Q3 2025 in Review: RightCapital's Most Exciting Enhancements

October 2, 2025

Looking for full-year 2025 updates? Here are RightCapital’s Most Exciting Enhancements in 2025.

Q3 delivered in a big way toward our goals of helping you win more prospects, serve complex clients, and save time. We launched a new Business module for deeper planning with business owners, introduced RightExpress™ to streamline prospecting and convert leads faster, and added time‑savers such as CSV holdings upload and expanded asset limits for high‑net‑worth households. Your plans now reflect recent tax changes with automatic adjustments tied to The One Big Beautiful Bill Act, while a new Client Overview tab and enhanced integrations reduce manual work.

Read on for more on how Q3’s updates help advisors:

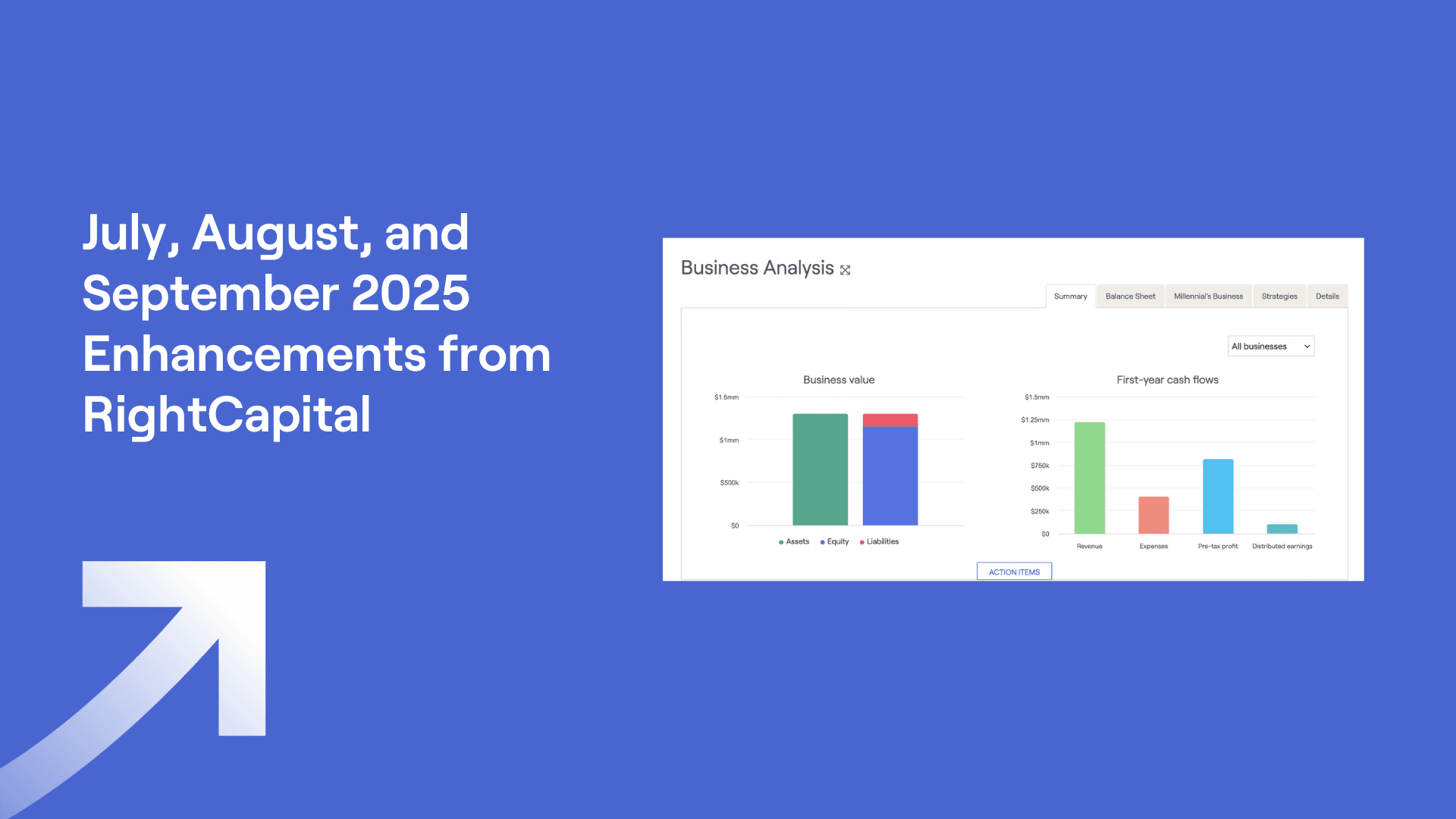

Support business owner clients further with advanced business planning tools

This quarter introduced the Business module: a powerful way to evaluate business performance, model cash flows, monitor assets and liabilities, and identify long-term planning opportunities. These advanced business planning features help advisors manage clients’ complex needs, and expand your firm's offering.

