Estate Planning Software For Financial Advisors

May 13, 2025

Estate planning is an important component of comprehensive financial advice, yet it’s often one of the most complex and time-consuming. As a financial advisor, you know that helping clients protect and transfer their wealth requires more than just expertise, it demands the right technology. The best estate planning software for financial advisors streamlines the process, reduces manual errors, and enables you to deliver a higher level of service.

In this 2025 guide, we’ll explore the benefits of integrating estate planning software into your practice, what features to prioritize, and compare eight leading solutions, including how RightCapital stands out for holistic planning and ease of use.

Benefits of integrating estate planning software into financial advisory practices

According to the Kitces Report released in March 2025, “How Financial Planners Actually Do Financial Planning,” 84% of surveyed respondents are including clients’ estate planning within financial plans, with 58% of respondents handling this service internally.

Incorporating estate planning software into your advisory workflow offers several advantages:

Streamlined processes: Automate document collection, beneficiary tracking, and scenario modeling, saving time with less administrative burden

Reduced manual errors: Digital tools minimize the risk of mistakes in complex estate structures

Enhanced client experience: Interactive visualizations and clear reports help clients understand their legacy plans, building trust and engagement

Holistic planning: Incorporate estate strategies into retirement, tax, and investment planning for a complete financial picture

Business growth: Offer more value to clients, differentiate your services, and increase retention by addressing multi-generational wealth transfer needs

What should financial advisors prioritize in estate planning software?

When evaluating estate planning software for your practice, look for these essential features:

Seamless integrations: Ensure the software connects with your existing CRM, financial planning, and document management systems for efficient data flow

Intuitive visualizations: Look for tools that translate complex estate structures into easy-to-understand charts and diagrams for clients

User-friendly interface: A clean, logical interface saves time for both advisors and clients, reducing the learning curve

Holistic planning capabilities: Choose software that allows you to incorporate estate planning into broader financial plans, including tax, retirement, and insurance

Ongoing feature development: Opt for providers that regularly update their platform to keep pace with regulatory changes and advisor needs

Value and ROI: Consider the overall value vs. the pricing, including time savings, client satisfaction, and the ability to attract new business

Customizable reporting: The ability to generate branded reports tailored to each client’s needs is a must

8 estate planning software tools for financial advisors

Below are eight leading estate planning software solutions for financial advisors, each offering unique strengths. Review the summaries and key features to find the best fit for your practice.

