Conducting and analyzing market research takes time and expertise. That’s why we are always thankful to the Kitces team for their in-depth research on how advisors approach financial planning and the role of technology in their planning process.

The latest Kitces Report, “How Financial Planners Actually Do Financial Planning (2023)”, released in January of 2023, analyzes the survey answers from 767 practicing financial advisors who’ve met Kitces’ strict criteria. The 67-page report is full of insights, but if you haven’t gotten through it all yet, here’s a quick summary of the current state of the financial planning software market.

Will ChatGPT replace human financial planners?

Well, not yet anyway. Joking aside, the Kitces survey findings suggest that financial planning is becoming more complex, more collaborative, and more dynamic.

Financial plans are becoming more comprehensive: 54% (a jump from <40% in years past) of the advisors say their financial plans cover 13+ topics.

More advisors prefer a real-time collaborative planning approach with their clients: 47% of all advisory teams collaborate with clients in real time using a financial planning software (via screen sharing or a conference room screen), which is an increase from just 35% of advisors who preferred a collaborative approach four years ago.

Financial planning is less about delivering “the plan” and more about ongoing planning: Of all clients receiving financial planning services, 71% are getting an updated plan at some ongoing point.

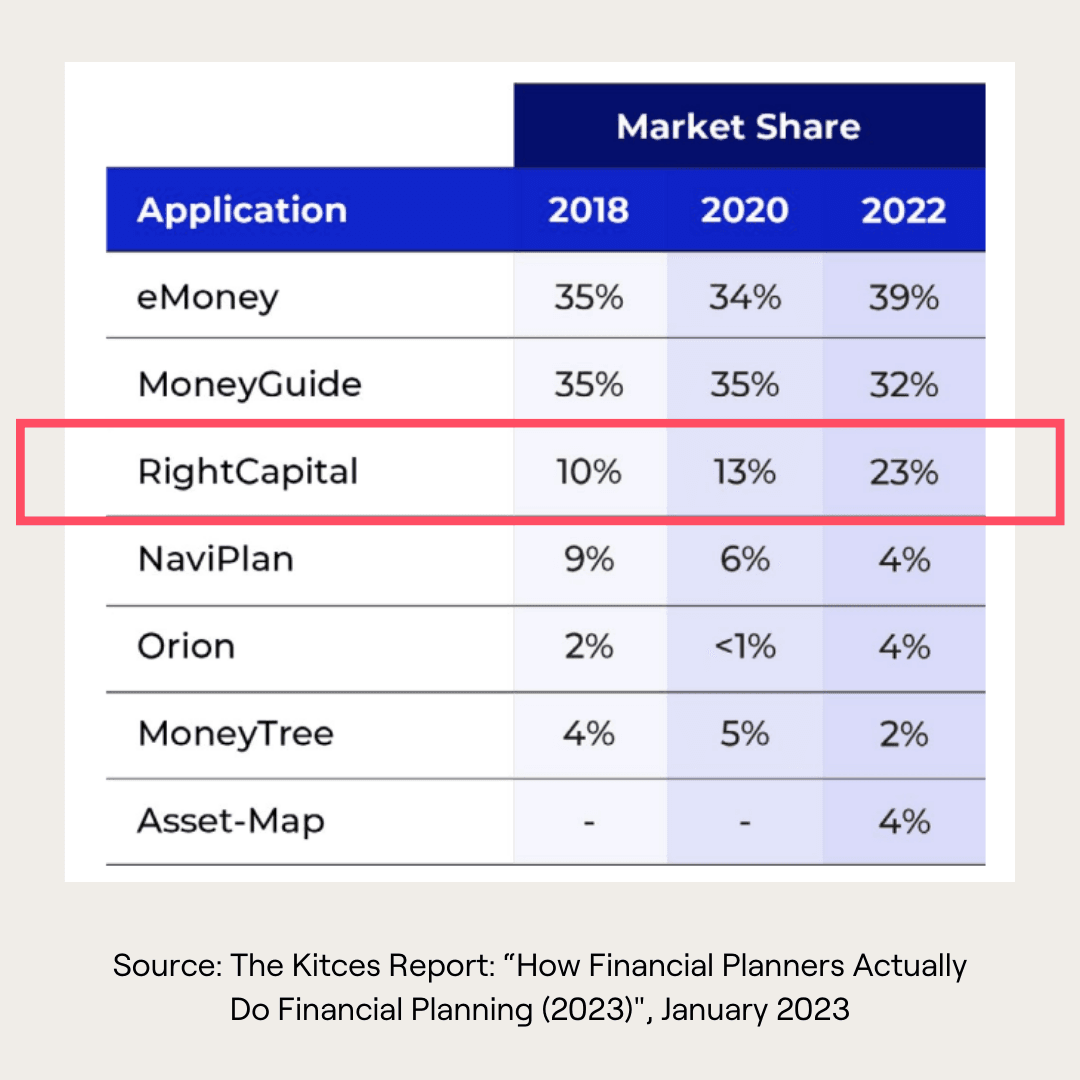

When it comes to financial planning software vendors, there are three clear leaders. But the race is tightening.

RightCapital saw the largest growth in adoption—increasing to 23% in 2022 from 13% in 2020. During the same period, eMoney’s market share rose slightly to 39% while MoneyGuide actually fell slightly to 32%.

Advisors are trending toward “greater depth and breadth in financial planning,” which explains why “the most comprehensive planning tools (including RightCapital and eMoney) are winning market share”. The report notes that “interest continues to wane for MoneyGuide’s simpler goals-based approach compared to more in-depth tools like eMoney and RightCapital”.

