RightCapital vs MoneyGuide: 7 Key Differences for Financial Advisors (2026)

January 16, 2026

The decision on which financial planning software to use with your practice can be a tough one. Two leaders in the industry are RightCapital and MoneyGuide. Let’s take a look at the differences between them. If you’re looking for a MoneyGuide alternative or comparing financial planning software for RIAs, the sections below break down the practical workflow differences that affect client meetings and plan delivery.

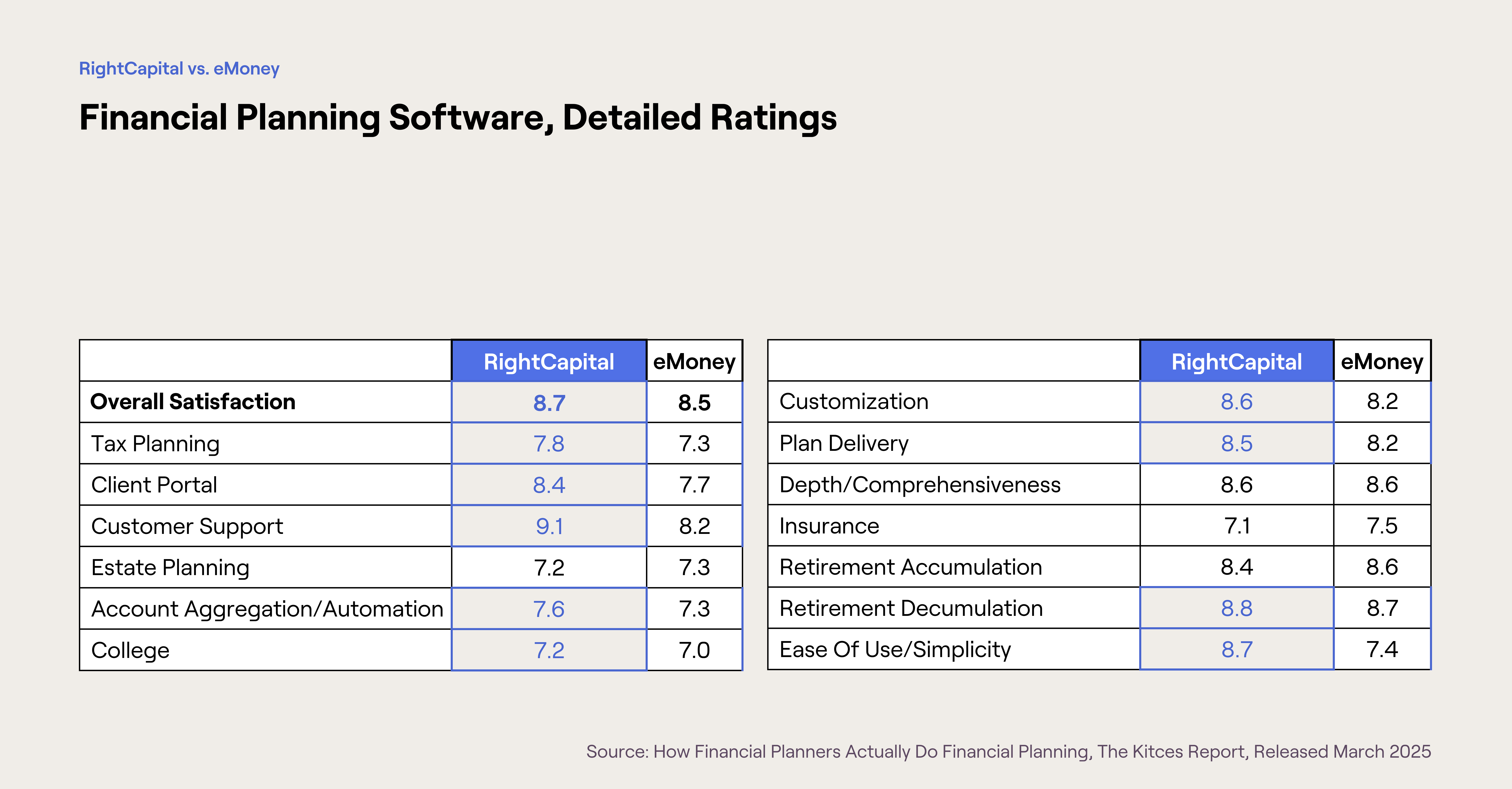

(Evaluating eMoney as well? Read this RightCapital vs. eMoney rundown.)

