Acquiring New Clients with Tax-Efficient Distributions

April 29, 2022

When it comes to the mystery of tax planning during retirement, there is a lot of opportunity for financial advisors to help everyday Americans uncover the truth. According to a 2021 survey by Nationwide:

42% of American retirees strongly or somewhat agreed with the statement: “I did not consider how tax rates in retirement would affect my retirement income when I was planning for retirement”.

41% strongly or somewhat agreed with the statement: “I wish I would have better prepared for paying taxes in retirement”.

36% strongly or somewhat agreed with the statement: “I am terrified of what tax rates during my retirement will do to my retirement income”.

In the same survey, 50% of Americans said they would switch financial professionals for someone who could help them plan for taxes in retirement. What if you could be the financial professional they switch to?

What is a retirement drawdown strategy?

Many investors think they have crossed the finish line once they’ve reached their retirement savings goal, but without an effective retirement distribution strategy in place, they may not be leveraging their retirement assets optimally and many are unaware of the potential impact of required minimum distributions (RMDs) to their taxable income.

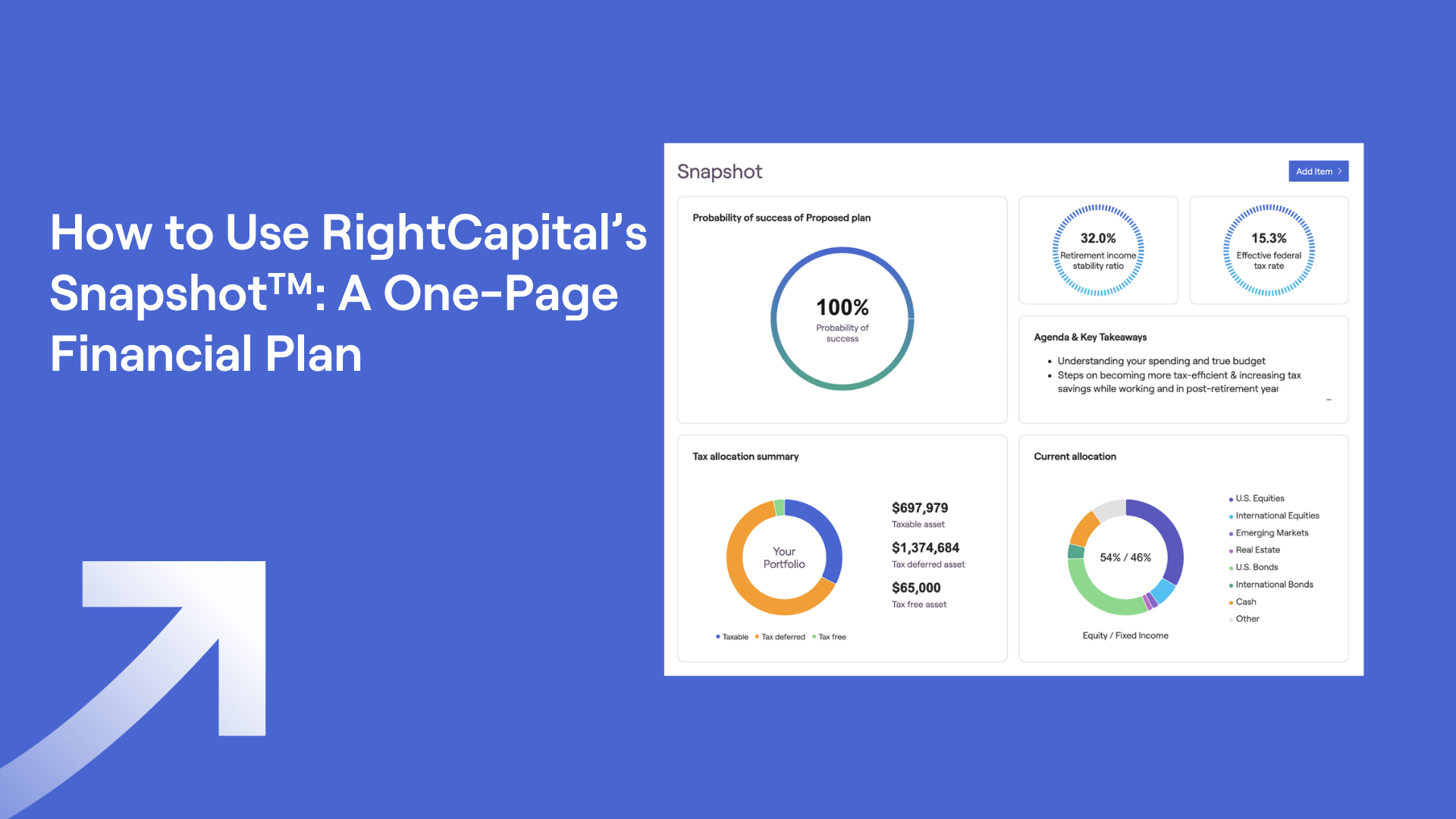

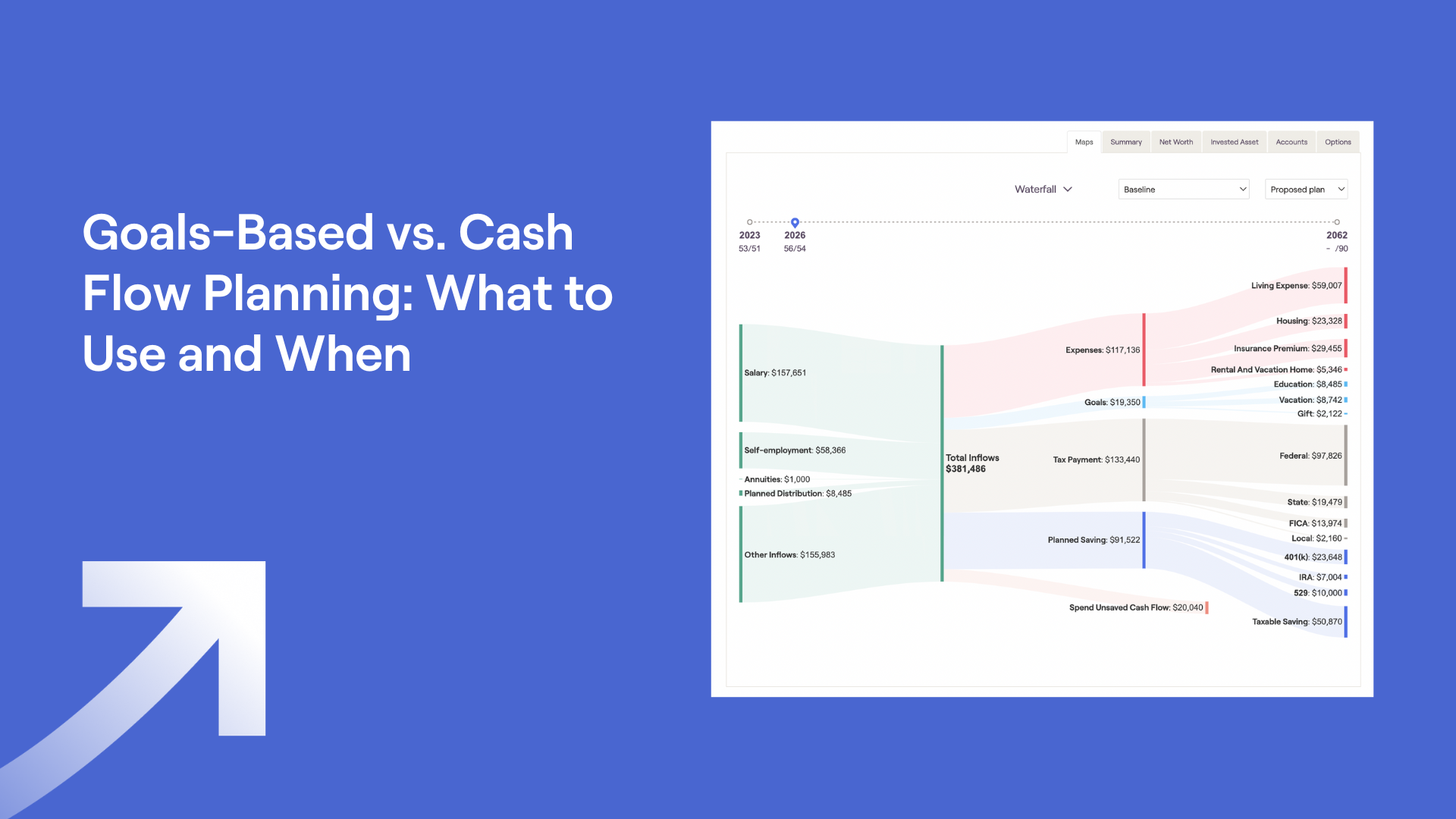

Few clients today have enough income from defined benefit pensions and Social Security to cover their expenses. Today, nearly all retirees must tap into savings to fund retirement expenses. Your client will likely have assets in the three categories of taxable accounts, tax-deferred accounts, and tax-free accounts.

