Financial Planning Software: RightCapital Plans Explained

January 29, 2026

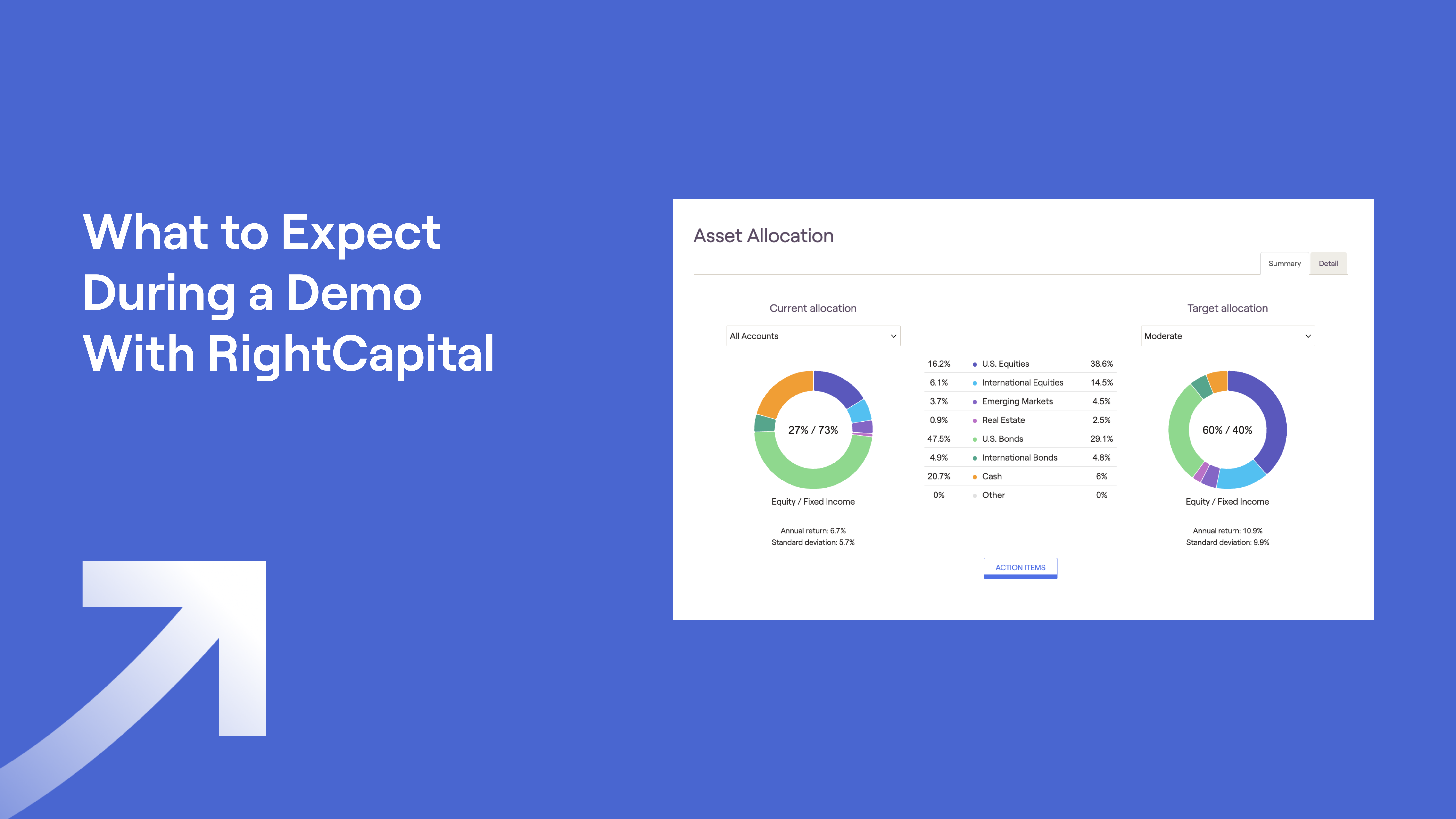

Financial advisors evaluating financial planning software often ask the same question: Which RightCapital plan should I choose? The right subscription for you (Basic, Premium, or Platinum) depends on how your firm is structured, how many team members will use the platform, and which workflows matter most, from client engagement and plan delivery to account aggregation, tax planning, and team oversight. A 1:1 demo helps to identify the right features to match your processes and growth goals.

