Which RightCapital plan should you choose?

One of the most frequently asked questions our team encounters is about choosing the right subscription package. While we can elaborate on the differences between the packages, determining the best fit for you requires understanding your unique business structure and anticipated use. That's why we initiate every relationship with a personalized 1:1 demo with our specialists. They can help guide you toward the best choice by addressing your specific queries. The right decision becomes more apparent once we understand your business better.

Please be aware that if you are part of a larger firm, the features available in your subscription may vary slightly from those listed below.

What are the subscription options?

Currently, RightCapital offers three subscription tiers, each progressively more advanced: Basic, Premium, and Platinum. All plans require an annual commitment for the first year.

What does every subscription come with?

Advanced planning features

No matter which subscription you choose, you will gain access to all of our planning modules, which include investment planning, retirement planning, college planning, insurance planning, tax planning, and estate planning.

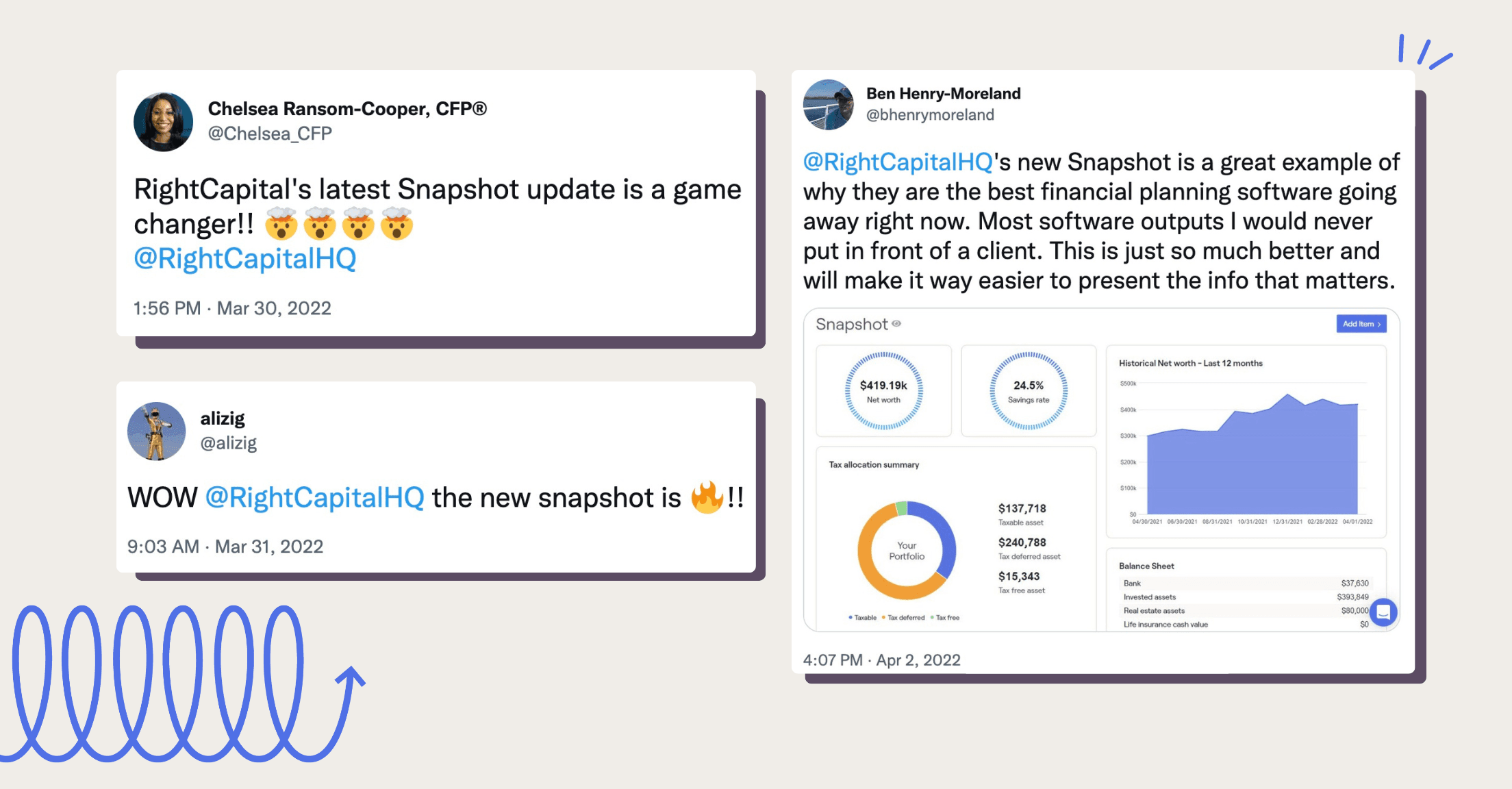

Beautiful, intuitive visualizations

Snapshot is a clear and personalized alternative to lengthy plan documents. This feature gives you the ability to organize key charts from your client's plan elegantly, allowing for personalized notes and comments through a free-form text box. This creates a streamlined summary, easily customizable to each client's needs.

