It’s difficult to say any legislation is on track with the mid-term elections just a few weeks away. Secure Act 2.0 might be the exception. It has bipartisan support, already passed through the House, and appears to have momentum in the Senate. The final draft isn’t ready for the President’s signature just yet, but many expect it to become law in 2022.

There’s a precedent to be optimistic about. The original Secure Act became law on December 20, 2019. That Congress wanted to make sure that any changes to the tax code went into effect for the next calendar year. Secure Act 2.0 is likely to follow the same pattern. If it passes, you can expect to see the following changes in retirement savings plans:

Improved access to workplace retirement plans

Increased catch-up contributions to workplace retirement plans

Required minimum distributions (RMDs) to start as late as age 75

Penalty-free early withdrawals from workplace savings plans

Why do American families need Secure Act 2.0?

The original Secure Act made it easier for small business owners to access “safe harbor” retirement plans and pushed RMDs to age 72. It also gave 401(k) providers the ability to offer annuities. It was a good first step, but not enough to bridge the retirement income gap in the United States, which is expected to be $137 trillion by the year 2050.

A 2018 study conducted at Boston College revealed that 51% of US households are at risk of not being able to maintain their pre-retirement income after they retire. 45% of households ages 55-64 have no retirement savings at all. The original Secure Act attempted to address these issues. Secure Act 2.0 was written to build on that foundation.

The median total household retirement savings across all workers is approximately $93,000. Expanding access to 401(k) plans for part-time workers and making it mandatory for employers to provide auto enrollment should increase that number. There’s also a provision in the bill that gives employers the right to match student loan payments with retirement contributions.

Increasing catch-up contributions and adding a few more years before RMDs kick in are two steps that can significantly increase retirement savings. The House and Senate have different proposals on the exact parameters for doing this, but the two versions of the plan are close enough that they shouldn’t be a major obstacle in the debate.

Discussion Points for Drafting the Final Legislation

There are two other pieces of legislation that need to be reviewed before Secure 2.0 is complete. The Senate HELP Committee approved Retirement Improvement and Savings Enhancement to Supplement Healthy Investments for the Nest Egg (RISE & SHINE) in June. The Senate Finance Committee is presenting Enhancing American Retirement Now (EARN).

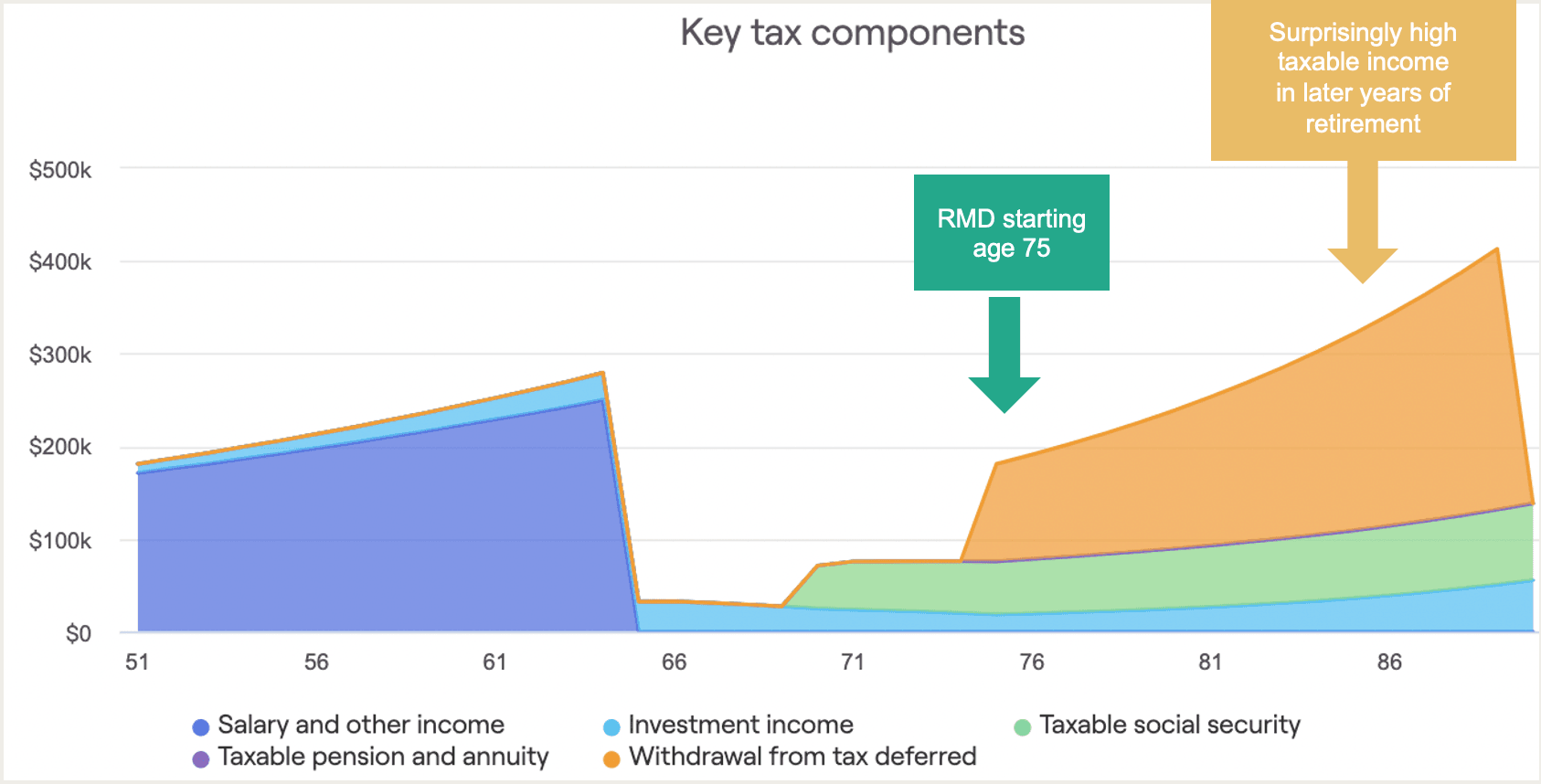

There are some differences in the two bills, but none of them are expected to derail the final drafting of Secure Act 2.0. One point of discussion now is the timing on raising the RMD age. RISE & SHINE proposes going to age 73 in 2023, age 74 in 2030, and age 75 in 2033. The EARN bill simply raises the age to 75 in 2032. That’s the most likely scenario we’ll see.

Penalty free withdrawals from workplace savings plans are another topic being debated before the final drafting of Secure 2.0. There’s an auto enrollment clause in the House bill that generates a 3% contribution up to $2,500 and an allowance in the Senate bill for up to a $1,000 penalty-free distribution. A hardship distribution is included in both bills.

RightCapital is Prepared for the Changes if the Bill Passes

RightCapital already has the tools to illustrate delayed RMD ages, additional catch-up contributions, and penalty-free distributions from qualified accounts. If and when Secure Act 2.0 passes, our team has the ability to adapt to the new changes. When the first Secure Act was passed, the advisors on our platform were ready for it.

Telling your clients that Secure Act 2.0 is guaranteed to pass would be irresponsible, but it looks promising. Now is a good time to discuss the potential impact on their financial planning and tax strategies if the bill makes it to the President’s desk. We can provide you the visuals you need for that when it happens. It’s on you to have the client conversations.