There’s more to estate planning than simply choosing an insurance beneficiary and making sure the line of succession is clear. Tax liabilities, the future value of money, and projected returns on investment funds need to be considered also. That’s too much math for a hand calculator and Excel spreadsheet. Thankfully, RightCapital can do most of it for you.

Like any major project, an estate plan should begin with an outline. We call it a checklist. It’s an itemized summary of the tasks required to put a comprehensive plan together. Data points on the list include the name of the executor, name of the guardian, power of attorney, and date the document was last updated. This data is used to create action items.

The checklist is a good way for financial planners to organize their thoughts and prepare for client meetings. Estate planning is an evolving process, not a one-time event. The list of action items should be dynamic and updated as the client’s financial situation changes. Income fluctuates, investment returns can be volatile, and new heirs could be designated at any time.

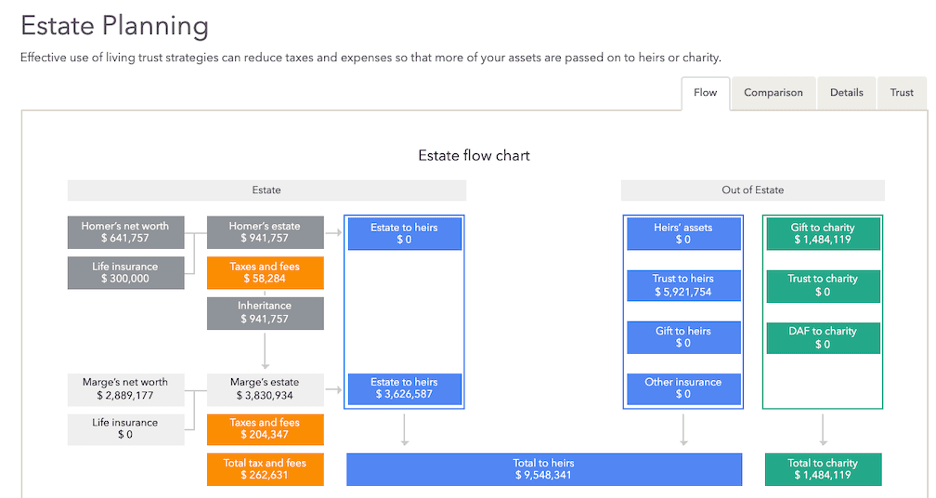

A picture paints a thousand words. The concept was introduced by an advertising executive a hundred years ago and still holds true today. RightCapital has embraced it with visuals that show the advisor and client exactly what they have for assets and where those assets will go in the event of their passing. The graphic above shows you exactly what that looks like.

The flow chart is a key visual in the analysis of client assets. Note that there are assets held directly by the estate and others that are outside of it. Assets owned by the estate generally pass directly to heirs, but they are subject to estate taxes. The trust funds in the “out of estate” column may offer some tax relief, depending on how they’re set up.

What percentage of assets are passing on to the beneficiaries? Clients will ask that question and financial planners need to be prepared to answer it. Estate holders want to know what their tax liability will be, how much estate fees and funeral expenses will cost, and how inflation and market volatility will affect those numbers over time.

Trust Fund Strategies and Minimizing Tax Liabilities

There are several moving parts to account for in estate planning. One of the most important is the tax liability that will affect the beneficiary’s inheritance. An example of this is the unified gift and estate tax exclusion allowed under the 2017 Tax Cuts and Jobs Act (TCJA). It’s $12.06 million this year. In 2025, the law sunsets and the exclusion goes back to previous levels adjusted for inflation (2017 level was $5.49 million).

