Your Guide to the RightCapital Client Portal

November 6, 2025

We believe people have more fun when they can take an active role in their finances. Our client portal is interactive, but advisors have the flexibility to decide which features their clients can view and edit. You’re still the advisor and your client will gain confidence and trust by being a part of the journey. If you’re wondering what it is your clients see in the RightCapital client portal and what they can do there, read on.

Every client’s technical skills and needs are different, which is why it is important to be able to tailor access to their specific needs. Let’s dive into how to customize your plans to each client while still allowing for a streamlined practice and emphasizing your brand.

How do I invite my client to their portal?

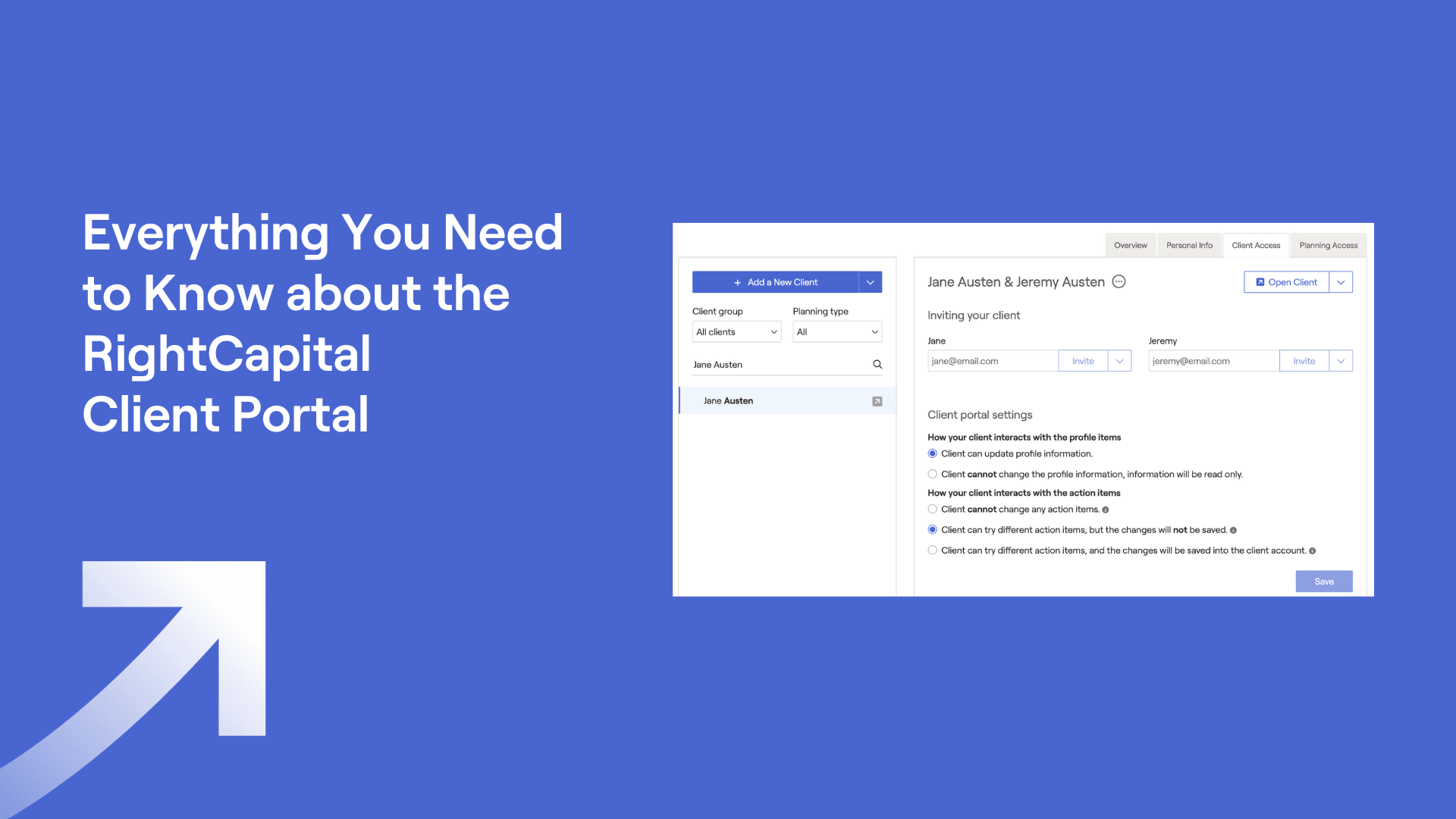

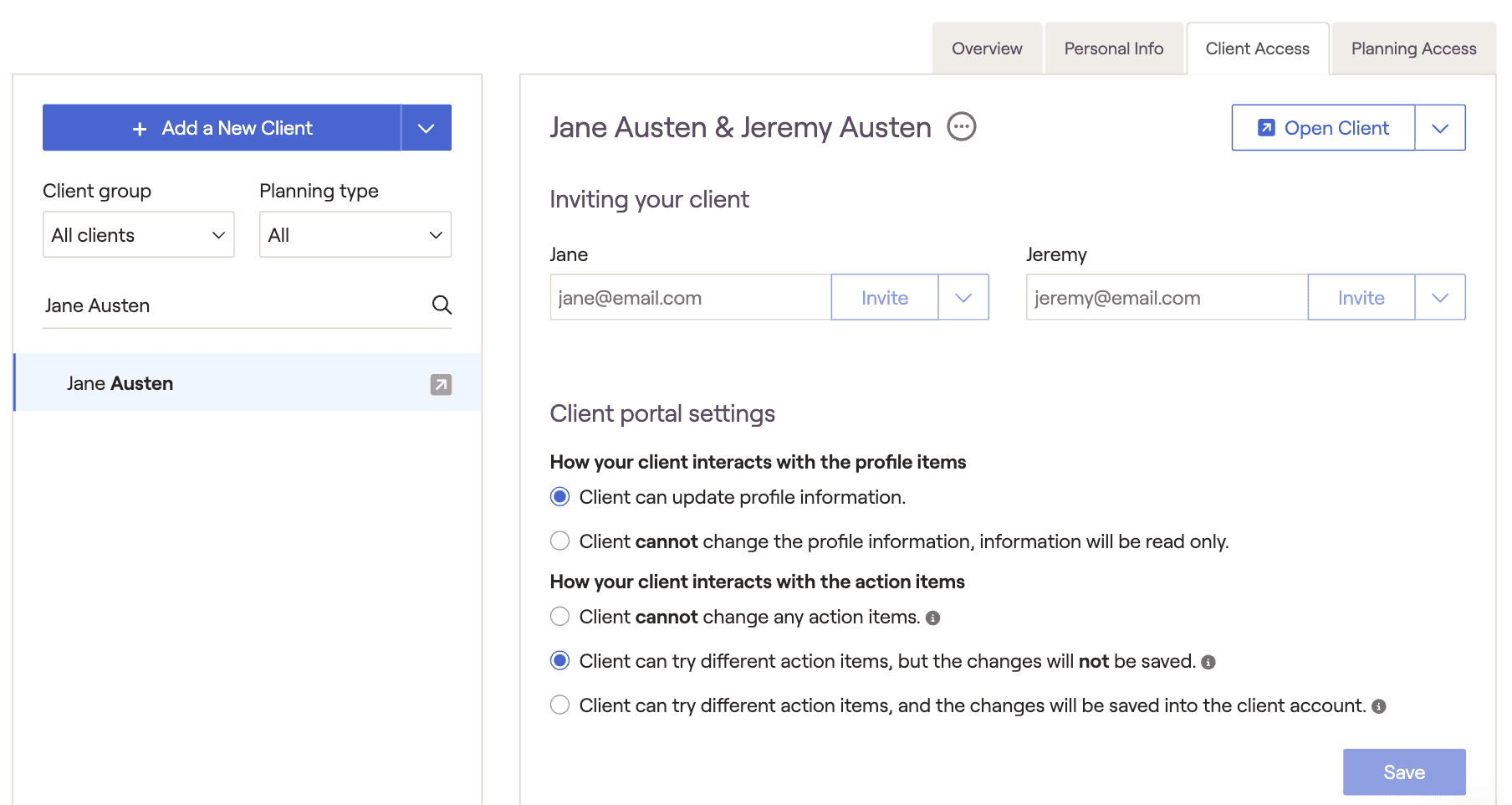

Choose a household from your client list and select the Planning Access tab to start to customize the client experience. From here, select which tools they can access and, if desired, rearrange the order of the planning modules. Then, navigate to the Client Access tab to invite them to access their client portal. Enter their email address and click the invite button. While on the Client Access page, indicate if you would like the client to participate in changing and building their plan or have “view only” access.

What is the client experience in RightCapital?

When your client receives their invite email, they can simply click the “Sign Up” button, enter their email address as their username, and create a password.

If you have granted your client access to do so, they can now assist in entering and updating their personal information such as their salary, expenses, and investment accounts. Engaging the client throughout this data entry process saves you time so that you can focus on creating effective financial planning strategies. If needed, clients can always return to the Profile section to add or modify any information later on.

What does my client have access to?

After the onboarding process has been completed, your client will then have access to any planning modules you indicated earlier in the Planning Access tab.

If you don’t make any adjustments to a client’s Planning Access selections, the default selections are the client Profile and Vault.

As noted earlier, if you’d prefer to enter information into the client’s Profile yourself, then you can provide clients with view access only.

The Vault allows for secure sending and storage of documents. The client can add, view, and remove documents that they’ve uploaded, but they won't be able to remove documents that you have added.

From there, it's up to you. Beyond the two default sections, your client will have access to whatever you’ve decided upon. This can include every tab in the plan, if you’d like. As an example, give them access to the retirement analysis area to let them play with the current vs. proposed plans.