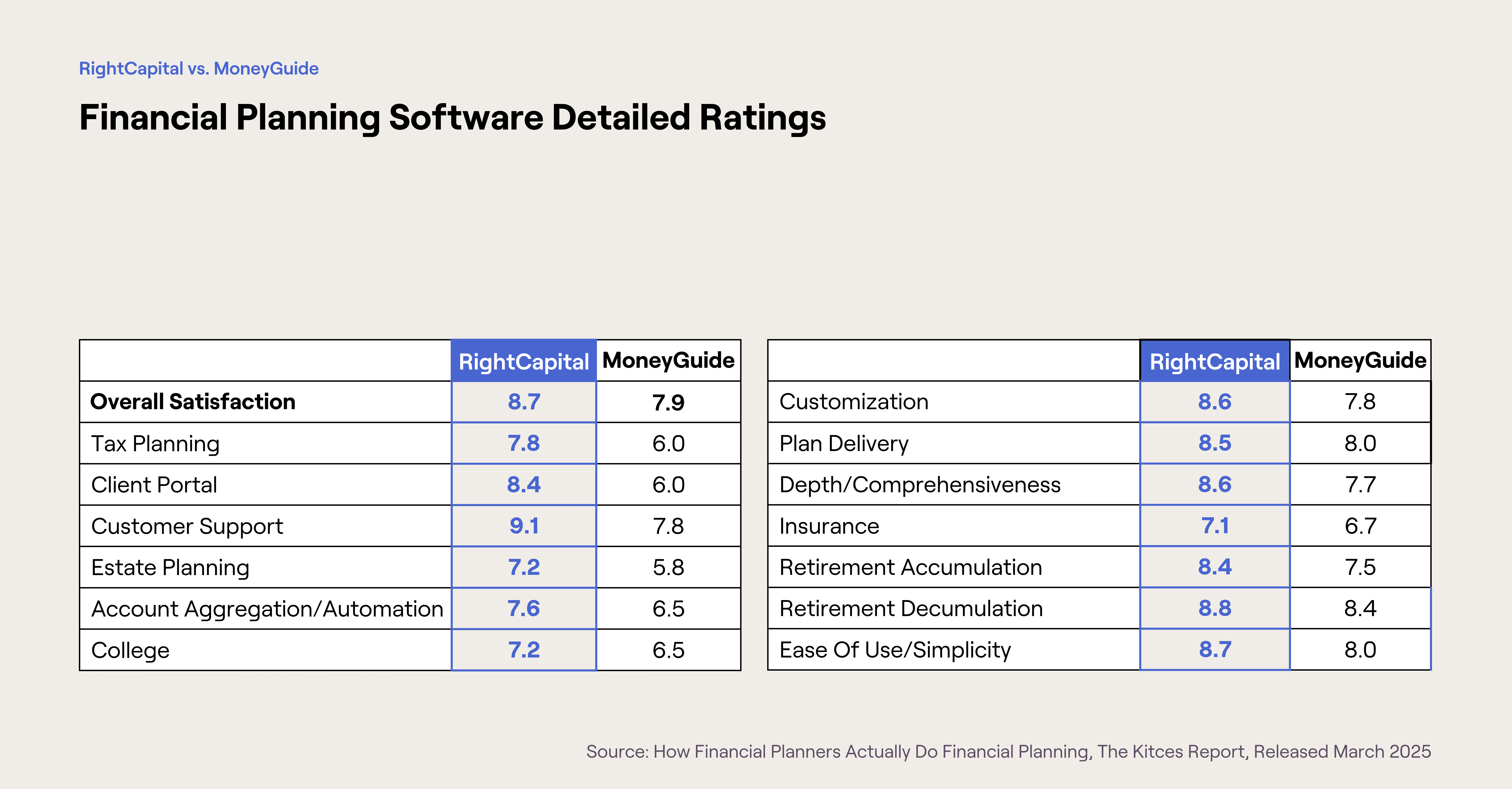

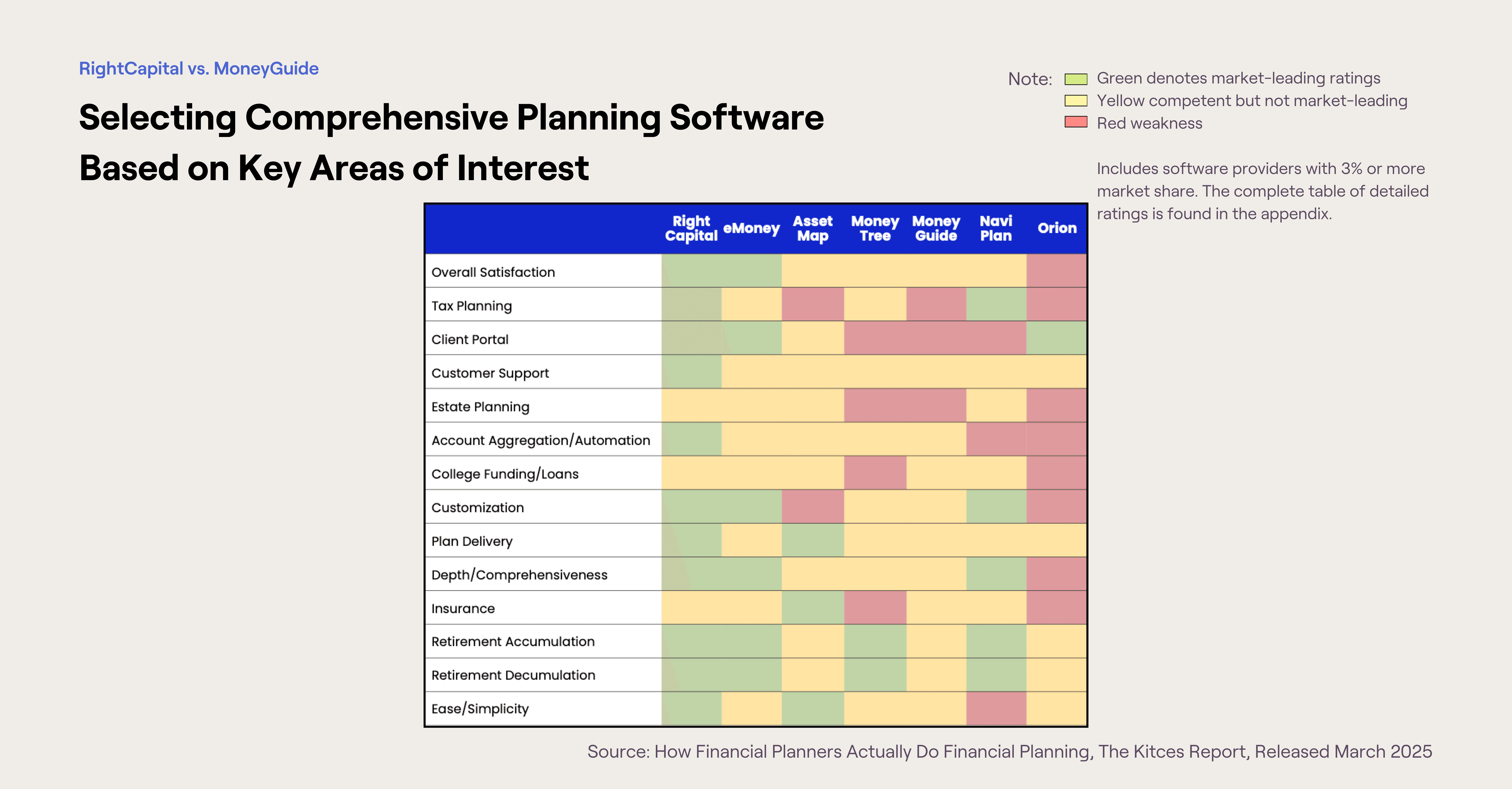

Advisor satisfaction ratings

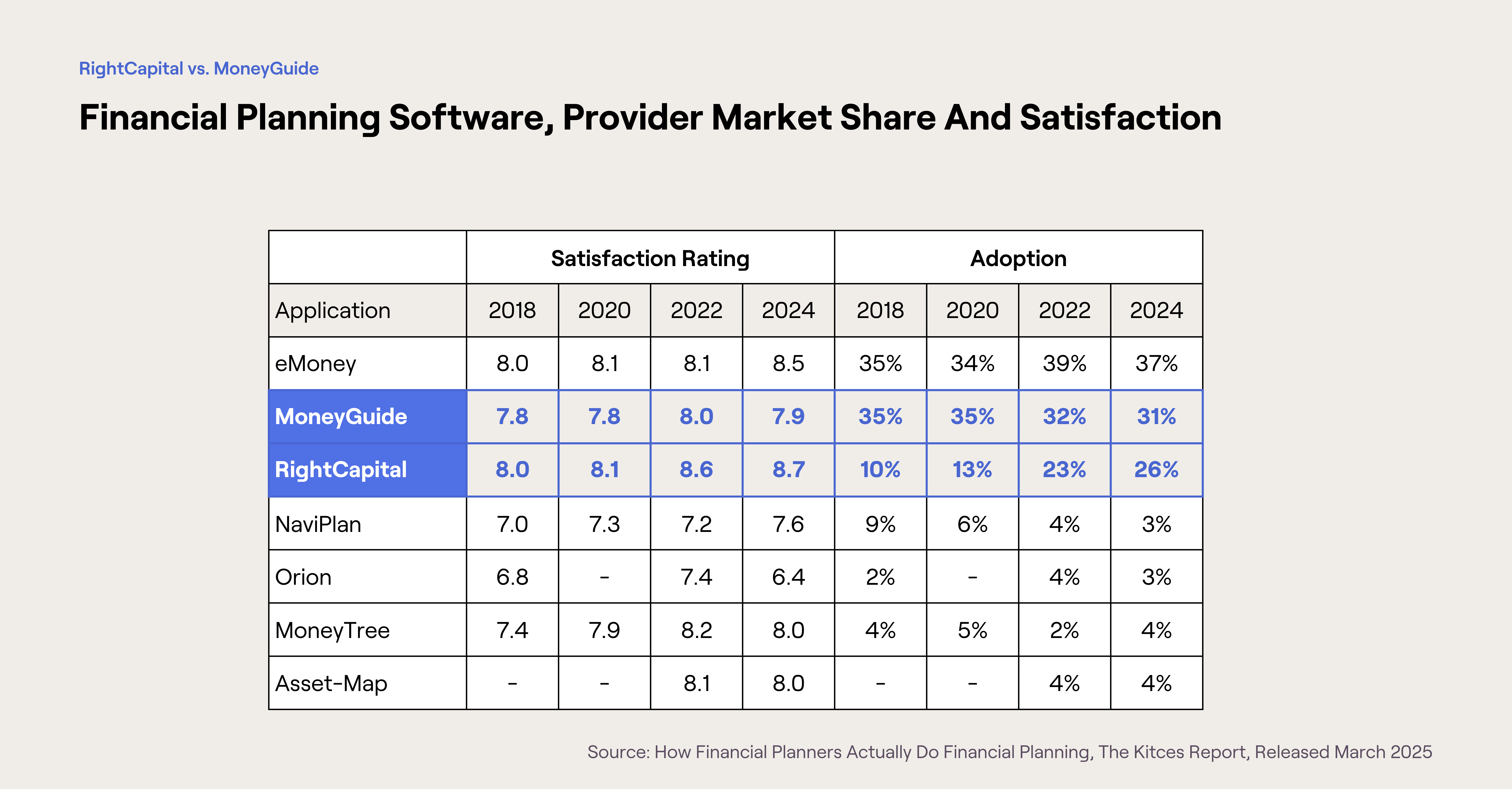

The Kitces Report released in March of 2025, “How Financial Planners Actually Do Financial Planning,” shows that RightCapital's overall user satisfaction score grew to 8.7 out of 10, from 8.6 in 2021. MoneyGuide’s rating fell from 8.0 out of 10 in 2022 to 7.9 out of 10, the lowest satisfaction rating of “the big three” financial planning software companies.

The report notes:

RightCapital’s average advisor satisfaction score has surged from 8.0 in 2018 to 8.7 in 2024, tying with Income Lab as the highest-rated program. Conversely, MoneyGuide – after a slight bump in satisfaction between 2020 and 2022 – saw a decline in 2024 (and at a rating of just 7.9, is ranked well below its competitors, signaling a continued decline in market share is likely in the years to come).