But which accounts should be withdrawn from, and in what order, to minimize tax liabilities in retirement? Lower taxes on retirement income mean greater financial security as savings will last longer, and in this day and age where the number of people in the US living to 100 is expected to quadruple by 2050, this is critical!

What are the different drawdown strategies?

With pro-rata strategy, clients would withdraw from taxable, tax-deferred, and tax-free accounts proportionally. This is not optimal in most cases.

With sequential strategy, clients would withdraw from taxable accounts first, then tax-deferred accounts, and lastly, tax-free accounts. This is a more classic approach that allows tax-deferred accounts to grow to their maximum potential.

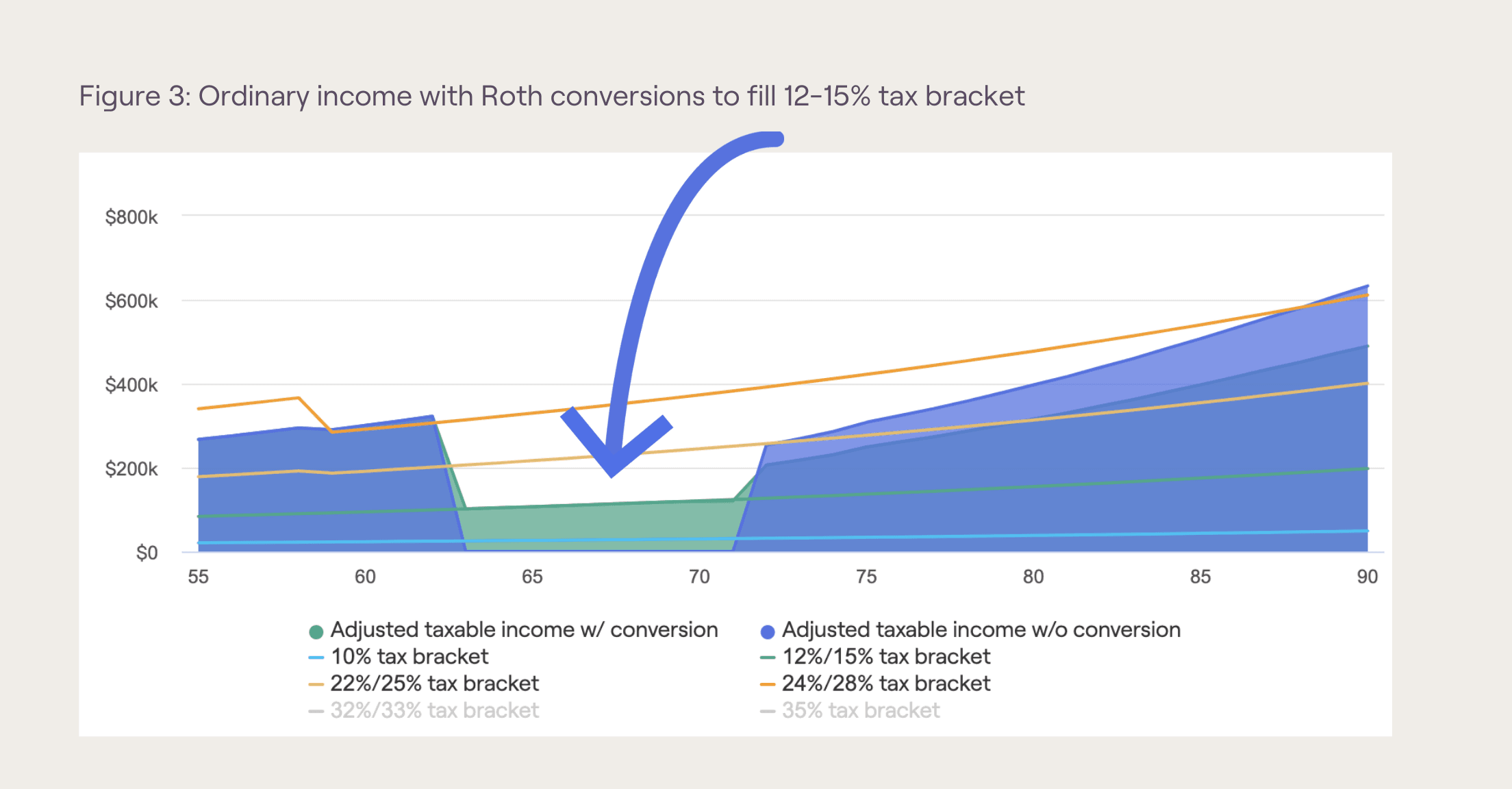

There is also the sequential strategy with Roth Conversion. Clients would follow the same order as in sequential strategy: taxable; tax-deferred; and tax-free accounts, but, in addition, Roth Conversions would be executed to take advantage of periods of lower tax brackets.

