We understand that making a decision about which financial planning software is right for your practice is a big one. eMoney and RightCapital are both leaders in the financial planning software category. Let’s dig into what makes them different. (Trying to decide between RightCapital and MoneyGuidePro? This post may help.)

RightCapital vs. eMoney cost

RightCapital’s retail pricing is found on our website’s pricing page.

While eMoney Advisor does not publish costs on their website, here’s what we know about their retail pricing from industry sources:

eMoney charges extra for these features that come with all subscriptions of RightCapital:

Goal-based planning (not included with eMoney Pro)

Marketing campaign resources

Advisor-branded client education materials

Additional training

RightCapital vs. eMoney functionality

eMoney has been around for more than two decades and RightCapital is a newer entrant in the space founded in 2015. As a result, it took a few years for RightCapital to achieve feature parity with eMoney. But today, RightCapital offers advisors many modules and features not found within eMoney, such as:

Advanced Social Security optimization such as government pension offset, windfall elimination provision, etc.

Medicare planning & premium calculation

Fully integrated risk assessment tool with customizable questionnaires

RightCapital vs. eMoney advisor satisfaction ratings

The Kitces Report from August 2023 reveals that RightCapital's overall user satisfaction score witnessed an increase to 9.1 out of 10, a significant increase from 8.6 in 2021. This surpasses eMoney's rating of 8.4 out of 10, which remains unchanged from the previous survey.

RightCapital also achieved a higher advisor rating than eMoney in 10 of the 13 sub-categories, including standouts where RightCapital was the highest of all the platforms included the survey:

RightCapital received top rankings on 4 attributes: plan methodology (RightCapital can model both goals-based or cash-flow-based plans), Monte Carlo simulations, ongoing advice engagement (highlighted by RightCapital’s recent Blueprint and Snapshot tools), and customer support.

The January 2024 T3/Inside Information Advisor Software Survey also revealed that RightCapital (with an average 8.46/10 user rating) was the highest rated software, as it was in the 2022 and 2023 surveys:

RightCapital vs. eMoney getting started

The most common feedback we hear from advisors transitioning from eMoney to RightCapital is how easy it is to get started with RightCapital.

According to advisors we spoke with, it can take three to six months to get completely up to speed with eMoney. One G2 review for eMoney illustrates this point, “With so many options it can be overwhelming.”

The Kitces Report from August 2023, “The Technology That Independent Financial Advisors Actually Use And Like” notes how eMoney is “incredibly in-depth" but at the expense of simplicity:

eMoney, second to RightCapital in overall satisfaction, received top ratings on 3 other specific attributes: comprehensiveness, depth of analysis, and interactivity, speaking to its overall reputation for being incredibly in-depth (albeit at a ‘cost’ of simplicity, where eMoney ranked second-to-last behind only NaviPlan).

It usually takes advisors less than a month to feel comfortable working with RightCapital. If you indicate to your dedicated onboarding specialist that you’re not feeling totally comfortable with the system, they will schedule follow-up calls to get you well on your way. All RightCapital training is totally free.