The March 2025 T3/Inside Information Advisor Software Survey also revealed that RightCapital (with an average 8.52/10 user rating) was the highest rated software, for the fourth consecutive year. In the most recent survey, MoneyGuide’s rating dropped to 7.67/10 and its market share dropped significantly from the previous year. (MoneyGuide is sometimes referred to as MoneyGuidePro):

Financial Planning Software | Market Share | 2024 Market Share | Average Rating | 2024 Average Rating |

|---|---|---|---|---|

eMoney | 28.20% | 29.55% | 8.22 | 8.21 |

MoneyGuidePro | 22.79% | 33.36% | 7.67 | 7.88 |

RightCapital | 20.68% | 14.64% | 8.52 | 8.46 |

As of January 2026, G2 ratings for RightCapital were 4.6 out of 5 compared to G2 ratings for MoneyGuide of 4.0 out of 5. G2 reviewers gave RightCapital higher marks for “Meets Requirements,” “Ease of Use,” “Quality of Support,” and “Product Direction,” similar to the feedback seen in the Kitces advisor survey.

Pricing and cost structure

The cost of RightCapital’s three tiers are laid out on the RightCapital pricing page. MoneyGuide publishes their pricing on their website as well. It’s worth noting that MoneyGuide is more of an “a la carte'' solution, where you pay extra for certain features, so it’s difficult to do an apples-to-apples pricing comparison.

MoneyGuide Plan | MoneyGuide Retail Price | MoneyGuide Plan Details | Comparable RightCapital Plan | RightCapital Retail Price |

|---|---|---|---|---|

MoneyGuide | $2000 + $400 for Account Aggregation = $2400 | Goal-Based Planning | Basic | $1800 |

Wealth Studios | $2500 + $400 for Account Aggregation = $2900 | MoneyGuide + Cashflow & Estate Planning | Premium | $2520 |

Platform | $3000 | Wealth Studios (Account Aggregation included) + Prospecting | Platinum | $3060 |

