MoneyGuide vs RightCapital:

Why RightCapital is the better alternative

Many advisors are moving from MoneyGuide to RightCapital—should you? With RightCapital you get:

A lower cost of ownership

MoneyGuide requires add-on fees for account aggregations and cash flow-based planning, which are included with RightCapital at a much lower price.

#1 in financial advisor satisfaction

RightCapital received the highest overall satisfaction (8.6) in the August 2025 Kitces advisor survey, leading above MoneyGuide (7.4).

Innovation and flexibility

One-page plan summaries, visual Roth conversion, dynamic retirement spending strategies, and student loan management are just a few of many unique features.

Download the RightCapital vs MoneyGuide Feature Comparison Chart to see which financial planning software is right for your practice.

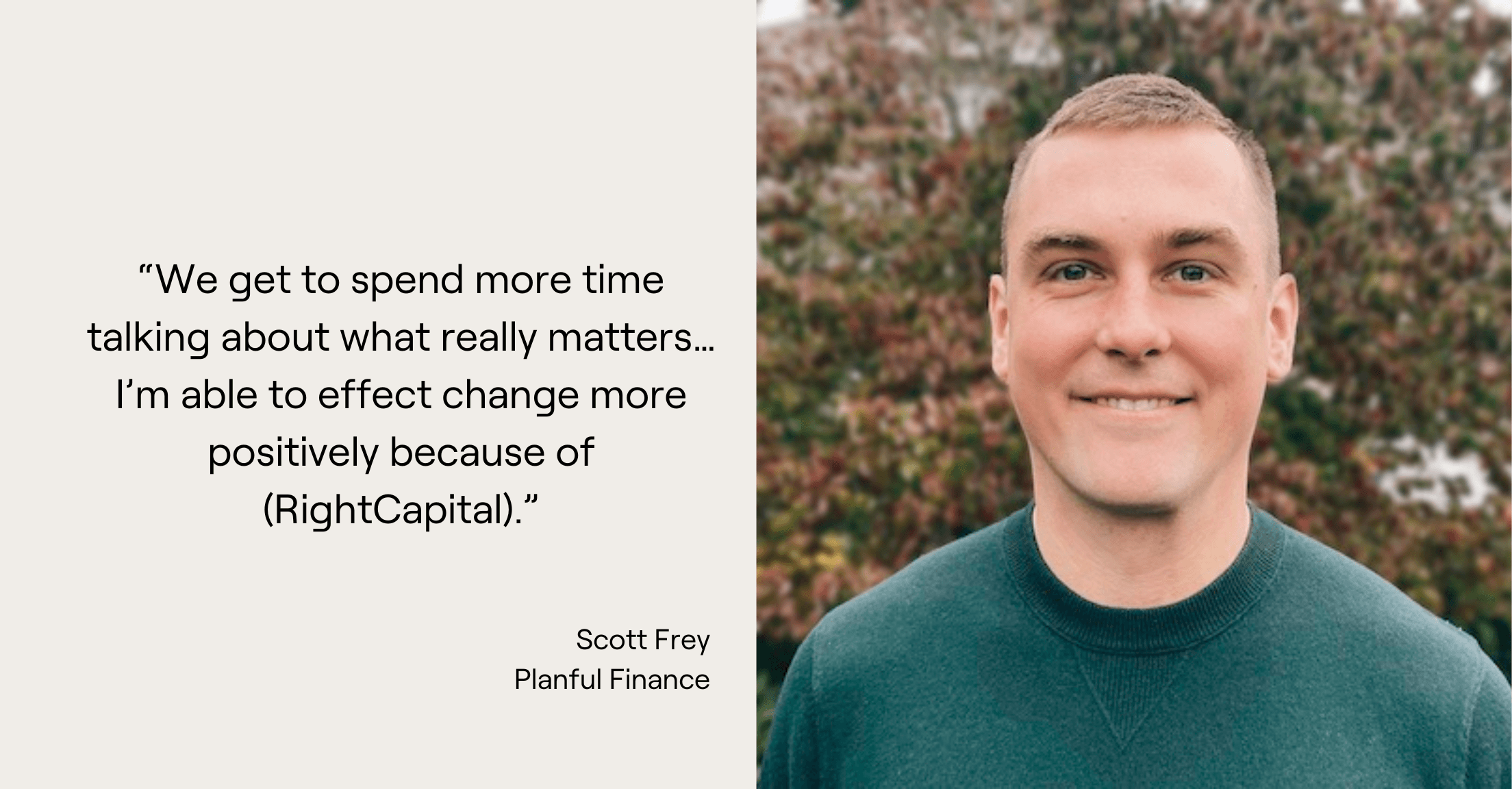

Get real advisors' perspectives on switching to RightCapital

May 19, 2023

Advisors' Advice for Switching Software to RightCapital

Are you thinking about switching from eMoney or MoneyGuide? Two advisors share the good, bad, and why behind switching to RightCapital.

