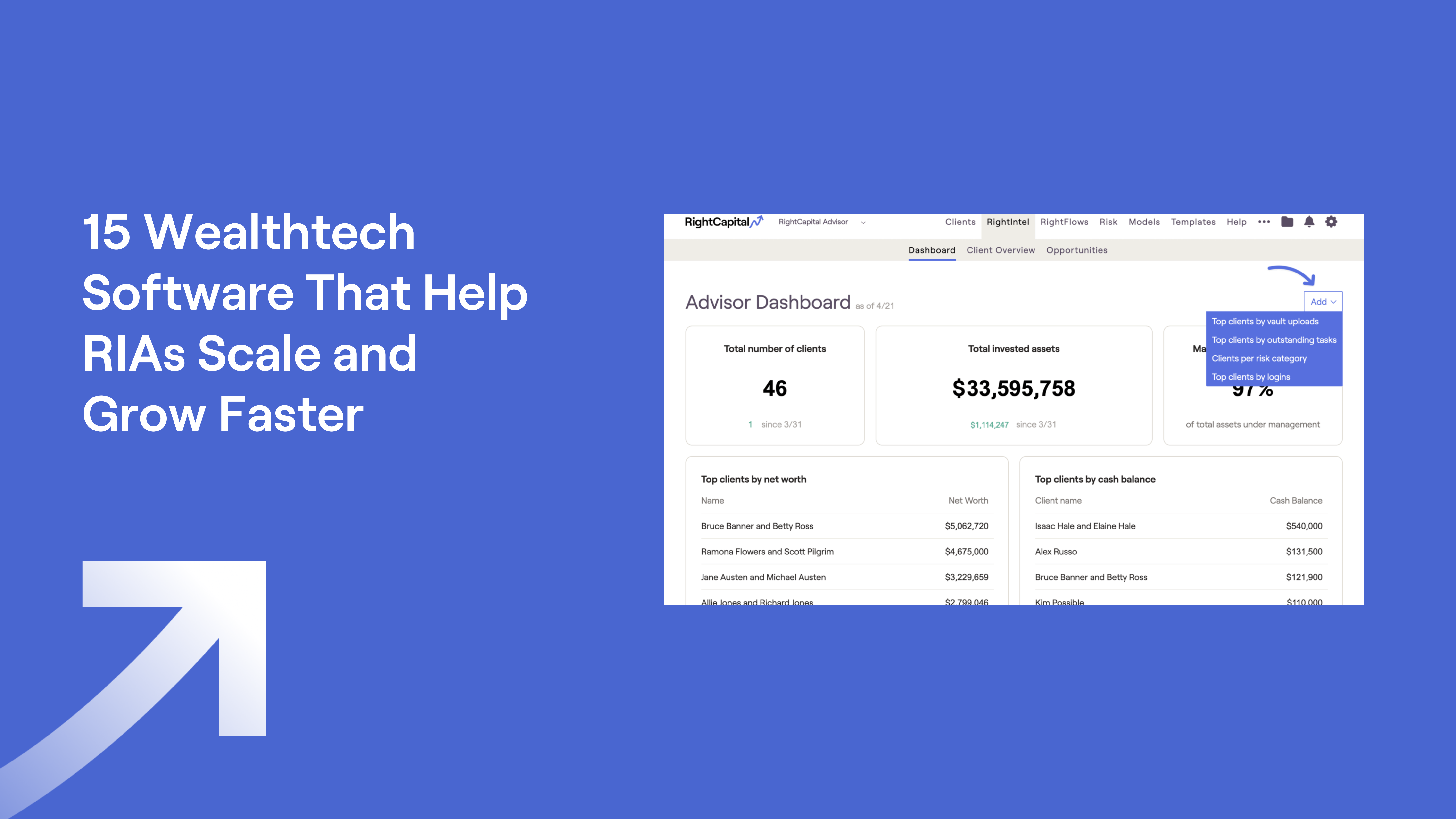

Adding Value with RightIntel and Business Intelligence

July 9, 2024

Financial advisors inherently provide immense value to their clients. Have you ever considered enhancing this value by diving deeper into your clients' complete financial pictures? We’ve come up with seven ideas to help you give your clients a white-glove service approach and discover more opportunities within your client base—without a large time commitment.

RightCapital’s business intelligence tool, RightIntel, can help you identify opportunities so you can focus on the action. All Premium and Platinum RightCapital subscriptions come with access to RightIntel. RightIntel presents all of the above data for you in a customizable dashboard, client overview, and opportunities tool. Sort by account values, upcoming dates, different client groups, interest rates, and more to determine small changes that can make big differences.

Watch a full webinar on RightIntel here or scroll down for some clips from Alexus, our Customer Relationship Lead.

