

Compliance and regulatory support

eMoney

eMoney describes itself as a comprehensive financial planning platform that helps advisors deliver holistic wealth management services. The platform lets advisors create detailed cash flow projections and provides clients with online access to their financial plans.

Key features:

Comprehensive financial planning tools

Client portal and document sharing

Account aggregation and data management

Spending and budgeting analysis

Business analytics and reporting

Integration capabilities with third-party systems

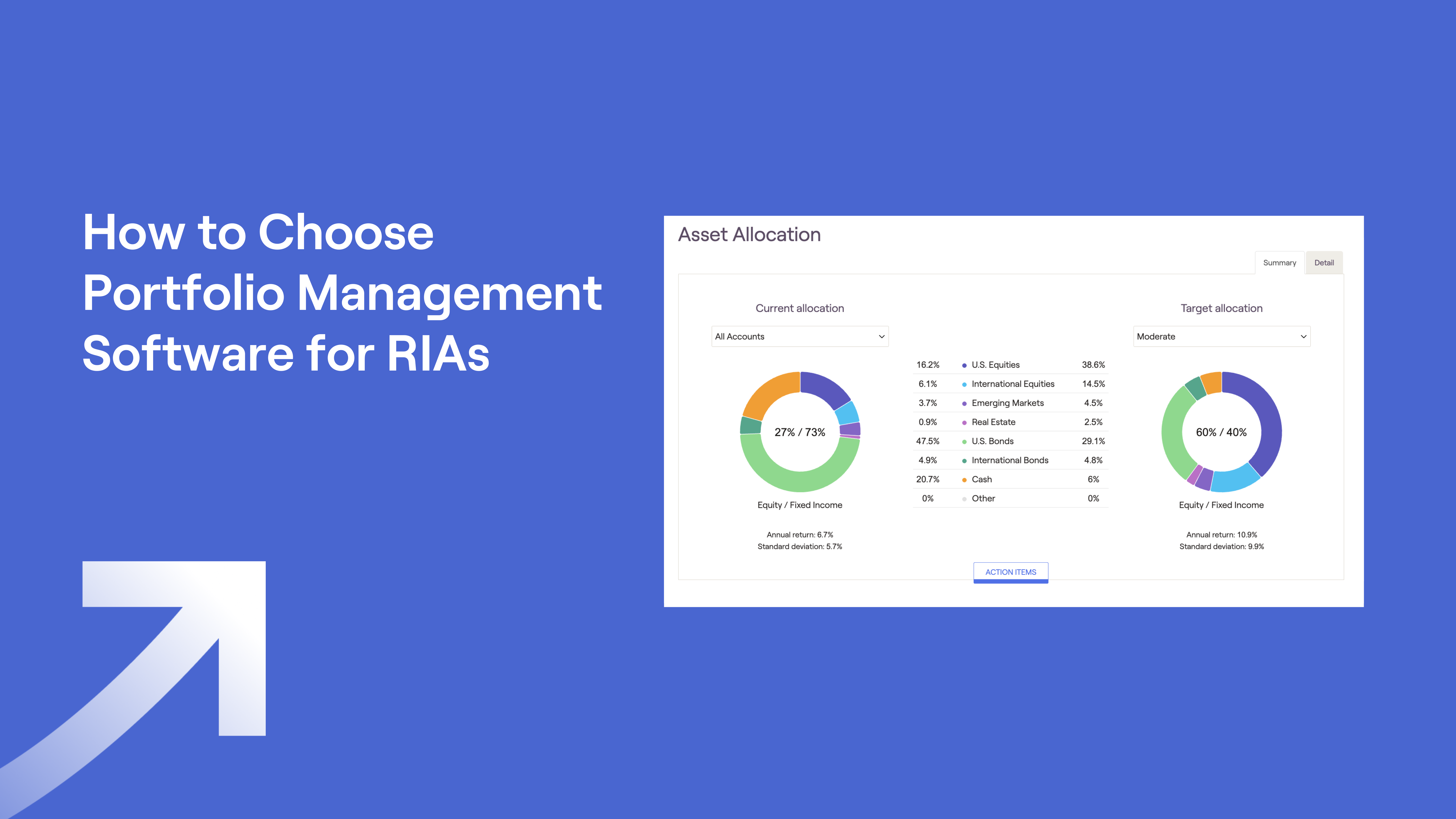

Orion

Orion operates as a wealth management platform that combines portfolio management, financial planning, and business intelligence tools into one solution for advisory firms. Orion integrates with RightCapital to provide comprehensive planning capabilities.

