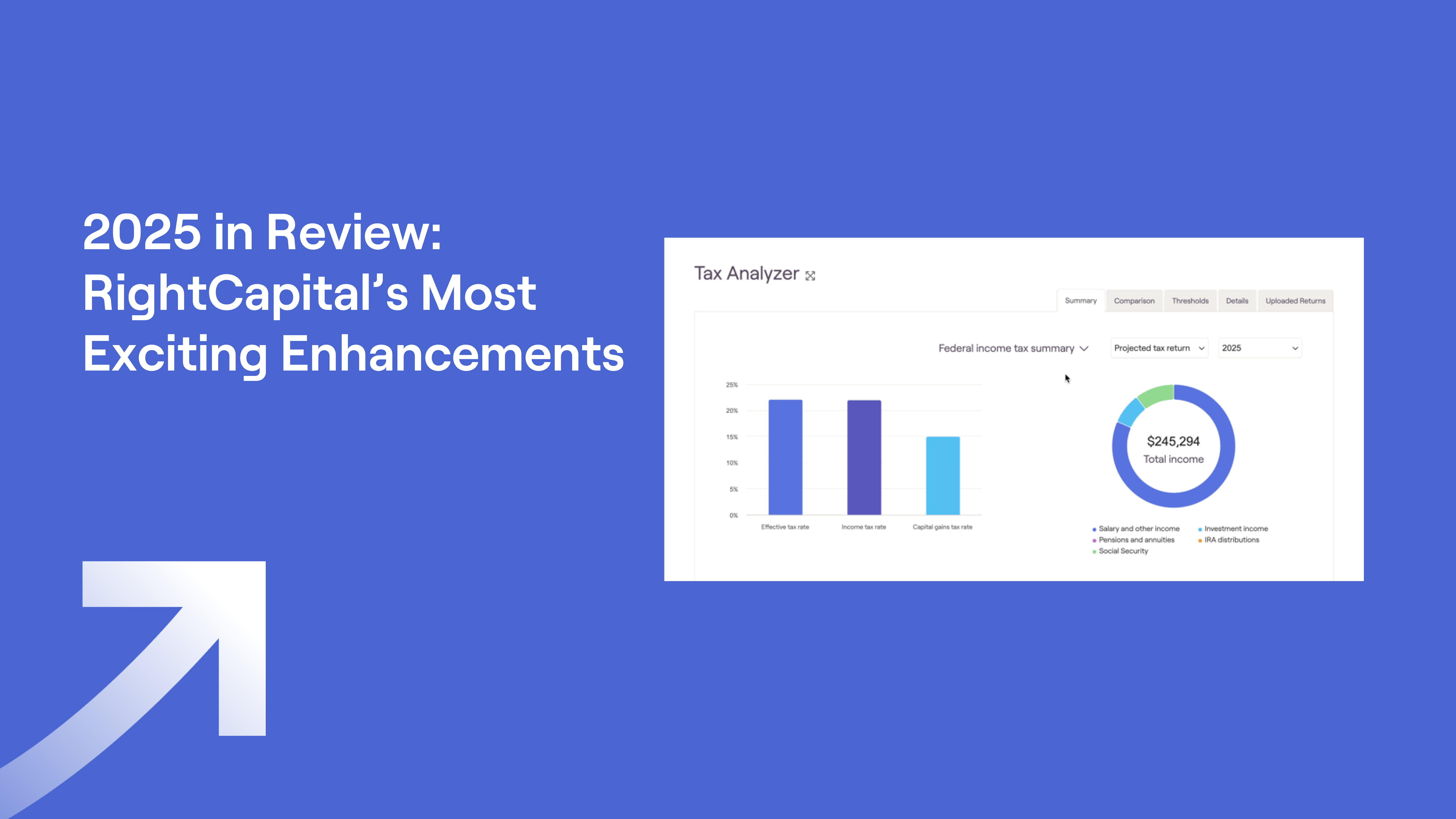

Q2 2025 in Review: RightCapital's Most Exciting Enhancements

June 30, 2025

Looking for full-year 2025 updates? Here are RightCapital’s Most Exciting Enhancements in 2025.

This quarter, we focused on empowering advisors with even more ways to personalize client experiences, unlock actionable business insights, and streamline day-to-day processes. These enhancements are designed to help you deliver greater value to your clients and grow your practice with confidence.

