RightCapital vs eMoney: 7 Key Differences for Financial Advisors (2026)

January 14, 2026

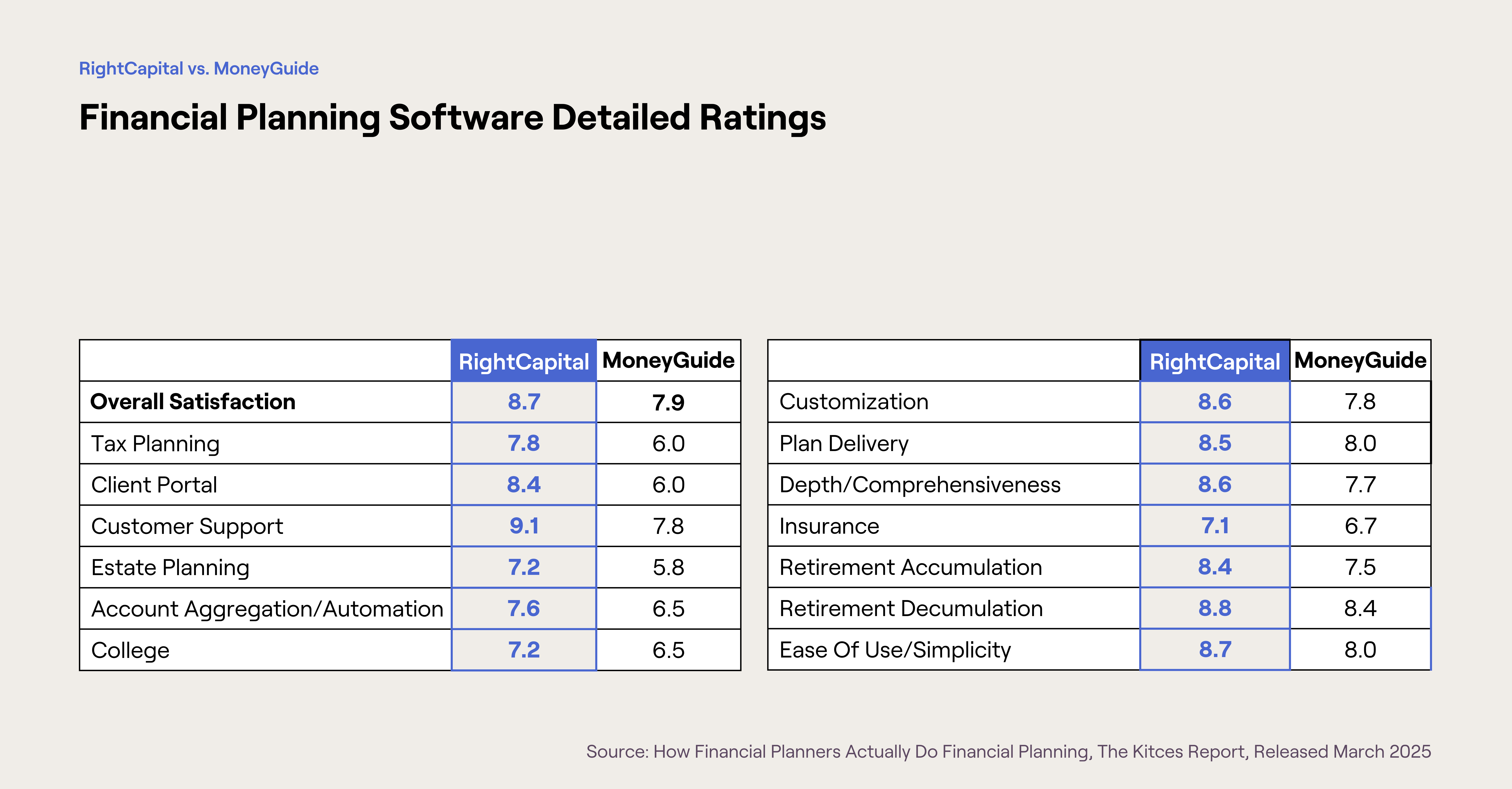

Making the decision about which financial planning software is right for your practice is a big one. eMoney and RightCapital are both leading financial planning software providers. Let’s dig into what makes them different. (Trying to decide between RightCapital and MoneyGuide? This post may help.)

If you’re searching for an eMoney alternative, or comparing the top financial planning software platforms, this breakdown highlights where the tools differ most in day-to-day advisor workflows.

Pricing and cost transparency

RightCapital’s retail pricing is found on the RightCapital pricing page. (“Retail pricing” here means publicly listed pricing available without an enterprise contract.)

