9 RIA Software Solutions in 2025: Hit Your Efficiency Goals

August 14, 2025

Running an RIA firm means you're juggling more than just investment management.

Between compliance requirements, client relationships, portfolio management, and back-office operations, you have a lot on your plate. And while there are plenty of technology solutions out there promising to make your life easier, it’s hard to know which ones will streamline your workflow. And which will just create more headaches.

The truth is, not all financial advisor tools are built with RIA firms in mind. Many miss the mark when it comes to the specific needs of independent advisors managing their own practices.

RIA software is different. These platforms are designed specifically for registered investment advisor firms, offering the automation, integrations, and compliance features you need to run an efficient practice while delivering exceptional client experiences.

This guide explores nine RIA software solutions that can help you hit your efficiency goals, streamline operations, and scale your firm (without you burning out in the process).

9 RIA software solutions to optimize your firm

The right RIA software makes your job easier by automating routine tasks, improving client engagement, and providing the integrations you need to make your daily operations less stressful.

Here are nine of the most popular solutions that RIA firms use to optimize their practices:

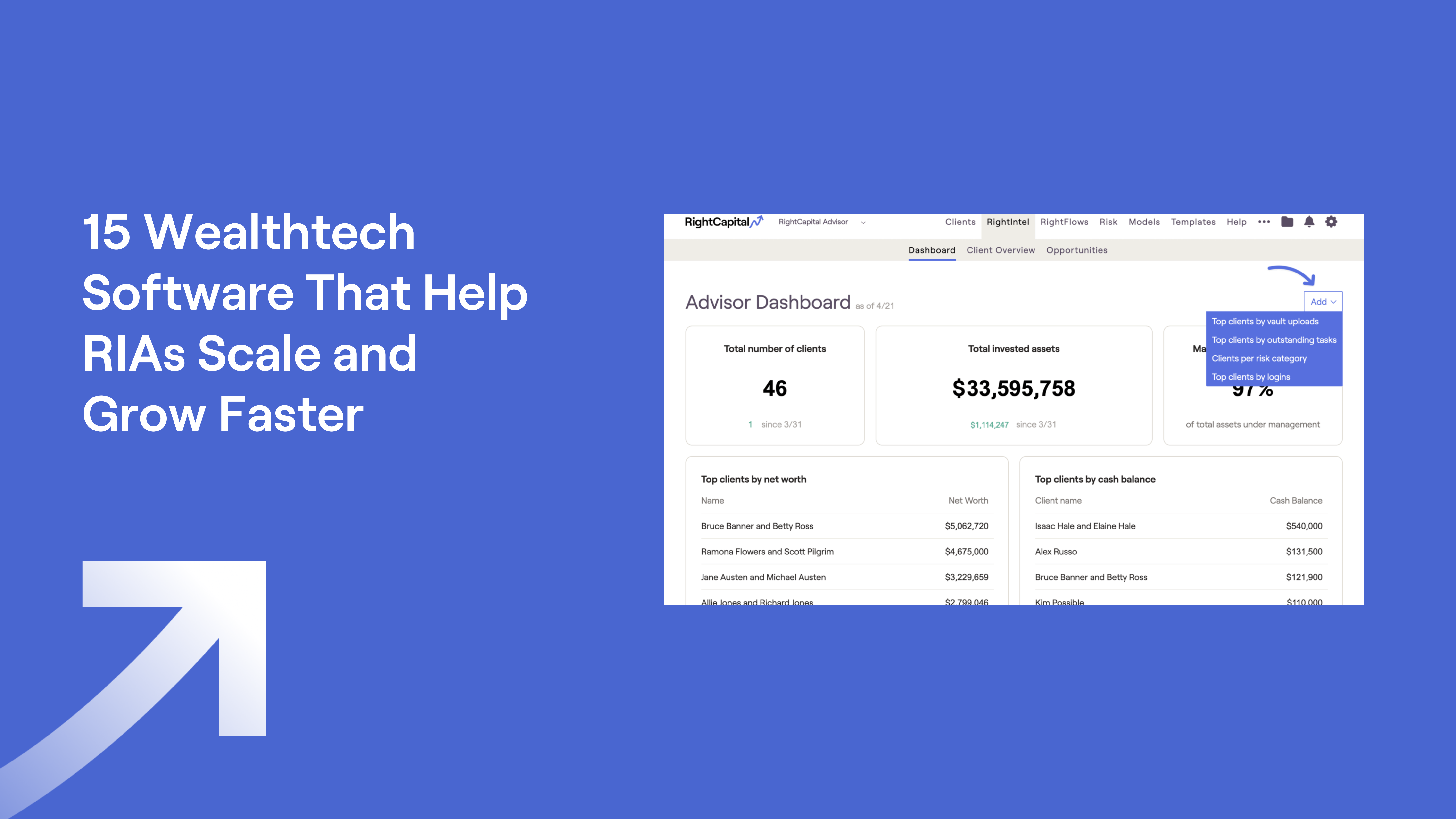

RightCapital

RightCapital provides modern advisors with holistic financial planning software designed to simplify decision-making, enhance client engagement, and help advisors scale efficiently. The platform combines comprehensive financial planning capabilities with intuitive visualizations and robust integrations.

RightCapital integrates with the major CRM systems and portfolio management platforms, enabling seamless data flow between your client management and financial planning workflows.

Key features:

RightExpress™ client prospecting and onboarding tools

Snapshot™ plan summaries and Blueprint™ visuals for financial life

Interactive financial planning capabilities and stress-testing tools

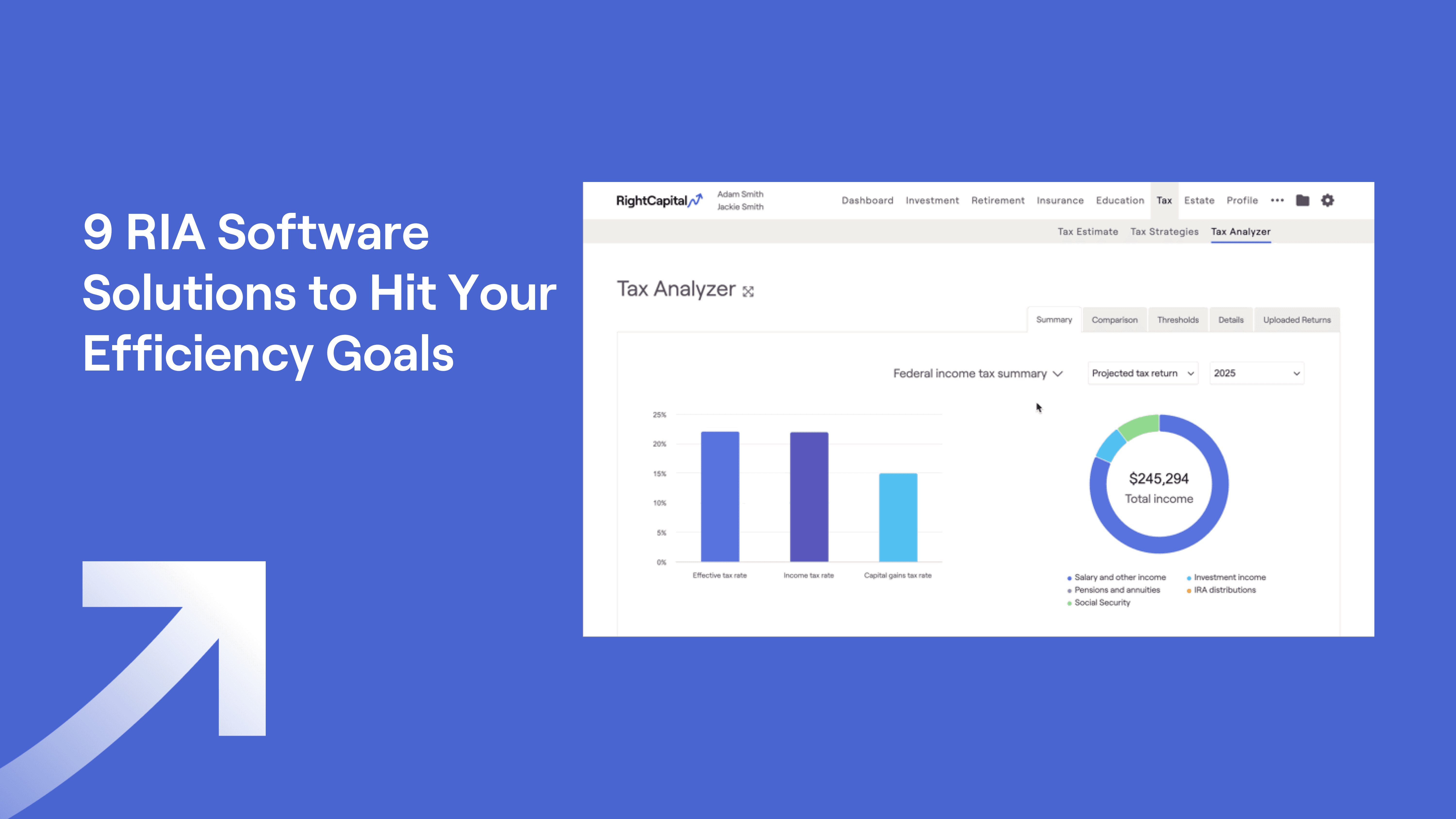

Tax Analyzer and comprehensive tax planning and analysis features

RightRisk™ risk assessment and client engagement tools

Integrations with major custodians and CRMs

Black Diamond Wealth Platform

Black Diamond describes itself as a portfolio and wealth management platform that provides accounting, performance reporting, trading, and rebalancing capabilities to firms of all sizes.

The platform includes Morningstar's investment research and analysis tools. Black Diamond integrates with RightCapital, enabling advisors to use portfolio data for more comprehensive financial planning.

Key features:

Portfolio accounting and performance reporting

Trading and rebalancing automation

Investment research and analysis capabilities

Client relationship management tools

Document management

Business analytics and reporting

Wealthbox

Wealthbox provides a modern, cloud-based CRM solution built specifically for financial advisors and wealth management firms. Wealthbox integrates with RightCapital so your client data flows seamlessly between both systems.

Key features:

Contact management and client profiles

Task automation and workflow management

Email integration and communication tracking

Document storage and sharing capabilities

Mobile accessibility and synchronization

Social media integration features

Redtail

Redtail is a comprehensive customer relationship management platform designed for the unique needs of the financial services industry, helping advisors manage client relationships and business workflows. Redtail integrates with RightCapital to streamline your client management and financial planning processes.

Key features:

Contact management and database organization

Task management and automation

Email marketing and communication tools

Document management and file storage

Customizable dashboards and reporting

Mobile app for remote access

Nitrogen

Nitrogen operates as a risk assessment and portfolio analytics platform that helps financial advisors quantify client risk tolerance and optimize investment portfolios accordingly. Nitrogen integrates with RightCapital, so you can easily pull risk assessment data directly into client financial plans without switching between systems.

Key features:

Risk tolerance assessment tools and analytics

Portfolio optimization algorithms

Stress testing and scenario analysis

Client communication and visualization tools

Compliance and suitability reporting