Key features:

Portfolio accounting and performance reporting

Trading and rebalancing automation

Client relationship management

Financial planning integration

Business intelligence dashboards

Compliance monitoring tools

Black Diamond Wealth Platform

Black Diamond functions as a comprehensive wealth management platform that provides portfolio accounting, performance reporting, and client management tools for advisory firms.

The platform includes Morningstar's Direct Advisory Suite for investment research and analysis. Black Diamond integrates with RightCapital so you can use your portfolio data for financial planning.

Key features:

Portfolio accounting and performance reporting

Trading and rebalancing capabilities

Client relationship management tools

Investment research and analysis (via Morningstar Office)

Document management and client communications

Business analytics and reporting

Altruist

Altruist describes itself as a modern investment platform designed to help financial advisors manage client portfolios more efficiently while reducing costs. Altruist integrates with RightCapital to make it easy to turn portfolio data into comprehensive financial plans.

Key features:

Commission-free trading and custody

Automated portfolio rebalancing

Client onboarding and account management

Performance reporting and analytics

Low-cost investment options

Integration with financial planning software

Automated investment platforms

These wealthtech solutions leverage automation and algorithms to help advisors manage client investments more efficiently, offering everything from automated portfolio management to institutional-grade investment platforms.

All of these platforms integrate with RightCapital, making it easy to connect your automated investing tools with your financial planning software workflows.

Betterment

Betterment Advisor Solutions operates as an all-in-one custodial platform that provides automated portfolio management and back-office support for independent RIAs.

The platform helps advisors serve clients more efficiently through automated investing, retirement planning, and cash management tools.

Key features:

All-in-one custodial platform

Automated portfolio management software

Back-office automation and support

Portfolio construction and model marketplace

High-yield cash management accounts

401(k) and retirement plan services

Charles Schwab

Charles Schwab operates as a major brokerage and custodial platform that provides investment management tools and support services for financial advisors. The platform also offers automated investment solutions for individual investors.

Key features:

Custodial and clearing services

Advisor support and resources

Portfolio management tools

Investment research and analysis

Trading platforms and execution

Client reporting capabilities

Fidelity

Fidelity operates as a comprehensive financial services provider offering custodial, brokerage, and wealth management solutions for financial advisors. The platform includes next-generation technology features like AI-powered analytics and consolidated data aggregation.

Key features:

Custodial and clearing services

Investment research and analysis

Portfolio management tools

Retirement planning platforms

AI-powered business analytics

Consolidated data aggregation

Addepar

Addepar operates as a wealth management technology platform specializing in data aggregation, analytics, and portfolio reporting for complex investments. The platform serves high-net-worth clients and institutional investors with sophisticated reporting needs.

Key features:

Data aggregation across all asset classes

Portfolio analytics and performance reporting

Risk management and scenario analysis

Client portal with real-time access

Alternative investment tracking

Compliance and regulatory reporting

Client engagement tools

Wealthtech platforms such as client portals, risk assessment questionnaires, and CRMs help you stay in touch with clients and boost engagement.

All of the tools below integrate with RightCapital, so your client information syncs across both platforms.

Blueleaf

Blueleaf describes itself as a client portal and account aggregation platform that helps financial advisors aggregate accounts from multiple institutions and send automated reports.

Key features:

Account aggregation from 20,000+ institutions

Automated client portal updates

Custom branded client communications

Mobile app for clients

Document vault and storage

Performance reporting and analytics

Wealth Access

Wealth Access is a customer data insights platform that helps financial advisors unify client data from multiple systems and create consolidated client portals. The platform specializes in data aggregation and client relationship management.

Key features:

Data unification from multiple systems

Consolidated client portal

Account aggregation across institutions

Client relationship management tools

Enterprise data integration

Mobile accessibility

Nitrogen (formerly Riskalyze)

Nitrogen operates as a risk assessment and portfolio analytics platform that helps financial advisors quantify client risk tolerance and optimize investment portfolios accordingly.