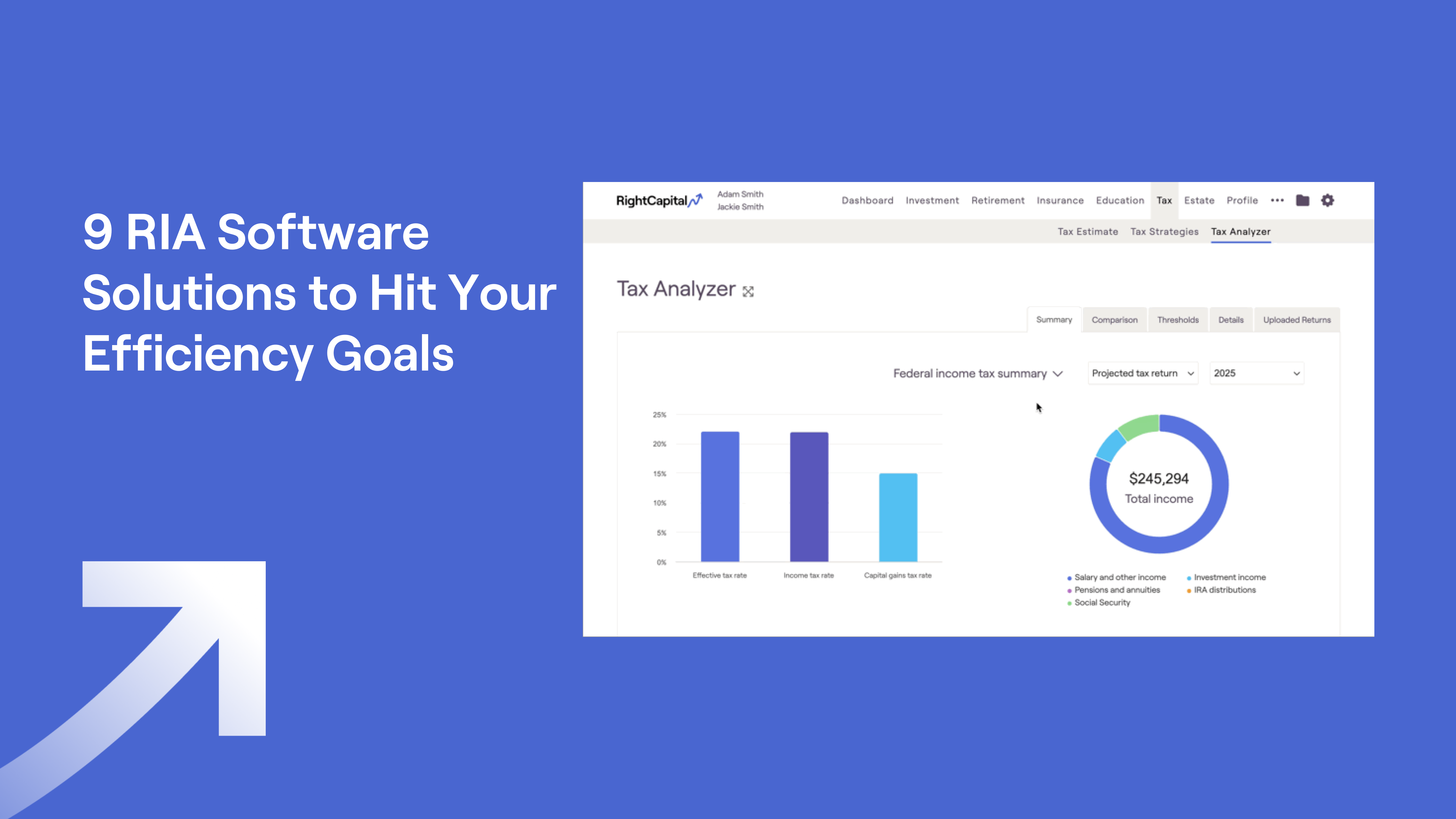

Determine effective ways to manage large cash balances

If you identify clients with large cash balances, make your clients aware of the potential losses they might incur by keeping their cash in low-interest accounts. You may wish to recommend that clients consider investing in the market, contributing more to their retirement accounts, or reducing their debt. If the cash is tied to businesses that your clients own, proposing reinvestment of the cash into their business could be another effective strategy. Here’s Alexus on how you can easily view cash balances of clients within RightIntel, first in “Dashboard” and then in “Opportunities”:

Recommend higher levels of savings

On the flip side, if a client does not have enough cash on hand to cover themselves in case of emergency, you might recommend they bump up their savings or—if the opportunity exists—liquify some of their existing assets. According to Kitces, almost 30% of Americans do not have an emergency fund, and even more surprising, more than 60% of Americans have less than $1,000 in a savings account and more than 20% are without a savings account at all. Emphasizing the importance of being equipped for unforeseen financial circumstances is crucial.

Offer to manage more of clients’ assets

In cases where your clients hold assets that you aren't actively managing, consider proposing to manage these assets yourself. This approach empowers you with a comprehensive understanding of and influence over the entire financial strategy. Alexus provides a detailed walkthrough on how to track managed assets and identify potential opportunities for expanded management using RightIntel:

Review client debt and determine refinancing opportunities

Evaluate if your clients carry mortgages, home equity loans, car loans, or student loans at interest rates higher than market averages. It could be beneficial to recommend strategies such as loan consolidation or refinancing. These moves might lower their financial burden and provide them with more favorable loan terms. Here’s Alexus on how to analyze Debt opportunities in RightIntel:

Examine client insurance needs and policies

Ensure that clients have the appropriate levels of insurance for their particular financial and lifestyle situations and help them avoid lapses in coverage by keeping track of policy expiration dates and identifying future protection needs. This proactive approach ensures their financial safety net remains intact. Alexus shows how to analyze these needs in RightIntel here, first in Client Overview > Insurance and then in Opportunities > Insurance:

Identify milestones to personalize your conversations

Maintaining awareness of your clients' important life milestones, such as turning 59 ½, reaching the age for Required Minimum Distribution (RMD), approaching retirement, or filing for Medicare or Social Security is important. By keeping track, you can ensure that your conversations are timely, relevant, and effectively address the unique financial considerations associated with these important life stages. Here’s Alexus demonstrating the “Key Events” tab within RightIntel:

Encourage clients to be involved with their finances

Monitoring the frequency of your clients' logins to their client portals can help ensure they stay informed about their financial situation and complete any tasks you've assigned. For a clear understanding of this data, you may refer to the "Activities" tab Client Overview in RightIntel. To learn more about this feature, check out this explanation from Alexus:

Learn more about our business intelligence tool and schedule a demo for access to a free 14-day premium trial complete with RightIntel today!