Integration with portfolio management systems

Advyzon

Advyzon offers advisors a comprehensive technology platform with portfolio management, performance reporting, client portals, and business intelligence capabilities. The platform serves independent advisors and RIA firms with integrated wealth management solutions. Advyzon connects with RightCapital for seamless financial planning workflows.

Key features:

Portfolio management and performance reporting

Trading and rebalancing automation

Client relationship management capabilities

Business intelligence and analytics tools

Client portal with mobile access

Compliance monitoring and reporting

Orion

Orion has established itself as an all-in-one financial advisor software platform that provides portfolio management and business intelligence tools to firms and individuals. The platform helps RIA firms manage client portfolios and run their practices more efficiently.

Orion integrates with RightCapital, allowing you to use your client's portfolio data to create more comprehensive financial plans.

Key features:

Portfolio accounting and performance reporting

Trading and rebalancing tools

Client relationship management features

Financial planning integration capabilities

Business intelligence dashboards

Compliance monitoring tools

Envestnet | Tamarac

Envestnet | Tamarac provides web-based portfolio rebalancing, performance reporting, and customer relationship management software to independent advisors and RIA firms. The platform automates many of the time-consuming aspects of portfolio management so you can focus on building and strengthening client relationships.

Envestnet | Tamarac integrates with RightCapital, making it easier to incorporate portfolio rebalancing data into your clients’ financial planning scenarios.

Key features:

Portfolio rebalancing and trading automation

Performance reporting and analytics

Client relationship management tools

Data aggregation and reconciliation

Compliance monitoring capabilities

Integration with third-party systems

eMoney

eMoney describes itself as a comprehensive financial planning platform that helps advisors deliver more holistic wealth management services to their clients. The platform offers detailed cash flow modeling and robust client portals.

Key features:

Client portal and document sharing

Account aggregation and data management

Spending and budgeting analysis capabilities

Business analytics and reporting features

Integration capabilities with third-party systems

What types of software do RIA firms need?

When you’re running an RIA, you need different software for different aspects of your business.

