Goals-Based vs. Cash Flow Planning: What to Use and When

November 21, 2025

One of the great debates in financial planning is which planning method delivers the most accurate, actionable recommendations for your clients. Different platforms take different approaches. Some (such as eMoney) allow you to plan in both modes; others (such as MoneyGuide) are more focused on goals-based planning. With RightCapital, financial advisors have the flexibility to choose between cash flow, goals-based, or a third “modified cash flow” option that allows for the control of savings.

In this guide, we’ll define each approach, compare the pros and cons, and show practical ways to win client buy-in and present plans clearly, using RightCapital’s interactive visuals and scenario modeling.

What is goals-based planning?

Goals-based planning is a financial strategy that focuses on the post-retirement plan, not fully considering the pre-retirement years. As the name implies, this approach captures goals, savings contributions, Social Security, pension income, and annuity income streams.

Who benefits most/when to use goals-based planning

Retirees or near-retirees who like to see their asset drawdown or growth while considering their retirement spending goals and savings

Prospects who may need a preview of a quick plan before committing to a full financial planning offering

Clients who find granular budgeting overwhelming or those who may not provide all of the necessary information, and prefer to look at post-retirement years' assets

Goals-based planning excels at clarity and speed. However, without detailed pre-retirement cash inflows, outflows, and full tax modeling, it can be less precise, especially when tax strategy and savings capacity are central to the plan. With clients who are not yet retired, this method may result in hard conversations with the client about needing to create more realistic goals. It can be challenging to make thoughtful financial goals before knowing what is possible, but it can help push the needle with a prospect who needs a quick preview of financial planning before looking at the comprehensive plan.

What is traditional cash flow planning?

Cash flow planning is commonly referred to as the comprehensive financial planning approach. It considers all details entered into the plan including income sources, savings contributions, expenses, existing net worth, and goals. Because of this, it allows for more complex planning and a solid grasp of the entire financial picture. At a high level, it projects a client’s yearly inflows and outflows in detail to demonstrate how money moves through their financial life and how decisions can affect savings, investments, and taxes over time.

Because it tracks all details entered into the plan from pre-retirement to post-retirement, cash flow planning naturally supports advisors looking to make tax-smart recommendations, such as Roth conversions, or other meaningful financial planning strategies.

Who benefits most/when to use traditional cash flow planning

Clients who need comprehensive financial planning and multiple planning topics such as debt management, insurance analysis, or budgeting

Business owners or households with stock plans and rental properties

Clients looking to explore trust proposals or other estate planning strategies

Pre-retirees and early retirees navigating multi-phase incomes and important tax planning phases

Clients who diligently track expenses and are avid savers of “the next dollar”

In a traditional cash flow plan, excess income is assumed to be saved into the taxable bucket and invested in the client’s asset allocation.

What is modified cash flow planning?

Modified cash flow planning models detailed inflows and outflows but assumes excess cash is spent unless explicitly saved. It preserves the realism of cash flow tracking while reflecting how clients actually live and spend their hard-earned money. Additionally, as it is a popular strategy to reinvest unspent Required Minimum Distributions (RMDs) from tax-deferred assets into the taxable bucket, there is a setting within RightCapital that the advisor can turn on that will do so automatically with this method.

Who benefits most/when to use modified cash flow planning

Clients who tend to spend extra cash unless a specific savings target is set

Those who would like more discipline about what is saved vs. spent

Households hoping for more realistic pre‑retirement projections as “automatic saving of every leftover dollar” could overstate savings behavior

Clients who don’t save but have the potential to

Clients who have unpredictable spending habits or are prone to splurges

This method allows for advisors to account for budgeting inaccuracy as it can be difficult for clients to understand and communicate true savings. In RightCapital, advisors will find a column in the Cash Flow Summary tab labeled “Spend Unsaved Cash Flows.” This can be viewed as an opportunity for additional savings that the client may not have expected. If you and the client decide to capture that opportunity, it can be directed to a taxable savings card or another account, maintaining flexibility without over-promising savings that may not materialize.

