Best Financial Advisor Tools for Streamlining Operations

July 11, 2025

Running a successful RIA or IFA practice means juggling countless moving parts. Between managing client relationships, creating comprehensive financial plans, handling portfolio management, and staying compliant, it's easy to feel overwhelmed by the sheer volume of tasks that demand your attention.

The good news? The right financial advisor tools can transform how you work. Thanks to the beauty of modern technology, financial advisors can now automate routine tasks, strengthen client relationships, and deliver more actionable investment advice (without burning out in the process).

In this guide, we'll explore the tools that financial advisors use to streamline workflows, improve client service, and scale their practices more efficiently.

Benefits of financial advisor tools

The right tech stack doesn't just make your job easier, it fundamentally changes how you serve clients and grow your business.

Here are some ways financial advisor tools can transform your business (and life):

Streamline daily workflows: Financial planning software and CRM systems automate time-consuming tasks such as data entry, report generation, and client communications. This gives financial advisors more time to focus on building smart financial planning and investment strategies.

Enhance client engagement and strengthen relationships: Interactive tools and customizable client portals help financial advisors deliver investment advice in ways that resonate with clients. Complex investment strategies and retirement planning become more accessible and engaging. These tools can also give you more time to truly connect with clients, address their specific needs, and build long-term relationships.

Improve accuracy and compliance: Automated analysis tools reduce human error in financial planning calculations. Built-in compliance features help investment advisors meet fiduciary responsibilities and regulatory requirements.

Scale your practice: As your client base grows, the right tech stack enables financial advisors to serve more clients effectively. You can handle growth without proportionally increasing workload or compromising service quality. (And who doesn’t want that?)

What to look for in financial advisor tools

When evaluating potential additions to your tech stack, focus on features that directly address your practice's biggest challenges.

Here are some features and qualities that may be important to consider:

Seamless integrations: Look for financial planning tools that connect easily with your existing systems. The best apps work together, allowing data to flow between your CRM, financial planning software, and portfolio management platforms without you having to lift a finger.

User-friendly interface: Both you and your clients should be able to navigate the software intuitively. You shouldn't need a team of IT pros to help you prepare reports or onboard new clients. It also helps if the platform is easily updated and can reflect new data and inputs in real time. When you’re in the middle of a client meeting, you want a platform that makes you look good.

Client engagement and retention features: There’s more to client engagement than just good-looking graphics. The best tools help you strengthen client relationships through interactive planning capabilities, engaging and easy-to-understand visualizations, and collaborative features that make complex financial concepts easier to digest and discuss.

Customizable features: Your practice is unique. Your financial advisor tools should adapt to your specific workflows, client needs, and service offerings. It also helps build trust if you can add your logo and other brand attributes to presentations and reports. Don't settle for tools that force you to change how you work or are hard to white label.

Scalability and efficiency: Choose platforms that can grow with your practice while improving your ROI. They should be able to handle increased client data, more complex financial plans, and expanded service offerings without compromising performance or requiring you to switch systems later.

Responsive human support: When you're working with client data and time-sensitive investment advice, responsive human support makes the difference between a minor hiccup and a major problem. Look for providers that offer real people, not AI chatbots, when you need help.

Regular software and feature updates: Choose providers that actually listen to financial advisors and regularly update their platforms based on your needs. Look for companies that respond quickly to industry changes and advisor requests, rather than platforms that remain stagnant for years.

Mobile accessibility: Look for tools that make it easy for clients to view their financial information on the go.

10 types of financial advisor tools to improve efficiency and client relationships

Building an effective tech stack requires understanding the different categories of tools available and how they work together to support your practice. Here are a few examples:

1. Financial planning software

Financial planning software serves as the foundation of most advisory practices. These tools help financial advisors create comprehensive financial plans, run retirement planning scenarios, and demonstrate investment strategies to clients.

