Using Annuities to Manage Retirement Income in RightCapital

October 21, 2022

Market volatility this year and forward-looking projections state a clear case for creating more guaranteed retirement income for your clients. Add that to questions about social security solvency in the next few decades. Advisors are looking for ways to boost client confidence in their retirement savings and provide them peace of mind in uncertain times.

Increasing retirement savings is a good first step. Managing the tax impact of retirement income must be part of that. The IRS will eventually get paid when withdrawals occur. Annuities can be used to set the timing on that. RightCapital has the tools to incorporate annuities into a tax-smart retirement income strategy. In this article, we’ll explain how that works.

Building a Tax-Smart Retirement Income Strategy

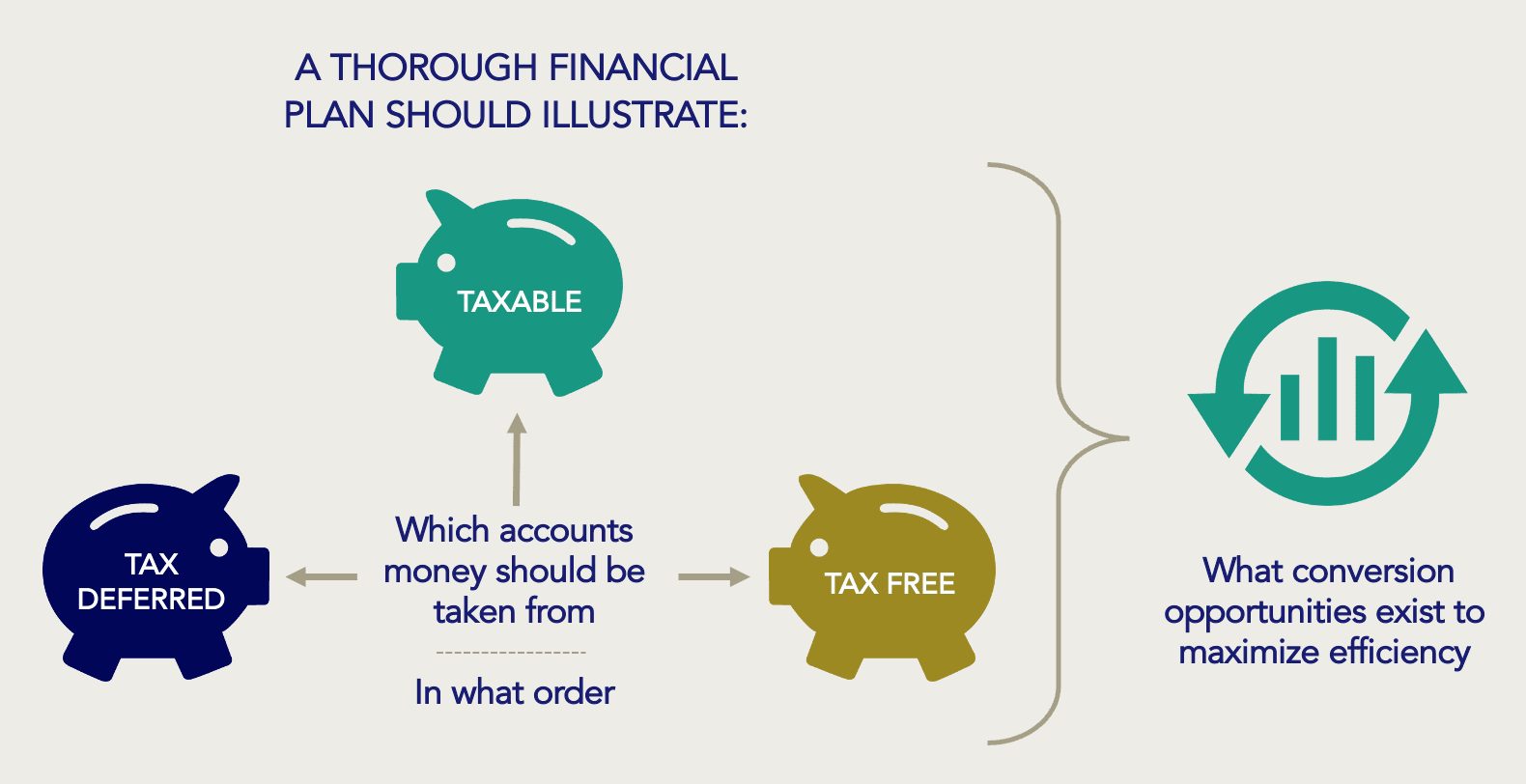

Clients often overlook the impact of taxes on their retirement income. They pay into tax-deferred investments when they’re working and forget that the tax bill for those will come due at some point. Financial planners can mitigate this risk to retirees with a tax-smart retirement income strategy. There are three steps in this process.