Cash flow planning vs. goals-based planning

Use this quick comparison chart to decide when to deploy goals-based, cash flow, or a modified cash flow planning approach.

| Planning Method | Pros | Cons |

|---|---|---|

Goals-based planning | Simple and prospect-friendly; fast onboarding; keeps focus on outcomes; great for post-retirees; high-level retirement focused visuals | May omit detailed pre-retirement cash flows and important tax calculations; less granular; can misstate savings and goal-funding capacity |

Traditional cash flow planning | Full financial planning capabilities; tax-smart recommendations; models variable income and life phases; easy to see more details or high-level visuals | Data input can overwhelm some clients; sensitive to spending assumptions and can overstate savings as a result |

Modified cash flow planning | Highest precision; realistic for many households’ spending behavior; flexible control; transparent tracking while still offering full financial planning; easy to see more details or high-level visuals | Requires more effort than cash flow planning to indicate taxable savings; data input can overwhelm some clients |

How to clearly present cash flow plans to clients

Cash flow based plans can illustrate detailed breakdowns while also offering intuitive visuals to serve as the backdrop for client conversations. The key is to keep the visuals simple, highlight the conclusions, and make the plan interactive so clients remain engaged.

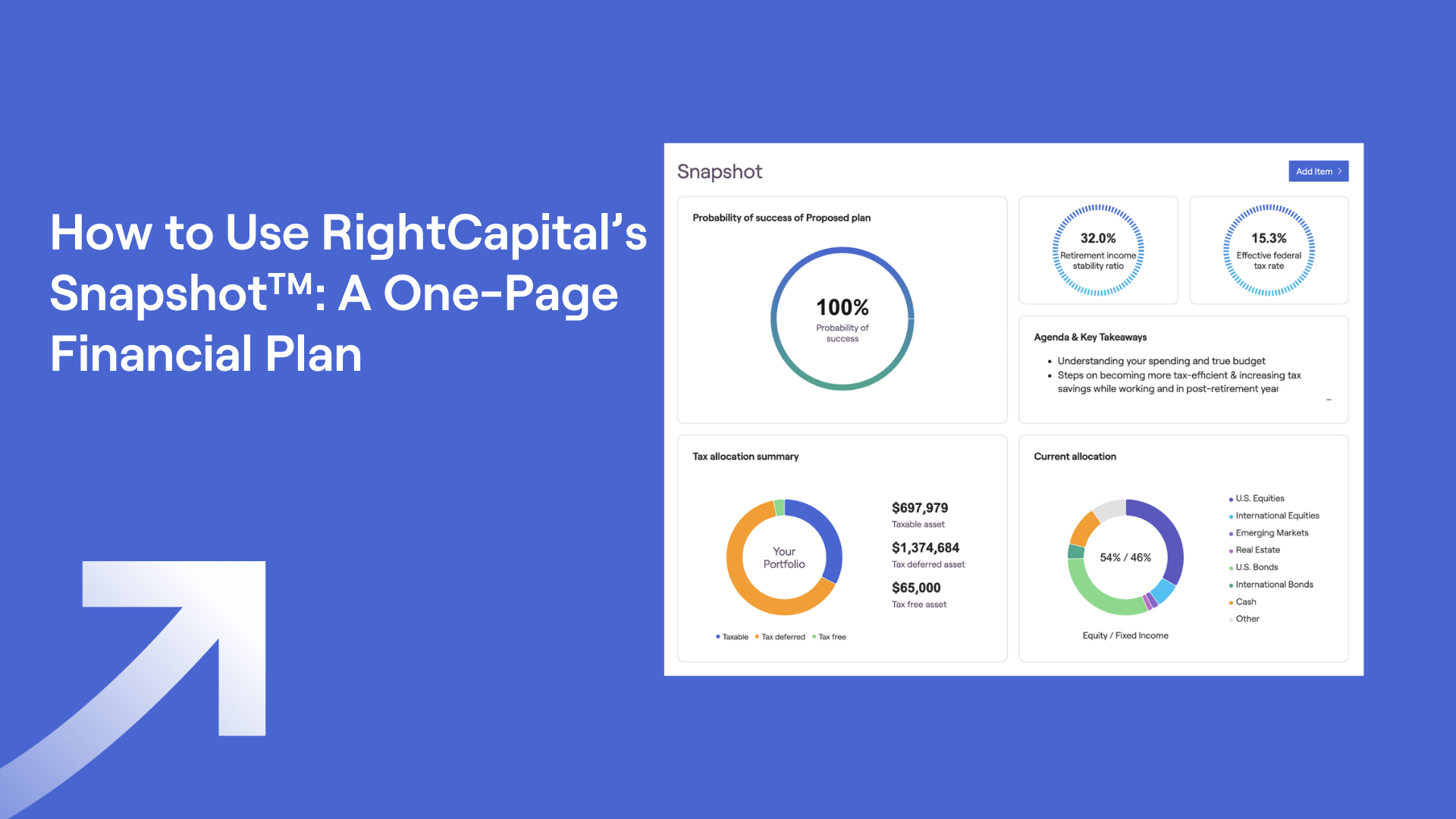

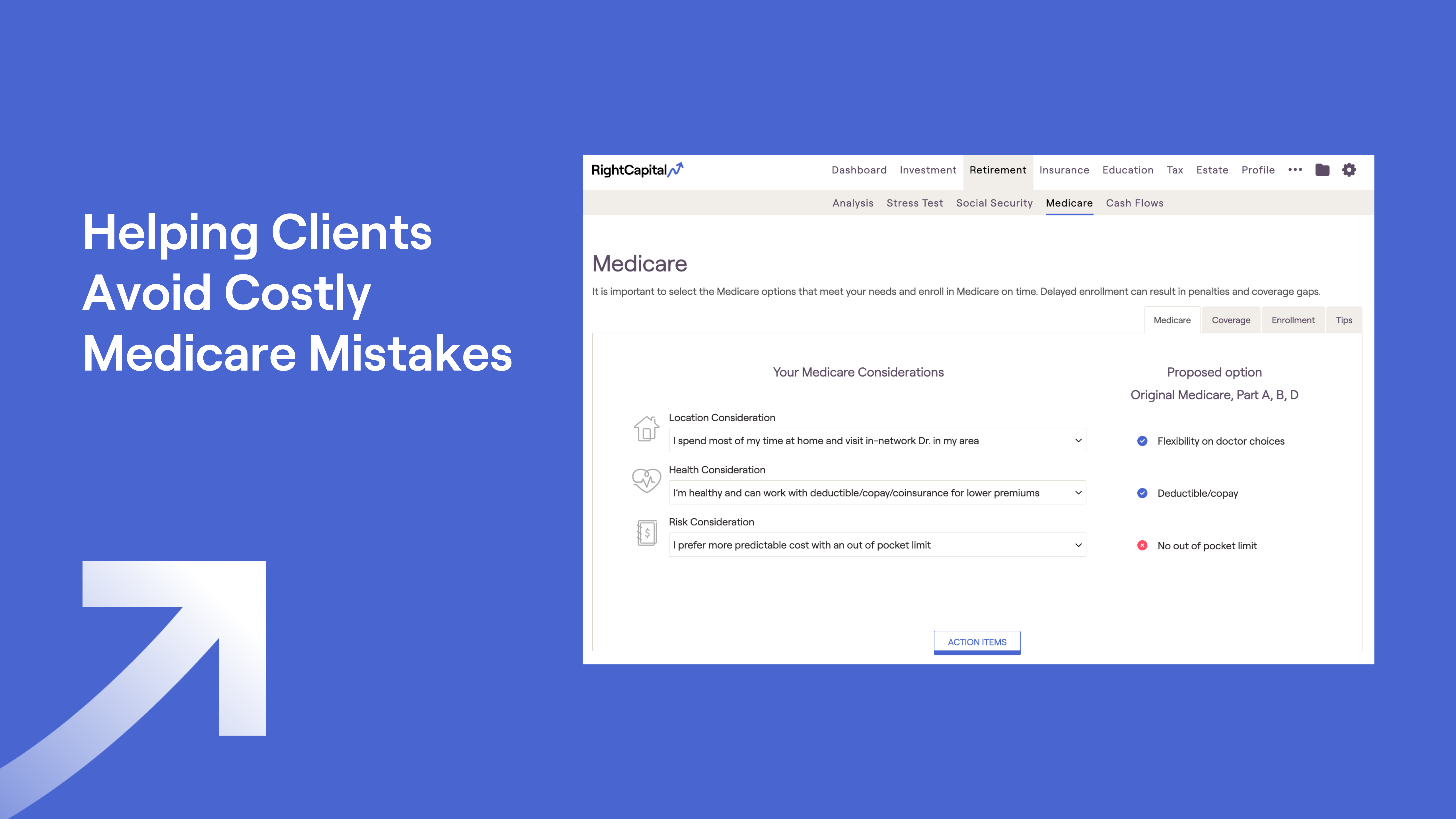

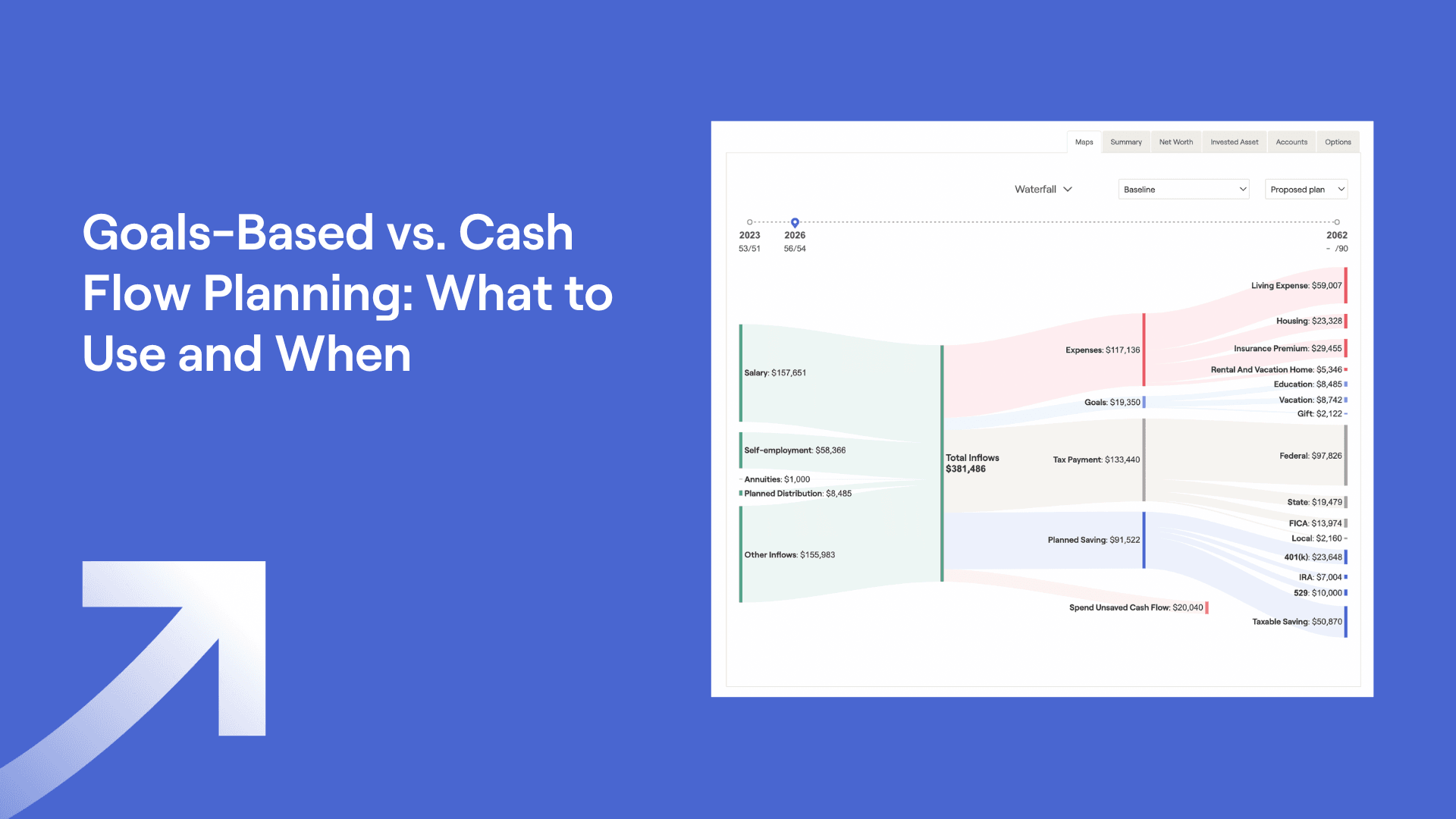

RightCapital supports cash flow planning by enabling advisors to create detailed, year-by-year projections of client income, expenses, savings, goals, net worth, and taxes. Its interactive tools, such as Cash Flow Maps and scenario modeling features, allow advisors to visualize how financial decisions impact a client’s plan over time.

With capabilities to model tax strategies, variable spending patterns, and multi-source retirement income streams, RightCapital helps advisors provide more accurate, flexible planning for clients. These tools are especially useful for illustrating short-term and long-term outcomes in ways clients can easily understand and engage with during planning conversations.

Use interactive visuals