Here are the main types of tools you can use to build a tech stack that works as hard as you do:

Customer relationship management (CRM)

CRM systems help you keep track of client information, communications, and daily tasks. For RIA firms, a good CRM handles everything from managing prospect follow-ups to client check-ins, so nothing falls through the cracks.

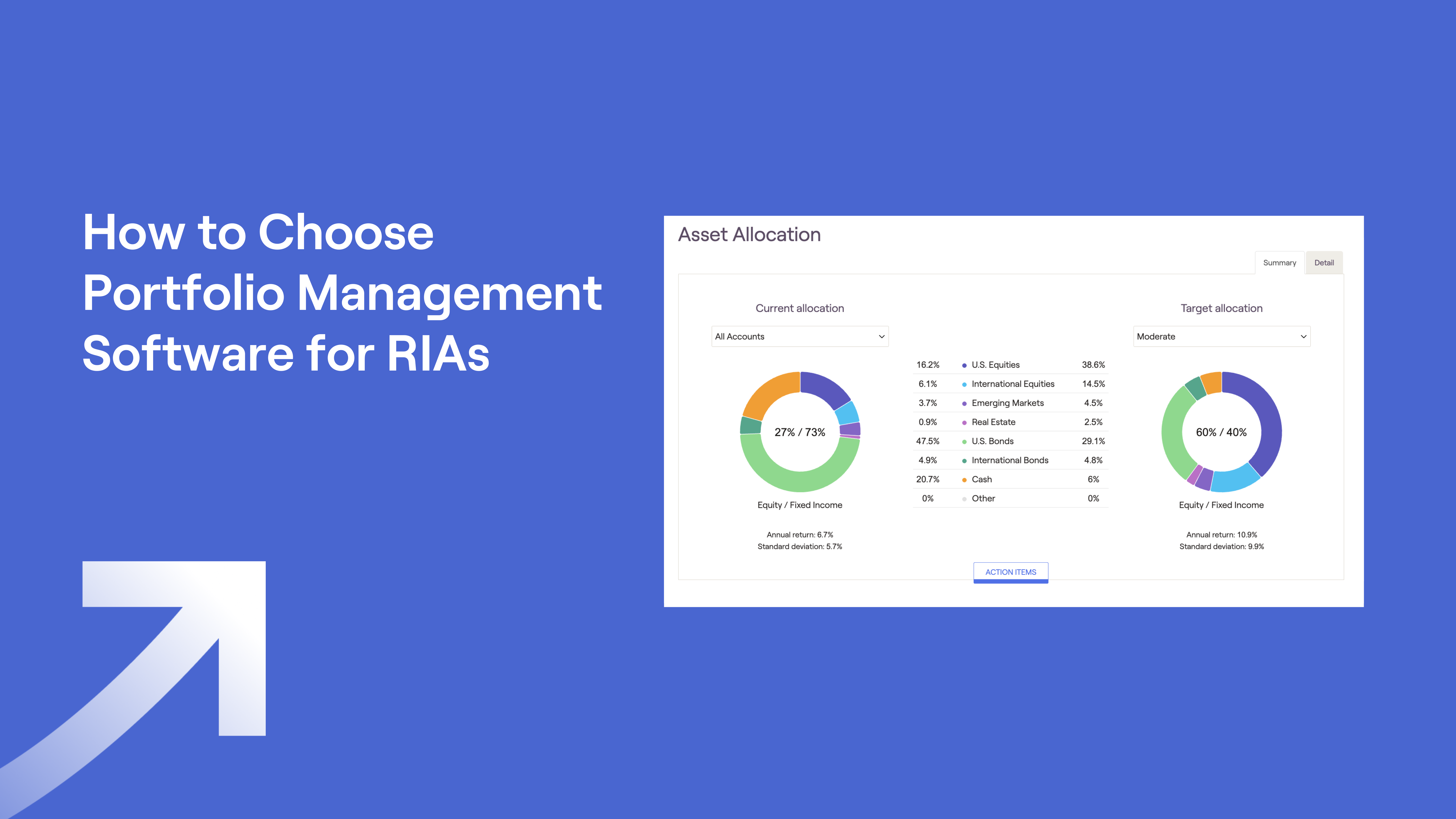

Portfolio management software

Portfolio management platforms help you stay on top of client investments, execute trades, and generate the performance reports clients need to see. Many of these tools automatically rebalance portfolios (so you don't have to). They also connect directly with custodians, which eliminates a lot of data entry and reconciliation work.

