What Does Retirement Look Like to Financial Advisors?

December 2, 2022

Lush green golf courses and sandy tropical beaches seem to be the top choices when we ask about retirement dreams. That’s followed by destination cruises, quiet mountain retreats, and traveling around the world. In our minds, anything is possible when we don’t need to go to work every day. The reality isn’t quite that simple.

Conceptualization is the first step in making dreams come true. If you can’t visualize it, the chances of attaining it are slim. You may have tried to communicate this to clients. In this exercise, we’d like for you as an advisor to imagine what your retirement looks like. Think of it as a role reversal. Here are some key questions to focus on.

When do you want to retire?

Early retirement is appealing for several reasons. It might not be the best option for you. Just for this exercise, try to leave out any questions around business succession when you contemplate this question. Those are relevant, but we’re trying to get you to imagine yourself as a client, not an advisor. Use that mindset going forward.

Retiring in a down market can result in the premature consumption of retirement savings principal. Filing for Social Security benefits too early leaves you stuck with a lower retirement income. Each of these should be a factor in deciding when to retire. Your clients might need an explanation on each of these.

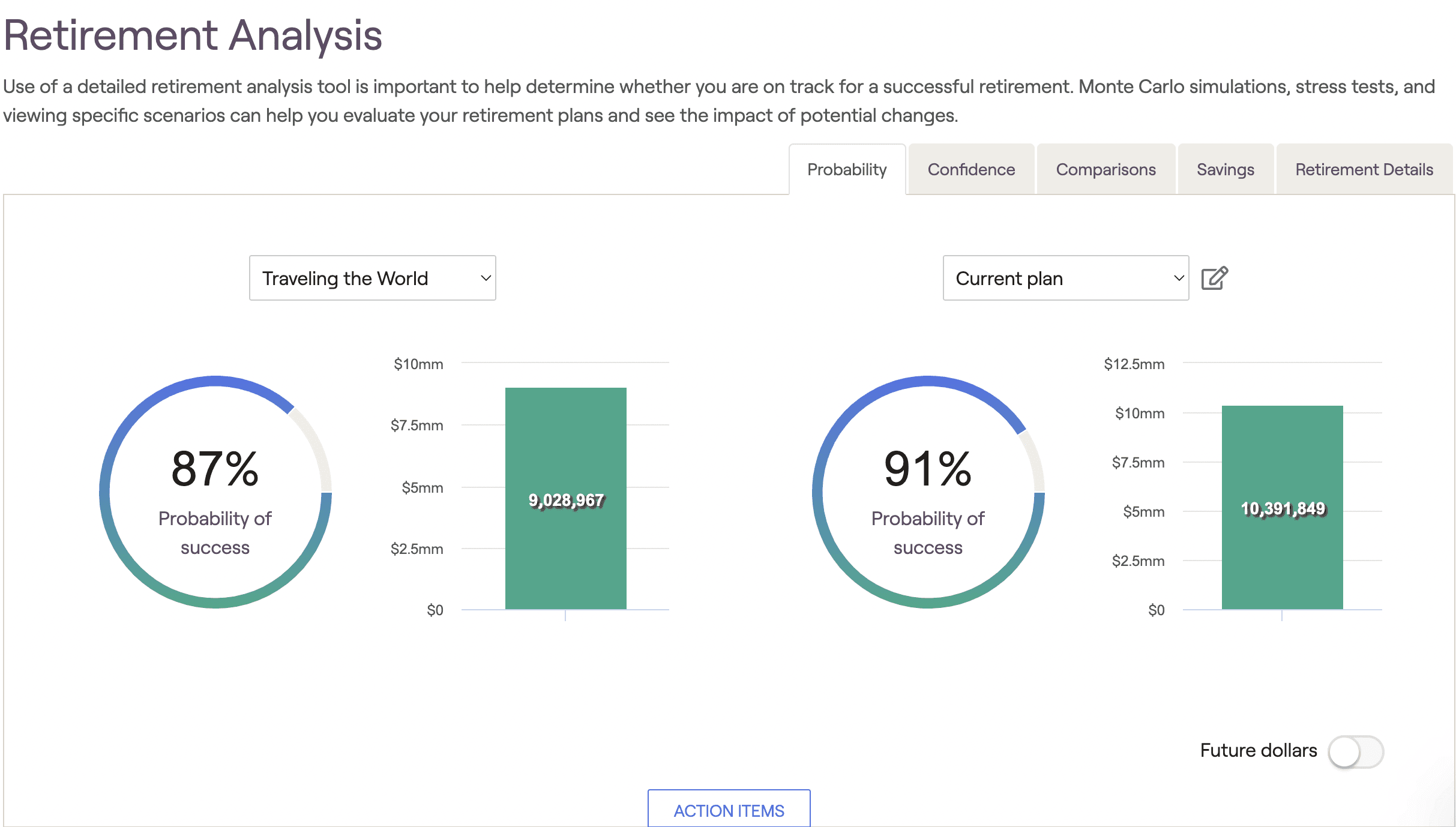

RightCapital provides the visuals to show and not just tell your clients how the timing of their retirement will affect them. Projected returns on investment accounts can be adjusted in the settings menu. Scenarios for Social Security filing can be tracked on an optimization graph. You can even create and compare different retirement plans.

Who will you spend your retirement with?

Retirement planning for one is a challenge. Doing it for a couple or family is more complex. Are you married? Do you have children? Factoring in your spouse’s salary, savings, and investments adds another dimension to this process. Adding items like college tuition and legacy funds complicates the math even further.