While eMoney Advisor does not publish costs on their website, here’s around what you can expect to pay according to industry sources:

Category | RightCapital Premium | eMoney Pro | eMoney Premier |

|---|---|---|---|

Price | $2,520/year | $4,100+/year | $5,000+/year |

Advisor Satisfaction Rating* | 8.7 | 8.5 | 8.5 |

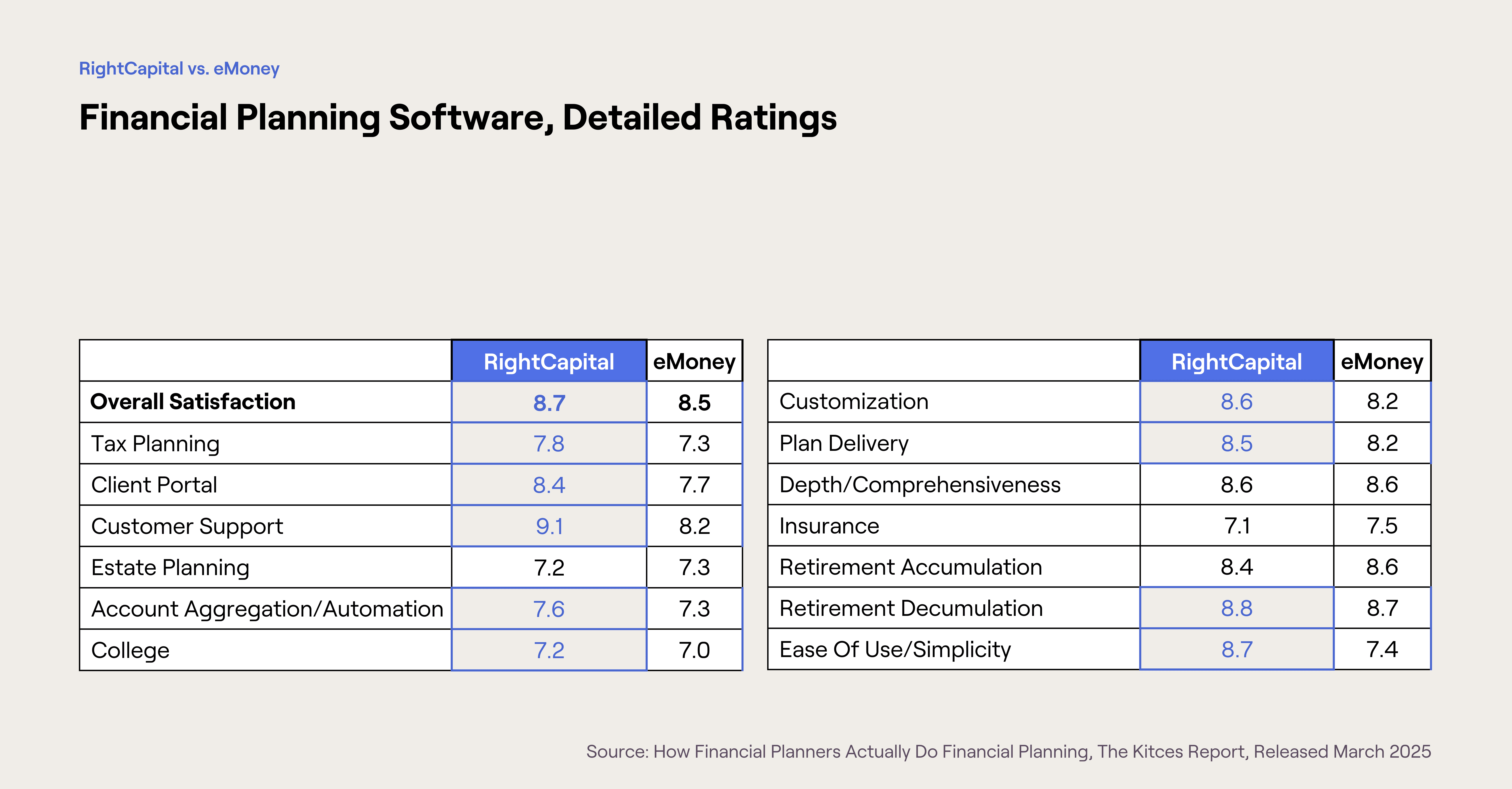

*Source: How Financial Planners Actually Do Financial Planning, The Kitces Report, Released March 2025

About eMoney pricing, the Kitces Report, “How Financial Planners Actually Do Financial Planning” released in March 2025 says:

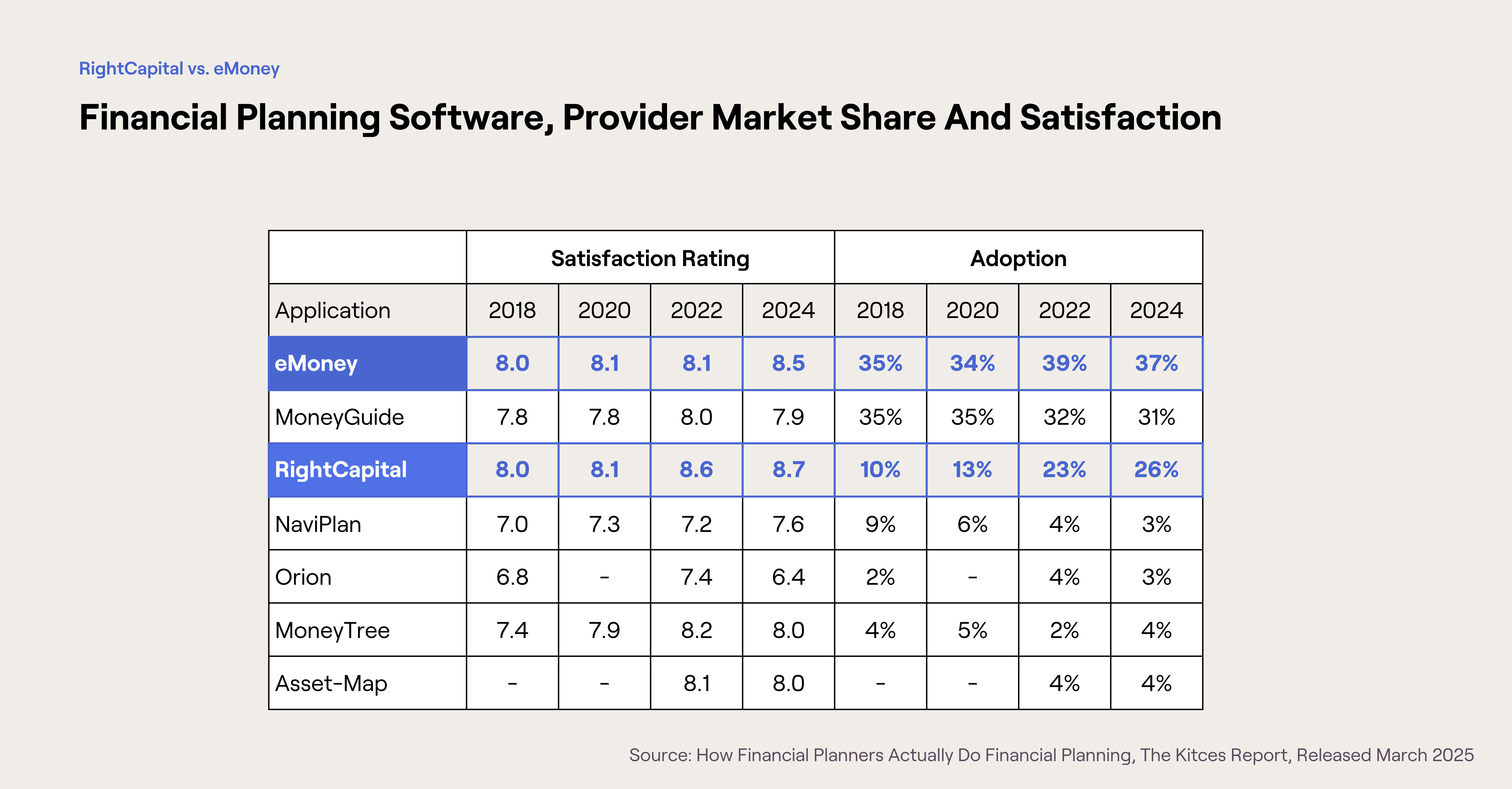

eMoney’s premium price point is less affordable for newer advisors with limited revenue, especially RIA-only advisors who don’t have access to the enterprise-level discounts available through independent broker-dealers…eMoney’s pricing has tilted its usage towards larger and more established advisory firms.