Financial planning software

Financial planning tools help you create detailed plans, run Monte Carlo simulations, and help clients make smarter investment decisions. The best platforms turn complicated financial strategies into easy-to-understand visuals and presentations that help people feel more confident and empowered.

Compliance solutions

RIA firms have a lot of fiduciary responsibilities, and you need tools that make compliance monitoring, regulatory reporting, and developing audit trails less stressful, so you can spend less time on compliance paperwork and more time serving clients.

Back-office automation

Back-office solutions automate routine administrative tasks such as billing, account management, client onboarding, and more. This automation eliminates hours of manual work and helps you run your practice more efficiently as you scale.

Client communication and engagement tools

Functionality such as client portals, document sharing systems, and secure messaging helps you keep clients informed and engaged. Clients can access their information whenever they want, upload documents securely, and see real-time account updates.

How to choose the right RIA software for your firm

Choosing the best RIA software for your firm is about more than just a list of features.

You need platforms that fit how your firm operates, connect with the tools you already use, and can grow alongside your practice.

Here’s how to figure out what you need now and in the future.

Start with the basics

Start by looking at your current client base, your total AUM, and what's eating up most of your team's time each day. Think about which manual processes are the biggest pain points and where automation would make the biggest difference.

Make sure everything connects

Look for software solutions that work well with your existing custodians, CRM, and other essential tools. The best RIA software platforms offer solid integrations so workflows are more efficient and you’re not stuck entering the same information over and over again.

Think about tomorrow, not just today

Look for platforms that can keep up with your success. The best RIA software can handle increasing client loads, growing AUM, and more complex situations. No costly migrations required.

Look for ongoing innovation

Find a provider that delivers frequent updates, evolving its offering to leverage the latest technology. The best RIA software providers regularly release new features, stay ahead of regulatory changes, and incorporate advisor feedback to keep improving their platforms.

Consider the user experience

Software that's easy to navigate reduces training time and makes life easier for your clients, creating better experiences for everyone.

Benefits of using RIA-specific software

Unlike generic financial advisor tools, RIA-specific software solves the real problems of running your own practice, which means increased efficiency, happier clients, and more time for growing your business.

Here are some of the top benefits:

It automates routines

RIA software handles routine tasks like portfolio rebalancing, client communications, and compliance monitoring without you having to lift a finger. This means less manual work, fewer errors, and more time for the work that drives revenue and builds your reputation.

Systems work together instead of against you

RIA software platforms are built to connect with other financial tools, offering integrations with custodians, portfolio management systems, and more. This means smoother workflows and less time wrestling with systems that don't communicate well with each other.

Compliance becomes more manageable

RIA-specific software handles the regulatory heavy lifting automatically. Stop scrambling to meet deadlines or worrying about missing requirements; these tools help keep you compliant without monitoring for the latest updates from FINRA or the SEC.

You can scale without the stress

Growing your practice should be exciting, not exhausting. Look for software that can handle the extra complexity as you add clients, so you can focus on growth (instead of worrying about whether your systems will crash under the extra pressure).

Conclusion

When you find the right RIA software, everything becomes easier. Your daily operations run smoother, clients are more engaged, and you can spend time on the work you love, instead of getting bogged down in administrative tasks.

Each of the tools above helps solve the specific problems that independent advisors face every day, from managing complex portfolios to keeping clients engaged.

What sets RightCapital apart? RightCapital turns complex financial plans into clear, interactive presentations that clients can easily understand, plus it integrates effortlessly with your existing portfolio management and CRM tools.

Schedule a demo to see how RightCapital streamlines tax, estate, and retirement planning for independent advisors.

RIA software FAQ

What is RIA software?

RIA software is technology built specifically for registered investment advisor firms. These platforms handle the unique needs of independent advisors, such as portfolio management, financial planning, compliance monitoring, and client relationship management. Unlike generic financial advisor tools, RIA software is designed to handle the operational complexity of running an independent practice.

What is the most important software for a new RIA?

When you're starting an RIA, consider focusing on the basics: A good CRM makes it easier to keep track of clients, portfolio management software helps you handle their investments, and financial planning tools let you create comprehensive plans that guide their financial decisions.

How does RIA software enhance client management for financial advisors?

RIA software makes client management easier by handling routine tasks automatically and keeping all your client information in one place. Client portals allow clients to check their accounts and documents on their terms, while CRMs make it easier to stay in touch and engaged. This technology helps you give people more personalized attention, build stronger relationships, and handle more clients efficiently.