RightCapital vs. eMoney user experience

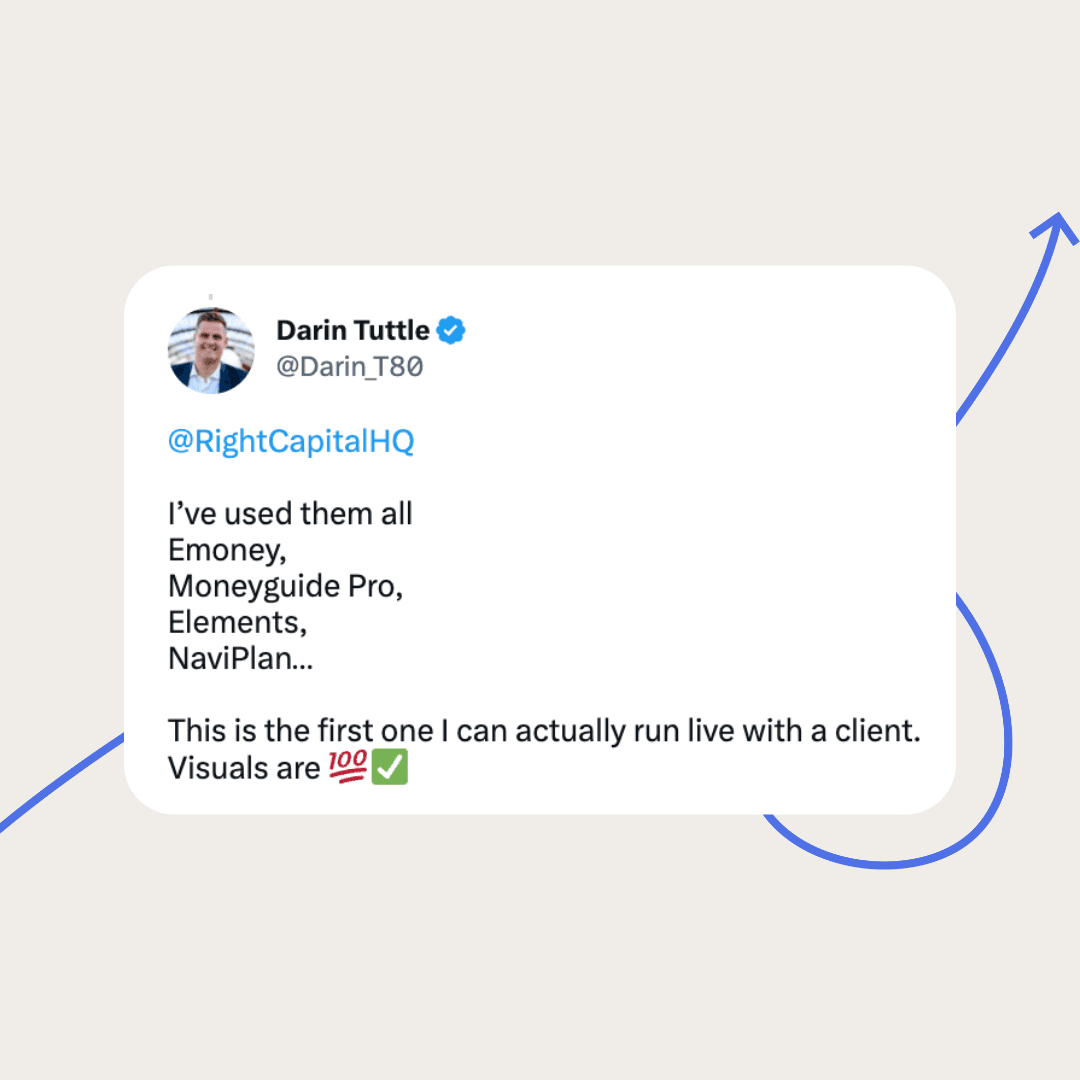

As the Kitces Report noted, RightCapital leads eMoney in terms of satisfaction rating for Ease of Use, Simplicity, Visuals, and Reporting Output. Advisors often share on social media how much they love our intuitive visuals and design:

Watch this case study to hear how one advisor was particularly impressed with our aesthetically pleasing interface and the ability to provide a one-page Snapshot. Another advisor has noted, “It’s pretty remarkable how RightCapital found a way to take all this information and communicate it in a way that’s intuitive, aesthetic, and clean, and in some ways, higher-tech than a lot of the other platforms, while still feeling simple and approachable.” In this blog post, an advisor discusses her switch to RightCapital from eMoney, highlighting the visual appeal and client engagement, while also noting that what she missed about eMoney was more for the advisor than the end-clients.