Feature depth and functionality

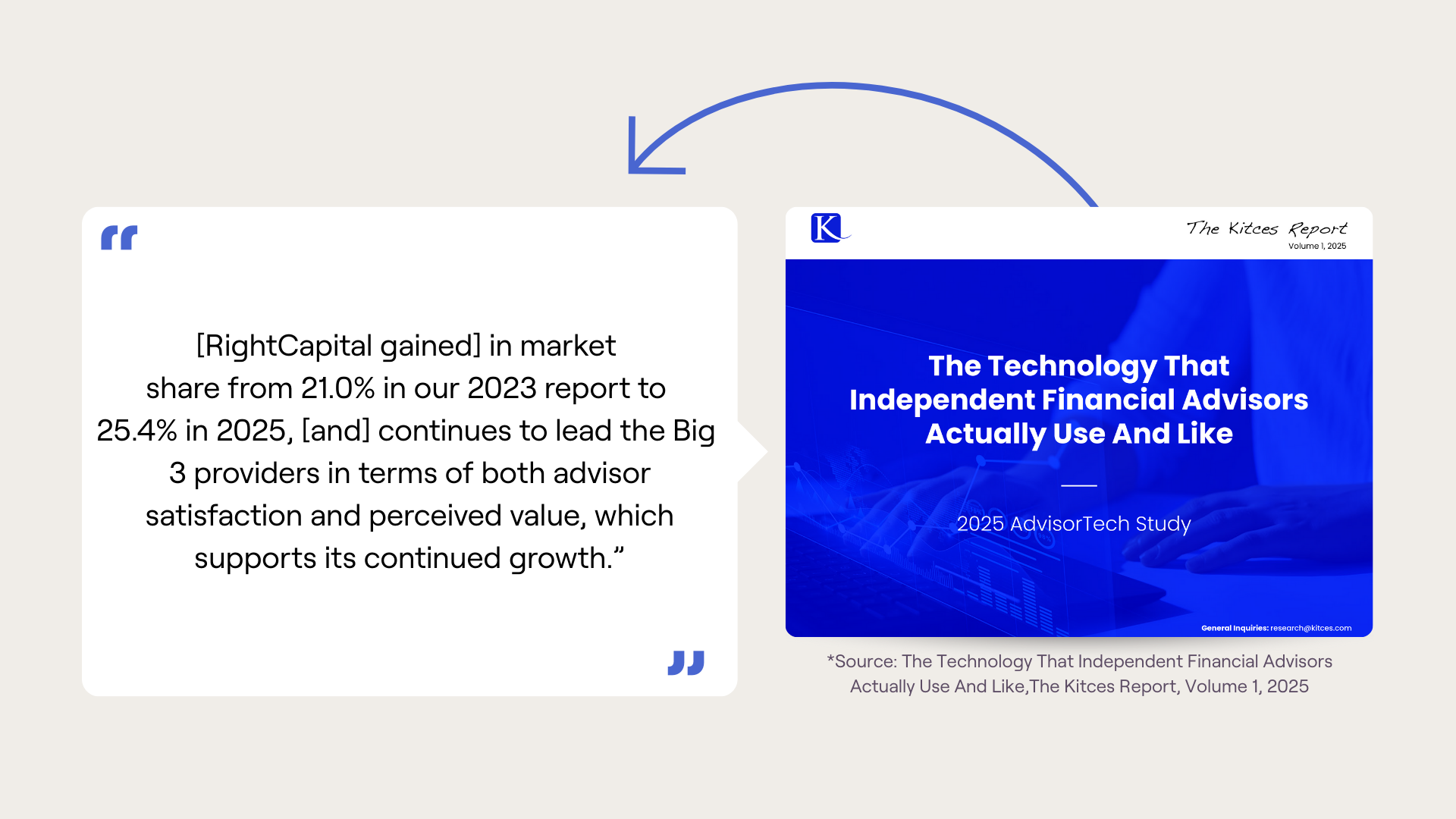

When RightCapital was founded in 2015, it took a few years to achieve feature parity with eMoney, which had been on the market since 2000. Today, RightCapital’s feature ratings outrank eMoney’s in industry reports.

In the Kitces Report released in March 2025, RightCapital achieved a higher advisor satisfaction rating than eMoney in nine of the 13 sub-categories, including five standouts where RightCapital was the highest of all the platforms:

Account Aggregation/Automation (Account aggregation refers to automatically pulling held-away accounts into the plan via data feeds.)

Ease of Use/Simplicity

RightCapital and eMoney tied for highest ranked in the survey for Depth/Comprehensiveness.

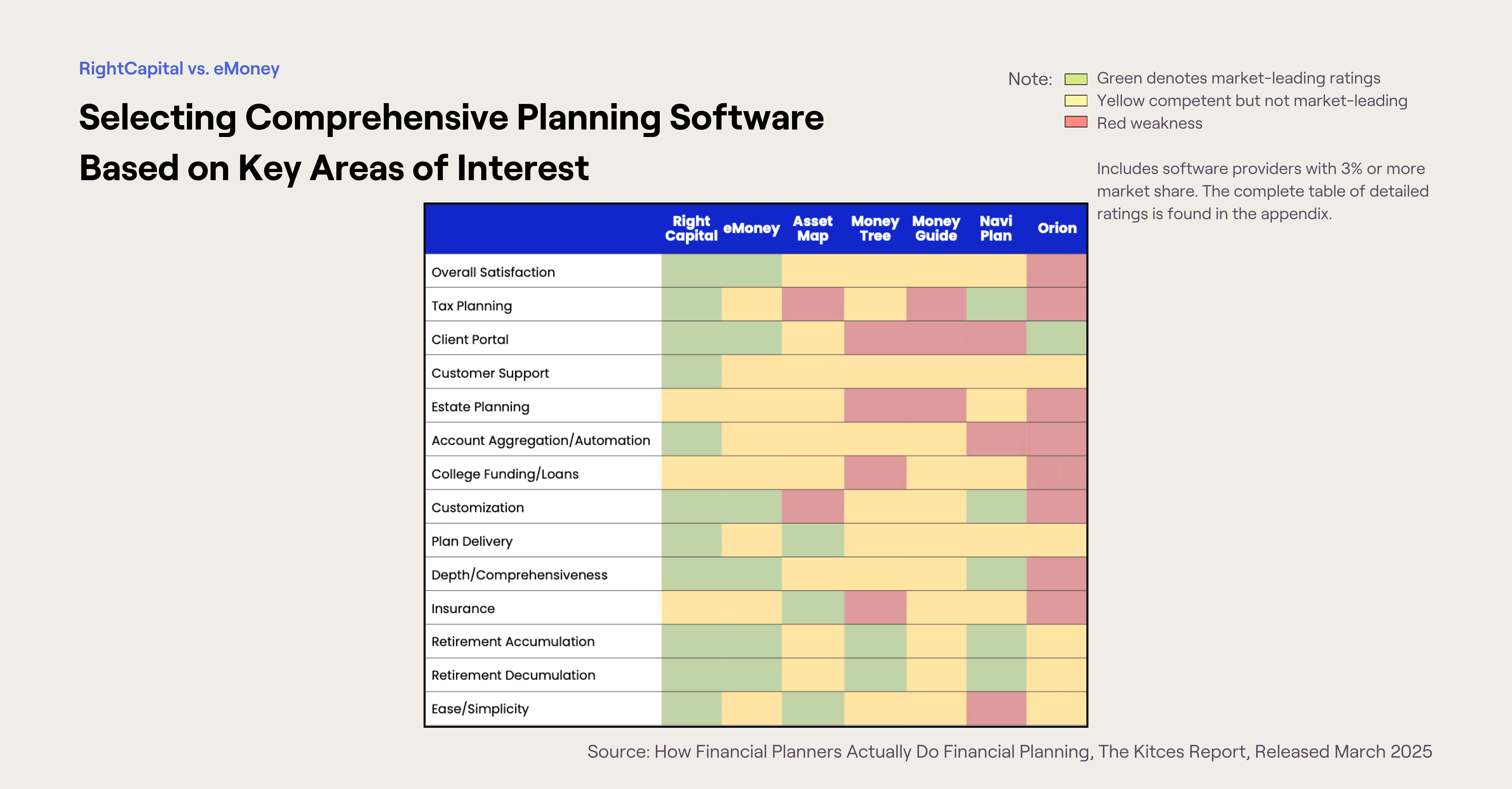

The report broke down this data visually (below), with Kitces adding:

The standout is RightCapital, ranked as a market leader in eleven categories and ranked as weak in none. Further, two of the three categories in which RightCapital did not excel are those where no program stands out above the rest.