Note: If you’re part of a larger firm, certain features or settings may vary slightly based on firm-level configurations.

RightCapital subscription options

Plan | Additions |

|---|---|

Basic | Core planning modules, Snapshot, Blueprint, Cash Flow Maps, client portal + mobile app, secure Vault, lead generation, custom branding, integrations, support |

Premium | Account aggregation, budgeting, RightIntel dashboard, RightRisk, Tax Analyzer, RightExpress |

Platinium | Team collaboration, firm-level assumptions/models, RightFlows workflow management |

RightCapital offers three tiers of financial planning software subscriptions, each with progressively more advanced capabilities:

Basic

Premium

Platinum

All plans require an annual commitment for the first year.

What every RightCapital subscription includes

No matter which tier you choose, every RightCapital plan includes the core tools advisors rely on to create modern, interactive financial plans:

Advanced financial planning modules

All subscriptions include advanced features across major planning needs:

Investment planning

Retirement planning

College planning

Insurance planning

Tax planning

Estate planning

Advanced business planning

These modules help advisors build comprehensive and flexible recommendations that can evolve as clients’ lives and situations change.

Client-friendly visualizations

RightCapital is known for clean, intuitive visuals that make it easier to communicate complex planning concepts.

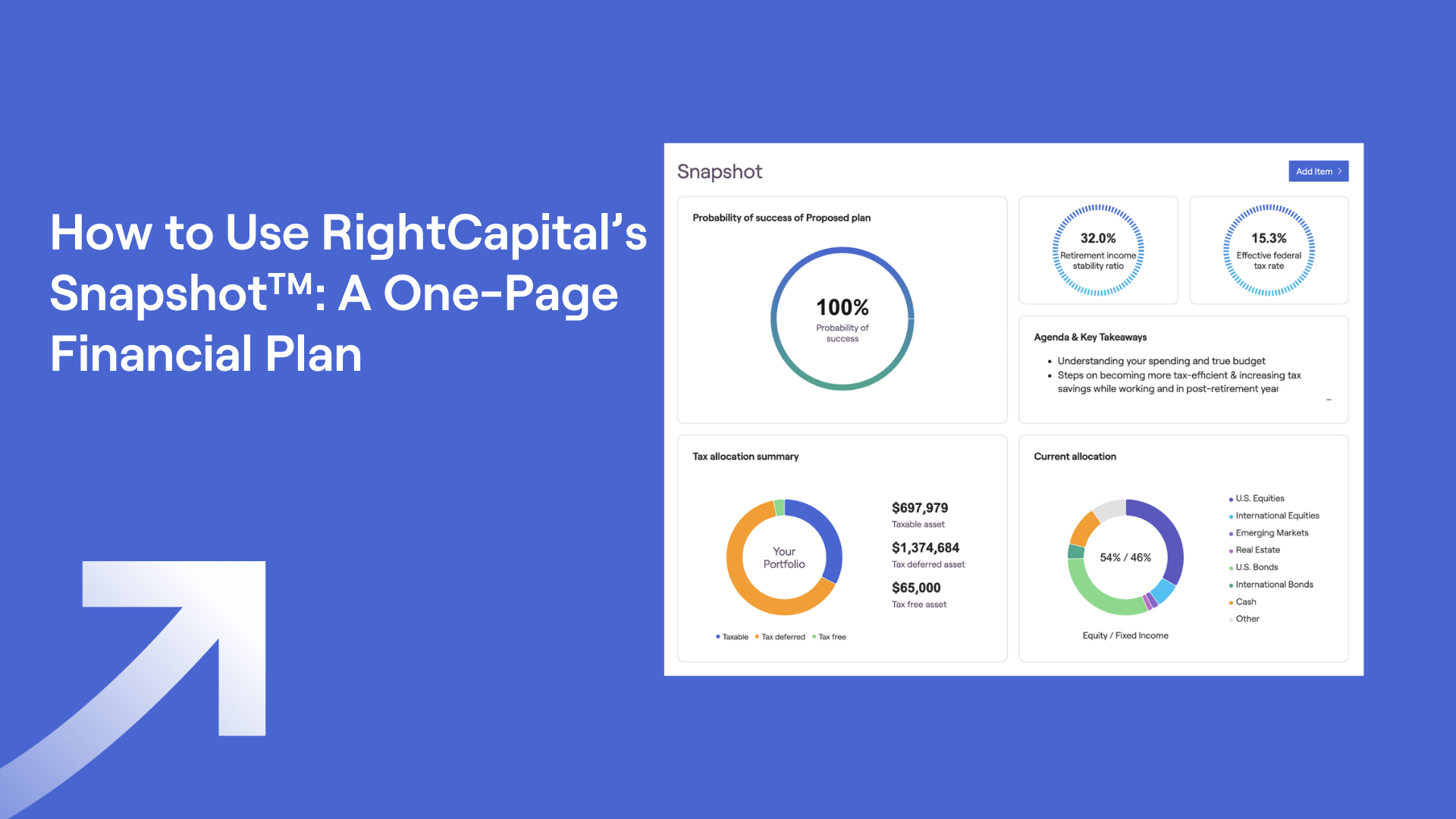

Snapshot: A clear, personalized alternative to long-form plan documents. Build a streamlined plan summary using key charts, plus advisor notes and commentary in free-form text boxes.

Blueprint: A dynamic view of household net worth, goals, income, savings, and expenses, helping advisors quickly spot missing data or changes, and the ability to update information directly in the visual layout.

Cash Flow Maps: Visual cash inflows/outflows with two formats: Waterfall (a horizontal Sankey chart showing cash flowing from left to right) and Breakdown (a vertical chart that allows you to click into individual items for details).

Client portal + client-facing mobile app

Invite clients to the client portal and mobile app (the first client-facing mobile app in the industry) and control which sections of RightCapital they can view or interact with. You can also:

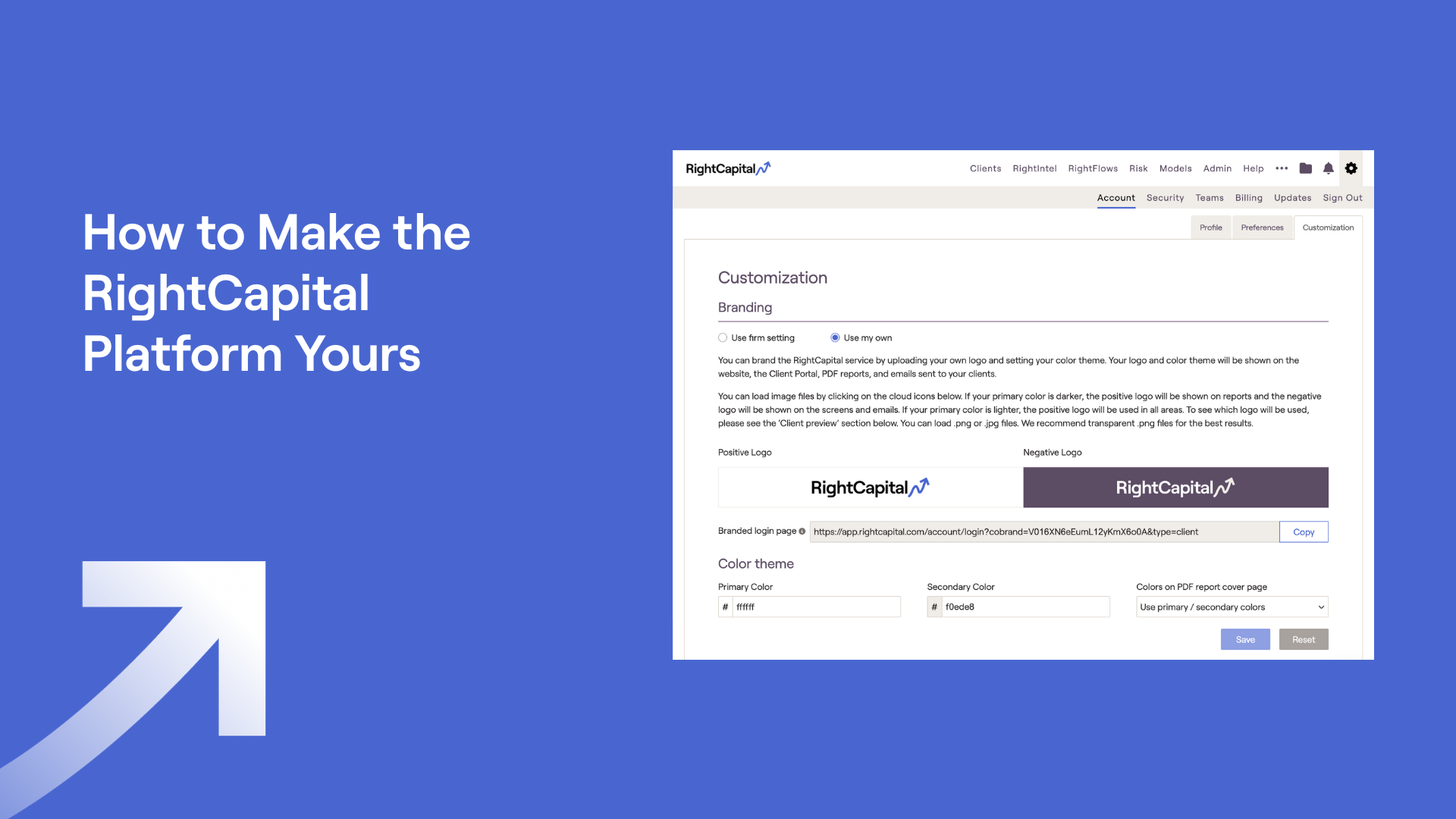

Customize branding (logos, colors)

Use the secure Vault for document uploads

Assign Tasks to keep clients engaged between meetings

Time-saving integrations and templates

Reduce manual data entry and streamline operations by connecting RightCapital to your broader advisor tech stack (CRM, custodians, etc.). Templates help standardize processes including, but not limited to:

