What to Expect During a Demo With RightCapital

December 9, 2025

Ready to explore the highest-rated financial planning software on the market? Schedule a personalized one-on-one virtual demo with our Sales Team at a time that works best for you. In just 20 minutes, we'll show you how RightCapital's intuitive, powerful tools can transform your practice. We’ll tailor every moment to address your unique needs, whether you're managing complex tax situations, serving business owners, or scaling your advisory practice. Come prepared with questions and we'll demonstrate exactly how RightCapital can fit into your workflow.

No prep needed

When you join your demo, one of our Sales Executives will welcome you and guide you through an interactive introduction. This is where we listen. Tell us about the size and goals of your firm, your planning philosophy, your ideal client profile, and the pain points you're experiencing today. Are you struggling with repetitive data entry? Want to deliver more sophisticated retirement projections? Managing business owner clients with complex needs?

After seeing how RightCapital can transform your practice and client relationships, our team can then walk through how to leverage our 40+ integration partners to have direct data feeds to accounts you manage and to make the data entry process even easier. Those coming from the eMoney platform can efficiently transfer existing client plans from eMoney reports into RightCapital using our optical character recognition (OCR) technology.

Financial planning done right

As one of our Sales Executive Managers, Chi Lam, says, “RightCapital is your ecosystem.” During this section, you'll witness the platform's remarkable flexibility firsthand. We'll walk through how easy it is to set up a client profile, from family structure and income streams through expenses, assets, and liabilities, and see how this data immediately feeds into comprehensive financial plans.

This is where RightCapital truly shines. You'll see our signature visualization tools in action:

Blueprint™ brings household finances to life through interactive, color-coded visuals that show net worth, goals, income, savings, and expenses at a glance, exactly what your clients need to see to understand their complete financial picture