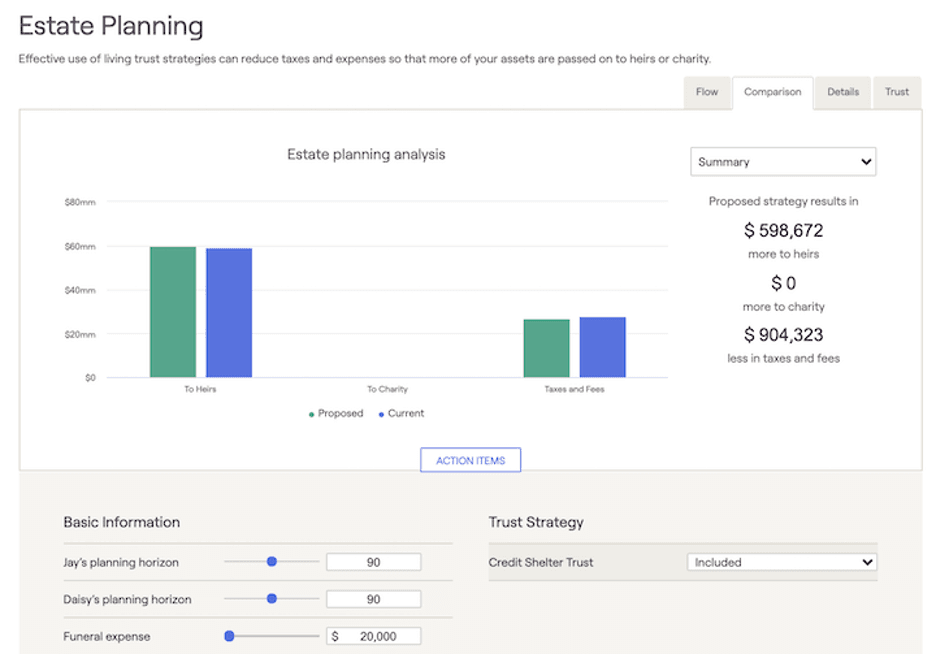

The smaller exclusion amount translates into a higher tax liability for the estate. One trust fund strategy to mitigate that is to open a Credit Shelter Trust (CST). This is an irrevocable trust fund that is held outside the taxable estate. When the client passes, assets inside the CST are passed to the spouse so income to the heirs won’t be subject to federal or state estate taxes.

The graphic above shows the difference between an estate without a CST and a proposal where one is included. Note the significant change in the tax liability. This is only one of several trust fund strategies you can propose and keep track of in RightCapital. Others include:

Charitable Remainder Trust (CRT)

Charitable Leads Trust (CLT)

Irrevocable Life Insurance Trust (ILIT)

Spousal Lifetime Access Trust (SLAT)

Qualified Personal Residence Trust (QPRT)

Grantor Retained Annuity Trust (GRAT)

Intentionally Defective Grantor Trust (IDGT)

Irrevocable Grantor Trust

RightCapital provides the visuals and does the math so you can clearly state your case for any of these trust fund strategies to the client. For more details on how to do this, see our recent webinar titled Helpful Hints for Estate Planning in RightCapital.

The Role of Assumptions in Estate Planning

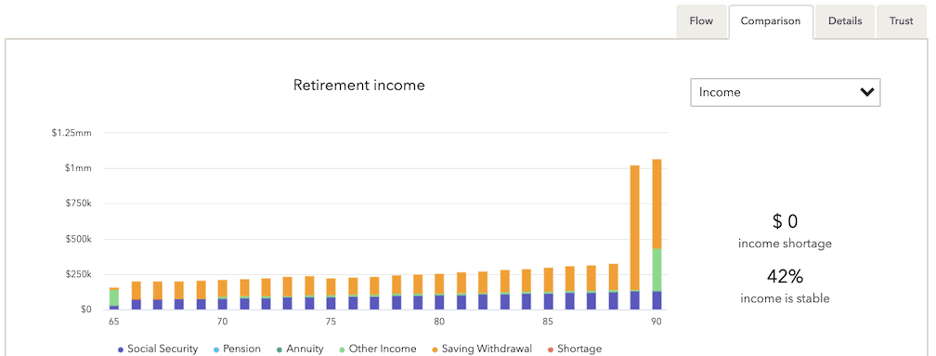

Change is the one constant in the world of finance that we can always count on. That means that many of the data points you’re inputting to RightCapital are assumptions. Investment accounts are a good example of this. How are you projecting returns? Historical data for a fifty-year lookback is significantly different than what we’ve seen in the past twenty years.

We’ve already mentioned the sunset of the TCJA. That’s not guaranteed either. Congress could act to extend or amend it at any time. Add that to the inflationary value of money, progressive growth of the estate tax exemption, and rising health care costs. Those are all part of the equation, along with social security income, which might not even be there.

RightCapital helps financial planners keep track of all these changes to provide clients the comprehensive estate planning they deserve. We have an extensive knowledge base on the subject that our subscribers can reference, and we regularly do webinars and blog posts to keep you current on any changes. Contact our team today to lean more.