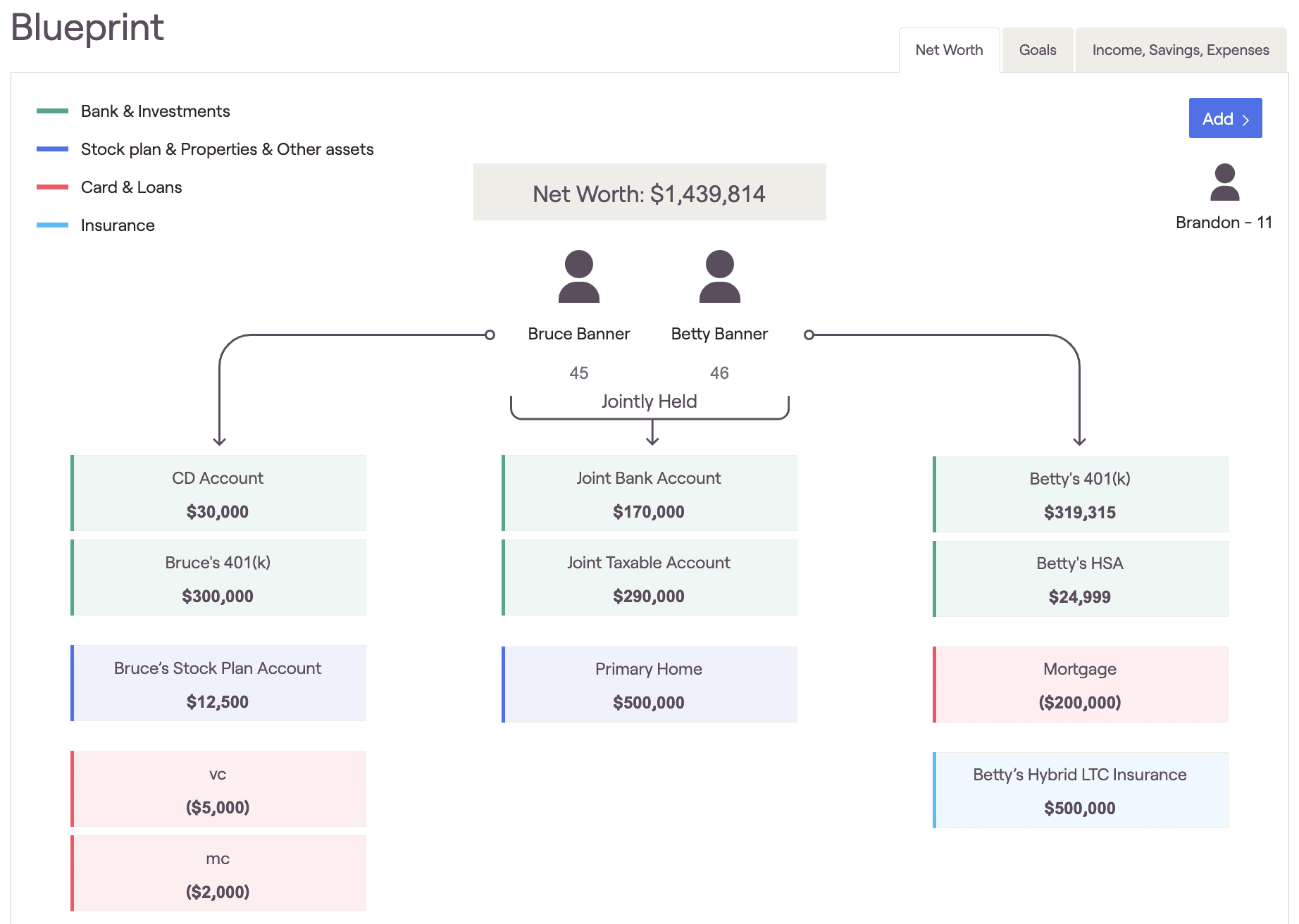

Experience a vibrant, user-friendly, and dynamic visual display of each client's net worth, objectives, income, savings, and expenses through Blueprint. This powerful tool helps rapidly pinpoint absent items or shifts in the household's financial profile, enabling direct updates within the visual framework. Easily discern the ownership particulars of assets and liabilities, outlining whether they are held by the client, co-client, or jointly.