With regards to the client portal, Kitces notes:

Also notable is RightCapital’s top ratings (by a large margin) for its Client Portal, a domain where competitor eMoney historically excelled.

Advisor satisfaction ratings

The March 2025 Kitces Report found that RightCapital's overall user satisfaction score is an 8.7 out of 10, outpacing eMoney's rating of 8.5 out of 10.

The March 2025 T3/Inside Information Advisor Software Survey also revealed that RightCapital (with an average 8.52/10 user rating) was the highest rated of “the Big 3,” as it has been for four straight years:

Financial Planning Software | Market Share | 2024 Market Share | Average Rating | 2024 Average Rating |

|---|---|---|---|---|

eMoney | 28.20% | 29.55% | 8.22 | 8.21 |

MoneyGuidePro | 22.79% | 33.36% | 7.67 | 7.88 |

RightCapital | 20.68% | 14.64% | 8.52 | 8.46 |

As of January 2026, G2 ratings for the two software platforms are comparable, with RightCapital at 4.6 out of 5 and eMoney at 4.7 out of 5. G2 reviewers gave RightCapital higher marks for “Meets Requirements,” “Ease of Use,” “Quality of Support,” and “Product Direction,” similar to the feedback seen in the Kitces advisor survey.

Ease of use and onboarding time

The most common feedback heard from advisors transitioning from eMoney to RightCapital is how easy it is to get started with RightCapital.

According to advisors, it can take three to six months to get completely up to speed with eMoney. This otherwise positive G2 review for eMoney illustrates this point, “...it can be a bit clunky to navigate through.”

The March 2025 Kitces Report notes:

The depth of eMoney eventually becomes cumbersome for advisors…eMoney scores lower than most of its peers in terms of simplicity of design and ease of use.

When it comes to RightCapital, several advisor success stories discuss how simple the learning process was:

“It was extremely easy,” Brooke Martinez commented, when asked about switching to RightCapital.

The Optima Capital Management team stated that within a week of using the software, it was clear, “RightCapital is so much smoother to work with.”

Michael Johnson, of Alchemi Wealth, mentioned in February 2025’s RightInsights event: “RightCapital was probably the easiest integration that we've had to date. We have done probably 15 different data migrations over the last four years. It can be really complex at times, but it truly was a click of a button with RightCapital.”

Client experience (portal, visuals, reporting)

In the March 2025 Kitces Report, RightCapital leads eMoney in terms of satisfaction rating for Client Portal and Ease of Use. In the August 2025 Kitces Report, “The Technology That Independent Financial Advisors Actually Use And Like,” RightCapital also outranked eMoney in the categories of Visuals (RightCapital at 8.5 vs. eMoney at 7.7) and Reporting Output (RightCapital at 7.8 vs. eMoney at 7.2).

Watch this case study to hear how one advisor was particularly impressed with the aesthetically pleasing interface and the ability to provide a one-page Snapshot. Another advisor has noted, “It’s pretty remarkable how RightCapital found a way to take all this information and communicate it in a way that’s intuitive, aesthetic, and clean, and in some ways, higher-tech than a lot of the other platforms, while still feeling simple and approachable.” In this blog post, an advisor discusses her switch to RightCapital from eMoney, highlighting the visual appeal and client engagement, while also noting that what she missed about eMoney was more for the advisor than the end-clients.

XYPN, in their own RightCapital vs. eMoney comparison post, wrote:

There's no right or wrong here, but we prefer RightCapital's visuals and presentation options, which simplify complex situations and better encourage behavior change for many clients.

Support experience

eMoney support team

Here is what eMoney Advisor reported about their client support team on their website:

170% more live support than other providers

Average response time under 1 minute

Overall support rating 96% “awesome or good”