Planning access

Tasks

Budget categories

Vault organization

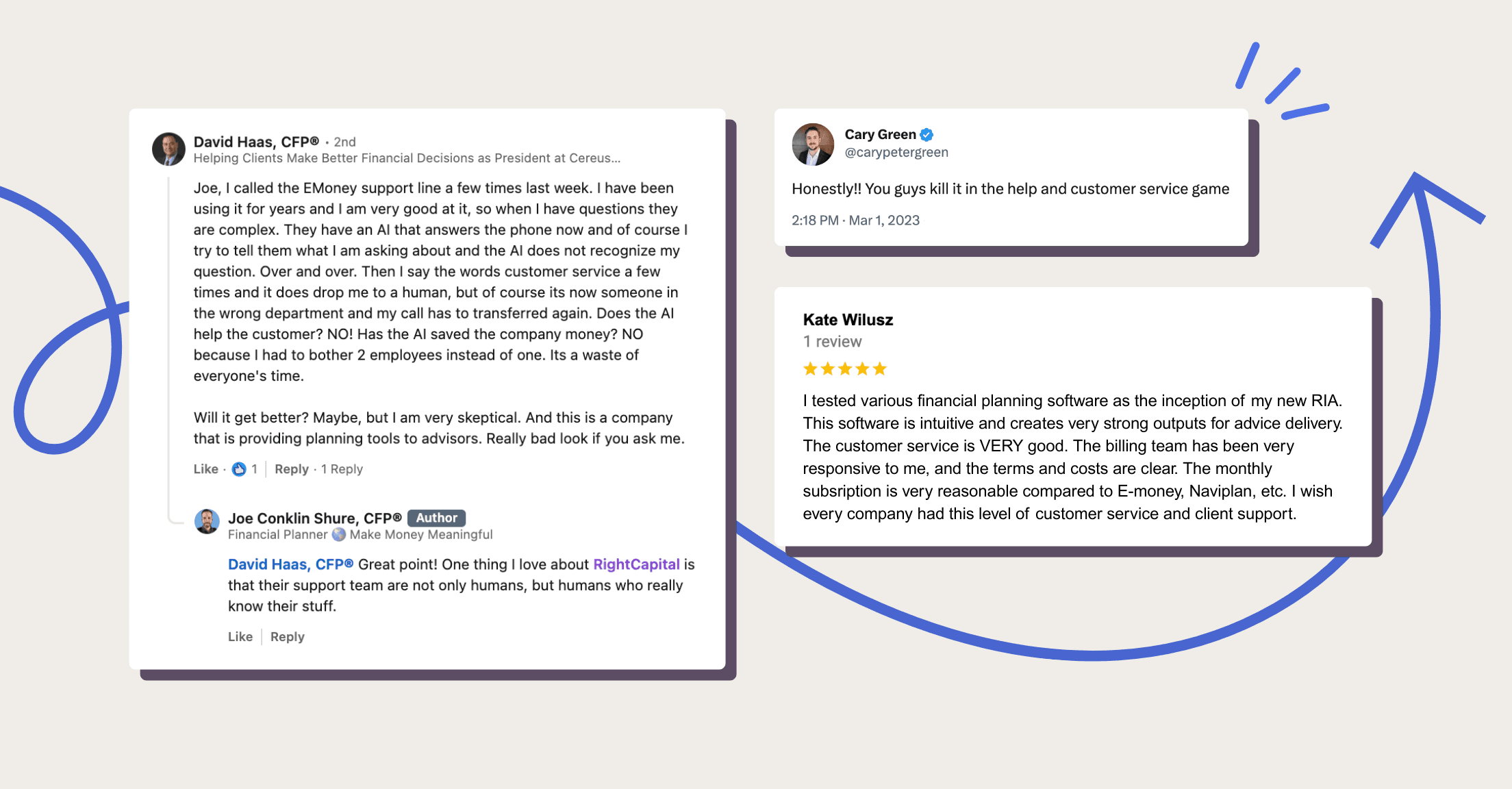

Industry-leading customer support

RightCapital’s support team is available through:

Phone

Email

In-platform chat

Scheduled case reviews

Premium plan: Tools for faster planning and deeper insights

The Premium subscription is designed for advisors who would like more automation, deeper client insights, and additional planning tools that support ongoing advice. It includes everything in the Basic subscription, plus the following upgrades:

Account aggregation + budgeting tools

The Premium subscription adds account aggregation so clients can link accounts for balances to update automatically (typically nightly). You also have access to budgeting features, including the ability to auto-categorize transactions, helping clients understand spending patterns and cash flow.

RightIntel® business intelligence dashboard

RightIntel, the business intelligence tool that allows you to see trends and opportunities across your book of business, is included with your RightCapital Premium subscription. Proactively identify planning opportunities with information from the dashboard, giving you visibility into key planning and client data such as:

Insurance coverage

Account values

Interest rates

RightRisk™ (integrated risk assessment)

RightCapital’s Premium subscription comes with RightRisk, which adds risk tolerance analysis inside the plan, including:

Visual risk tolerance summaries

Household-level risk comparisons

Interactive risk-return analysis

Customizable questionnaires

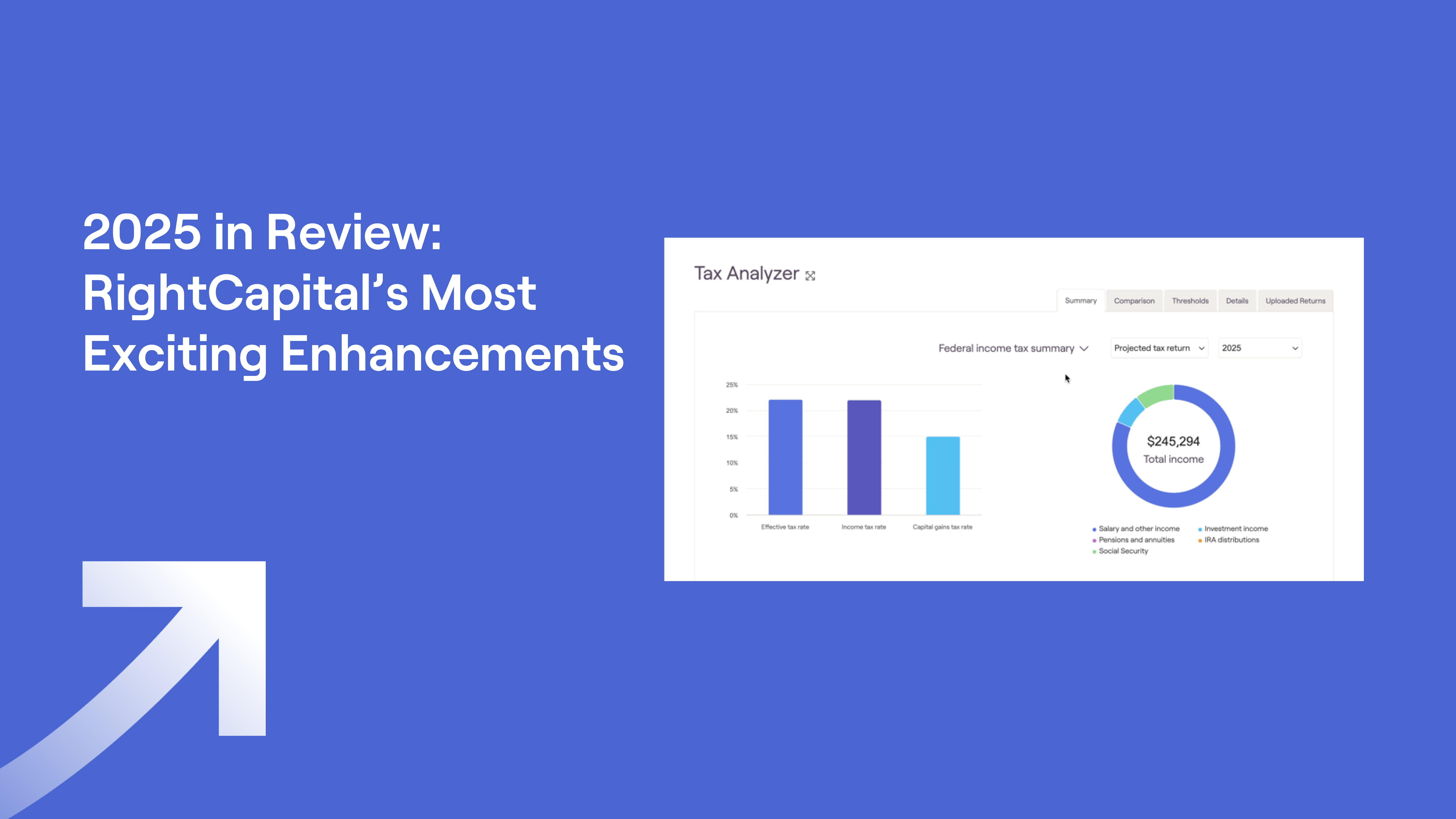

Tax Analyzer

RightCapital’s Tax Analyzer (released in 2025) is included in Premium subscriptions. Tax Analyzer uses advanced OCR to read uploaded tax forms in seconds, populate relevant fields, and support tax-aware planning, so advisors can model alternative scenarios and identify strategies to reduce clients' tax burdens.