Social security optimization

Income protection with annuities

Tax-smart distribution strategy (decumulation of assets)

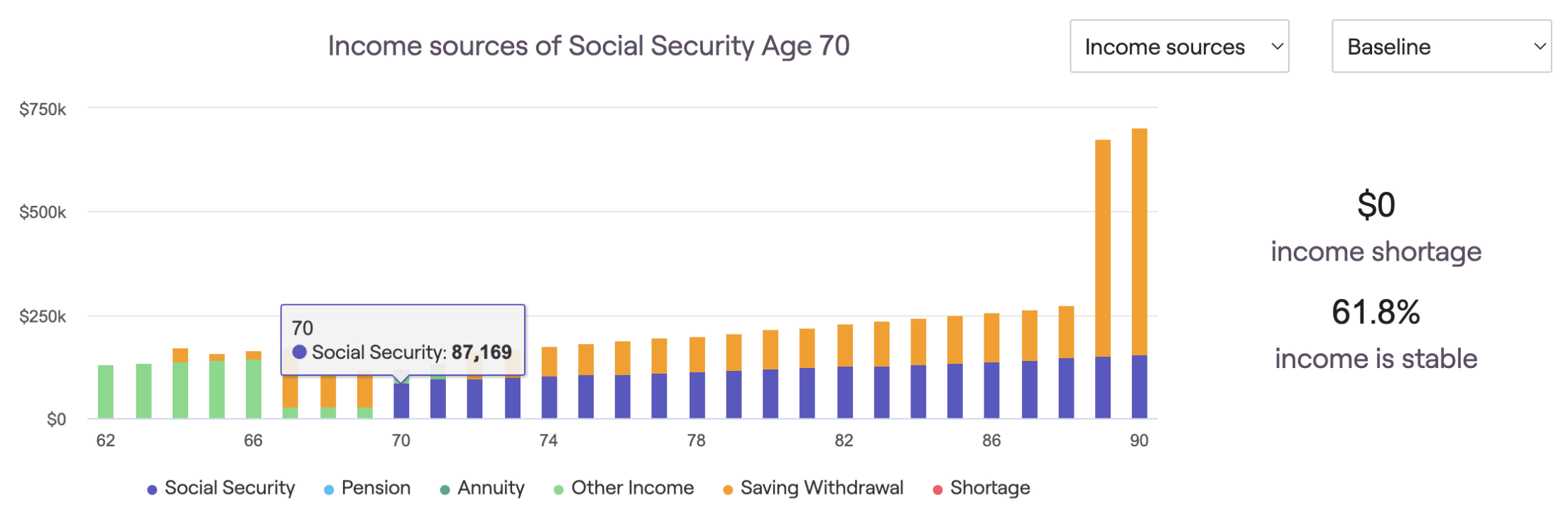

Timing is an important variable in the retirement planning process. Social security benefits are lower for individuals who retire at 62 compared to those who keep working until age 67. Waiting until age 70 increases them even further. Social security payments are guaranteed income for retirement. Optimizing them should be your first step in retirement planning.

Income protection with annuities basically means that the client can increase the guaranteed portion of their retirement income by investing in a fixed annuity. Variable annuities can accomplish this also, but there’s a risk component if the client retires in a down market cycle. A managed or self-managed stock portfolio could accomplish the same thing.

Qualified annuities are tax deferred because they’re funded with pre-tax dollars. They’re often included in employer-sponsored retirement plans. Non-qualified annuities are funded with after-tax dollars, so distributions are tax-free. Contributions to a non-qualified annuity are not deductible from the annuity holder’s gross income.