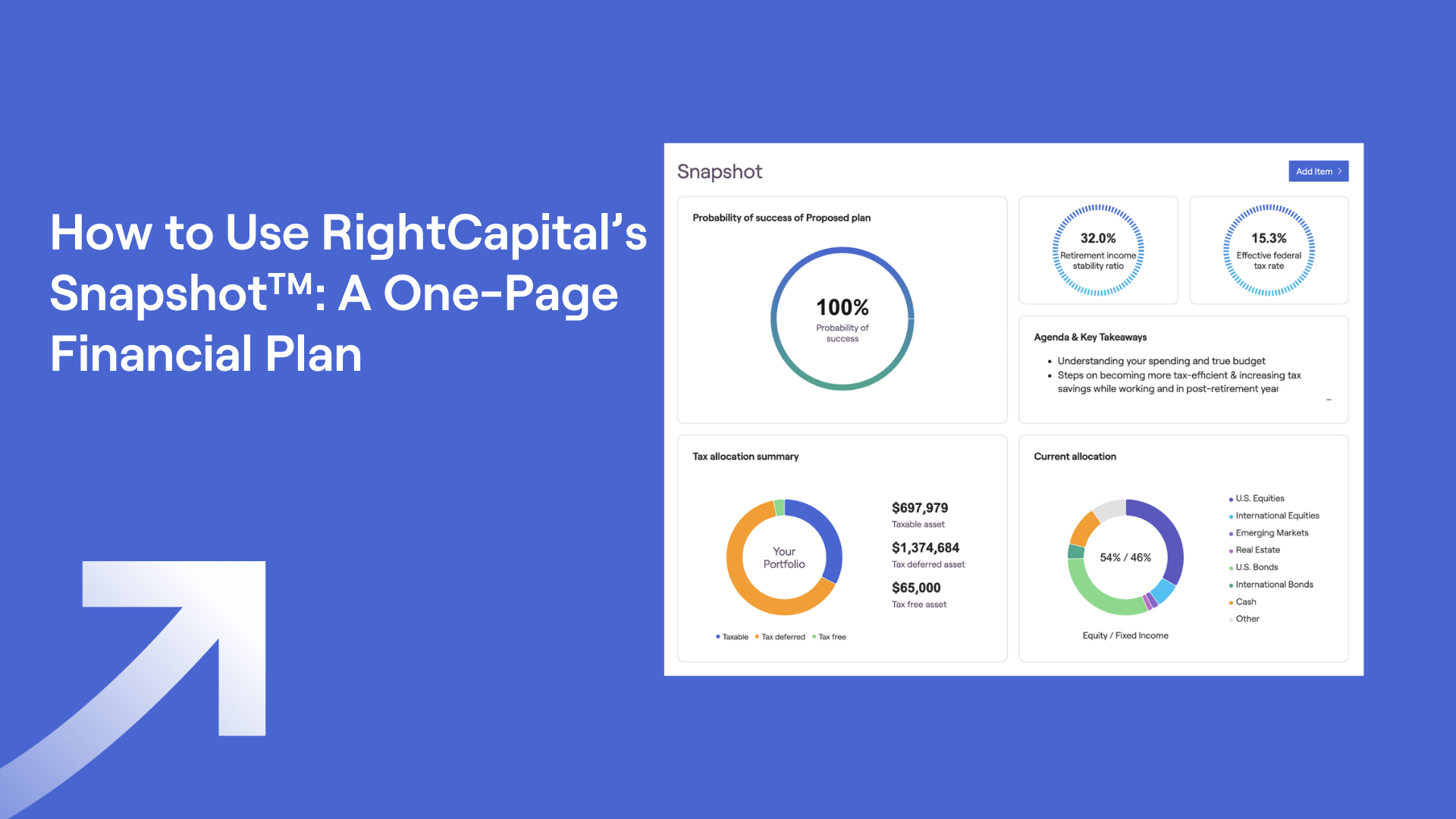

Snapshot™ lets you create polished, customized plan summaries in seconds, complete with professional charts and your personalized notes, ready to share via the client portal or PDF

Cash Flow Maps help clients visualize exactly where money flows in and out each year, making abstract financial concepts concrete and actionable

We'll also showcase our mobile app and client portal, demonstrating how you can engage clients between meetings and keep them updated on their financial progress in real time. You’ll also learn how to personalize your software including your own branding and which modules and features should show for each client.

Planning features you won’t want to miss

Now for the technical deep dive. You'll explore RightCapital's specialized modules, each designed for a specific planning challenge:

Retirement Planning: Dynamic retirement spending strategies that model multiple scenarios such as guardrails, floor-and-ceiling strategies, staged spending, and retirement spending smile, going far beyond standard inflation-adjusted models