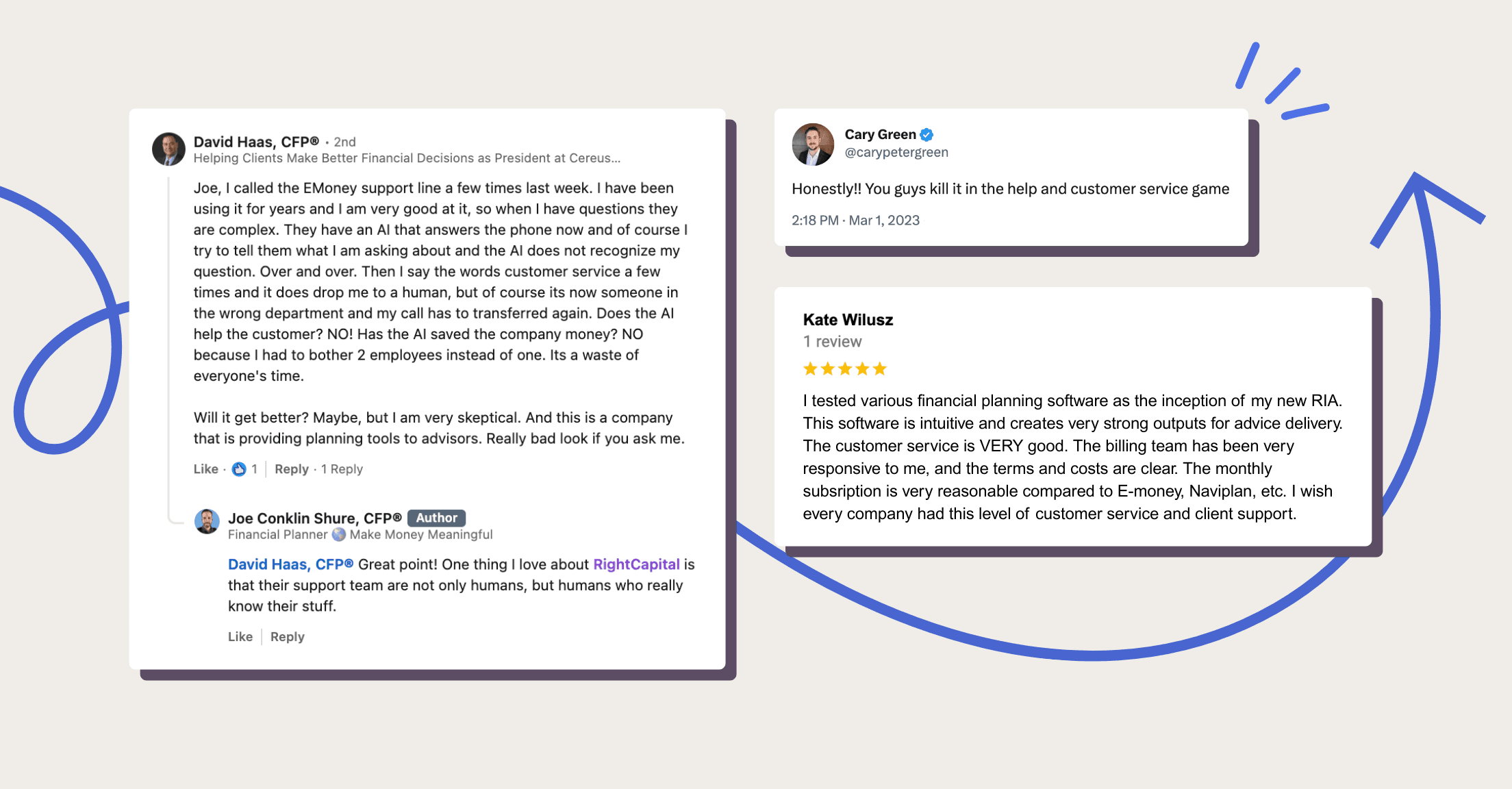

It’s worth noting that as of March 2025, it seems that eMoney has started to use some AI in their customer support, which advisors may be concerned about, as you can read about in the above image.

RightCapital support team

Here are some stats about the RightCapital support team:

Median inbound answer time under 60 seconds

98% satisfaction rate

All support inquiries answered by a live product specialist

The Kitces survey published in March 2025 shows that advisors rated RightCapital’s customer support experience higher (9.1/10) than that of eMoney (8.2/10).

One user on G2 noted they liked best about RightCapital, “The immediate help we can get from the support team when we are stuck on how to model something. It's especially helpful because we like to create and update financial plans interactively with our clients and the quick solutions keep everyone engaged.”