Here’s a closer look at the most exciting enhancements from Q2 and how they can help you elevate your financial planning process:

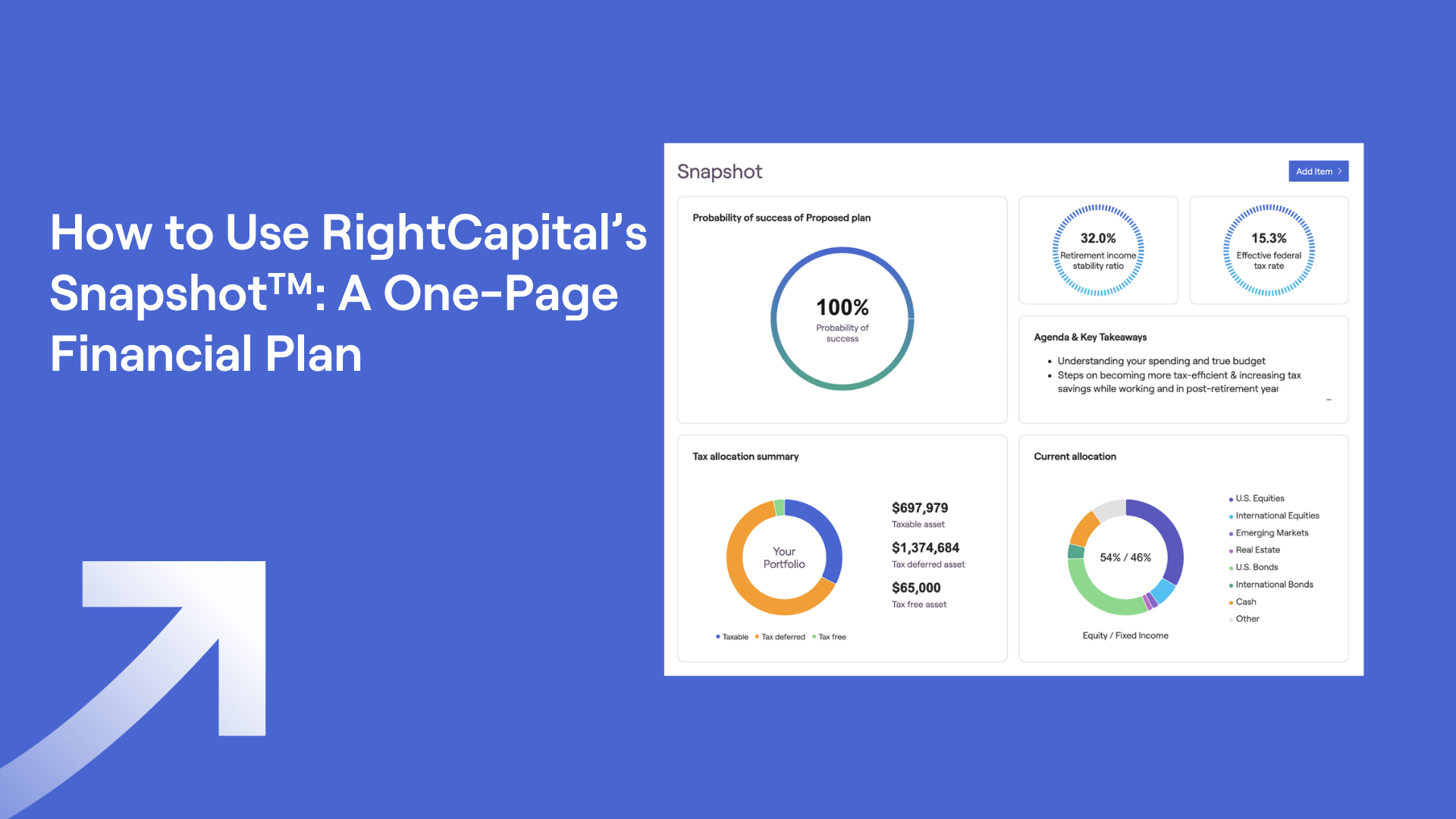

Customize the Snapshot even more

Personalized plan summaries are having a moment and RightCapital’s made it even easier for you to get creative. You can now upload images into the Snapshot such as a company logo or business card in two different sizes. Next, use the magnifying glass icon on widgets to open them into a full-screen, interactive view. Finally, when building a template, you’ll find a new “Clear all” option to make it easier to start from scratch.