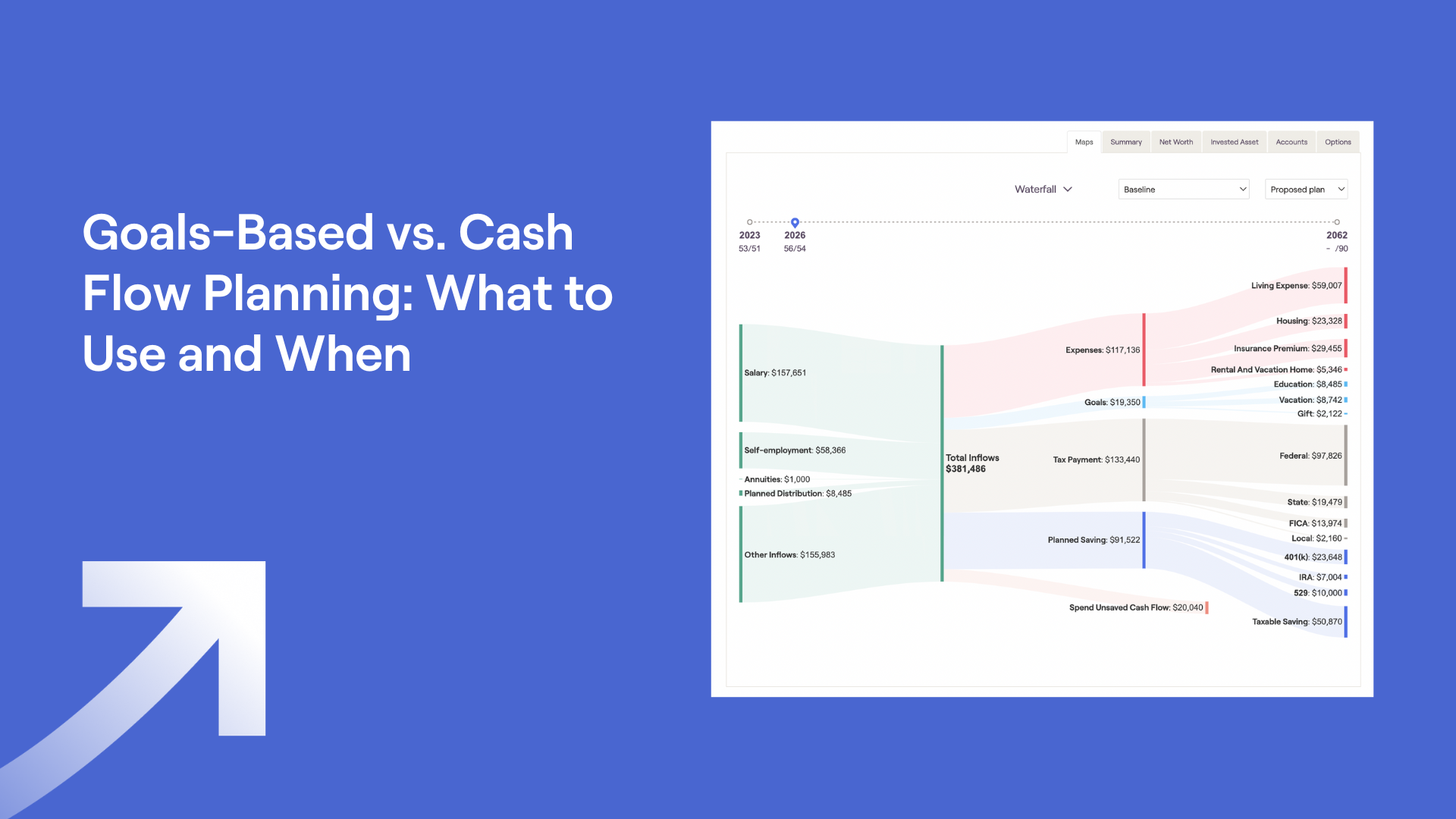

Using RightCapital to set up Tax-Smart Distributions

The right balance of taxable, tax-deferred, and tax-free distributions of retirement assets will be different for every client. We don’t provide advice on that because that’s a conversation best left between advisors and clients. What we can do is point out how some of the tools that RightCapital has can help show income projections in multiple “what if” scenarios.

One example of this is the effects on retirement income that the pending Secure Act 2.0 will have if it passes this year. It will raise the RMD age from 72 to 75. That might happen gradually over several years or it could be done in one step in 2030. With RightCapital, advisors can show clients the impact of both scenarios, which could be significant.