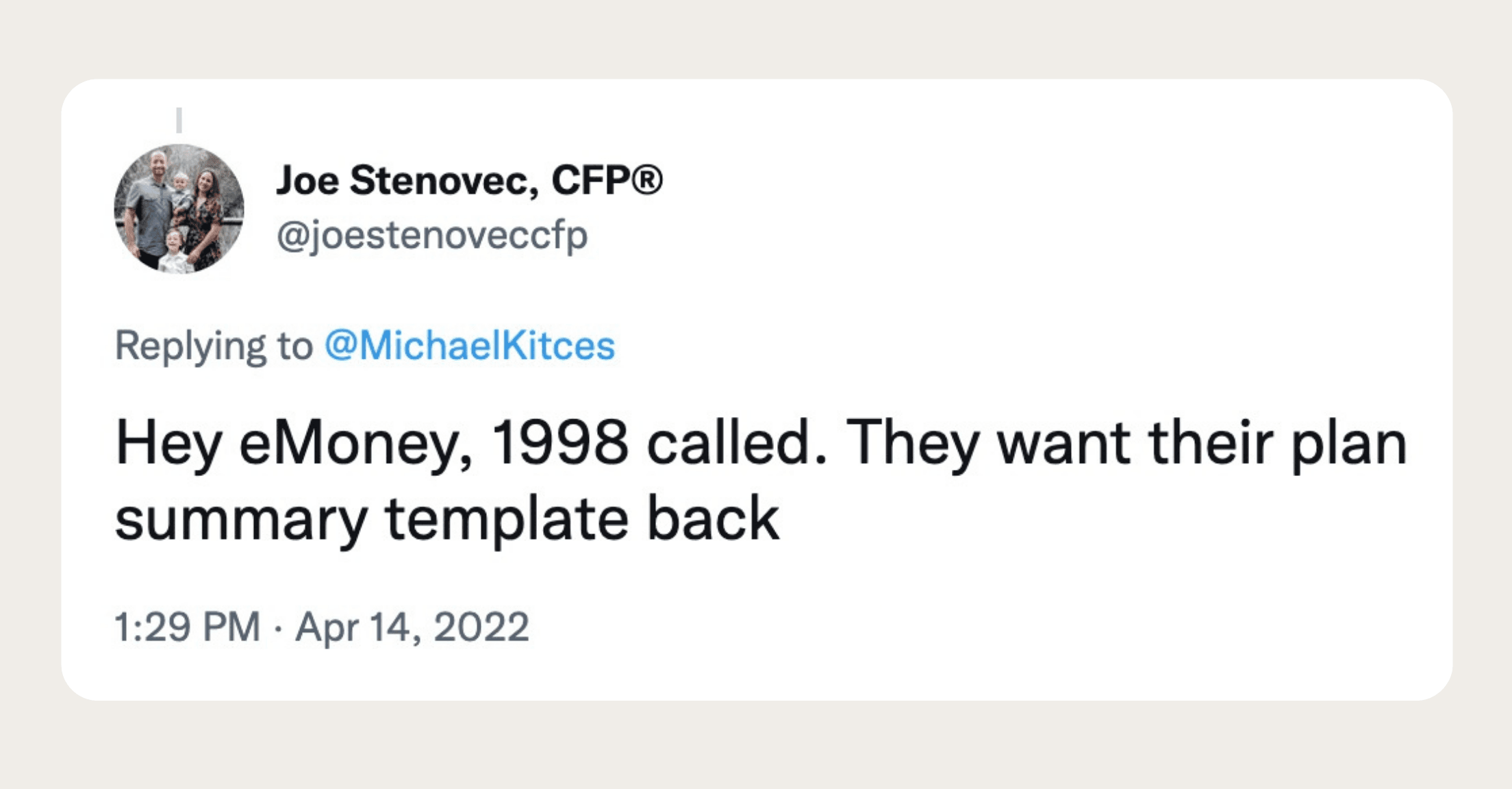

Not surprisingly, this advisor pointed out how design and user experience don’t seem to be eMoney’s core strength:

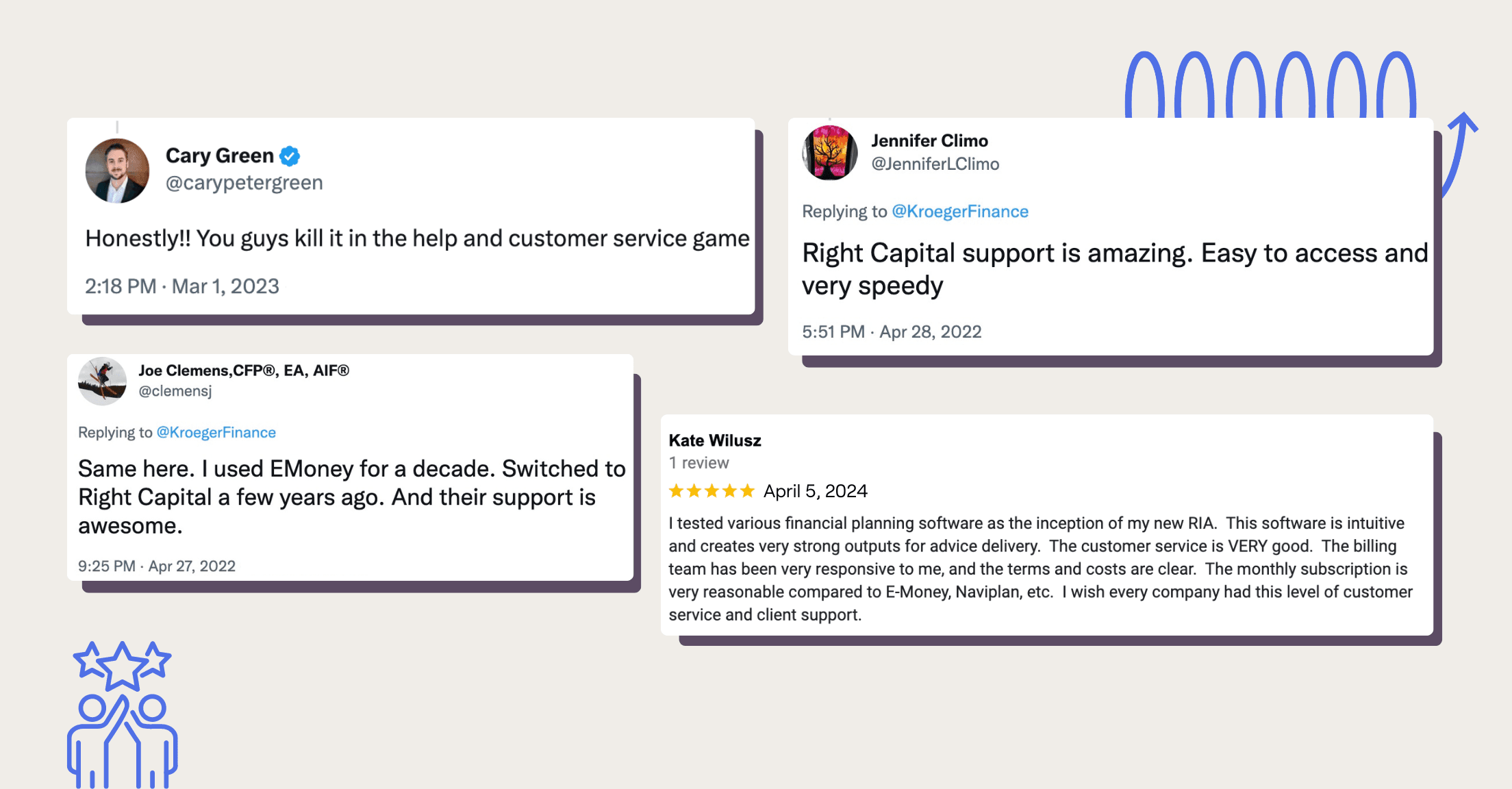

RightCapital vs. eMoney client support

Here is what eMoney Advisor reported about their client support team on their website:

170% more live support than other providers

Average response time under 1 minute

Overall support rating 96% “awesome or good”

Here are some stats about the RightCapital support team:

Median inbound answer time under 60 seconds

98% satisfaction rate

However, the most recent Kitces survey from Aug 2023 showed that advisors rated RightCapital’s customer support experience much higher (9.0/10) than that of eMoney (8.2/10).

One user on G2 noted they liked best about RightCapital, “The immediate help we can get from the support team when we are stuck on how to model something. It's especially helpful because we like to create and update financial plans interactively with our clients and the quick solutions keep everyone engaged.”