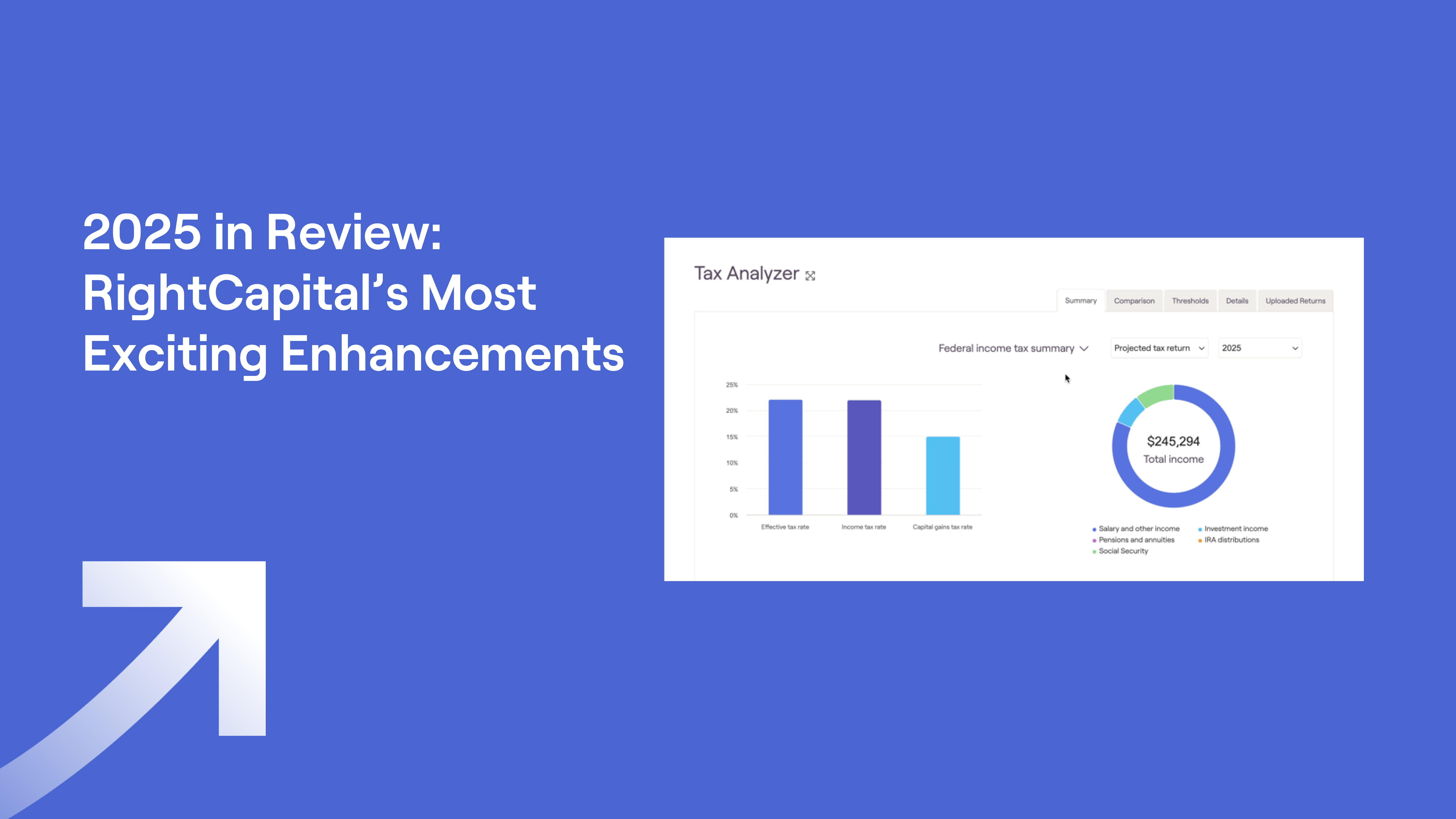

Tax Planning: Adaptable strategies including Roth conversion analysis, asset location, and tax-efficient withdrawals

Social Security Optimization: Pinpointing the optimal filing age for maximum benefits and analysis of the breakeven point between different filing ages that account for standard retirement benefits, spousal benefits, and more

Retirement Income & Expenditure Analysis: Annuity proposal illustrations, pension option comparisons, and accounting for the dynamics of Medicare premiums in the financial plan

