Planning for retirement involves more than simply maximizing retirement savings fund contributions. 401(k) returns are volatile. Retiring during a down market could deplete the principal more rapidly than expected. Pension funds are more stable, but at best they pay out 80% of annual income. Making up the difference is where the challenge lies.

The Social Security trust funds are one option for addressing that disparity. The Old-Age and Survivors Insurance (OASI) trust fund was established by the Social Security Act of 1935 as a response to poor economic conditions among US elderly. The disability Insurance (DI) fund was added in 1956 for individuals unable to continue working due to health conditions.

Social Security Benefit Payments and Potential Insolvency

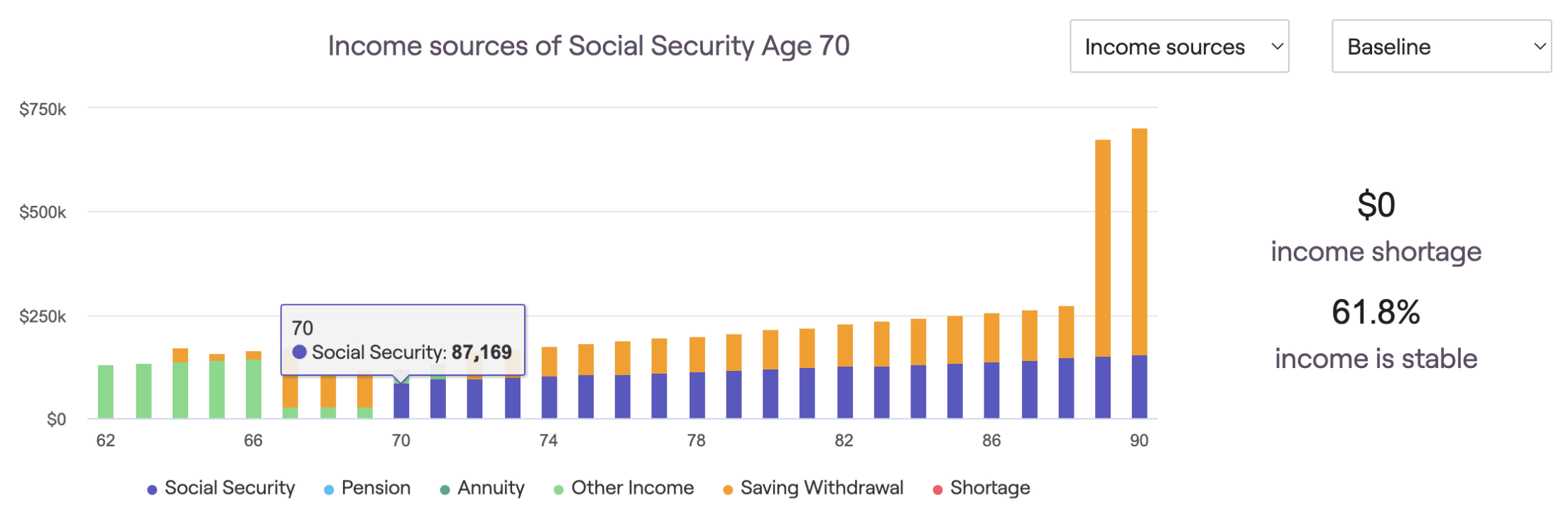

Social Security has worked for decades, but it’s on the verge of insolvency. That makes long-term retirement planning more difficult. Working adults can file for OASI benefits at age 62 if they’re willing to take a reduced rate. Unfortunately, they’ll be stuck with that reduced payout for the rest of their lives. Full social security benefits can’t be accessed until age 67.

The official position of the Social Security Administration is that the OASI fund will be able to pay out full benefits until 2034. After that, projected tax revenue will allow for payouts of 77% of eligible benefits. Those numbers could change if benefit payments are reduced now, or the combined federal payroll tax rate is increased from 12.4% to 14.4%.

Pending benefit reductions create a quandary for financial planners. Should clients file at age 62 to take the guaranteed money or gamble and wait for a full benefit payout at age 67? It’s not just about the math, though that’s an important factor. The overall health condition and life expectancy of the individual should also be evaluated before making that decision.

Utilizing the Disability Insurance Trust Fund

To qualify for disability insurance benefits, an individual must have a medical condition that prevents them from working for a period of at least one year. They can also qualify if their condition is terminal. DI benefits are paid to the recipient until they file for OASI payments. This is another factor in deciding whether to “retire” at age 62.

The amount of DI benefits could be equal to a full retirement benefit from OASI, so it’s beneficial to take disability until age 67 (or age 70 with delayed retirement). The problem is that it takes an average of six months to process a DI claim and approval is not guaranteed. The individual filing the claim can’t work during that time, leaving them with little or no income.

To avoid an income drought, financial planners could recommend that clients file for DI and early OASI at the same time. The OASI payments would start coming in immediately and DI would supplement that income when it finally kicks in. Unfortunately, if the claim is denied, the client’s retirement income will be limited by those reduced OASI payments.

What is an Insurance Needs Analysis?

Last week, we talked about using annuities a fixed-income retirement strategy. Social security is also fixed, so the two together can supplement the variable income produced by retirement savings accounts that are dependent on stock market performance. Insurance is another piece. It’s not income, but cash value insurance is an asset that offers income protection.