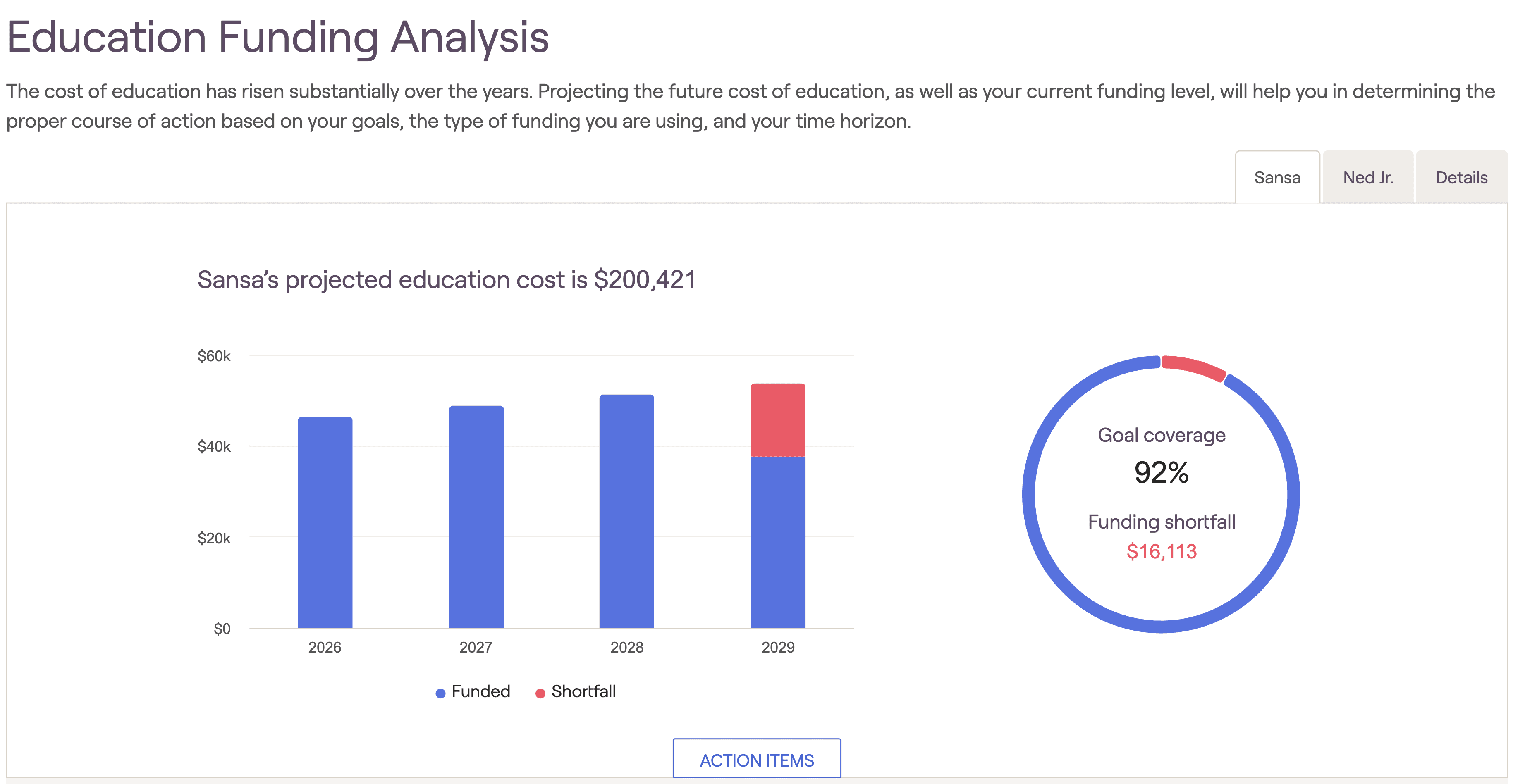

You can change what your clients can access at any point in time. If they are expanding their family and starting to plan for future education goals, you can grant them access to the Education planning tool. As life happens, client needs shift, so it is extremely important to have the flexibility to quickly change what clients can access and how they access it.

What doesn’t my client have access to?

As mentioned above, your client will only have access to sections that you have provided. Have no fear, your clients will never be able to view the advisor portal, your list of clients, your integrations, the reporting tool, or RightIntel.

Clients are also limited when it comes to viewing any templates or models that you have created. For example, if you haven’t assigned a model portfolio to a client, then they won’t be able to see it as an option to view as a potential asset allocation. This means that you can create custom models and templates for other clients without all of them being able to access them.

How will my client learn how to use RightCapital?

There are convenient client-facing materials within the Help Center for a good background on RightCapital. These materials include information about the value of their portal, security, outside account linking, and trouble-shooting. There’s also a video about how the client can fill out the profile section.

If your client has questions you don’t know the answers to, advisors can contact our support team via phone, email, or the chat within the platform.

How else can my client check in on their finances?

In addition to the full client portal, clients who desire to view their balances on the go anywhere can download the RightCapital mobile app, the only of its sort available within the financial planning software industry. On the app, they’ll be able to manage their budget, accounts, tasks, and upload documents to the Vault. They can easily view their probability of success and your contact information, providing an at-a-glance summary of their financial plan.

Interested in using our client portal to help clients have confidence in their financial futures? Schedule a demo to gain access to your free 14-day trial.