Show the big picture first, then drill down. RightCapital’s yearly Cash Flow Maps (Sankey charts) illustrate where every dollar goes across earnings, taxes, savings, and spending so clients immediately understand the flow. Present interactive charts to highlight how timing trade-offs (such as Social Security filing ages, pension options, and stock plan liquidation strategies) affect the client’s finances in the long run.

Share side-by-side comparisons

It’s always important to enhance the conversation with comparisons of the current plan against your proposed plan with easy-to-understand visuals.

With modified or traditional cash flow based planning, you can develop more in-depth proposals than with goals-based planning. Since goals-based planning is retirement focused, any proposals revolve around those types of topics, such as retiring earlier or taking a vacation sooner.

As modified and traditional cash flow based planning both focus on comprehensive financial planning, they can offer more persuasive comparison visuals than goals-based planning. With that being said, in RightCapital there are many retirement focused visuals that can be leveraged with whichever planning methodology is selected.

Customize the client experience

Tailor reports to each household’s style: high-level visuals for some and detailed cash flow breakdowns for others. Use RightCapital’s client portal to give clients on-demand access to their financial plans so they can explore scenarios in between meetings or collaborate with you throughout the planning process.

Conclusion

Cash flow planning allows for more precision and flexibility in planning, especially when dealing with tax-smart planning or any other nuanced strategy. Goals-based planning offers strong visuals with less required information, making it an easier choice for prospects or those who prefer quick simple retirement snapshots. RightCapital brings these methods together in one platform, so you can deliver advice clients understand and act on.

If you’d like the flexibility to choose the best planning method for each client and present it with clear visuals, RightCapital could be the right financial planning software for you. You can also set a universal planning method across the board as a default if you prefer. Schedule a demo to learn how to demonstrate different planning methods in practice.