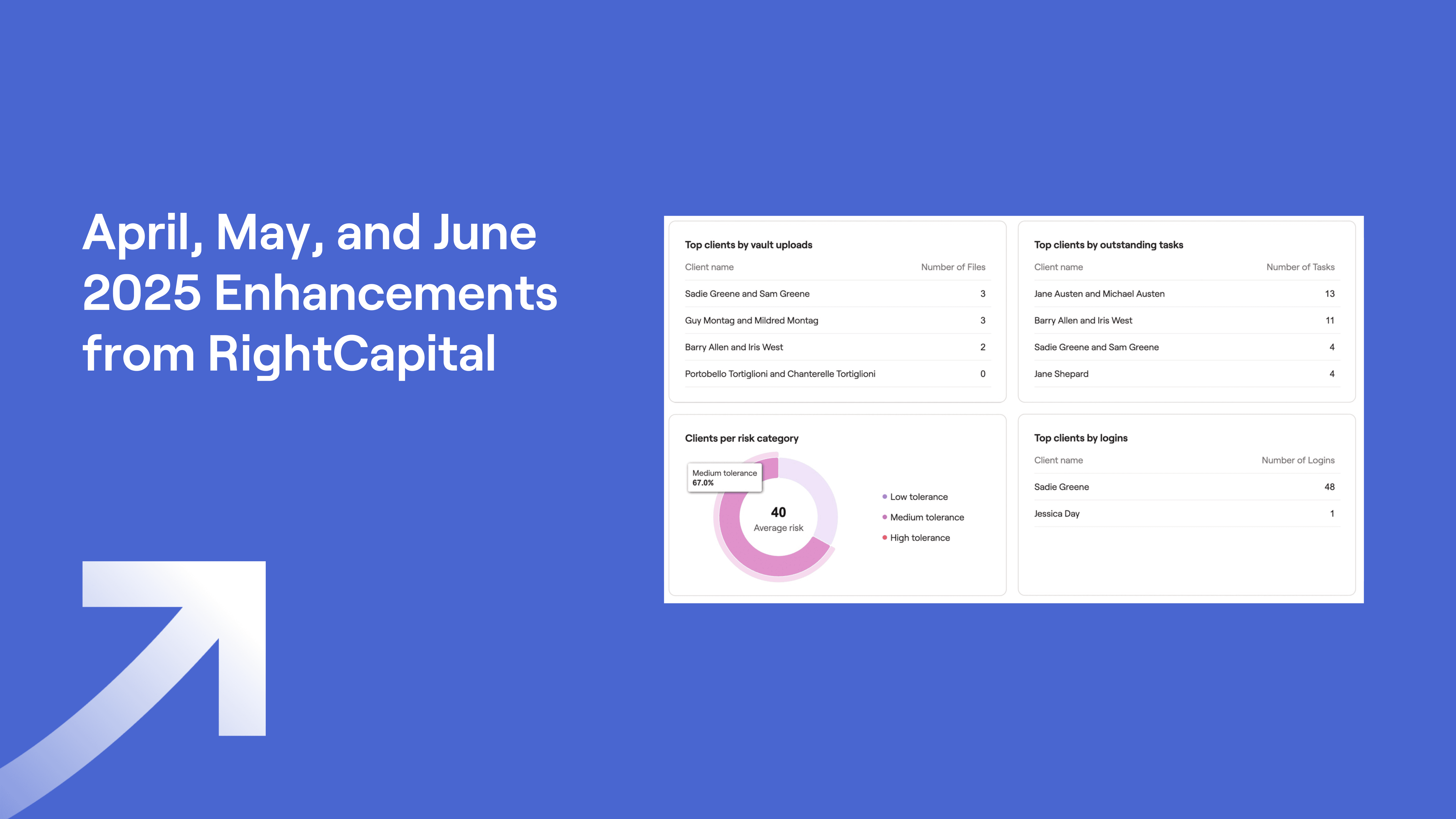

Unlock deeper business insights with updates to RightIntel

This quarter, five new RightIntel widgets were released to provide even more insight across your book of business. First, “Clients per risk category” shows the average risk score across client plans and the percentage of clients who fall within each risk category. Then there are four widgets that show the top four clients within the following categories: “Top clients by vault uploads,” “Top clients by outstanding tasks,” “Top clients by logins,” and “Top clients by highest debt balance.”

In addition to the new widgets, there is new functionality from a firm perspective. Super Administrator(s) can now utilize a Firm-Level RightIntel Dashboard for expanded insights across their organization. They’ll have access to a Firm Dashboard, showing key metrics for the entire firm including total invested assets by account type and total assets under management; Advisor Overview, tracking advisor usage and asset information; and Opportunities, identifying growth areas by analyzing cash, assets held away, debt, and insurance for each client account.

RightIntel is available to Premium and Platinum subscribers.

Tailor Roth conversion strategies further

Help your clients manage future Medicare premiums effectively by personalizing conversion strategies to their unique tax and Medicare situations. Using Action Items within Tax Strategies, propose Roth conversions up to the specific Medicare premium tax brackets (IRMAA tiers).

Capture ongoing costs for home upgrades

Account for additional property tax, insurance, or maintenance expenses related to a home upgrade on the Home Improvement Goal Card.

Dive deeper into the cash flows

Access an additional layer of data in the Cash Flow Waterfall chart. Click into each section for a breakdown of income, savings, goals, and expenses.