Business entries now appear in their own dedicated section. Easily assign a business as the owner of bank and brokerage accounts, credit cards, loans, properties, home, auto, and umbrella insurance policies, or other assets.

The new module comes with the following sections and data visualizations:

Summary: Analyze business value and first-year cash flows, broken down into revenue, expenses, pre-tax profit, and distributions

Balance Sheet: Track all business-related assets, liabilities, and total equity

Business: Build proposals to compare a business’s sale, revenue, expenses, and distributions

Strategies: Evaluate the impact to invested assets and tax liabilities across various scenarios

Details: Review annual detailed reports highlighting overall business performance

Transform your prospecting approach with RightExpress

We were excited to announce the launch of RightExpress, a powerful new prospecting tool designed to simplify your outreach process and grow your book of business. RightExpress enables advisors to show value from day one by delivering focused, actionable plans to prospects.

Key features include:

Express modules: Choose from six simplified RightCapital modules, including Social Security, Retirement, Debt, Risk, Tasks, and Vault. Use one or combine multiple to create a personalized approach to fits prospects’ needs

Enhanced onboarding: With just two or three steps per module, prospects provide key information to quickly create a focused plan. Customize Express Templates to streamline setup. When the time comes, transition an Express plan into a full financial plan with one click, delivering a seamless client experience

Track and manage leads: Create Express Client Groups to efficiently manage prospects from multiple referral sources, stay engaged with potential clients, and customize your outreach

Comprehensive reporting: Generate detailed reports for each Express module, providing immediate value to prospects through a preliminary financial plan

RightExpress is included with RightCapital’s Premium and Platinum subscription level. Please contact our sales team if you are interested in upgrading.