Each member of a family can be both an asset and a liability in retirement, depending on their relationship to you. Spouses will have an income. It could be through a retirement savings plan like a 401(k) or pension. It could also come as Social Security benefits payments, assuming that the SSA trust funds remain solvent.

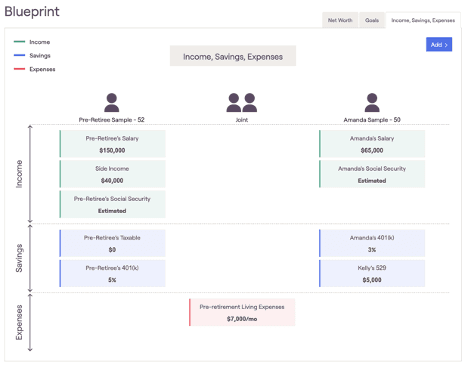

Financial planners in olden times did this math on spreadsheets. You have RightCapital to do it for you. Using your own situation, create a personal client profile on our platform. Include income, savings, and expenses for both you and your spouse. If you do it correctly, you’ll be able to see that information in a RightCapital Blueprint.

Do you plan on traveling or staying in place?

Retirement is a good time to travel around the country, go on Caribbean cruises, and maybe visit historical sites in other parts of the world. Having the money to do all this is one piece of the puzzle. Making sure you have the right health coverage when you travel is equally important. That means making the correct Medicare decisions.

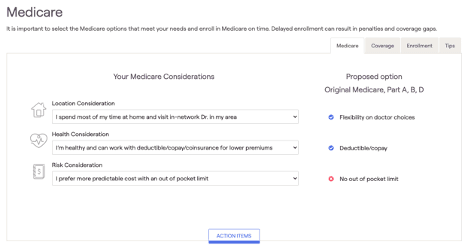

For more details on this, refer to the Navigating Medicare Decisions article we published back in October. The graphic below also provides some insight. If you’re going to travel in retirement, you might want to choose Original Medicare because Medicare Advantage can lock you into specific doctor’s networks.

RightCapital simplifies this for you. The “Medicare” module in the “Retirement” section of our application provides a simple questionnaire that can help you make this vital decision. There are three questions that ask you about location, health, and risk. Based on your answers, we provide Medicare recommendations.

Why are we doing this exercise?

RightCapital is a tool. The best way to become proficient with a tool is to use it. We’ve spent years developing our platform to make sure you can show clients exactly what their retirement will look like from a financial perspective. Creating a personal profile and walking through these questions will make you better at doing that.

Uncertainty during a client presentation can undermine their confidence in your abilities. Shrugging it off as a “tech issue” suggests the software is inadequate. They won’t use it if you can’t demonstrate what it’s capable of. This exercise is a good way to hone your skills. We also suggest a visit to our Help Center to learn more.