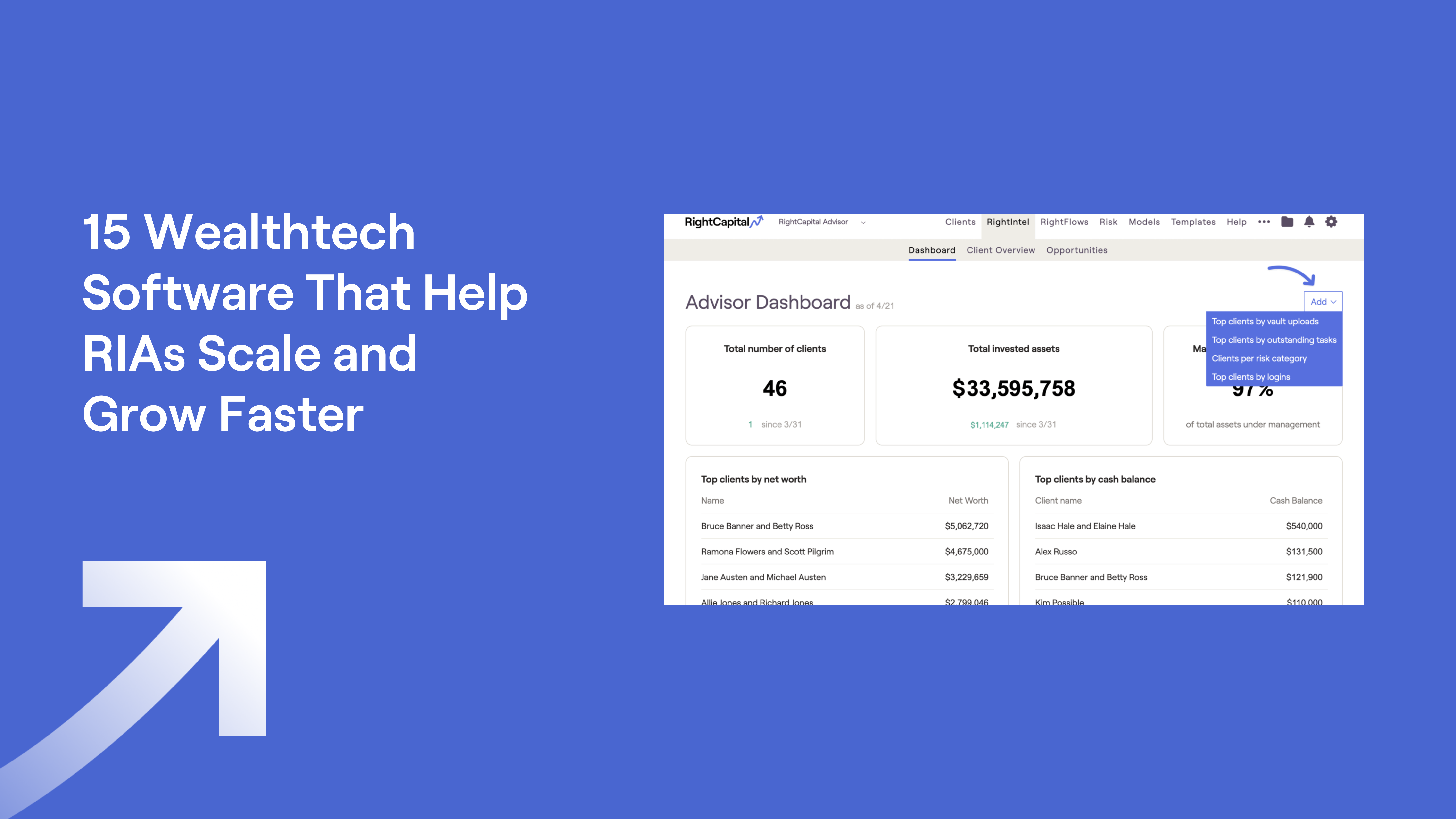

Advisors appreciate that RightCapital’s financial planning tools have a user-friendly interface and robust feature set. The platform offers interactive planning capabilities, stress-testing tools, and client engagement features such as customizable reports and a client portal.

RightCapital also connects with major CRM and portfolio management platforms. And if you have any questions about the features or integrations, the friendly support team is just a phone call away.

Other popular financial planning software options include eMoney and MoneyGuidePro, both offering comprehensive wealth management planning capabilities.

2. Customer relationship management (CRM) and scheduling software

CRM software helps financial advisors manage client data, track communication history, and automate client service workflows. Effective CRM systems are essential for maintaining strong client relationships as your practice grows.

Popular CRM options for financial advisors include Wealthbox, SmartOffice, and Redtail. For scheduling, many financial advisors use apps like Calendly to automate appointment booking and client messaging.

3. Performance reporting platforms

These tools help financial advisors analyze investment performance, generate client reports, and track portfolio management metrics across multiple custodians and account types.