Key features:

Risk tolerance assessment tools

Portfolio optimization algorithms

Stress testing and scenario analysis

Client communication and visualization tools

Compliance and suitability reporting

Integration with portfolio management systems

Wealthbox

Wealthbox provides a modern, cloud-based CRM solution built specifically for financial advisors and wealth management firms, focusing on client relationship management and workflow automation.

Key features:

Contact management and client profiles

Task automation and workflow management

Email integration and communication tracking

Document storage and sharing

Mobile accessibility and synchronization

Social media integration

Redtail CRM

Redtail CRM describes itself as a comprehensive customer relationship management platform designed specifically for the financial services industry, helping advisors manage client relationships and business workflows.

Key features:

Contact management and database organization

Task management and workflow automation

Email marketing and communication tools

Document management and file storage

Customizable dashboards and reporting

Mobile app for remote access

Essential features for wealthtech software

When you're shopping for wealthtech solutions, focus on the features that will make your life easier and help you grow your business.

Here are some top features to consider:

Workflow automation

Automated processes help speed up and simplify routine tasks like portfolio rebalancing, client communications, and compliance monitoring.

Data aggregation

Look for platforms that automatically pull data from multiple account types and custodians. The best wealthtech companies connect everything in real time so you're not stuck copying and pasting account numbers all day.

Investment intelligence

Choose wealthtech platforms that use algorithms and data-driven insights to let you create customized investment portfolios that help people make smart investment decisions.

Client engagement

The best solutions include client engagement tools and marketing automation features that help you attract new prospects while keeping existing relationships strong. Think lead capture forms, automated email campaigns, and interactive client portals.

Scalability and functionality

Any wealthtech solution should integrate smoothly with your existing tech stack and grow with your practice as you add clients. The right wealthtech providers offer flexible pricing and functionality that adapts as your AUM and client base expand, without forcing you to manage multiple disconnected systems.

Conclusion

These wealthtech solutions help financial advisors work smarter, not harder. The 15 software solutions we've covered here represent some of the most popular tools available today, each solving real problems that advisory firms deal with every day.

The trick is finding wealthtech platforms that solve real problems instead of adding another layer of complexity. Look for solutions that automate the boring and repetitive stuff, create better client experiences, and give you the data-driven insights you need to make smart investment decisions.

While these platforms handle everything from portfolio management to client portals, RightCapital provides the comprehensive financial planning capabilities that tie it all together.

Our platform integrates seamlessly with many of these wealthtech solutions, giving you powerful analytical tools wrapped in an interface that both you and your clients will actually enjoy using.

Ready to see how RightCapital can work with your existing wealthtech stack? Schedule a demo to discover how our financial planning platform can streamline your workflows and help you deliver better client experiences.

Wealthtech FAQ

What is wealthtech?

“Wealthtech” refers to financial technology solutions specifically designed for wealth management and investment services. These platforms use software, algorithms, and digital tools to improve how financial advisors and wealth management firms serve their clients.

Common wealthtech use cases include:

Automated portfolio management and rebalancing

Digital financial planning and analysis tools

Client onboarding and engagement platforms

Risk assessment and investment optimization

Data aggregation and reporting systems

What is the difference between fintech and wealthtech?

Fintech is a broader category that encompasses all financial technology solutions, while wealthtech specifically focuses on wealth management and investment services.

Fintech examples include:

Payment processing and digital wallets

Peer-to-peer lending platforms

Cryptocurrency and blockchain solutions

Insurance technology (insurtech)

Banking and lending automation

Wealthtech examples include:

Portfolio management platforms

Financial planning software

Robo-advisors and automated investment services

Risk assessment and analytics tools

Client portal and engagement platforms

Investment research and analysis systems

What are the largest wealthtech companies?

The largest wealthtech companies include established financial institutions and innovative startups.

Major players include traditional firms like Charles Schwab and Fidelity, which have invested heavily in digital transformation, alongside newer companies like Betterment and Addepar that were built specifically for modern advisory practices.

These companies typically serve different segments of the advisory market, from independent RIAs to large wealth management firms requiring sophisticated portfolio management and institutional-grade reporting.

Schedule a demo to see how RightCapital can integrate with your current wealthtech stack, streamline your workflow, and enhance client management.