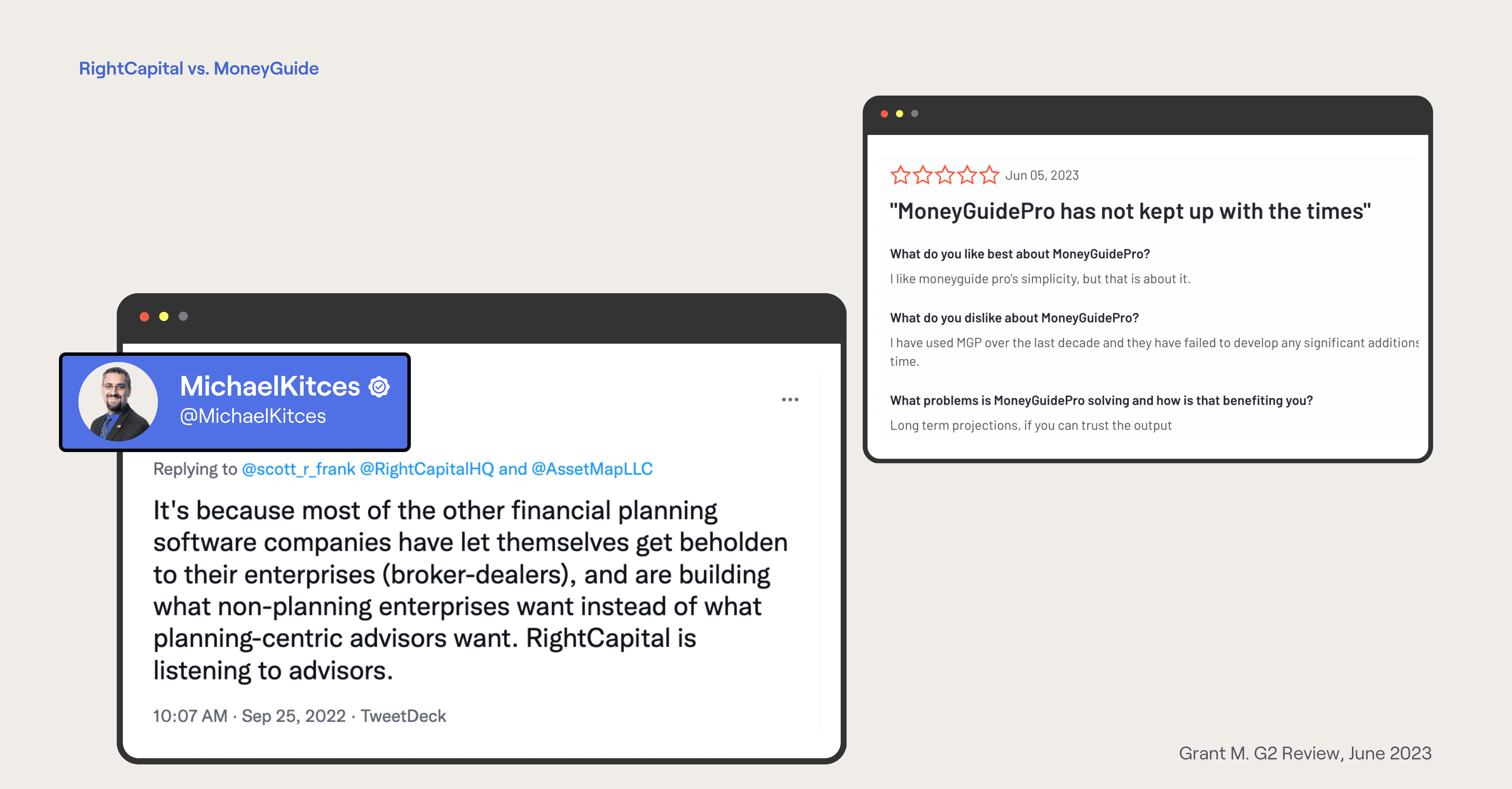

Product updates and innovation pace

A review on G2 titled “MoneyGuidePro has not kept up with the times” notes “I have used MGP over the last decade and they have failed to develop any significant additions (phone app, HSA, budgeting) in that time.”

MoneyGuide is part of Envestnet, which was acquired by private equity firm Bain Capital in 2024. RightCapital is owned by the company’s original founders and remains independent. In the social media post above, Michael Kitces notes this difference is how “RightCapital is listening to advisors.”

Another advisor, Scott Frey, raves about RightCapital’s ability to take feedback from advisors and make changes: “When we went to MoneyGuide with problems, we got a ‘we’ve got bigger fish to fry’ message. RightCapital…took feedback as well as a technology company has in my experience.”

Functionality (planning approach, tax, data inputs)

Planning approach

There are some major differences between RightCapital and MoneyGuide, the main one being that with MoneyGuide, advisors must use the goal-based planning approach. With RightCapital, advisors have the flexibility to use goal-based planning, cash-flow planning, plus modified cash-flow planning.

Data sources used in financial planning

RightCapital considers more data sources than MoneyGuide does. People’s lives are complex, that’s why RightCapital includes budgeting, and debt and student loan management tools built within the software to envision a client’s entire financial picture, and accounts for clients’ habits such as when they are spending more than they make within a given year. These additional inputs and tools provide more control for the advisor to help clients with their specific financial situations.

MoneyGuide, on the other hand, has minimal consideration of pre-retirement income and expenses. MoneyGuide assumes that clients are not spending more than they make in a given year.

Tax considerations

RightCapital notes all income sources and how each is taxed. To fund any deficits, RightCapital also considers drawing down and selling assets, which produce unique tax scenarios.

RightCapital offers an interactive Roth conversion tool that makes it easy to visualize the impact of conversions on items such as tax brackets, IRMAA surcharges, and increases to taxable Social Security. While MoneyGuide has Roth conversions, it lacks the interactivity and visual outputs. RightCapital also includes future tax projections including sample tax forms such as the 1040.