RightCapital

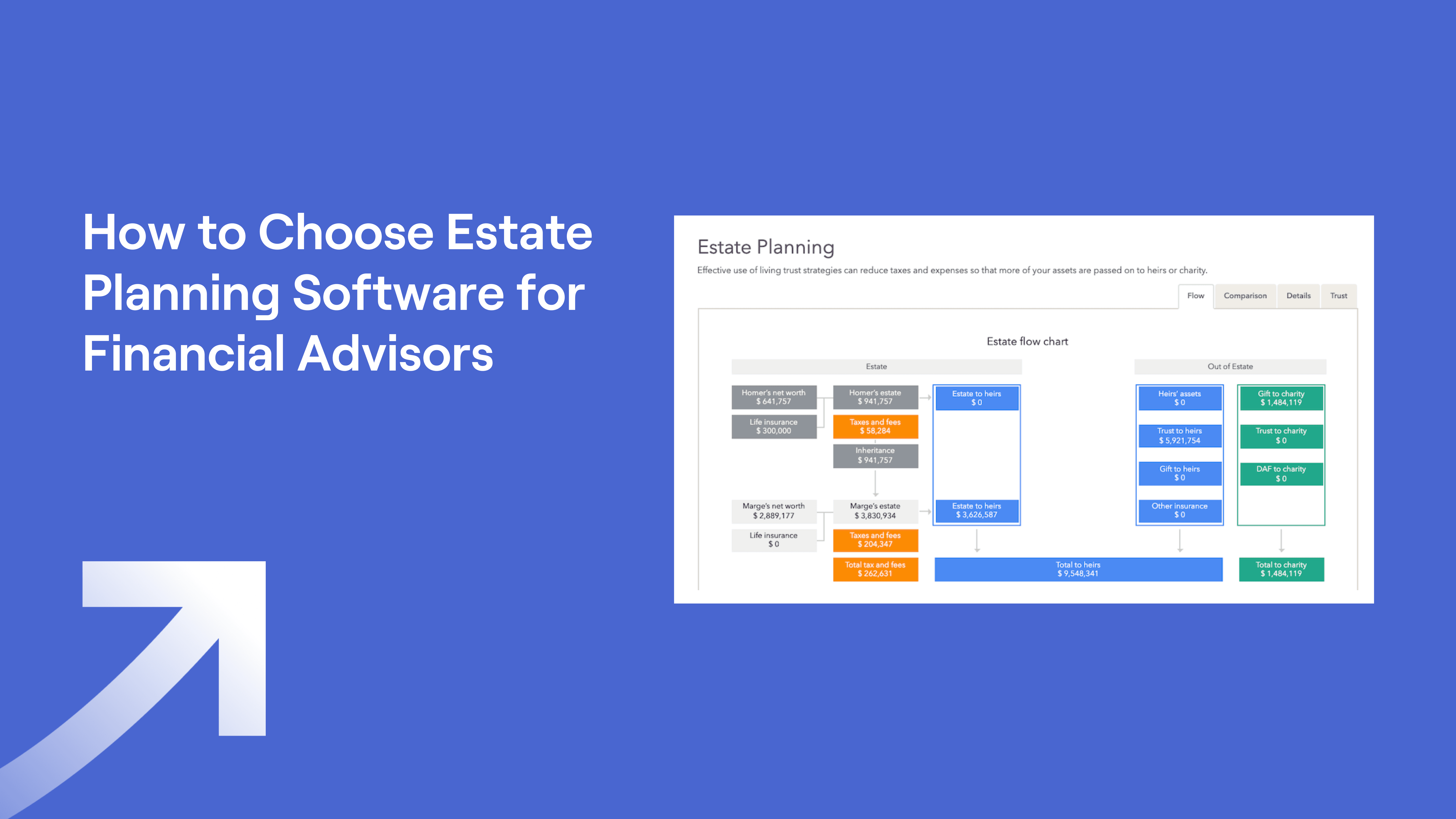

RightCapital is a comprehensive financial planning platform that empowers advisors to integrate estate planning seamlessly into holistic client plans. The software offers intuitive visualizations, scenario modeling, and robust integrations, making it easy to address complex estate and legacy needs alongside retirement, tax, and investment strategies.

Key Estate Planning Features

Estate flowcharts and beneficiary visualizations

Integrated estate, tax, and retirement planning modules

Customizable client reports

Secure document vault for wills, trusts, and legal documents

Scenario modeling for wealth transfer and gifting strategies

Checklist to keep track of estate planning documents, beneficiaries, and power of attorney

2025 Industry Ratings for Estate Planning

Kitces: 7.2/10 (8.7/10 overall)

T3: 7.63/10 (8.52/10 overall)

eMoney

eMoney describes itself as a comprehensive financial planning solution with robust estate planning capabilities, including document storage and interactive client portals.

Key Estate Planning Features

Estate plan summaries and flowchart

Secure document vault for estate planning documents

Scenario modeling for legacy planning

2025 Industry Ratings for Estate Planning

Kitces: 7.3/10 (8.5/10 overall)

T3: 7.8/10 (8.22/10 overall)

MoneyGuide

MoneyGuide describes itself as a goal-based financial planning platform with estate planning features that help advisors model legacy scenarios and beneficiary outcomes. Most of these features are available with the WealthStudios add-on, as noted below.

Key Estate Planning Features

Estate planning checklist and flowcharts

Calculation of estate taxes and what-if scenarios

Estate planning reports ("Advanced Estate Strategies" with WealthStudios add-on)

Beneficiary and inheritance modeling; scenario analysis for wealth transfer (with WealthStudios add-on)

2025 Industry Ratings for Estate Planning

Kitces: 5.8/10 (7.9/10 overall)

T3: 7.48/10 (7.67/10 overall)

Asset-Map

Asset-Map describes itself as a visual financial planning tool that helps advisors map out client assets, liabilities, and estate structures in an intuitive, client-friendly format.

Key Estate Planning Features

Visual estate and asset mapping

Beneficiary and ownership tracking

Customizable reports and presentations

2025 Industry Ratings for Estate Planning

Kitces: 6.7/10 (8/10 overall)

fpAlpha

fpAlpha describes itself as an estate and tax planning platform leveraging artificial intelligence, designed to help financial advisors deliver advanced planning strategies efficiently.

Key Estate Planning Features

AI-powered estate and tax analysis

Automated identification of planning opportunities

Digital estate flowcharts and visualizations

Alternative estate scenario modeling

2025 Industry Ratings for Estate Planning

Kitces: 8.3/10

T3: 7.87/10 (7.81/10 overall)

Wealth

Wealth describes itself as a digital estate planning platform focused on simplifying the creation and management of estate planning documents for advisors and their clients.

Key Estate Planning Features

Digital creation of wills, trusts, and power of attorney

Secure client-advisor collaboration tools

Visual estate plan summaries and flowcharts

2025 Industry Ratings for Estate Planning

Kitces: 6.7/10

T3: 8.24/10

Vanilla

Vanilla describes itself as a modern estate planning platform built for advisors, offering digital tools to design, visualize, and manage complex estate plans.

Key Estate Planning Features

Interactive estate diagrams and flowcharts

Digital legal document templates

Estate plan strategy modeling

2025 Industry Ratings for Estate Planning

Kitces: 7.1/10

T3: 7.23/10

EncorEstate

EncorEstate describes itself as an estate planning platform designed for advisors, offering digital document creation and collaboration features.

Key Estate Planning Features

Creation of custom estate documents

Estate planning workflows

Visual plan summaries

2025 Industry Ratings for Estate Planning

Kitces: 8.3/10

T3: 8.47/10

Conclusion

Choosing the right estate planning software for financial advisors can transform your practice—streamlining workflows, reducing errors, and delivering a more engaging client experience. As you evaluate your options, prioritize solutions that offer seamless integrations, intuitive visualizations, and holistic planning capabilities.

RightCapital stands out by making estate planning an integral part of a broader financial strategy, helping you deepen client relationships and drive long-term retention.

Schedule a RightCapital demo and learn how to effortlessly integrate estate strategies into your clients’ financial plans.