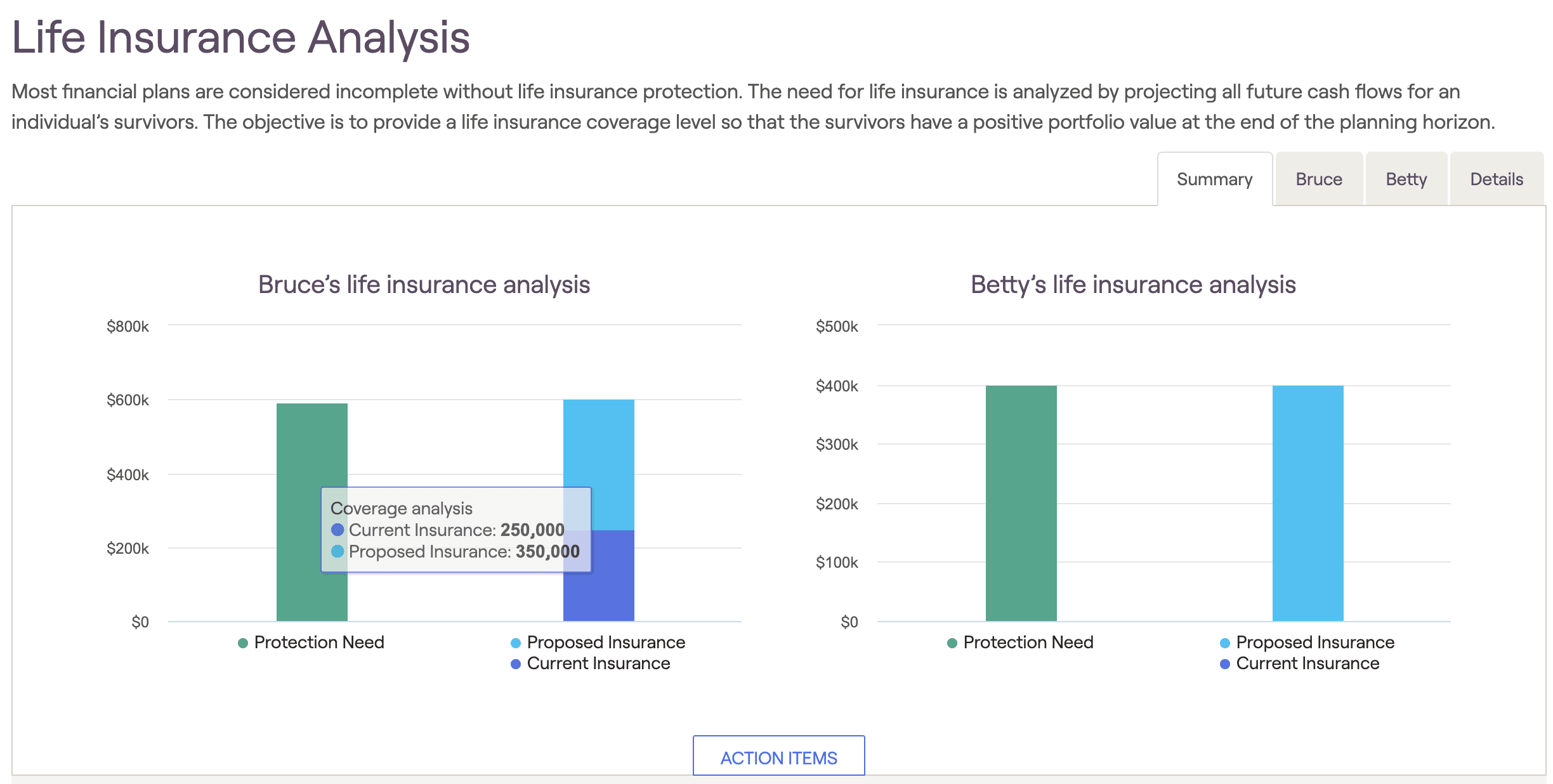

An insurance needs analysis begins with calculating end-of-life expenses like funeral costs, estate settlement fees, and income replacement to support spouses and dependents. The sum of those expenses determines how much insurance the individual needs to carry. Life is fragile, so don’t assume that death will come in the sunset of life. It can happen at any time.

This is not a casual dinner conversation. Mortality is a somber subject that should be broached while creating the client’s initial financial plan. It becomes more pressing when you start talking about filing for OASI or DI benefits that lock the client into a fixed income. Insurance is not an expense. It’s an investment in the financial security of your client’s loved ones.

RightCapital Tools for Insurance Needs and SSA Scenarios

RightCapital understands the importance of insurance protection. Our platform is equipped with the tools financial planners need to assess client insurance needs and make recommendations. We also offer a feature to compare the scenarios of taking OASI at age 62, age 67, or age 70, and how that would be affected by filing for DI benefits.

Benjamin Franklin once said, “Death and taxes are the only certainties in life.” We all have a beginning and an end. A financially secure retirement is one of the goals along the way. As the time to leave the workforce looms closer, conversations about social security and insurance need to happen. RightCapital can help you with those. Contact us today to learn more.