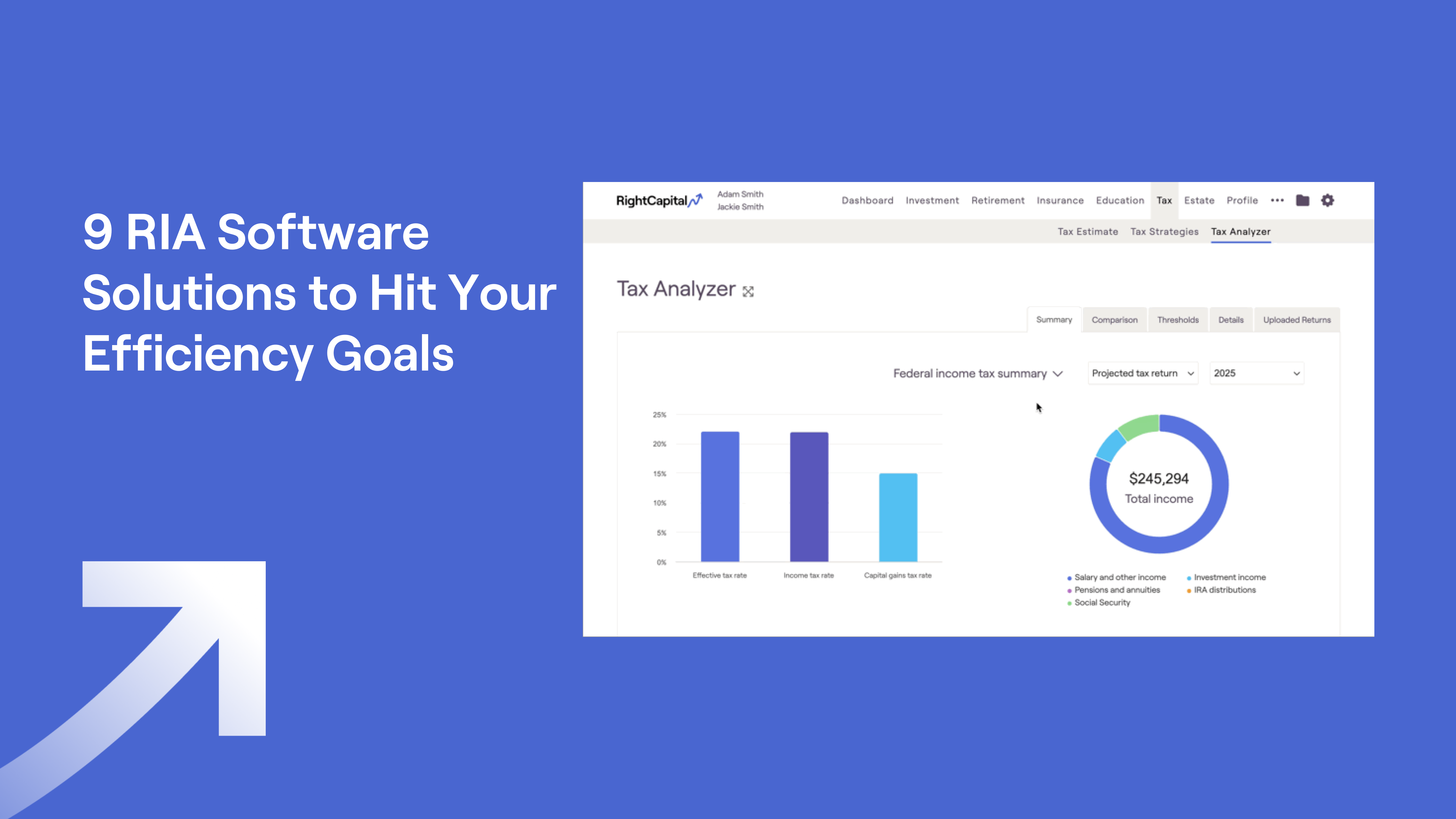

Additional tax-planning capabilities within RightCapital include Tax Strategies, which solves for the top asset location, withdrawal, and Roth conversion strategies based on the client plan. Another tax-focused tool, Tax Analyzer, allows for deeper tax return analysis and client-friendly visuals that break down their tax picture in an easy-to-understand way. With Tax Analyzer, you can upload a client’s tax return and/or view the future projected tax returns based off of the client’s current plan or your proposals.