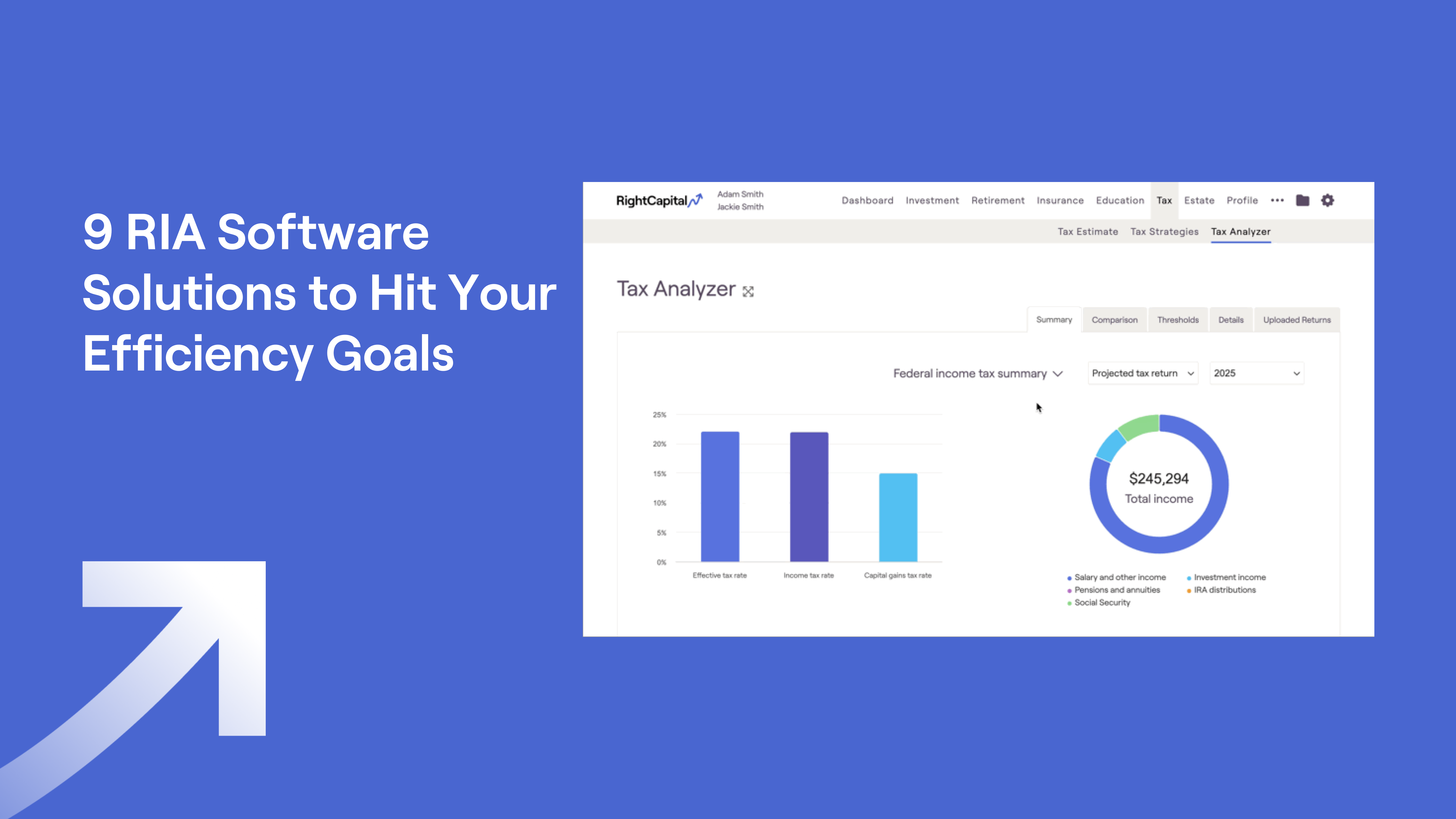

Product updates and pace of innovation

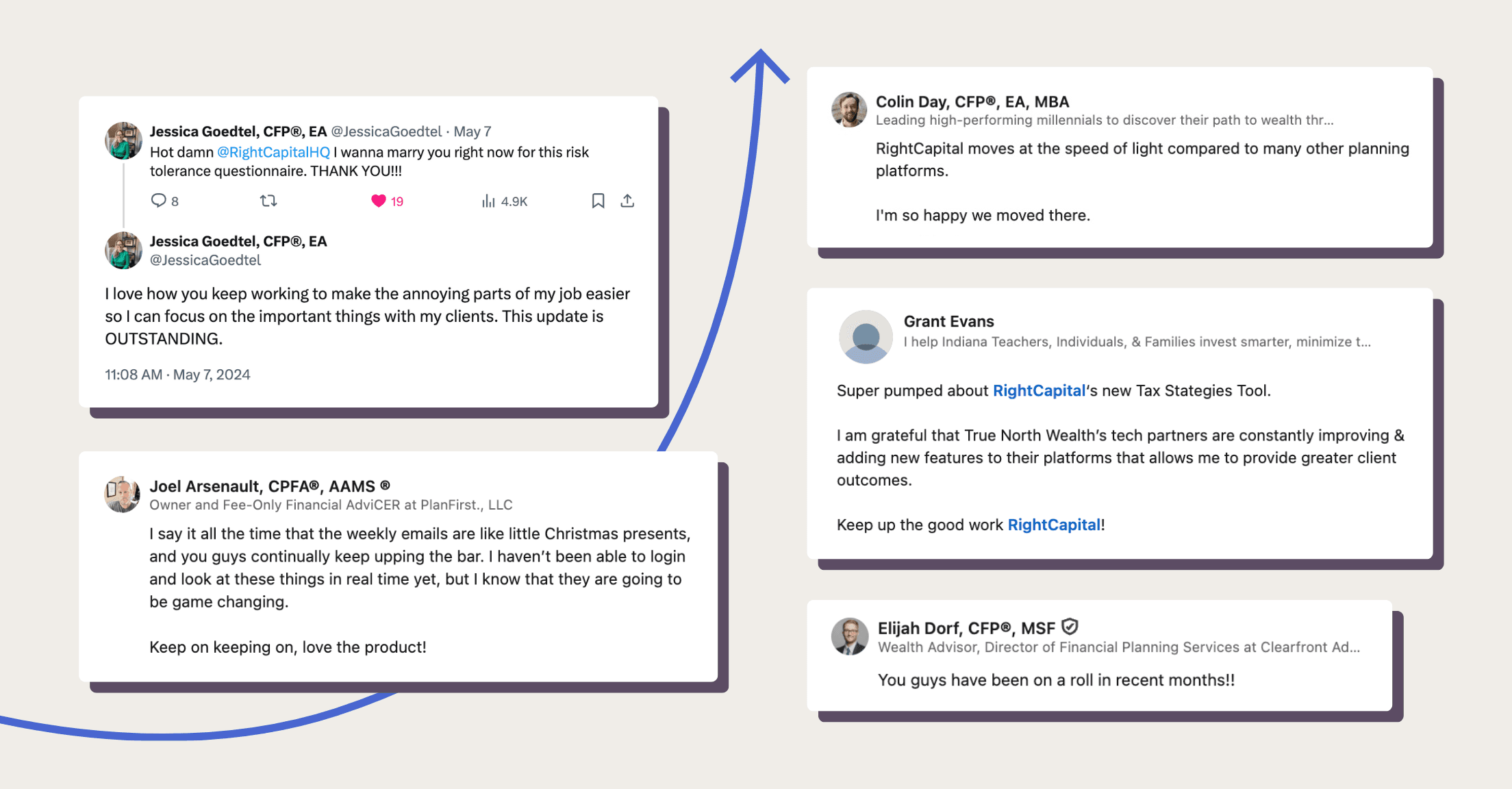

RightCapital is well-known in the industry for continuous enhancements (see RightCapital’s 2025 product updates) and attention to what advisors are looking for.