Leading performance reporting platforms include Addepar, Black Diamond, CircleBlack, Envestnet | Tamarac, and PershingX (formerly Albridge). All of these platforms work with RightCapital, allowing seamless data flow between your financial planning and performance reporting workflows.

4. Risk analysis tools

Risk tolerance assessment and analysis tools help financial advisors understand client needs and create appropriate investment strategies based on individual risk tolerance profiles.

RightCapital includes built-in risk assessment capabilities with customizable questionnaires and interactive risk tolerance tools. Nitrogen (formerly Riskalyze) and Morningstar Advisor Workstation also provide comprehensive investment research and risk analysis.

Both integrate with RightCapital for seamless workflows.

5. Retirement planning tools

Specialized retirement planning tools help financial advisors model different scenarios, optimize Social Security strategies, and create comprehensive retirement income plans for clients.

RightCapital offers robust retirement planning features including dynamic spending strategies, Social Security optimization, and income analysis.

Other options include eMoney and MoneyGuide for their retirement planning modules, while Morningstar Office (now part of Black Diamond) provides additional analytical capabilities and can integrate with RightCapital.

Additional tools include platforms like Advyzon and Envestnet | Tamarac, both of which connect with RightCapital.

Other financial advisor retirement planning platforms include Betterment, Allianz, Jackson, and Nationwide Advisory. These offer specialized retirement planning products, and all link with RightCapital for comprehensive planning.