An example of the benefits of sequential strategy with Roth Conversion

As an example, let’s look at Mike and Amanda Brady, 56 and 54 respectively, who plan on retiring at 65. They have accumulated retirement assets of $1.5 million in tax-deferred vehicles and $100,000 in taxable investments.

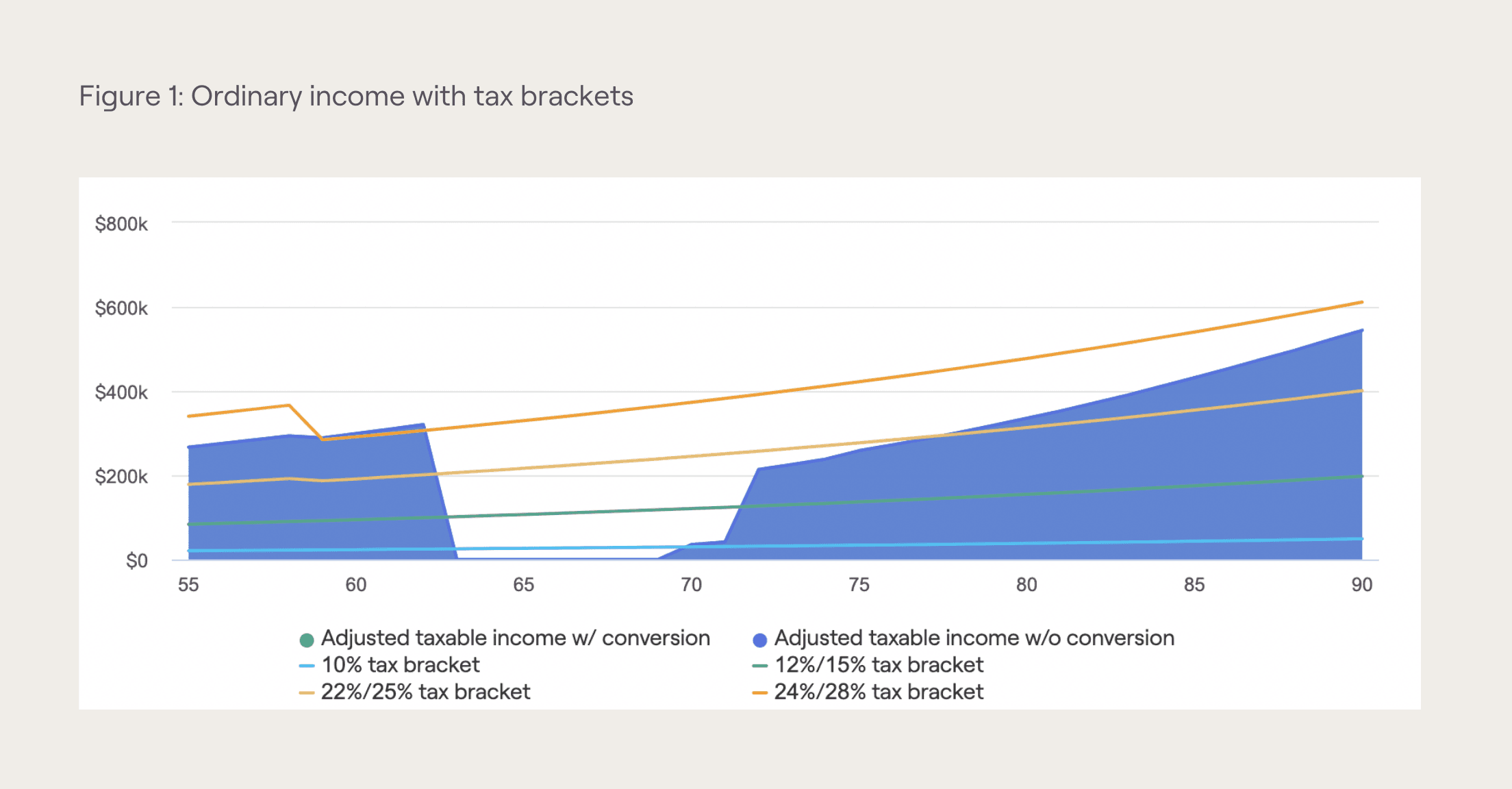

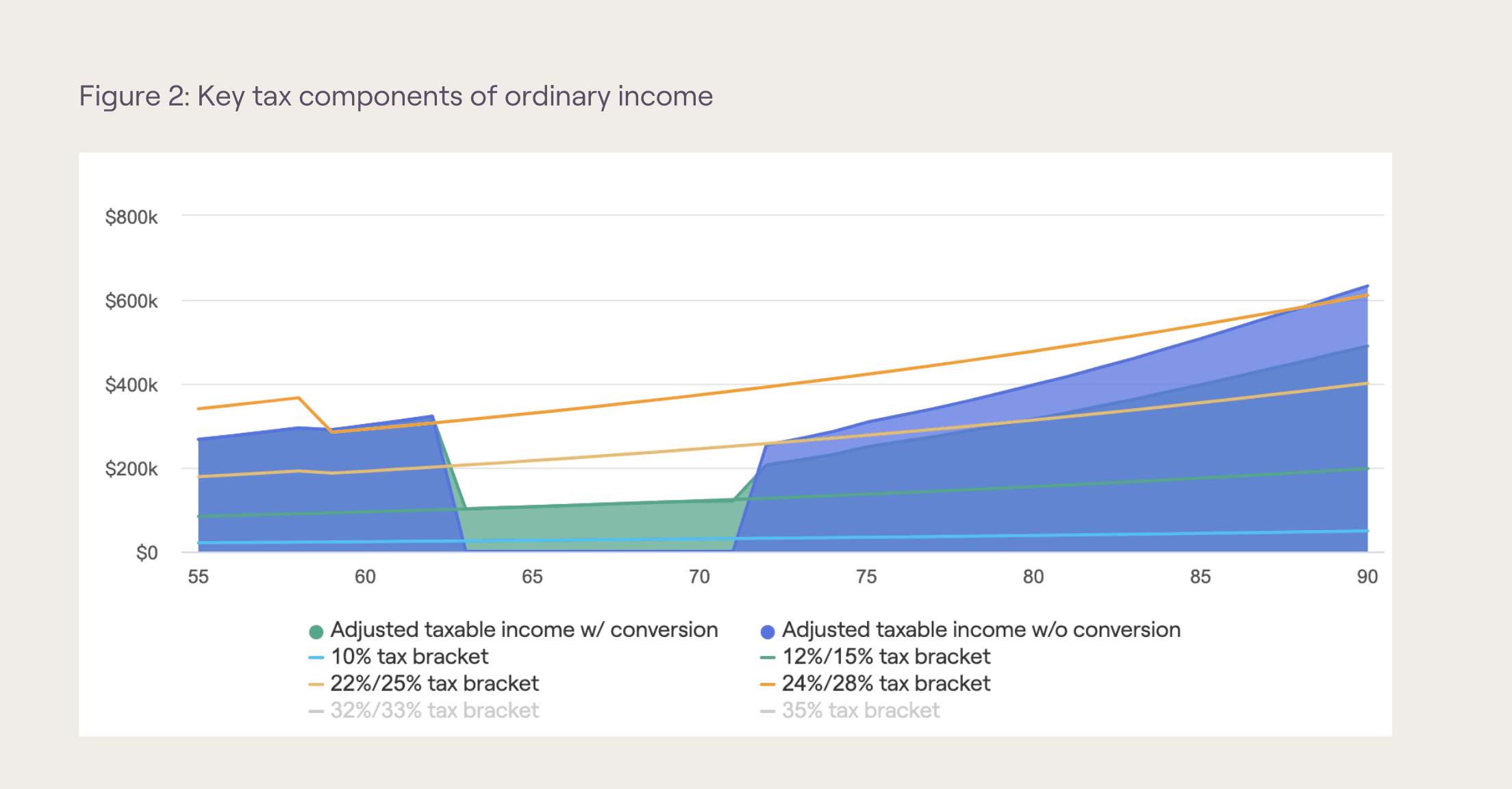

Our initial observation is that their taxes in retirement could be very high. This is driven by Required Minimum Distributions (RMDs) and Social Security.

By altering the sequence of distributions and leveraging Roth conversions in lower tax bracket years, they could achieve a $1.14 million net gain in tax-adjusted income versus a plan that simply used a pro-rata withdrawal strategy without any Roth conversions.