RightCapital vs. eMoney product updates

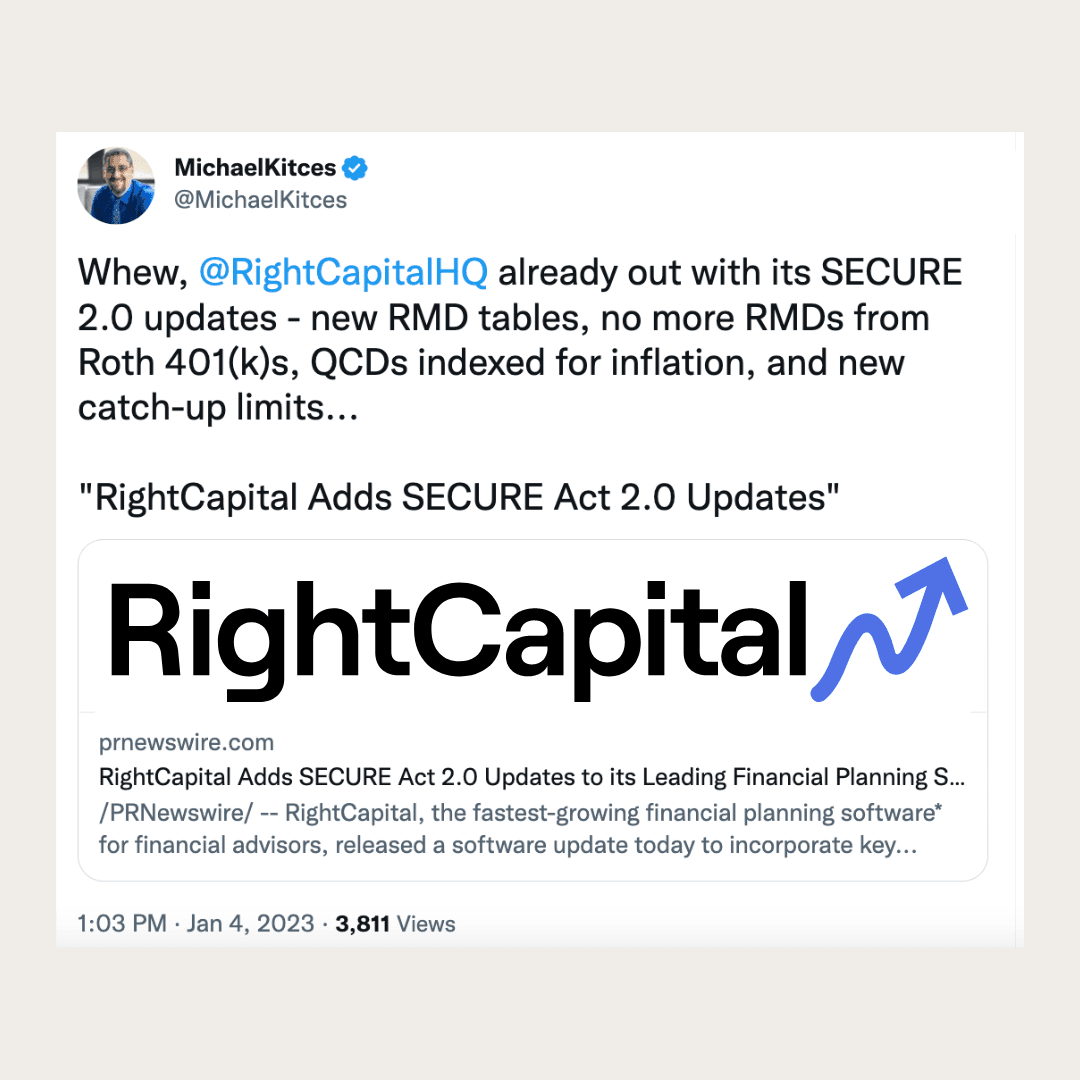

RightCapital is well-known in the industry for continuous enhancements (see a summary of our 2023 and Q1 2024 updates) and attention to what advisors are looking for. On RightCapital’s G2 page, one user mentioned, “...if they don’t have a feature you ask for, they forward all requests to their developers.”

Advisors have openly complained about eMoney’s slow response to product enhancements: Even eMoney’s original founder Edmond Falters told Citywire that “The product hasn’t gotten anywhere…they’re a Betamax.”

On the flip side, RightCapital moves fast. For example, we introduced updates to account for changes in a plan with the passing of SECURE 2.0, just days after the legislation was signed into law:

RightCapital’s personalized plan summary, Snapshot, was introduced in April of 2022, giving advisors a “one-page” plan that they could customize for their clients. eMoney followed with their own personalized plan summary 16 months later.

In the end, you can try RightCapital and see it for yourself. We encourage you to sign up for a personalized 1:1 20-minute demo with a member of our team to gain access to a 14-day free trial.