Be more flexible with retirement expenses

To effectively manage expenses during retirement and plan for long-term care costs, you can specify with a checkmark in the Retirement LTC Cost card that retirement expenses automatically end when the last long-term care event begins.

Streamline your processes with new and enhanced integrations

Our new integration with Jump allows you to host efficient client meetings and keep plans accurate and actionable. Review and approve key financial planning data such as family information, income, expenses, and goals before syncing to RightCapital.

To streamline the tracking of client progress and plan details, Notes and Tasks are now visible for imported clients within the dashboard and contact record in both Redtail and Wealthbox.

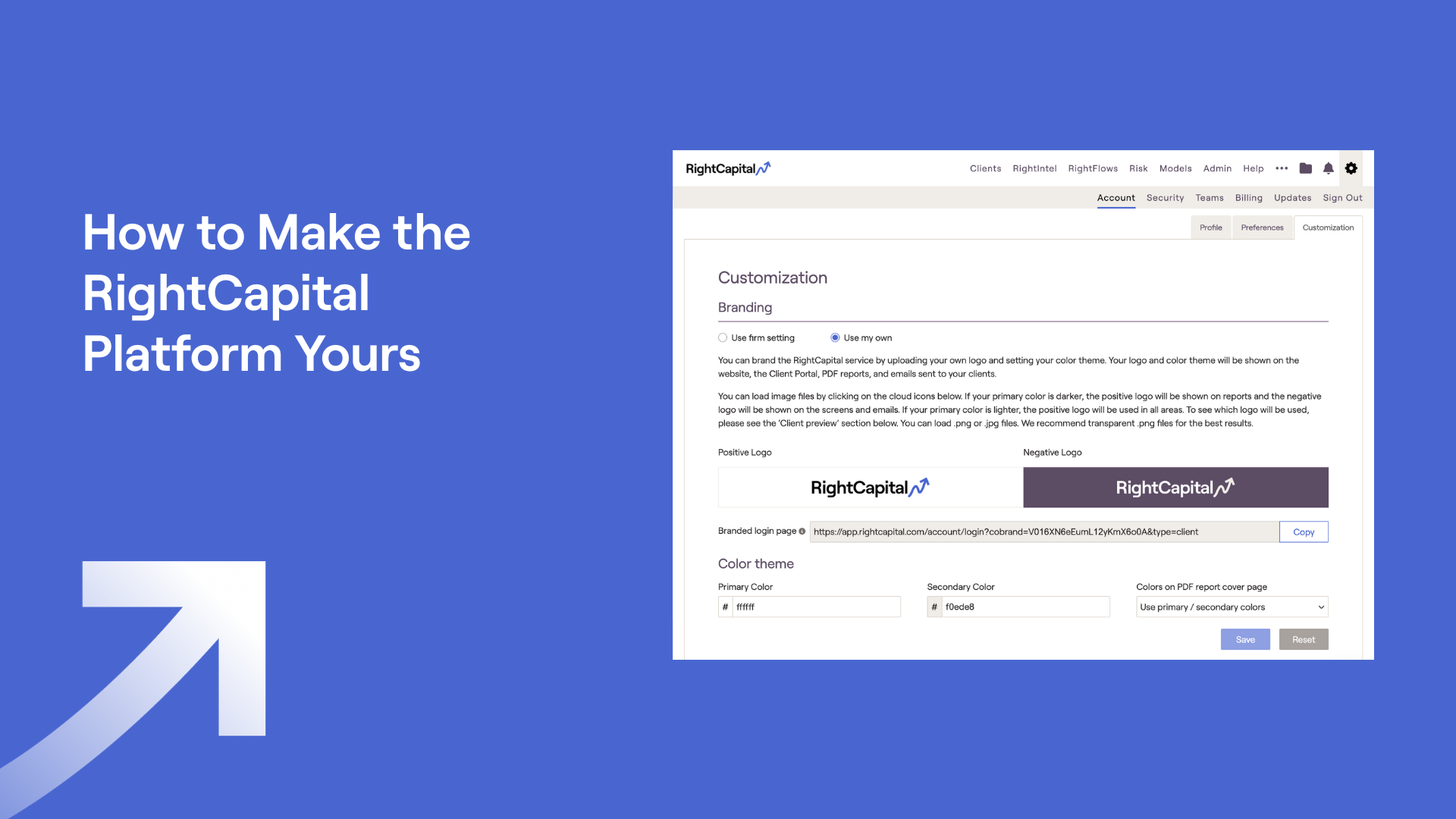

To learn more about these changes as well as items such as the ability to crop and adjust your logo right within the software, the support for non-refundable state tax credits, and the annual college cost update, schedule a demo today!