Data visualization tools

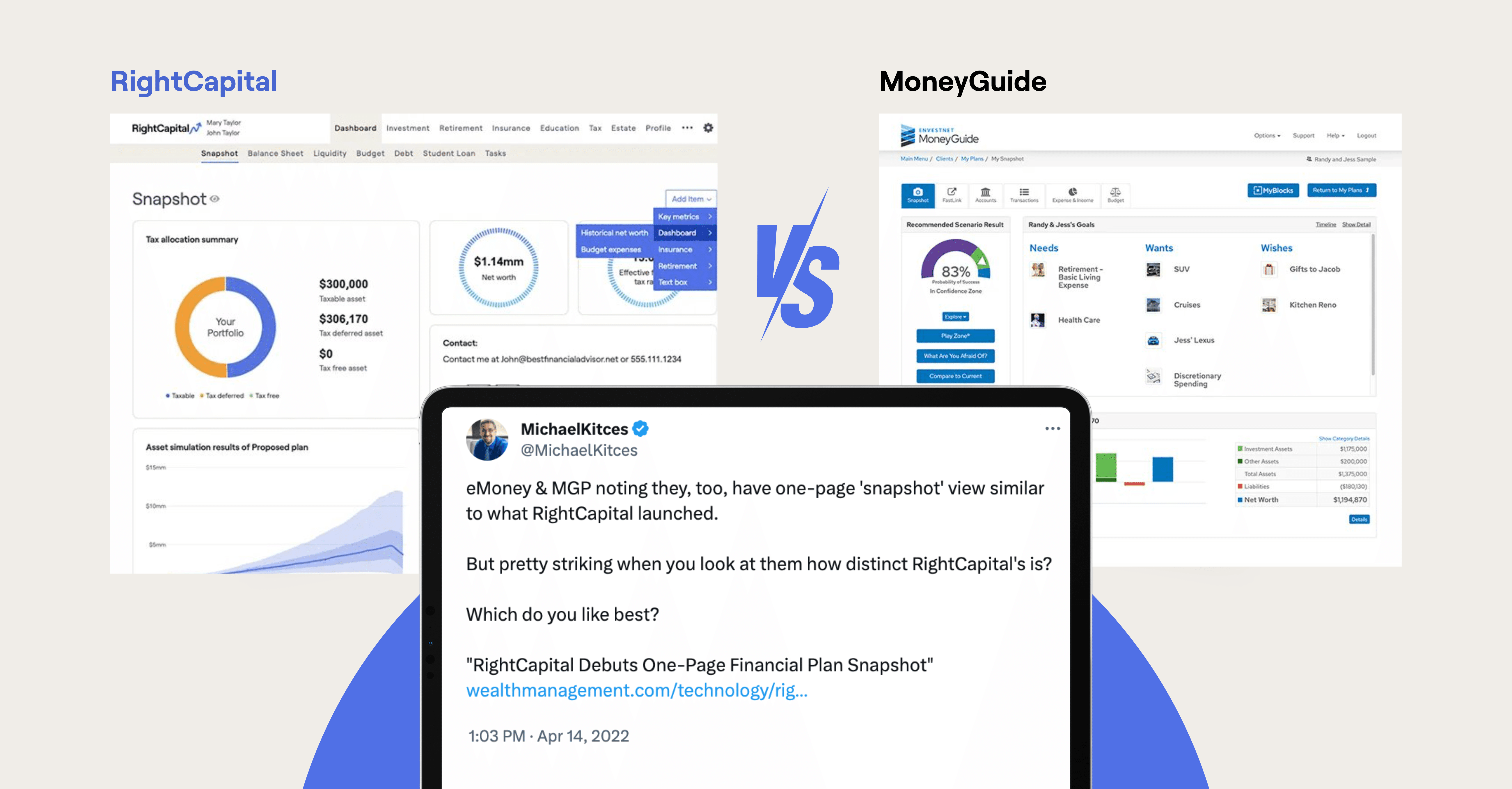

RightCapital offers data visualizations that are much clearer than the alternative solutions. For example, RightCapital received a lot of press and advisor approval about the personalized one-page plan summary, Snapshot. MoneyGuide also offers a “digital page summary” called “My Snapshot."

According to the advisor replies to the above post from Michael Kitces, it seems RightCapital is more preferred, with quotes such as “Design wise RC crushes,” “I can’t tell you how much RightCapital’s illustration of future wealth distribution warms my heart,” and “MGP and eMoney reports look like they should come with a fax cover sheet.”