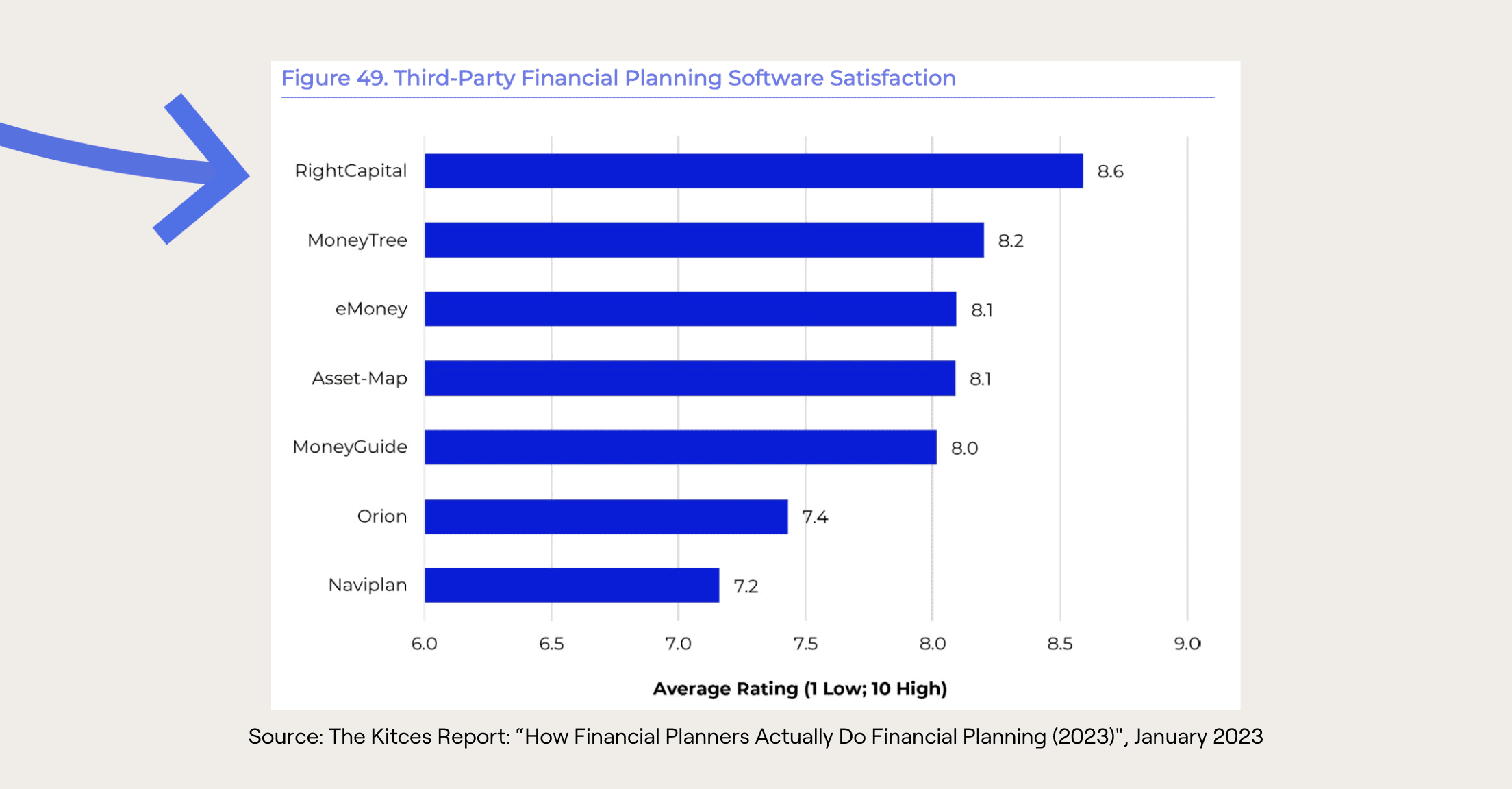

The highest satisfaction rating goes to…RightCapital! 🎉

RightCapital leads the pack with the highest satisfaction ratings (8.6/10), which might explain why it has become the fastest-growing financial planning software.

RightCapital wins on depth and breadth of planning, client portal, and collaboration capabilities