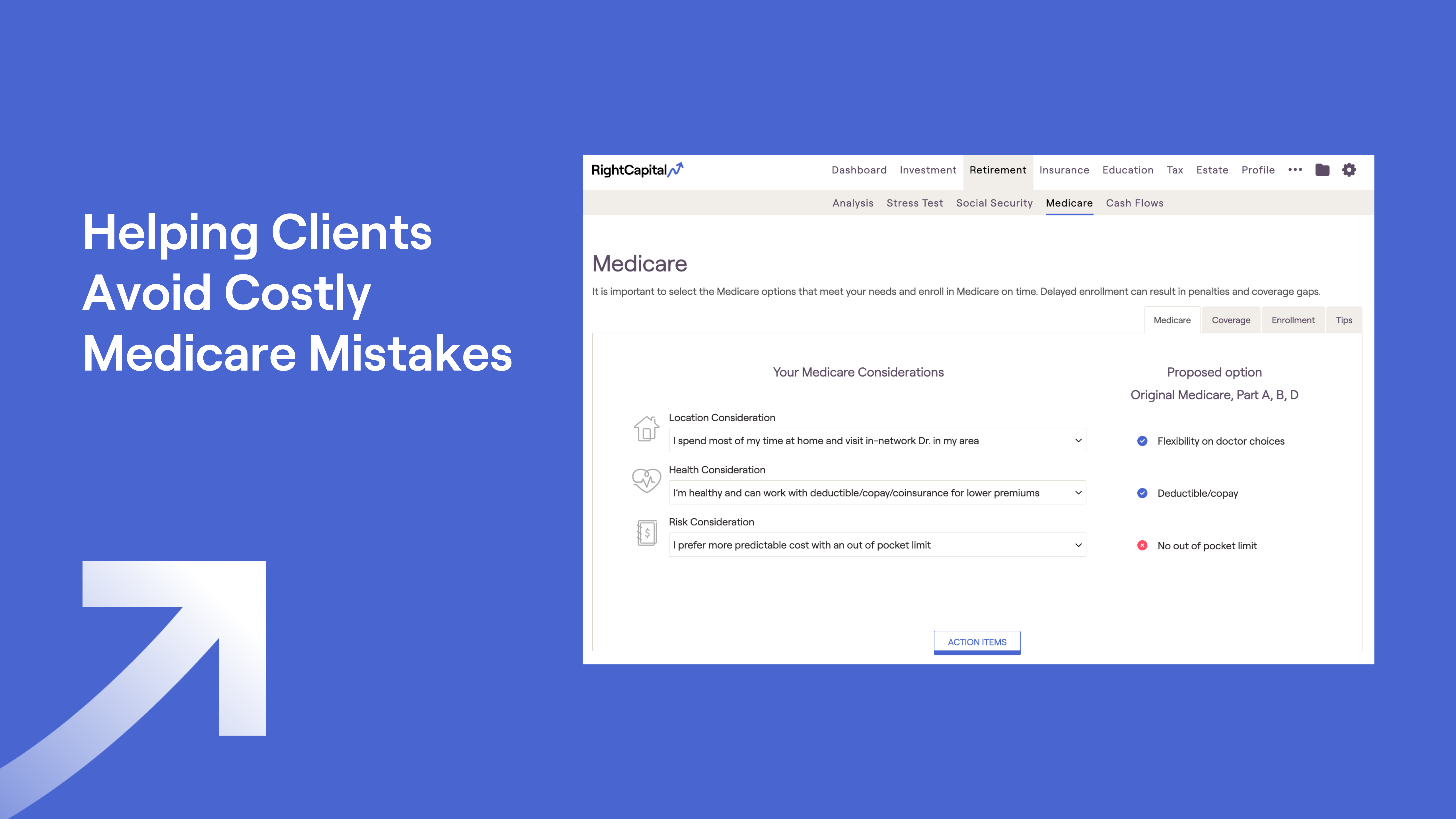

With RightCapital, you can experiment with the order of tax distribution and determine which strategy looks best for each client. With intelligent Roth Conversion optimization, our software can also demonstrate a household’s taxable income in relation to capital gains tax brackets or the Modified Adjusted Gross Income (MAGI) used to calculate adjustment to Medicare premiums in relation to the thresholds that trigger higher premiums (IRMAA).

Many advisors have seen success in acquiring new clients by engaging prospects in a tax-efficient distribution conversation. RightCapital’s intuitive and interactive tools in your proverbial pocket can help make this complex topic easy for clients to understand.