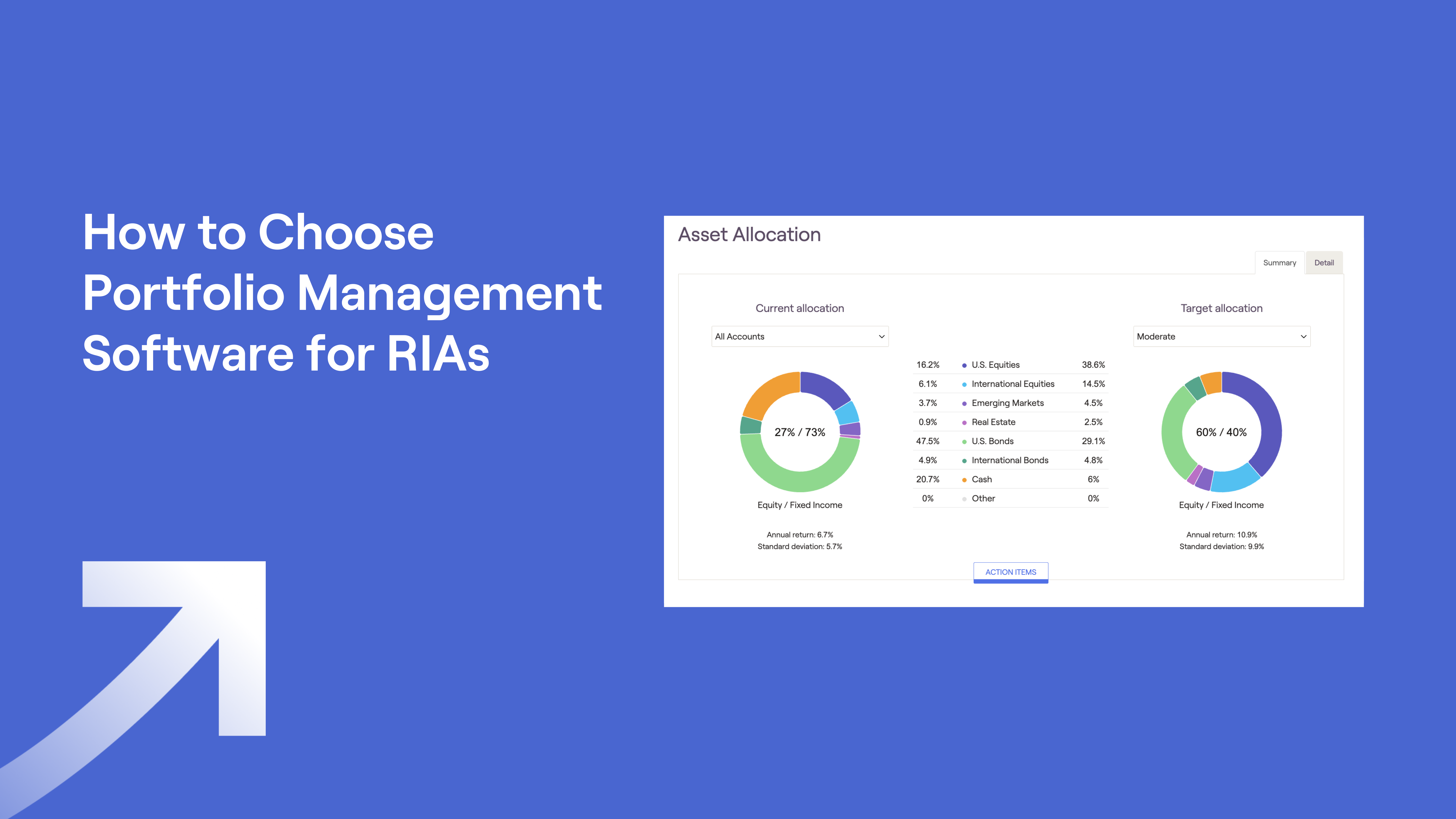

6. Portfolio management software and investment management tools

Portfolio management platforms help financial advisors monitor investments, execute trades, rebalance portfolios, and maintain compliance across client accounts. These investment management tools often include mutual funds analysis and portfolio optimization features.

Major portfolio management tools include Orion, Addepar, Black Diamond (which now includes Morningstar Office capabilities), Envestnet | Tamarac, Advyzon, FinFolio, Panoramix, AssetBook, and Capitect.

All of these platforms sync with RightCapital, ensuring your portfolio management and financial planning work together seamlessly.

Additional support comes from providers like SEI, Betterment, and AssetMark, which integrate with RightCapital, plus various custodians that provide portfolio data and trading tools.

7. Document management tools

Secure document storage and sharing platforms are essential for maintaining client files, ensuring compliance, and facilitating smooth client communication.

Popular document management solutions include Microsoft SharePoint and OneDrive, Citrix ShareFile, Google Drive, and Box.

8. Marketing and lead generation tools

Lead generation and client acquisition tools help financial advisors build their practices and maintain visibility in their local market, as well as with customers and prospects around the country.

Helpful marketing tools include Google Business Profile, LinkedIn, Hootsuite, and email marketing providers such as MailChimp and Constant Contact. These platforms help with social media management, professional networking, client newsletters, and lead generation campaigns.

Another popular tool is Cognism, which helps you find the contact information you need to build a strong lead-gen pipeline.