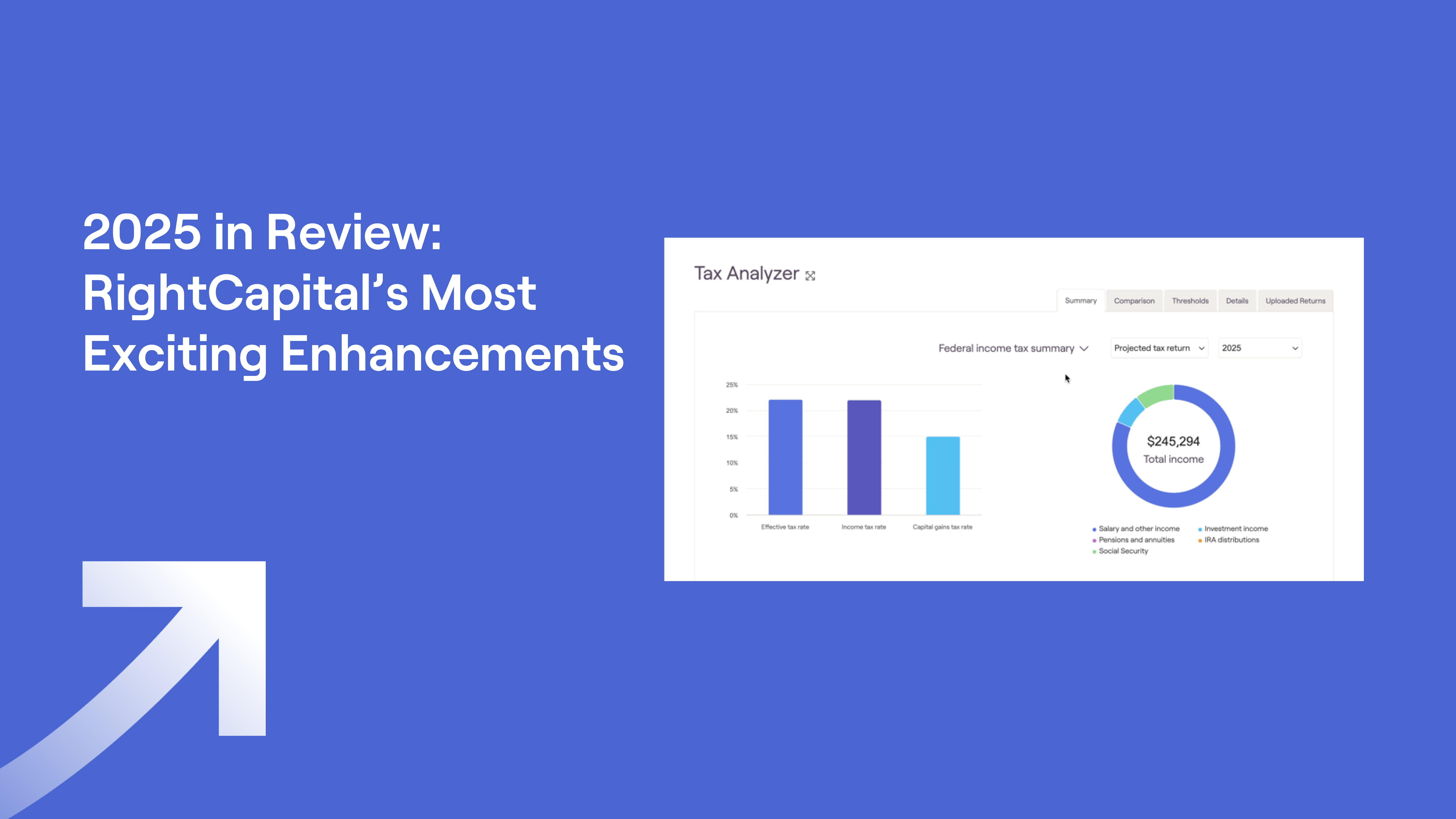

View automatic plan adjustments in accordance with The One Big Beautiful Bill Act

We have adjusted our tax parameters to incorporate several elements of the recent legislation change, all of which you can read more about in this blog post.

Key changes per the bill include:

Tax rates: The TCJA tax law provisions and limitations on itemized deductions are now permanent

Deductions and credits: The standard deduction has increased, with an additional deduction for seniors (age 65 and older) through 2028. Other updates include changes to the child tax credit, State and Local Tax (SALT) deduction cap, and charitable contributions for non-itemizers

Exemptions and phaseouts: Increases to the estate tax exemption, along with expanded phaseout ranges for the Qualified Business Income (QBI) deduction and changes to the Alternative Minimum Tax (AMT) thresholds

Upload holdings into manual investment accounts

To save time and minimize data entry errors, you can now upload investment holdings via CSV file or copy and paste data directly into the new Upload Holdings page. Download our CSV template to streamline the upload process. Please note, the imported holdings will override existing holding data in the account.

Access key client data with the Client Overview tab

You can now view individual client data without clicking into plans. Find information such as net worth, invested assets, cash holdings, debt balances, and Vault and Task activity on the new Client Overview tab within the Advisor Portal.

Keep track of larger asset values for high-net-worth clients

To provide greater flexibility for high-net-worth clients, we have expanded the maximum value users can enter for the following assets:

Bank and investment accounts, real estate, notes receivable, lifestyle assets, business assets, umbrella coverage, and legacy goals support values up to $1,000,000,000

Associated fields such as rental income, property expenses, business income and distributions can be entered up to $100,000,000

The Property and Casualty Insurance module supports proposed umbrella insurance in $1,000,000 increments, up to a maximum of $50,000,000

Save even more time with integration enhancements

Cost basis information from Betterment, SEI, and First Clearing now imports automatically into RightCapital when the integrations are connected, reducing data entry time and potential manual errors.

The Redtail and Wealthbox CRM integrations now provide more flexibility when it comes to decisions about Notes and Tasks synchronization and importing multiple clients. Import Tag Groups and multiple clients simultaneously and link household contact information from RightCapital back into Redtail and Wealthbox.

To learn more about these changes as well as items such as a new shortcut for searching specific pages in the Advisor and Client Portal (Ctrl + K on a Windows device or ⌘ + K on a Mac), more flexibility when adding Cash Flows to Reports, and enhancements to the personal information tab and client settings during onboarding, schedule a demo today!