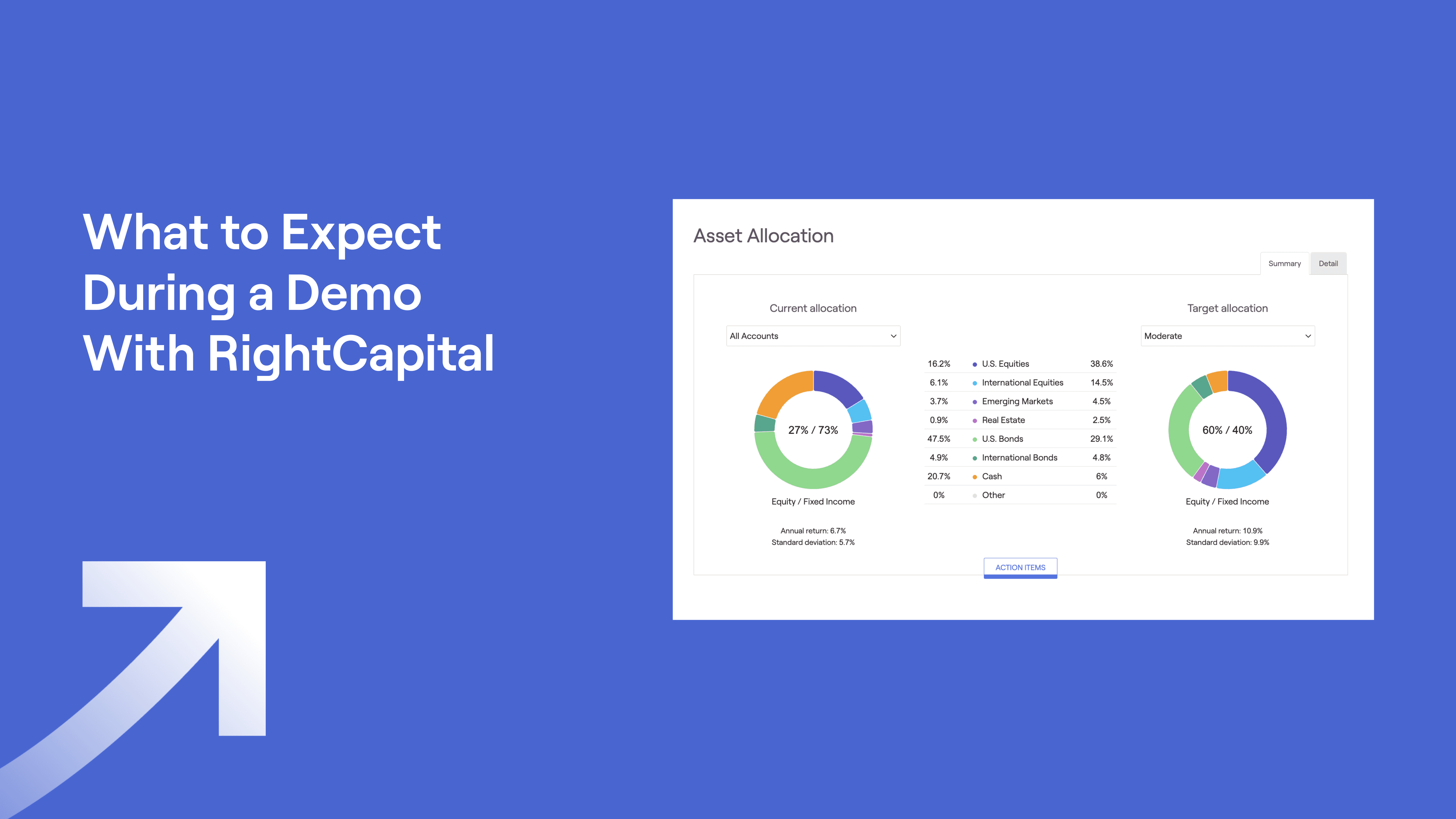

Investment and Risk Management: RightRisk™ assessment tools and portfolio analytics

Education Planning: College funding strategy modeling

Estate Planning: Dynamic trust proposals and visuals of a client’s estate

Insurance Analysis: Life, disability, property and casualty, and long-term care planning integrated into your complete financial picture

Business Planning: A new-in-2025 capability that allows you to model client businesses, including assets, liabilities, revenue, expenses, and potential sale strategies, right within the financial plan

This is your chance to ask "what if" questions and watch RightCapital instantly recalculate plans based on changing variables. Is your client interested in retiring three years earlier? Watch the impact ripple through their retirement spending, tax strategy, and portfolio needs in seconds.

You’ll also learn how to interact with our highest-rated-in-industry support team. They are available from 9 am to 6 pm ET via phone, email, scheduled calls, or in-platform chat support.

A 14-day free trial, on us

Once your demo concludes, you'll unlock a complimentary 14-day trial. This is your playground. Experiment with sample client scenarios, explore the modules that matter most to your practice, test integrations, and experience the efficiency gains firsthand. We've created a comprehensive guide to maximize your trial period so you can confidently evaluate whether RightCapital is the right investment for your firm.

Ready to see RightCapital in action? Let's schedule your demo today.