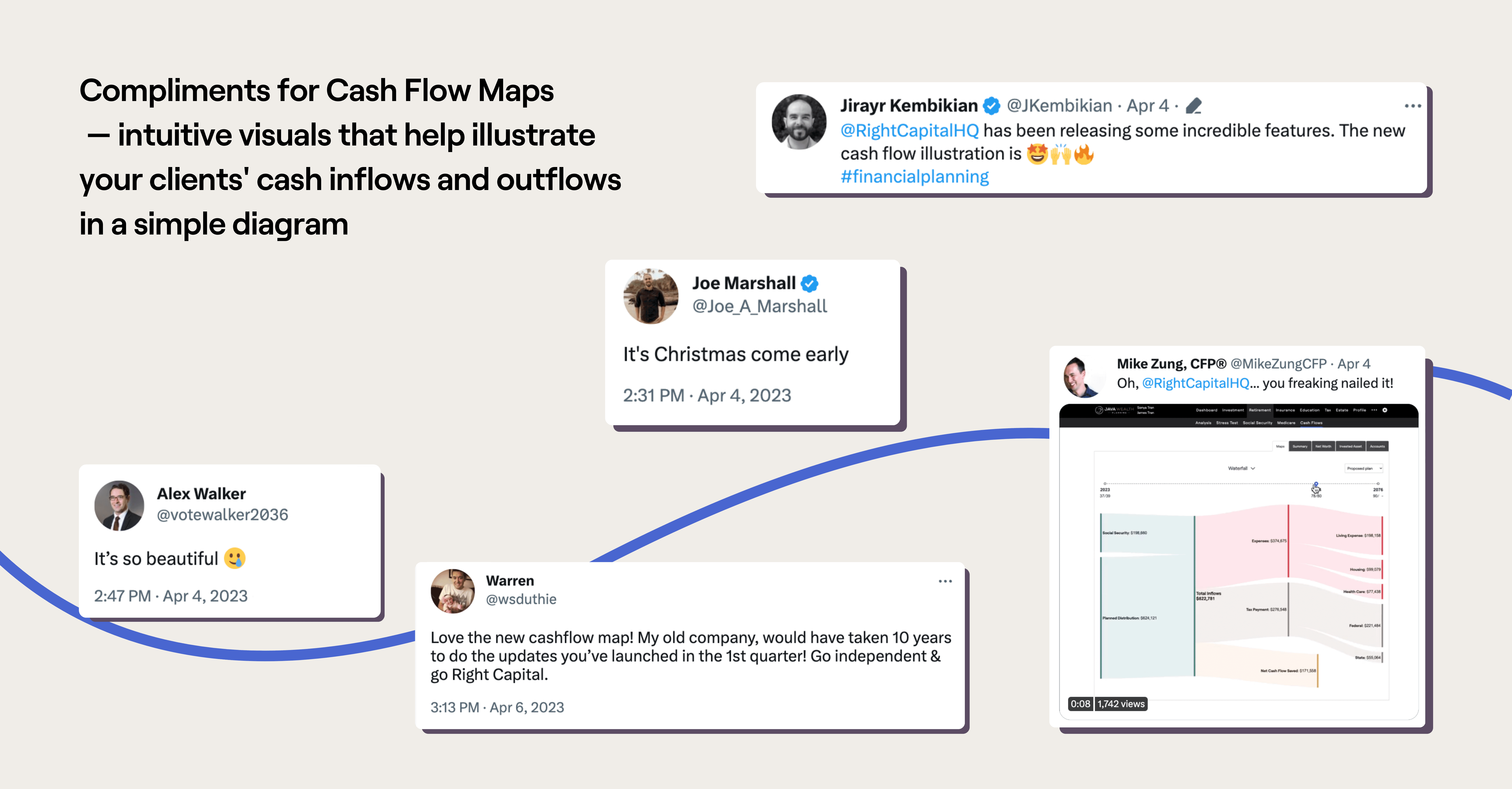

Other exciting visualization features from RightCapital include Blueprint™—an engaging, intuitive, and interactive graphical layout of each clients’ net worth, goals, income, savings, and expenses—and Cash Flow Maps— intuitive visuals that help illustrate your clients' cash inflows and outflows in a simple diagram, which advisors were excited to see:

In the August 2025 Kitces Report, “The Technology That Independent Financial Advisors Actually Use And Like,” RightCapital also outranked MoneyGuide in the categories of Visuals (RightCapital at 8.5 vs. MoneyGuide at 7.2) and Reporting Output (RightCapital at 7.8 vs. MoneyGuide at 6.6).

Additional differences

RightCapital also has the following features that are not available within MoneyGuide:

Budgeting

Streamlined annuity modeling

Back office access

User experience (advisor + client experience)

Advisor Scott Frey said MoneyGuide “is a relic of the nineties,’ stressing his disappointment in having to take time in client meetings to explain the software, and sometimes even having to vouch for its reliability. “The UI (user interface) was unintuitive to say the least.”

Advisor Jonathan Kiehl had used MoneyGuide with a previous firm before starting his own RIA and switching to RightCapital. It “didn’t really sit well with me” to send clients off on their way with a 60-page report, he said. During a Good Advisors Finish First panel, Jonathan discussed the differences he found between RightCapital and MoneyGuide:

Diving more into the cohesiveness of RightCapital, Jonathan noted, “It looks the same whether I'm presenting a financial plan, or whether clients are logging into their client portal to see their net worth statement, or to do some work with the budgeting tool…When I was with MoneyGuide, a lot of the things were add-ons…it was a little disjointed.”

Client support and onboarding

In the March 2025 Kitces Report, RightCapital rated highest for Customer Support with 9.1 out of 10 compared to MoneyGuide’s 7.8 out of 10. As of January 2026, according to the user surveys collected on G2, the overall quality of support is rated as 9.5 out of 10 for RightCapital vs 7.5 out of 10 for MoneyGuide. All support inquiries to RightCapital are answered by a live product specialist.

Onboarding experience

Several advisor success stories mention how simple the learning process was when starting to use RightCapital:

“It was extremely easy,” Brooke Martinez commented, when asked about switching to RightCapital.

The Optima Capital Management team stated that within a week of using the software, it was clear, “RightCapital is so much smoother to work with.”

Michael Johnson, of Alchemi Wealth, mentioned in February 2025’s RightInsights event: “RightCapital was probably the easiest integration that we've had to date. We have done probably 15 different data migrations over the last four years. It can be really complex at times, but it truly was a click of a button with RightCapital.”

Some MoneyGuide reviewers on G2 comment on the difficulty of getting started. This otherwise positive review notes, “There are so many different tools/scenarios it can be cumbersome at times.”

Choosing a financial planning software for your practice is a big decision. We encourage you to sign up for a personalized 1:1 20-minute demo with a member of the sales team and test drive RightCapital during a 14-day free trial.

If you're a MoneyGuide user looking to move over, learn about our cutting-edge OCR solution to automate financial plan transitions from the MoneyGuide platform to RightCapital here.