- Advisor Stories

- Practice Management

December 12, 2025

What Do Advisors Think Is the Best Planning Software?

Here are some words straight from financial advisors as to why THEY continue to choose RightCapital.

- Advisor Stories

- Industry Intel

March 17, 2025

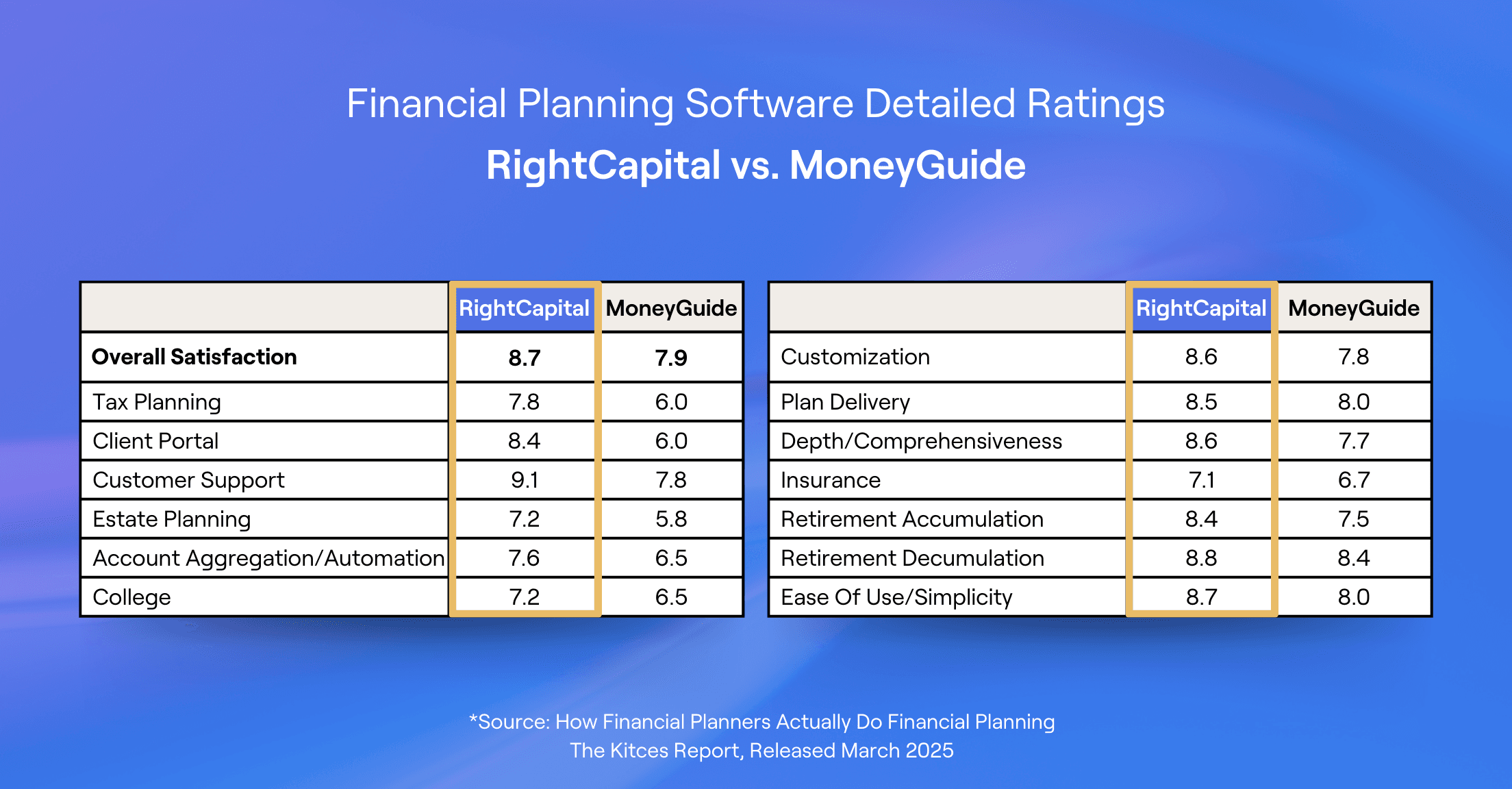

7 Differences Between RightCapital and MoneyGuide in 2025

Two leaders in the industry are RightCapital and MoneyGuide. Let’s take a look at the differences between them.