9. Tax planning software and estate planning tools

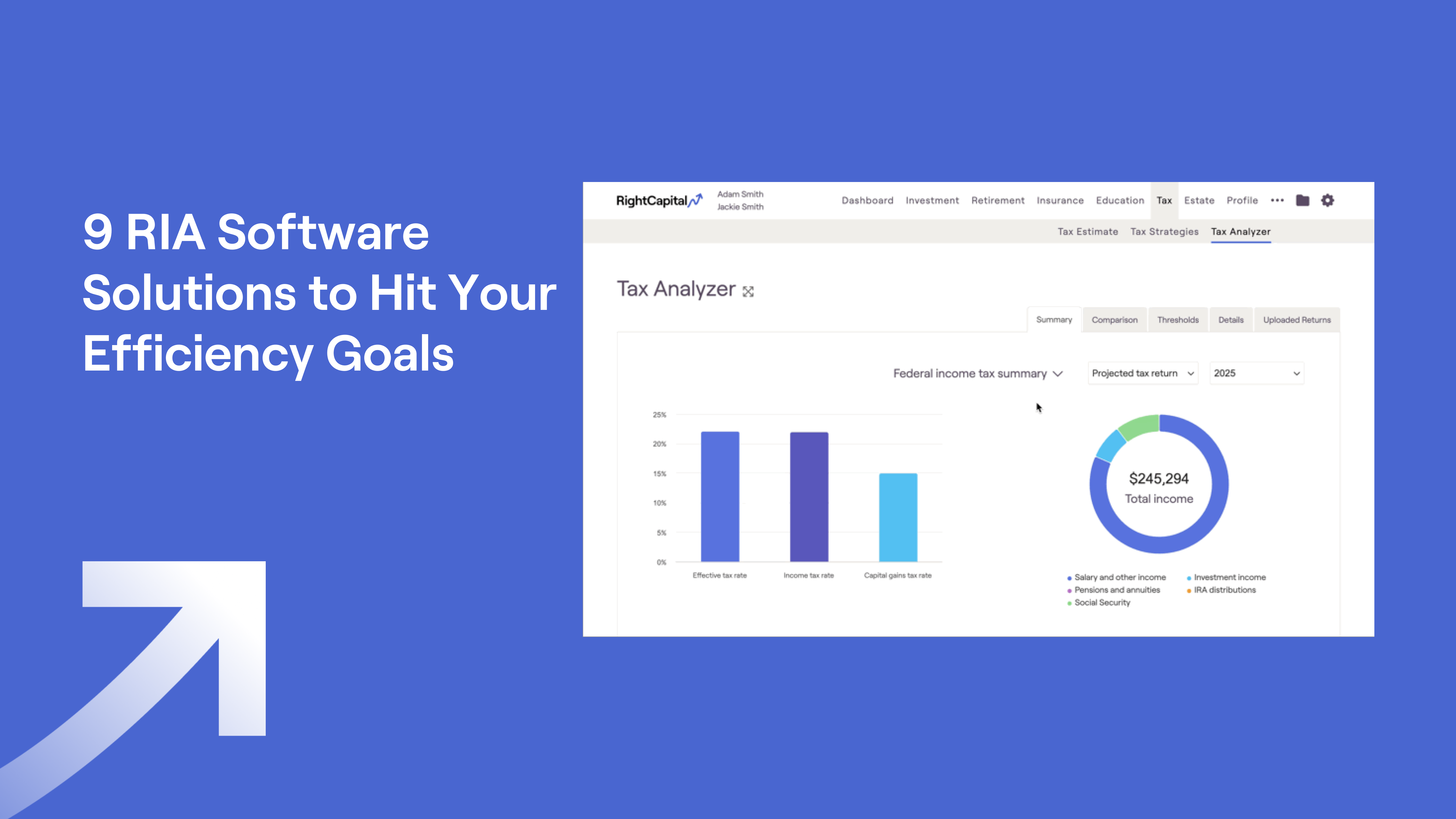

Tax planning tools help financial advisors identify optimization opportunities, model different investment strategies, and integrate tax considerations into clients’ financial plans. Estate planning capabilities are often included in these platforms.

RightCapital offers robust tax planning features including tax strategy analysis and scenario modeling. The platform also includes estate planning tools for comprehensive wealth management planning.

Other specialized tools include systems such as Morningstar Office (now part of Black Diamond), Envestnet | Tamarac, and Advyzon, which all connect with RightCapital for seamless tax and estate planning workflows. Holistiplan is also a popular financial planning option.

Additional supporting platforms include Orion, Panoramix, Capitect, FinFolio, and Addepar, all of which link with RightCapital to provide expanded tax planning capabilities.

10. Custodians

Custodian platforms provide the foundation for holding client assets and executing trades. Many also offer additional tools for portfolio management and client reporting.

Major custodians include BNY Mellon | Pershing, LPL Financial, Fidelity, Charles Schwab, Raymond James, RBC Clearing & Custody, First Clearing / TradePMR, Interactive Brokers, Apex Fintech Solutions, AXOS Advisor Services, Altruist, Folio Institutional, Betterment, Nationwide Advisory Solutions, and my529.

All of these custodians integrate with RightCapital, ensuring smooth data flow between custody platforms and your financial planning workflows.

Conclusion

As the financial services industry shifts toward greater automation and data-driven decision making, advisors who embrace tools like the ones listed above will be empowered to deliver the best investment advice, build stronger client relationships, and scale more efficiently.

The key is choosing tools that work well together and support your specific workflows. As you evaluate options, prioritize platforms that connect seamlessly with your existing tech stack and offer the customizable features your clients value most.

Considering the changes seen in the past few years, it’s no secret that technology will continue to advance and innovate. Look for tools that will evolve to keep up with the times while supporting your business’s and your clients’ changing needs.

RightCapital's comprehensive financial planning platform streamlines your workflows by integrating with the CRM, portfolio management, and performance reporting tools you already use. The user-friendly interface helps you create engaging client-ready presentations, while the customer support team (real humans, not AI) ensures every feature delivers maximum value.

Schedule a demo to explore how RightCapital streamlines tax, estate, and retirement planning all in one place.