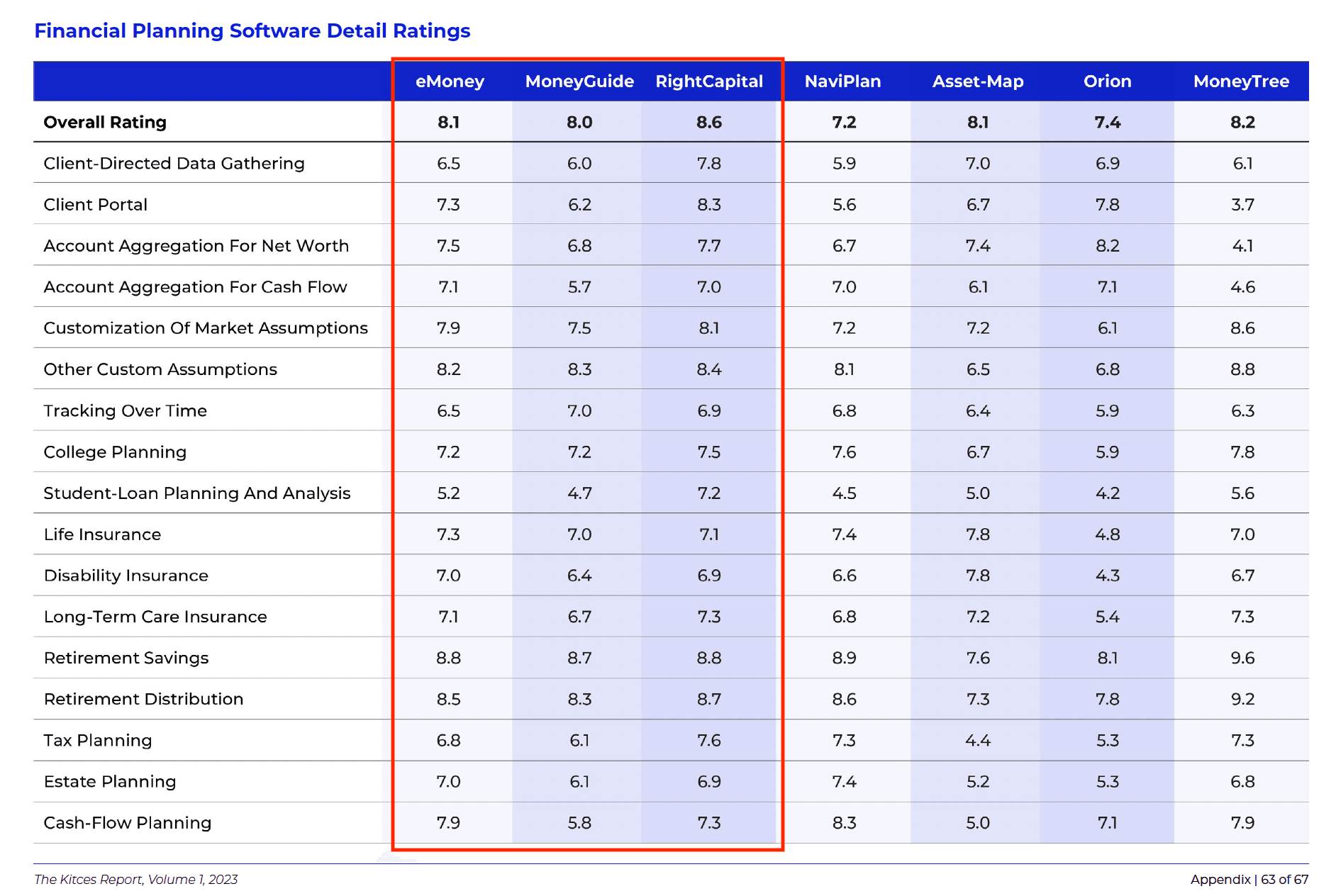

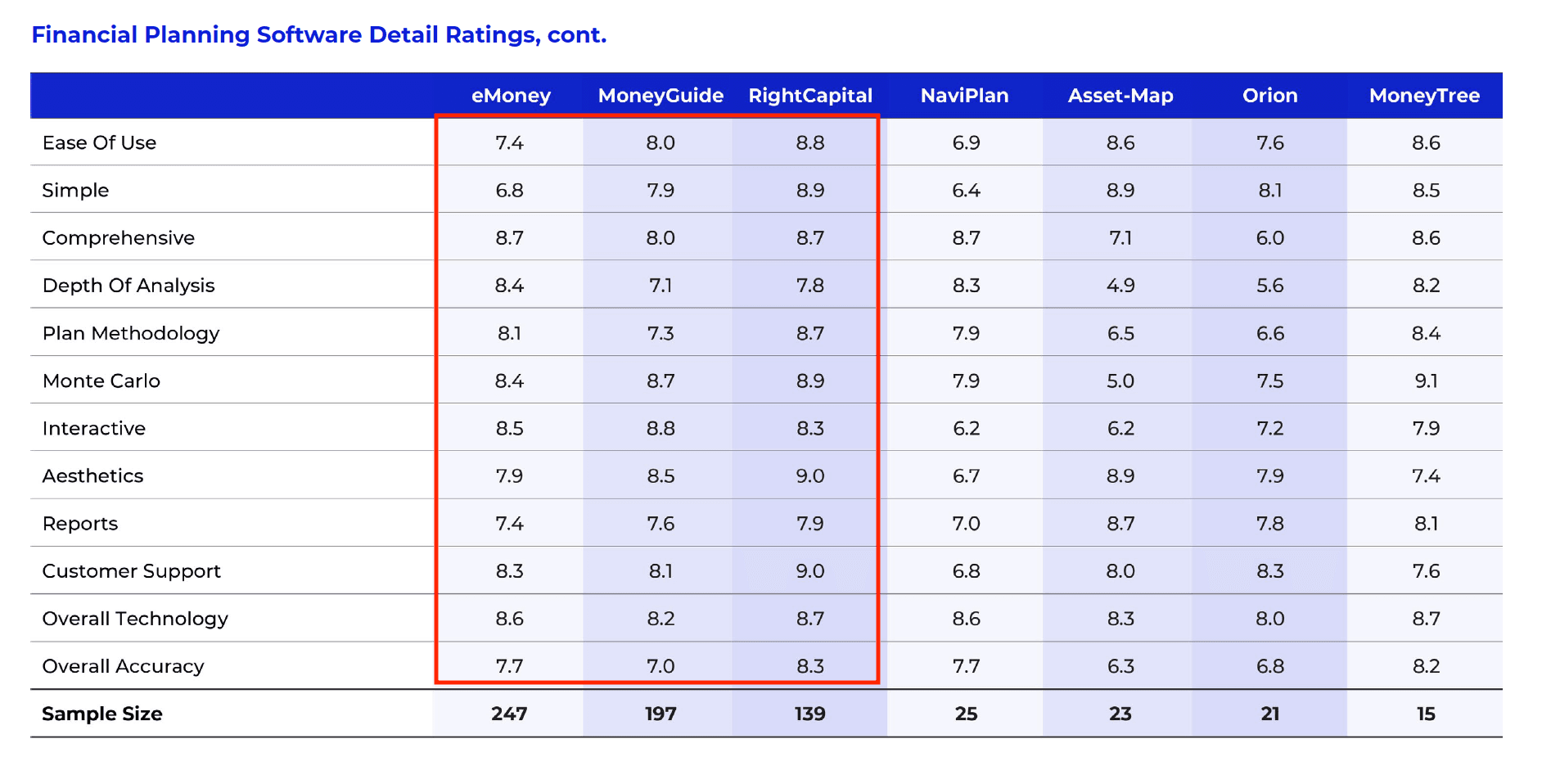

The report digs deeper into seven financial planning software tools by rating them across 29 sub-categories. Not surprisingly, only eMoney, MoneyGuide and RightCapital had a statistically significant sample size (responses > 100). Looking at these three vendors only, RightCapital had the highest satisfaction rating in 19 out of 29 sub-categories.

In comparison to eMoney and MoneyGuide, RightCapital’s biggest standouts were Student Loan Planning and Analysis, Client Portal, Simplicity, Client-Directed Data Gathering, Tax Planning, and Ease of Use.

The report calls out that “the fact that RightCapital shows up near the top of the advisor satisfaction ratings across several of these sub-categories—for depth and breadth of planning, its client portal, and its collaboration capabilities—helps to explain why it is gaining market share so rapidly.”

RightCapital is more of a “one-stop shop” than other planning software

Data integrations are important for sure, but the survey found that “RightCapital users tend to have reduced reliance on other specialized software…RightCapital is effectively proving itself to be the most efficient at creating extensive financial plans by more consistently operating as a ‘one-stop shop’ compared to its competitors.”

It continues, “Only 41% of advisors using RightCapital also used specialized planning software, compared to 48% of all advisors using comprehensive planning applications. This suggests RightCapital is doing a better job of actually incorporating the full breadth of analyses that advisors tend to conduct, reducing the need for advisors to invest in other software to supplement.”

If you’re curious why more advisors are happier with RightCapital, get a 14-day free trial!

Schedule a 20-min demo to get a 14-day free trial of RightCapital. As a trial user, you’ll also get to experience firsthand RightCapital’s awesome training and support team (also rated #1).

To read the full report, download the complimentary copy from the Kitces website: “How Financial Planners Actually Do Financial Planning (2023)”.