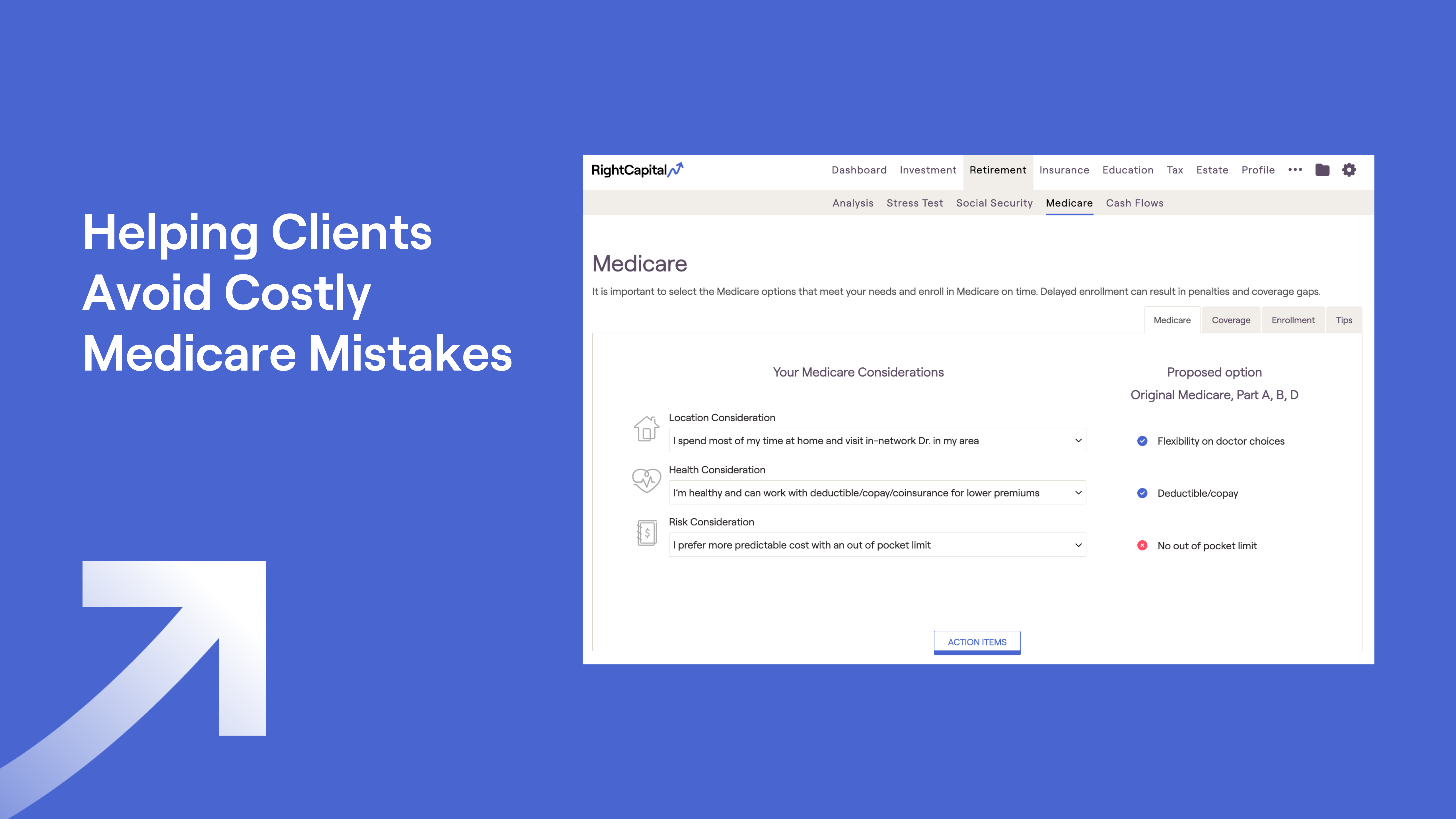

It’s also possible to propose an annuity purchase in RightCapital to show clients how it will work in providing downside protection from a volatile market. Annuity products can be mapped to show realistic expectations of income, expenses, and funding sources. Our system provides actionable steps and integrations with annuity providers Allianz and Jackson National.

You can customize annuity distributions in RightCapital. This can be helpful for qualified annuity holders who prefer to take tax-deferred distributions early in their retirement cycle. It can also work in reverse for non-qualified annuity holders who prefer to wait on taking those tax-free distributions. Clients should ask their advisor about these strategies.

Client Retirement Concerns: Social Security Solvency and Sequence Risk

We’ve all seen the numbers and clients are asking questions about it. How long will the Social Security fund remain solvent? Will benefit payments be reduced in the next decade? They just approved a cost-of-living (COLA) increase of 8.7% to offset this year’s record-high inflation. That’s helpful for today’s SSI recipients, but it could shorten the runway for future retirees.

Another pressing concern is sequence risk. Advisors understand the concept. Clients may have never heard the words before, but they know their 401(k) and pension funds are showing significant losses this year. Retiring now, while the market is in a down cycle, could be disastrous if that’s all they have to work with. Will they outlive those assets?

These are the questions that cause discomfort in advisors and instill fear in clients. Income protection with annuities can alleviate some of the pressure. Proper tax planning for after retirement helps too. RightCapital has the tools for advisors to do both, and the visuals to help clients better understand the impact of those actions.