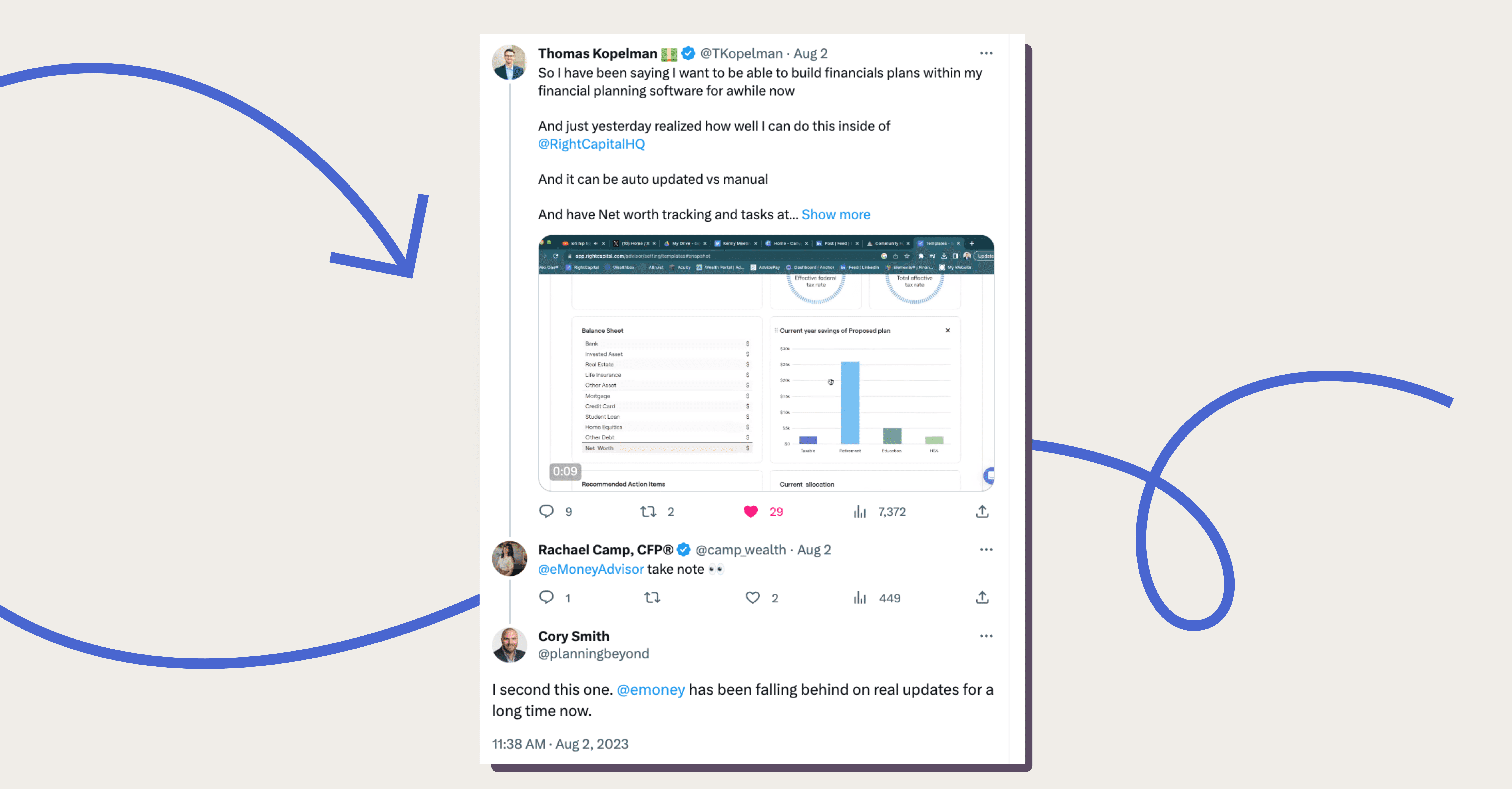

Advisors have openly complained about eMoney’s slow response to product enhancements:

Even eMoney’s original founder Edmond Walters told Citywire that “The product hasn’t gotten anywhere…they’re a Betamax.”

On the flip side, advisors rave about how fast RightCapital moves, with one advisor saying “RightCapital moves at the speed of light compared to many other planning platforms” in response to our Tax Strategies feature release in the fall of 2024:

In the end, you can try RightCapital and see it for yourself. Sign up for a personalized 1:1 20-minute demo with a member of the team to gain access to a 14-day free trial. If you're an eMoney user looking to move over, learn about the cutting-edge OCR transition support from eMoney to RightCapital here.