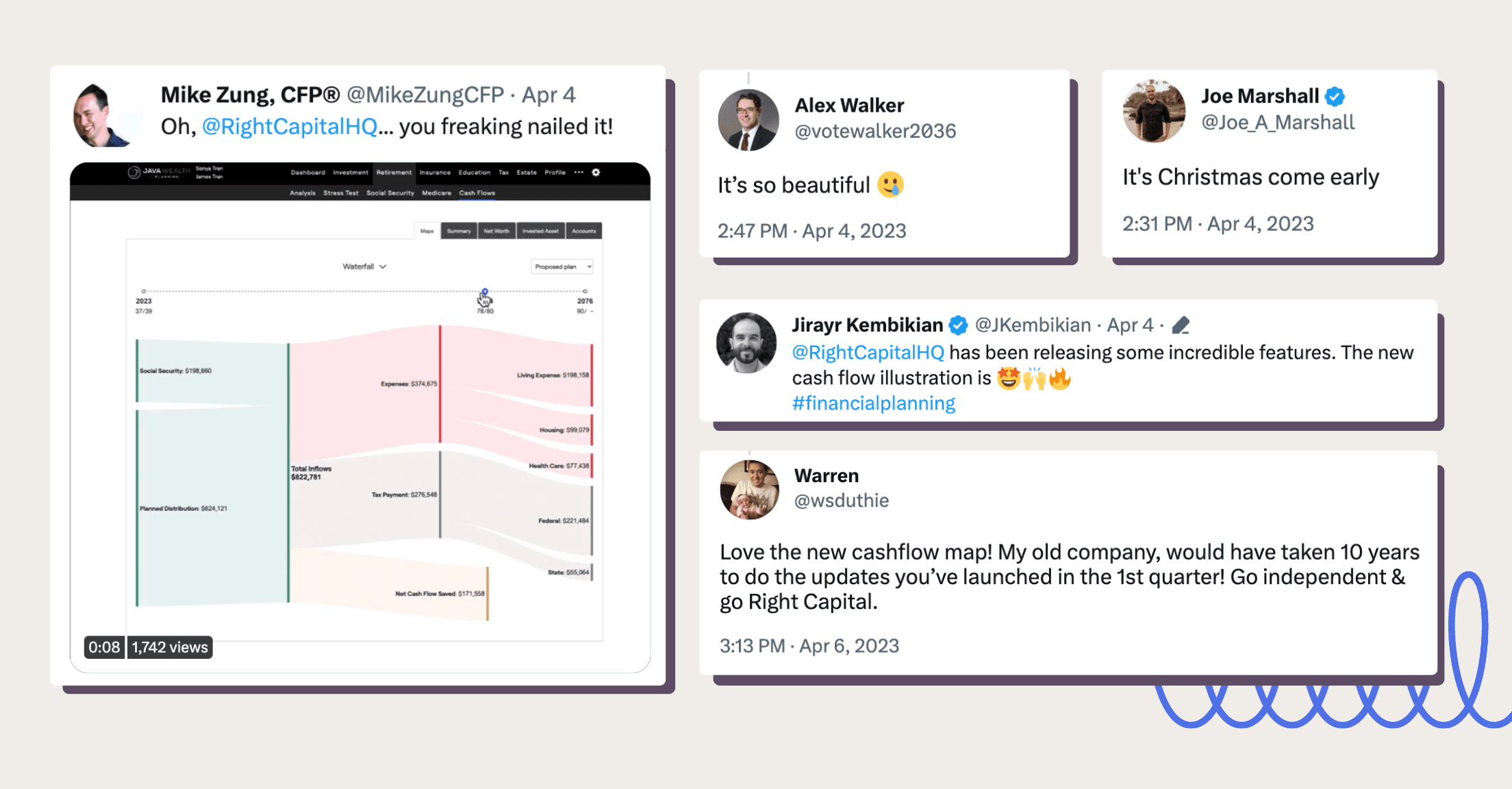

Cash Flow Maps, designed to depict a client's cash inflows and outflows through straightforward diagrams, are an integral component of our system. The mapping features two types of cash flow visuals. First is the "Waterfall," a horizontal Sankey chart that illustrates the flow of cash from left to right. Second is the "Breakdown," a vertical flow chart that provides detailed insights into each item upon clicking.

Client engagement opportunities

Invite whichever clients you’d like to the client portal and the client-facing mobile app—the first in the industry—and choose which features they can interact with or view. Customize the portal and mobile app with your own branding, logos, and colors. Both advisors and clients can upload documents to the secure Vault. Tasks help keep clients engaged in between meetings.

Time-savings

Save time with data entry by integrating the other platforms in your tech stack—see who we integrate with here. A variety of templates (such as for planning access, tasks, budget categories, the Vault, and more) support smoother and time-saving operational processes, especially for routine tasks.