- Industry Intel

March 18, 2025

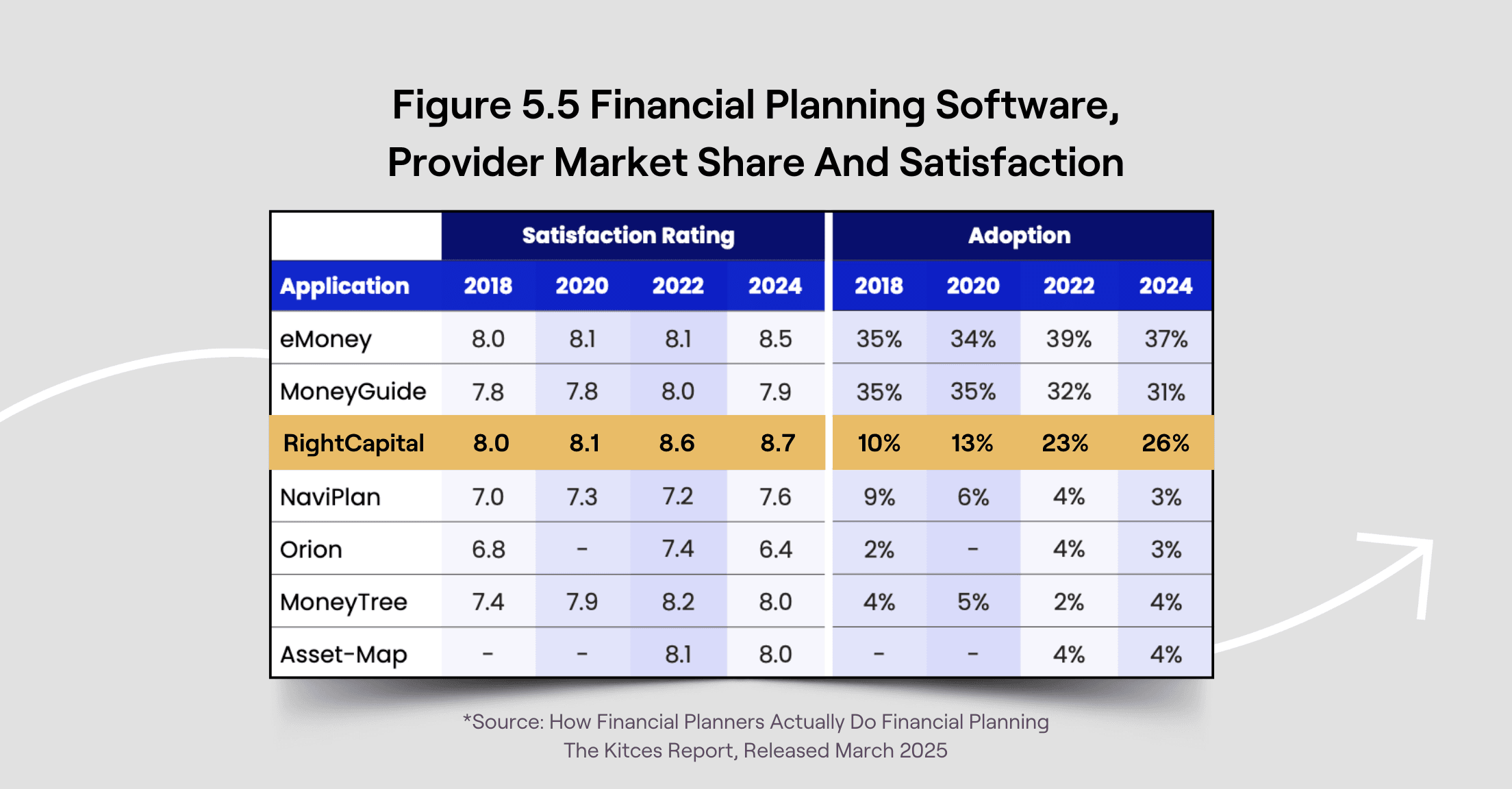

Key Takeaways from the March 2025 Kitces Report

The Kitces Report, “How Financial Planners Actually Do Financial Planning”, analyzes the state of the financial planning software market.

- Industry Intel