RightExpress™ prospecting tool

The Premium subscription adds access to RightExpress, launched in 2025. RightExpress helps advisors build a simplified plan for prospects using up to six RightCapital modules. It supports:

Fast prospect data capture

Instant delivery of a preliminary plan (to demonstrate value early)

Seamless transition from RightExpress to a full client plan after onboarding

Platinum plan: Firm controls and team collaboration

The Platinum subscription is built for firms that require stronger internal coordination, consistency across advisors, and firm-level oversight. This plan includes everything available in the Premium subscription plus:

Team collaboration + oversight

Many advisors choose Platinum for enhanced collaboration, especially when:

Clients are shared across multiple advisors

Firms have additional compliance review needs

Leadership requires visibility into planning processes

Firm-level assumptions and models

Platinum adds firm-wide controls, including the ability to standardize items such as:

Custom asset classes

Assumptions

Models

This supports consistency across plans and advisor teams.

RightFlows™ workflow management

The RightCapital Platinum subscription includes RightFlows, a workflow tool designed specifically for financial planning, including direct collaboration with clients. Features include:

Assignable client tasks

Centralized, kanban-style dashboard for tracking progress

Consistent processes across your team, with flexibility where needed

Enterprise (50+ advisors): What to expect?

Enterprise solutions

If your firm has 50 or more advisors, we recommend contacting our Enterprise team so we can understand your firm’s needs and recommend the best-fit configuration.

Call: (888) 982-9596 (Opt. 1)

Email: enterprise@rightcapital.com

Optional add-ons: RightPay® and assistant access

In addition to subscription tiers, RightCapital offers add-ons that many firms use to expand functionality.

RightPay payment system

RightPay enables easy fee collection inside the platform with:

Flexible payment options

Streamlined advisor workflow

A smooth client experience

Assistant access (Premium and Platinum)

Premium and Platinum subscribers can add assistant access for an additional monthly fee.

Premium: Allows for one assistant license add-on

Platinum: Can support multiple assistant licenses

Assistant access is typically used for data entry and review, while fiduciary responsibility remains with the advisor.

FAQ: RightCapital Financial Planning Software Plans

Which RightCapital plan is best for financial advisors?

Most financial advisors start by comparing Premium vs. Platinum. Premium is often best for those who'd like account aggregation, budgeting, risk assessment, tax analysis, and prospect planning. Platinum is typically best for firms that need team collaboration, oversight, and firm-wide assumptions/models.

Does RightCapital include account aggregation?

Yes. Account aggregation is included with Premium and Platinum. Clients can link accounts so values update automatically (typically nightly), reducing manual data entry for advisors.

Does RightCapital offer a client portal and mobile app?

Yes. All RightCapital plans include access to the client portal and client-facing mobile app, and you can customize branding (logos and colors). You can also control which features clients can use.

What is included in RightCapital’s financial planning modules?

All subscription tiers include advanced planning modules such as investment, retirement, college, insurance, tax, estate and business planning, plus the ability to run scenarios and deliver client-friendly outputs.

What’s the difference between RightCapital Premium and Platinum?

Premium focuses on advisor efficiency and insight (account aggregation, budgeting, RightIntel, RightRisk, Tax Analyzer, RightExpress). Platinum adds firm-level capabilities such as team collaboration, firm controls, and RightFlows workflow management.

Can large firms (50+ advisors) use RightCapital?

Yes. Firms with 50+ advisors may need an Enterprise configuration. Contact RightCapital at (888) 982-9596 Opt. 1 or enterprise@rightcapital.com to discuss firm needs.

Does RightCapital support tax planning for advisors?

Yes. RightCapital includes tax planning across plans, and Premium/Platinum subscriptions include the Tax Analyzer module, which uses OCR to read uploaded tax forms and supports scenario comparisons to evaluate tax impacts.

Is RightPay included in the subscription?

RightPay is an optional add-on that enables fee collection within the platform and supports flexible payment options.

Ready to compare pricing or see the plans in action?

Visit the RightCapital pricing page for subscription costs or schedule your 1:1 RightCapital demo for a recommendation tailored to your firm, workflows, and growth goals.