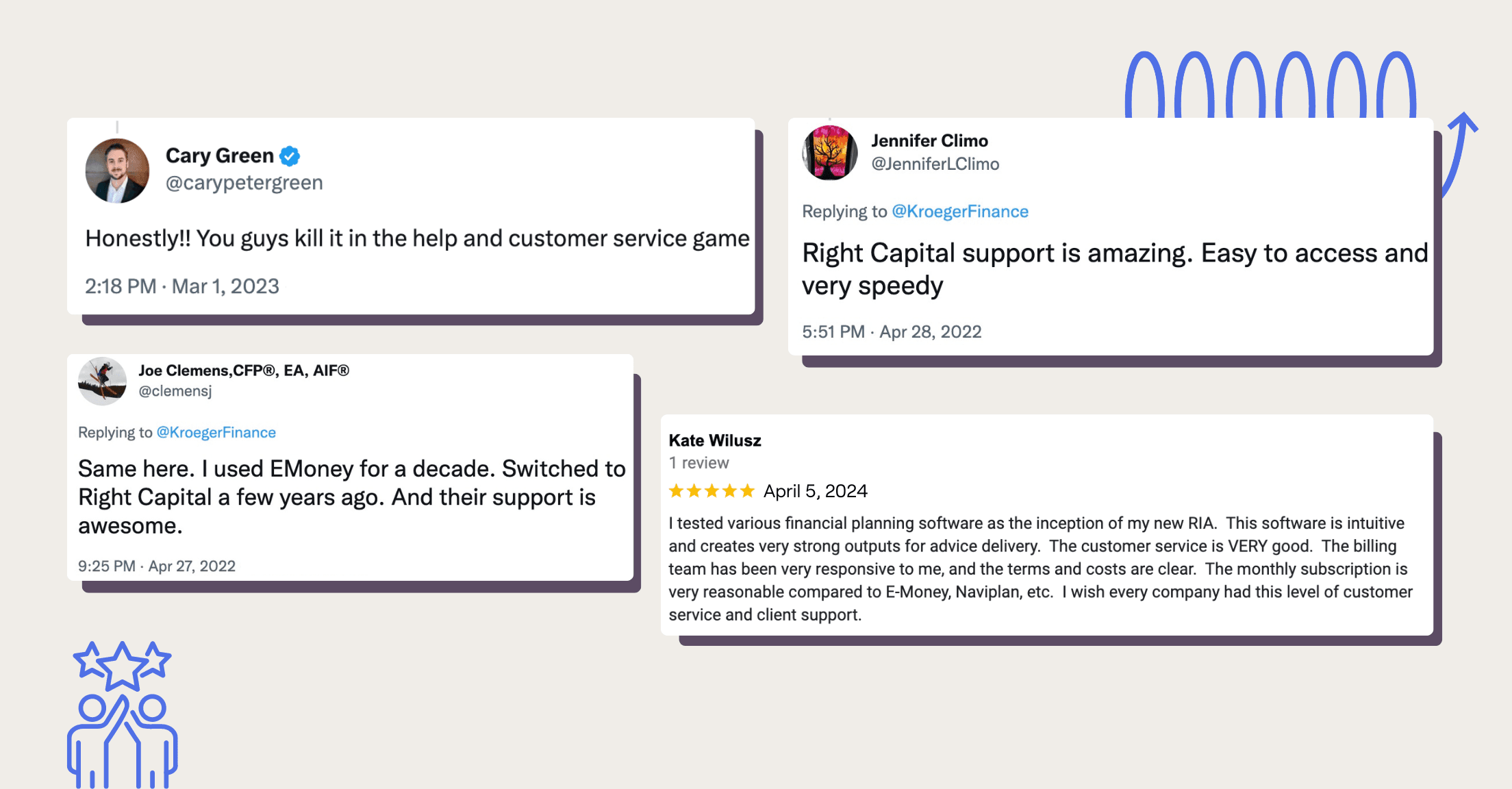

A world-class support team

Don’t forget about our industry-leading support team, who you can contact by phone, email, or by chatting within the platform.

What are the additional features with the Premium subscription?

Account aggregation and budgeting tools

With this upgrade, save even more time with our account aggregation tool that allows clients to link accounts directly so that values are updated each evening. There is also a budgeting tool with the ability to auto-categorize purchases into groups so your clients can see where they are spending their hard-earned money.

Business intelligence

Premium subscriptions also come with our RightIntel business intelligence tool which gives you a full view into your book of business with a dashboard with overviews of insurance coverage, account values, interest rates, and more, to help you deliver more value to your clients by identifying additional opportunities.

A fully integrated risk assessment tool

RightCapital’s new-in-2024 risk tool provides an integrated solution for incorporating risk assessments into your financial plans. This innovative module allows for concise visual representation of risk tolerance scores, making it easier for you and your clients to understand, compare, and analyze risk profiles. From household risk summaries and interactive risk-return analysis to the flexibility of customizable questionnaires, RightRisk revolutionizes client engagement in risk assessment.

What are the additional features with the Platinum subscription?

Team collaboration

The main reasons advisors upgrade further to our Platinum subscription is because of the team collaboration. Team collaboration can help firms that have shared clients between advisors or an additional compliance need for firm oversight.

Firm-level assumptions and models

With the Platinum subscription, there are firm-level controls that can be put into place for all advisors such as custom asset classes and standard assumptions and models.

What if my firm has 50+ advisors?

Enterprise solution

Firms with 50 or more advisors are encouraged to dial our sales line at (888) 982-9596 Opt. 1 or email us at enterprise@rightcapital.com. As firms this size may have specific needs, this is another situation where it’s best for us to have as much information as possible before steering you toward a solution.

Are there any add-ons beyond the subscriptions?

RightPay® payment system

The first optional add-on is our payment system, RightPay, which provides advisors with easy fee collection right within the platform, flexible payment options, and a seamless client experience.

RightFlows™ workflow management tool

In 2024, RightCapital launched RightFlows, the first financial planning workflow tool to incorporate direct client collaboration. With RightFlows, streamline your team's planning processes and easily scale financial plan implementations. This tool allows for collaborative efforts with clients through assignable tasks, providing a centralized, kanban-style dashboard for progress tracking. RightFlows allows for consistent planning processes but provides enough flexibility for advisors to adjust specific steps as needed, balancing structure with adaptability.

Assistant access

Premium and Platinum subscribers can also gain assistant access for an additional fee each month. Premium subscribers are given one assistant license with this fee and Platinum subscribers can have more than one. This is mostly limited to data entry and review—the fiduciary responsibility still falls to the advisor.

Visit our pricing page for more information on subscription costs and how to contact us to move forward or schedule your demo today!